White Cement Market Size 2024-2028

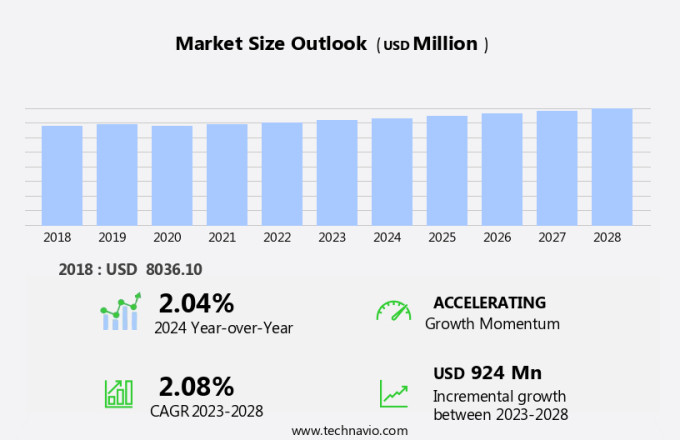

The white cement market size is forecast to increase by USD 924 billion at a CAGR of 2.08% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The construction industry's expansion, driven by rapid urbanization and increasing disposable income, is a major market driver. Additionally, stringent regulations on the use of raw materials have led to a growing preference for white cement, which offers superior strength and durability. These trends are expected to continue, making the market an attractive investment opportunity. Furthermore, the market analysis report highlights the importance of adhering to environmental regulations, as well as the ongoing research and development efforts to improve the production process and reduce carbon emissions. Overall, the market is poised for steady growth In the coming years.

What will be the Size of the White Cement Market During the Forecast Period?

- The market In the United States is experiencing steady growth, driven by increasing demand from various sectors, including residential construction, commercial construction, and the industrial floor area. In the residential sector, the preference for white cement in interior applications, such as bathrooms and kitchens, is on the rise due to its superior whiteness and aesthetic appeal. In the commercial sector, the construction of office buildings and educational institutions is fueling demand for white cement In the production of concretes and mortars. Moreover, the trend towards carbon emission targets is driving the adoption of white cement, as it offers improved heat reflection properties compared to gray cement, reducing the need for energy-intensive cooling systems.

- Raw material suppliers are investing In the production of raw materials, such as iron and manganese, to meet the increasing demand for white cement. The use of pigments In the production process allows for customization of the final product, further expanding its applications. Construction expenditures In the United States are projected to continue growing, boding well for the future of the market.

How is this White Cement Industry segmented and which is the largest segment?

The white cement industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Residential

- Commercial

- Infrastructure

- Geography

- APAC

- China

- India

- North America

- US

- Middle East and Africa

- Europe

- Spain

- South America

- APAC

By Application Insights

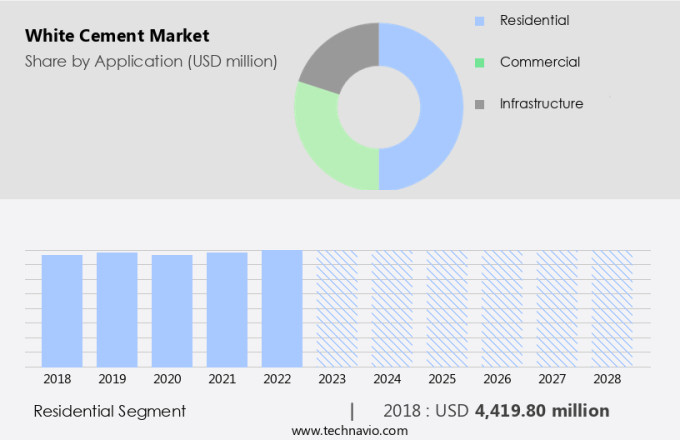

- The residential segment is estimated to witness significant growth during the forecast period.

White cement is a popular choice for various residential applications, including flooring and walls, In the construction industry. New housing projects are anticipated to increase, with the majority of development taking place in Asia-Pacific (APAC) and the Middle East and Africa (MEA) regions. In APAC alone, approximately 38 million new housing units are projected to be developed during the forecast period, accounting for over 60% of global new housing unit development. The growing trend of smaller household sizes is expected to result in a steady annual increase of 1%-2% In the number of households. Commercial and industrial segments also utilize white cement for their construction needs due to its whiteness content, heat reflection properties, and aesthetic appeal.

Construction expenditures are expected to be influenced by economic indicators, such as Gross Domestic Product (GDP), and the COVID-19 pandemic's impact on the industry. Raw material suppliers play a crucial role in maintaining a consistent supply of white cement to meet the increasing demand.

Get a glance at the White Cement Industry report of share of various segments Request Free Sample

The Residential segment was valued at USD 4.42 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

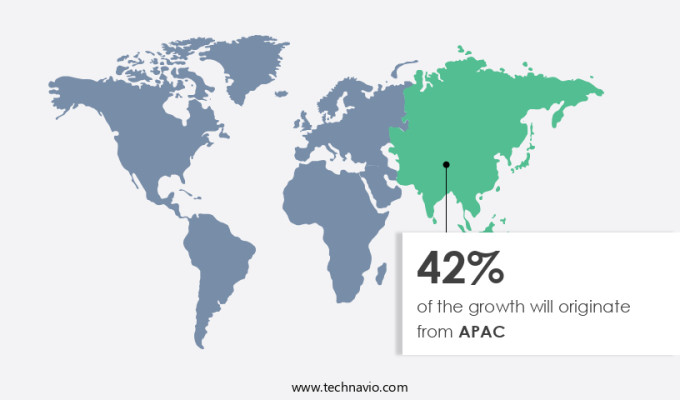

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is experiencing significant growth, particularly in Asia Pacific regions such as India, China, Japan, Thailand, Indonesia, and the Philippines. The expansion of infrastructure and construction projects In these countries is the primary driver of market growth. Favorable government policies and the availability of abundant raw materials and inexpensive labor have led to an increase In the number of manufacturing plants. For instance, India's government has planned to invest USD650 billion in urban infrastructure projects over the next two decades. This investment is expected to fuel the demand for white cement In the region. Overall, the increasing construction activities and supportive government initiatives are propelling the growth of the market.

Market Dynamics

Our white cement market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of White Cement Industry?

Growing construction market is the key driver of the market.

- The market is experiencing growth due to its extensive usage in various sectors of construction, including residential, commercial, and industrial. White cement's desirable properties, such as high whiteness, excellent workability, and low shrinkage, make it a preferred choice for constructing office buildings, shopping malls, educational institutions, and even designer buildings. The increasing focus on environmental sustainability and green building practices is also driving the demand for eco-friendly construction materials, such as white cement, which has lower carbon emission targets compared to gray cement. Raw material suppliers, including iron, manganese, and fuel oil, are essential to the production of white cement.

- The US, India, China, Brazil, Malaysia, Russia, Hungary, and Vietnam are significant players In the global construction market, contributing to the demand for white cement. In the US, repair works and tile installation in residential and commercial segments account for a considerable portion of the market. In the industrial segment, white cement is used for flooring and roofing applications, pre-fabricated products, and terrazzo tiles. The construction industry's expenditures have been impacted by the COVID-19 pandemic, leading to fluctuations In the market. However, product diversification and market expansion opportunities remain, with potential applications in architectural concrete, decorative concrete, tile adhesives, and mortars.

- Modern manufacturing plants are using cooling techniques and energy-efficient processes to reduce production costs and enhance the heat reflecting properties of white cement, making it an attractive option for architects and designers. In conclusion, the market is expected to continue its growth trajectory due to its versatility and desirable properties. Its usage in various sectors of construction, including residential, commercial, and industrial, and its potential for energy savings and environmental sustainability make it a preferred choice for modern construction projects. The focus on architectural integrity, aesthetics, and energy costs is driving the demand for white cement, with natural gas, diesel, and coal being the primary raw materials used in its production.

- The market's growth is also influenced by factors such as labor costs, transportation costs, and the increasing per capita GDP in emerging economies.

What are the market trends shaping the White Cement Industry?

Rapid urbanization and rising disposable income is the upcoming market trend.

- The market is poised for growth due to the expanding construction industry, particularly In the residential and non-residential sectors. Economic advancements in countries like India, Vietnam, Malaysia, China, and Qatar have driven urbanization and increased disposable income, leading to a rise in infrastructure spending. This trend is expected to positively impact The market during the forecast period. Additionally, the ever-growing global population, with an urban population of 7.7 billion in 2021, according to The World Bank Group, continues to fuel the construction industry's growth. White cement, a type of Portland cement with high whiteness, is increasingly being used in architectural and decorative applications due to its heat reflecting properties and aesthetic appeal.

- This includes use in architectural concrete, terrazzo tiles, and pre-fabricated products. The construction material's versatility extends to various sectors, including the education sector for school buildings, office buildings, shopping malls, and healthcare institutions. White cement's use in industrial applications, such as floor areas and roofing, also contributes to its market expansion. The market's growth is further supported by the adoption of green building practices and eco-friendly construction materials, as well as the need for environmental sustainability and energy efficiency. The raw material suppliers' modern manufacturing plants produce white cement using raw materials like iron, manganese, and fuel oil, with cooling techniques employed to enhance the whiteness content.

- The market's diversification into specialty materials, such as pigments and concretes, and the increasing use of white cement in repair works, tile installation, and prefabricated items, also contribute to its growth. Despite the challenges posed by the COVID-19 pandemic, the construction expenditures in various sectors are expected to recover, further supporting The market's growth.

What challenges does White Cement Industry face during the growth?

Stringent regulations on use of raw materials is a key challenge affecting the industry growth.

- The market experiences growth in various sectors such as residential construction, commercial construction, and industrial applications. In the residential segment, white cement is used for architectural concrete and decorative concrete in modern homes, while In the commercial segment, it is utilized for office buildings, shopping malls, and educational institutions. Strict carbon emission targets have driven the demand for eco-friendly construction materials, including white cement, which has heat reflecting properties and aesthetic appeal. Raw material suppliers face challenges in sourcing iron, manganese, and other essential raw materials for white cement production. The manufacturing process of white cement involves the use of large amounts of fuel oil, natural gas, diesel, and coal, leading to high energy costs.

- However, market expansion is driven by product diversification, including the production of white masonry cement, dry mix mortars, and pre-fabricated products. The industrial segment uses white cement for floor areas, roofing applications, and infrastructural applications. Designers and architects prefer white cement for its architectural integrity and ability to blend seamlessly with various designs. The healthcare, office, and institutional sectors also utilize white cement for tile installation, repair works, and prefabricated items. The COVID-19 pandemic has affected construction expenditures, leading to a decrease in demand for white cement. However, the market is expected to recover as construction projects resume, and the need for eco-friendly and sustainable construction materials continues to grow.

- Overall, the market is a significant contributor to the construction industry, with ongoing research and innovation aimed at improving its production process and reducing its environmental impact.

Exclusive Customer Landscape

The white cement market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the white cement market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, white cement market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Al Rashed Cement Co. - Our company provides white cement, which functions as a hydraulic binder identical to Portland Grey Cement in terms of physical attributes. This high-performing cement option caters to the specific demands of projects requiring a pristine, white finish.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Al Rashed Cement Co.

- Buzzi SpA

- Cementir Holding NV

- Cementos Molins SA

- CIMSA Ingenieria de Sistemas SA

- Fars and Khuzestan Cement Co.

- Federal White Cement

- FCC SA

- Holcim Ltd.

- JK Cement Ltd

- Kuwait Cement Co.

- OYAK Cimento AS

- Ras Al Khaimah Co.Â

- Royal El Minya Cement Co.

- Royal White Cement Inc.

- Saveh Cement Co.

- Semapa

- Shargh White Cement Co.

- The India Cements Ltd.

- UltraTech Cement Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of construction materials, primarily used for their unique whiteness and heat reflecting properties. These materials include concretes, mortars, and various specialty products, such as terrazzo tiles, pavers, and pre-fabricated items. The demand for white cement is driven by various sectors, including residential construction, commercial construction, industrial applications, and the education sector. In the residential construction sector, white cement is often used for architectural concrete and decorative concrete applications, such as stamped concrete and terrazzo tiles. The aesthetic appeal of white cement makes it a popular choice for modern homes, particularly in regions with high per capita GDP and a focus on environmental sustainability and green building practices.

The commercial construction sector also utilizes white cement extensively, particularly for office buildings and shopping malls. The use of white cement In these structures contributes to their overall design and architectural integrity. Additionally, the heat reflecting properties of white cement help reduce energy costs by minimizing the need for air conditioning. The industrial segment is another significant consumer of white cement, with its use in infrastructure applications, such as roofing and precast concrete products. The versatility of white cement allows it to be used in various industries, including healthcare, education, and institutional buildings. The production of white cement involves the use of raw materials, such as iron, manganese, and fuel oil, to produce a gray cement base with a high whiteness content.

The addition of pigments, such as iron oxide, is used to enhance the whiteness of the cement. Modern manufacturing plants employ cooling techniques to ensure the highest level of whiteness and consistency In the final product. The market is experiencing product diversification and market expansion, with the development of new applications and the introduction of eco-friendly construction materials. The use of white cement in precast concrete products, tile adhesives, and RMC (ready-mixed concrete) is increasing, providing opportunities for growth In the market. The construction industry as a whole has been impacted by various factors, including the COVID-19 pandemic, energy costs, transportation costs, and labor costs.

Despite these challenges, the demand for white cement remains strong, driven by its unique properties and the growing trend towards sustainable and eco-friendly construction materials. In conclusion, the market is a dynamic and evolving industry, driven by various sectors and applications. The use of white cement in construction continues to grow, driven by its unique properties and the increasing focus on sustainable and eco-friendly building practices. The production of white cement involves the use of various raw materials and modern manufacturing techniques to ensure the highest level of whiteness and consistency. The market is experiencing product diversification and market expansion, providing opportunities for growth In the industry.

|

White Cement Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.08% |

|

Market growth 2024-2028 |

USD 924 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.04 |

|

Key countries |

US, China, India, Saudi Arabia, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this White Cement Market Research and Growth Report?

- CAGR of the White Cement industry during the forecast period

- Detailed information on factors that will drive the White Cement growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Middle East and Africa, Europe, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the white cement market growth of industry companies

We can help! Our analysts can customize this white cement market research report to meet your requirements.