Zero-Energy Buildings Market Size 2025-2029

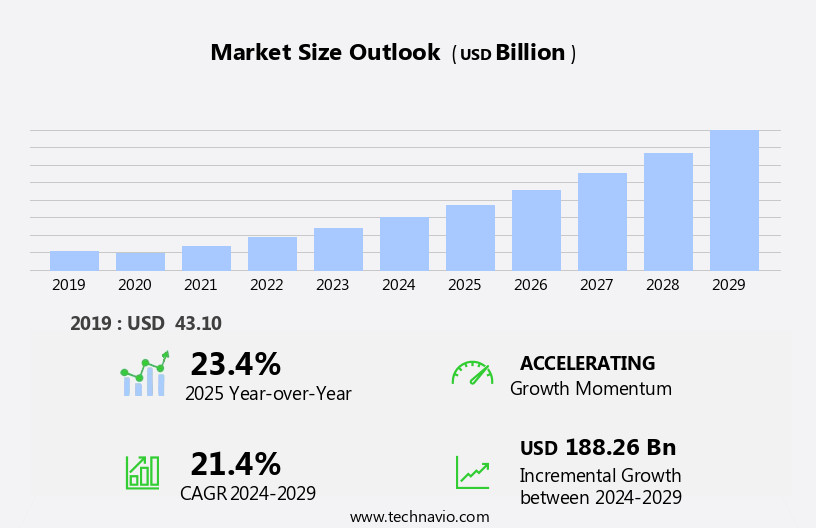

The zero-energy buildings market size is forecast to increase by USD 188.26 billion at a CAGR of 21.4% between 2024 and 2029.

- The Zero-Energy Buildings (ZEB) market is experiencing significant growth due to the increasing global focus on sustainability and the shift towards net-zero emissions. Zero-Energy Buildings are structures that produce as much energy as they consume, primarily through renewable sources such as solar power. This trend is being driven by various factors, including stringent energy efficiency regulations, rising energy costs, and growing awareness of the environmental impact of traditional energy sources. However, the intermittent nature of solar power poses a challenge to the widespread adoption of ZEBs. To mitigate this issue, advancements in energy storage technologies and smart grid systems are gaining traction.

- These solutions enable the efficient management and distribution of energy, ensuring a consistent power supply and maximizing the benefits of renewable energy. Companies seeking to capitalize on this market opportunity should focus on developing innovative energy storage and management solutions, while also collaborating with stakeholders across the value chain to create a sustainable and interconnected energy ecosystem.

What will be the Size of the Zero-Energy Buildings Market during the forecast period?

- The market represents a significant growth opportunity in the global construction sector, driven by increasing environmental awareness and the need to reduce carbon emissions. Zero-energy buildings, also known as net-zero energy structures, consume only as much energy as they produce through renewable sources, such as solar panels, wind power, and geothermal energy systems. This market is poised for expansion as the building sector seeks to contribute to carbon neutrality and mitigate the impact of global average temperature increases and climatic changes. Key trends in the market include the integration of energy-efficient appliances, green construction technology, and the use of natural ventilation, air sealing, and insulation in walls and roofs.

- Renewable energy systems, such as solar panels and wind power, are becoming increasingly cost-effective and accessible, making zero-energy buildings an attractive option for both new construction and retrofits. Additionally, the market is being fueled by the growing demand for educational facilities and other institutions to lead by example in environmental protection. Overall, the market is expected to continue growing as businesses and governments prioritize energy consumption reduction and carbon emissions mitigation.

How is this Zero-Energy Buildings Industry segmented?

The zero-energy buildings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Source

- Solar energy

- Biogas

- Others

- Product

- HVAC and controls

- Insulation and glazing

- Lighting and controls

- Water heating

- Component

- Solutions and services

- Equipment

- Application

- Public and commercial buildings

- Residential buildings

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Middle East and Africa

- South America

- North America

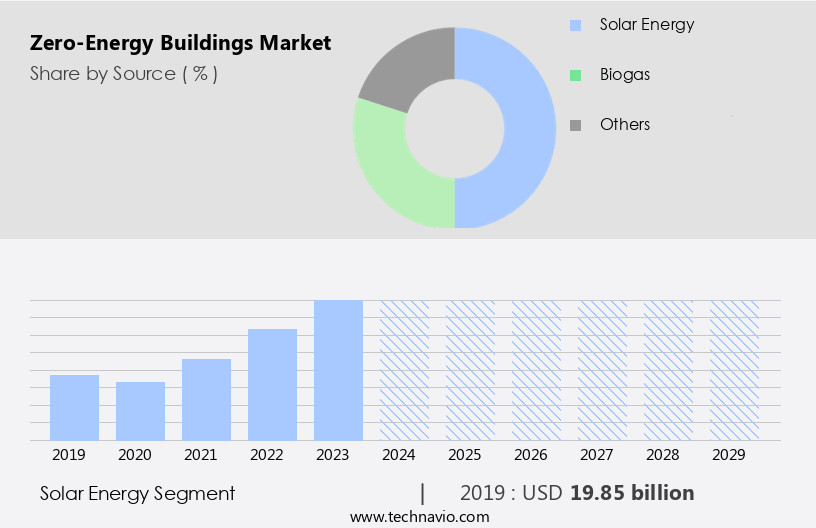

By Source Insights

The solar energy segment is estimated to witness significant growth during the forecast period.

The Zero-Energy Buildings (ZEB) market is experiencing notable growth in the solar energy segment between 2025 and 2029. This expansion is driven by technological advancements and heightened environmental consciousness. Solar power is a preferred renewable energy source for ZEBs due to its efficiency in on-site energy generation. In January 2024, Canadian Solar introduced a new line of high-performance solar panels tailored for residential applications, improving energy generation and lowering installation expenses. This innovation underscores the trend of incorporating renewable technologies into architectural designs. In March 2024, First Solar increased its US manufacturing capacity to cater to the escalating demand for solar modules in net-zero energy projects.

The integration of greenhouse gas reduction technologies, such as solar and wind power, into building structures is crucial in mitigating carbon emissions and contributing to sustainable development. Additionally, energy efficiency improvements in HVAC systems, greenhouse gases, and energy-efficient appliances contribute to the carbon emissions reduction in the construction sector. Nearly Zero-Energy Buildings (nZEBs) and Green buildings employ green construction technology, natural ventilation, air sealing, and energy management systems to ensure indoor air quality and reduce energy consumption. This environmental conservation approach is essential in combating global average temperature increases, CO2 emissions, and climatic changes while promoting a non-hazardous environment.

Get a glance at the market report of share of various segments Request Free Sample

The Solar energy segment was valued at USD 19.85 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth, driven by the increasing adoption of renewable energy systems, particularly solar and wind power. This trend is fueled by the desire for energy independence among households due to rising energy costs and concerns over greenhouse gas emissions and global average temperature increases. Solar panels and energy storage systems are becoming increasingly cost-effective, leading to their widespread use in residential applications. In the US, incentives such as Feed-in Tariffs (Fits) and net metering policies have encouraged the deployment of solar distributed generation units. The building sector is embracing carbon neutral solutions to reduce CO2 emissions, contributing to sustainable development and environmental conservation.

Green construction technology, including energy-efficient appliances, HVAC systems, and greenhouse gas emission reduction strategies, is gaining popularity. Nearly Zero-Energy Buildings (NZEBs) and Geothermal energy systems are also being adopted for their energy efficiency and environmental protection benefits. Energy management systems, networked sensors, and analytics platforms are essential components of NZEBs, ensuring indoor air quality and optimizing energy consumption. The construction sector is implementing energy efficiency standards and building codes to promote the design and construction of net-zero energy structures. Overall, the shift towards renewable energy sources and carbon emissions reduction is a critical step towards power generation technologies that prioritize the indoor atmosphere, environmental conservation, and sustainable development.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Zero-Energy Buildings Industry?

Growing use of sustainable energy is the key driver of the market.

- The reliance on fossil fuels as a primary energy source is diminishing due to their finite nature and detrimental environmental impact. The world's fossil fuel reserves are uncertain, with proven reserves representing the quantity extractable. These reserves are estimated to sustain human societies for approximately two centuries. However, the use of fossil fuels poses health risks, with emissions from coal-fired power plants contributing to fatal illnesses among vulnerable populations.

- The demand for energy, which fossil fuels have historically met, must be addressed through alternative means. Zero-Energy Buildings (ZEBs), which generate as much energy as they consume, offer a viable solution. These structures reduce reliance on fossil fuels, minimize greenhouse gas emissions, and contribute to a more sustainable energy future.

What are the market trends shaping the Zero-Energy Buildings Industry?

Increasing in net-zero buildings is the upcoming market trend.

- The World Green Building Council (WGBC) has unveiled its Net Zero initiative, a global campaign to attain 100% net-zero carbon emissions in buildings by 2050. This endeavor includes pilot sites in Australia, Brazil, Canada, Germany, India, the Netherlands, South Africa, and Sweden, where net-zero certifications for existing and new buildings will be developed. The building sector in these countries is poised for significant expansion in the coming years.

- Transforming buildings into energy-efficient structures will lead to increased demand for the heating, ventilation, and air conditioning (HVAC) market. Several energy-conserving building materials are showcased below, contributing to the growth of the green building industry.

What challenges does the Zero-Energy Buildings Industry face during its growth?

Intermittent nature of solar power is a key challenge affecting the industry growth.

- The market has experienced notable growth due to the significant decrease in prices for solar power infrastructure. This trend has the adoption of photovoltaic (PV) systems, leading to a substantial number of installations. However, the intermittent nature of solar power presents a challenge to the widespread use of renewable energy sources. The power generated from solar PV systems is influenced by various factors, including the degree of shading, panel efficiency, and solar irradiation.

- These elements can significantly impact the power output per kW of solar module, with generation peaking around midday and decreasing in the late afternoon. Addressing the inconsistencies in solar power generation remains crucial for the continued growth of the market.

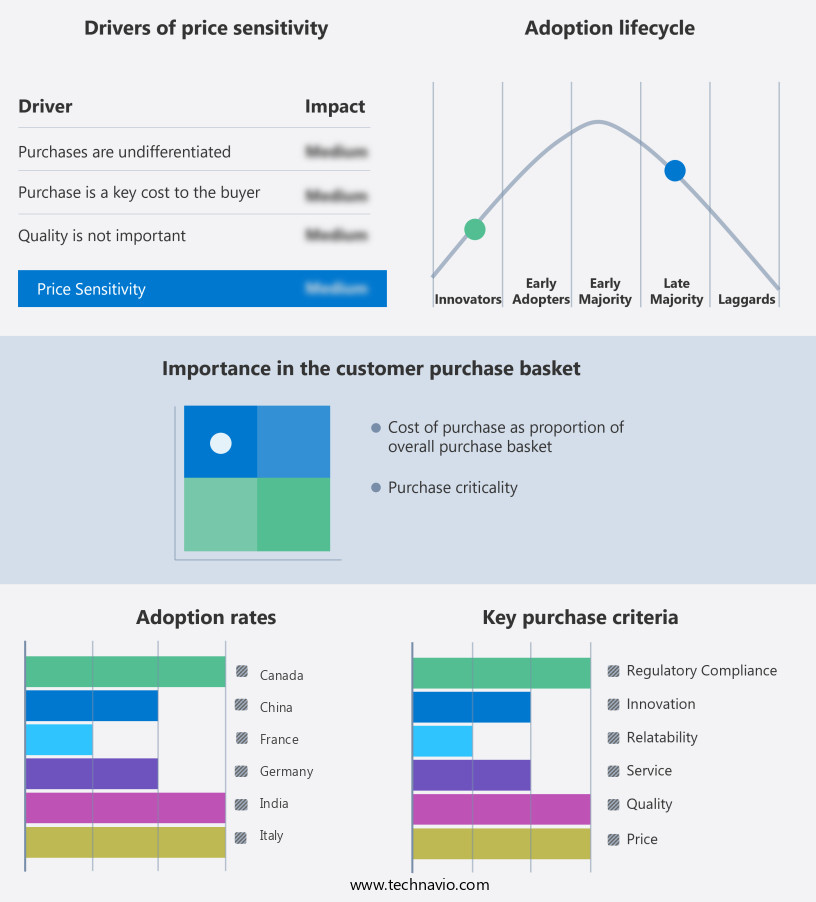

Exclusive Customer Landscape

The zero-energy buildings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the zero-energy buildings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, zero-energy buildings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

altPOWER Inc. - The company specializes in constructing zero energy buildings, featuring building-integrated photovoltaic systems under the brand altPOWER. This innovative approach to architecture combines energy production and consumption, enhancing sustainability and reducing reliance on traditional energy sources. By integrating solar panels into the building design, altPOWER optimizes energy efficiency and contributes to a greener future.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- altPOWER Inc.

- Altura Associates

- Canadian Solar Inc.

- Daikin Industries Ltd.

- Danfoss AS

- ertex solar

- First Solar Inc.

- General Electric Co.

- Heliatek GmbH

- Honeywell International Inc.

- Johnson Controls International Plc

- Kingspan Group Plc

- Mahindra and Mahindra Ltd.

- Schneider Electric SE

- Siemens AG

- TotalEnergies SE

- Trane Technologies plc

- Trina Solar Co. Ltd.

- Wuxi Suntech Power Co. Ltd.

- Yingli Solar

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The building sector is increasingly recognized as a significant contributor to global greenhouse gas emissions, with energy consumption in this sector accounting for approximately 40% of total energy use and 36% of total CO2 emissions. As the world strives to reduce carbon emissions and mitigate the effects of climatic changes, the market for zero-energy buildings has gained significant traction. Zero-energy buildings, also known as net-zero energy structures, are structures that produce as much energy from renewable sources as they consume over the course of a year. These structures are designed to minimize energy consumption through the use of energy-efficient appliances, HVAC systems, and green construction technology.

They also incorporate renewable energy sources such as solar power, wind power, and geothermal energy systems to generate the remaining energy required. The renewable energy segment, which includes solar energy and wind power, is expected to play a crucial role in the growth of the market. Solar panels, which convert sunlight into electricity, are becoming increasingly cost-effective and efficient, making them an attractive option for building owners. Similarly, wind power, which generates electricity from wind, is also becoming more affordable and accessible. The adoption of zero-energy buildings is driven by several factors, including environmental awareness, carbon neutrality, and sustainable development.

As the world becomes more conscious of the impact of energy consumption on the environment, there is a growing demand for energy-efficient and environmentally friendly buildings. Additionally, governments and regulatory bodies are implementing energy efficiency standards and building codes to reduce carbon emissions and improve indoor air quality. The design and construction of zero-energy buildings involve several strategies, including the use of natural ventilation, air sealing, and energy management systems. These strategies help to minimize energy consumption and maximize the use of renewable energy sources. For instance, natural ventilation reduces the need for mechanical air conditioning, while air sealing prevents the loss of conditioned air.

Energy management systems, on the other hand, optimize energy use by monitoring and controlling energy consumption in real-time. Zero-energy buildings are not limited to residential structures but are also being adopted in educational facilities, public buildings, and other commercial structures. The benefits of zero-energy buildings extend beyond energy savings and environmental protection. They also provide a non-hazardous environment for occupants, contributing to improved indoor air quality and overall health and well-being. The market for zero-energy buildings is expected to grow significantly in the coming years, driven by increasing environmental awareness, regulatory requirements, and technological advancements. The integration of networked sensors, analytics platforms, and consulting services is expected to further enhance the efficiency and effectiveness of zero-energy buildings.

In , the market represents a significant opportunity for businesses involved in renewable energy systems, green construction technology, and energy efficiency services. As the world continues to grapple with the challenges of energy consumption and environmental protection, the demand for zero-energy buildings is expected to grow, offering significant opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.4% |

|

Market growth 2025-2029 |

USD 188.26 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

23.4 |

|

Key countries |

US, Canada, China, Germany, Japan, UK, India, Italy, France, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Zero-Energy Buildings Market Research and Growth Report?

- CAGR of the Zero-Energy Buildings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the zero-energy buildings market growth of industry companies

We can help! Our analysts can customize this zero-energy buildings market research report to meet your requirements.