Liquid Floor Coatings Market Size 2024-2028

The liquid floor coatings market size is forecast to increase by USD 1.76 billion at a CAGR of 5.7% between 2023 and 2028. In the dynamic world of flooring solutions, liquid coatings have emerged as a preferred choice for their durability, chemical resistance, and aesthetic appeal. These coatings offer various finishes, including glossy, matte, anti-slip, textured, and metallic, catering to diverse customer preferences. The market is driven by key factors such as rapid urbanization and infrastructure growth, leading to an increasing demand for durable and aesthetically pleasing flooring options. Moreover, the strong demand for moisture-resistant liquid floor coatings, particularly in industries such as food and beverage, pharmaceuticals, and chemical manufacturing, is also contributing to market growth. Moreover, the healthcare sector's growing focus on infection control and patient safety further boosts the market's expansion. Stricter government regulations related to indoor air quality and worker safety are pushing manufacturers to develop eco-friendly and safe coating formulations. Urethane and epoxy are popular coating types due to their superior wear resistance and ease of application. Overall, the market is poised for growth, offering numerous opportunities for stakeholders.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth due to the increasing demand for high-performance and sustainable flooring solutions in various sectors. These sectors include residential houses, hotels, offices, and warehouses. The primary reasons for this growth are the need for floor conditions to withstand weather protection, wear and tear, and the desire for aesthetically pleasing and eco-friendly coatings. Liquid floor coatings offer several advantages over traditional floor paints. They provide superior chemical resistance and wear resistance, making them an ideal choice for industrial applications. Moreover, they are self-leveling and can be applied quickly, reducing downtime during construction activities.

Coating technologies have advanced significantly, leading to the development of high-performance coatings such as epoxy and polyurethane. Epoxy coatings offer excellent adhesion, durability, and resistance to abrasion and impact. On the other hand, polyurethane coatings provide superior elasticity and flexibility, making them suitable for use in areas subjected to heavy traffic and vibration. Water-based coatings are gaining popularity due to their low volatile organic compound (VOC) emissions. These coatings are not only eco-friendly but also contribute to better indoor air quality. Furthermore, antimicrobial coatings are increasingly being used to prevent the growth of bacteria and viruses, ensuring a healthier environment.

Anti-static coatings are essential in industries where the risk of static electricity is high, such as electronics manufacturing. These coatings prevent the buildup of static electricity, reducing the risk of damage to equipment and ensuring worker safety. Anti-slip coatings are another type of liquid floor coating that offers significant benefits. They provide excellent traction, reducing the risk of slips and falls, making them ideal for use in areas with high foot traffic or wet conditions. Sustainable and eco-friendly coatings are becoming increasingly important in today's world. These coatings are made using renewable resources and have a minimal impact on the environment.

They offer the same performance benefits as traditional coatings but with a reduced carbon footprint. In conclusion, the market in North America is growing due to the increasing demand for high-performance, sustainable, and eco-friendly flooring solutions. These coatings offer several advantages, including chemical resistance, wear resistance, and improved indoor air quality. The use of advanced coating technologies has led to the development of high-performance coatings such as epoxy and polyurethane, catering to the diverse needs of various industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Industrial

- Commercial

- Residential

- End-user

- Epoxy

- Acrylic

- Polyurethane

- Others

- Geography

- APAC

- China

- Europe

- Germany

- UK

- France

- North America

- US

- Middle East and Africa

- South America

- APAC

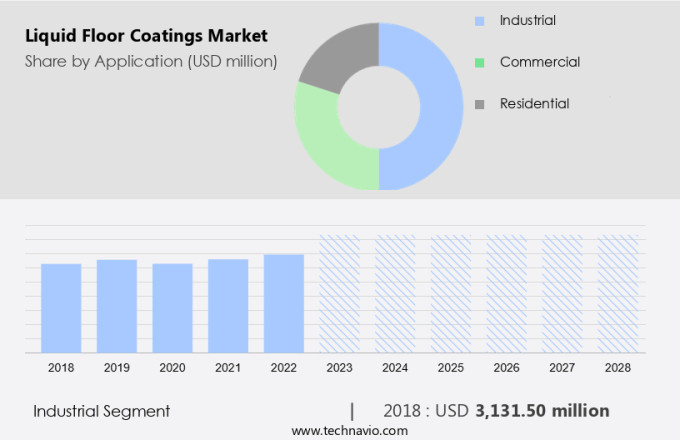

By Application Insights

The industrial segment is estimated to witness significant growth during the forecast period. The residential segment, which includes single-family homes, apartments, condominiums, townhouses, and multifamily units, holds a substantial share in the global market for liquid floor coatings. The preference for this segment is due to the rising demand for long-lasting, visually appealing, and effortless-to-maintain flooring options in residential properties. One primary reason for the acceptance of liquid floor coatings in the residential sector is the increasing need for enduring flooring solutions. Homeowners are progressively choosing floor coatings to shield their floors from scratches, stains, and deterioration. Epoxy, polyurethane, polyaspartic, and acrylic liquid floor coatings offer a tenacious and safeguarding coating, enhancing the longevity of residential floors and minimizing the frequency of replacements or repairs. These coatings contribute to the aesthetic appeal of the property while reducing the need for frequent upkeep.

Additionally, they offer beneficial properties like cracking reduction, easy cleaning, and the provision of antiskid and non-slip surfaces, making them an excellent choice for various residential applications. Educational institutions are also adopting liquid floor coatings due to their durability and ease of maintenance, ensuring a safe and clean learning environment for students.

Get a glance at the market share of various segments Request Free Sample

The Industrial segment accounted for USD 3.13 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

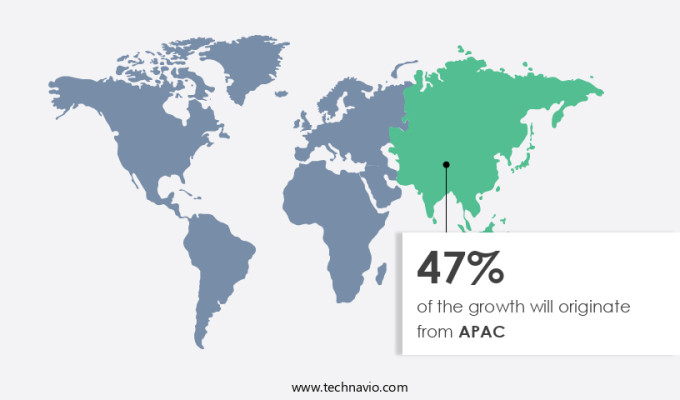

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the Asia Pacific (APAC) region, the market for liquid floor coatings is thriving due to the region's dynamic automotive and electronics industries. These sectors require high-performance flooring solutions that meet stringent quality, safety, and cleanliness standards. Liquid floor coatings, such as epoxy and polyurethane, are popular choices due to their ability to provide protection against abrasion, impact, chemical spills, and electrostatic discharge. With the rapid industrialization and infrastructure development in countries like China, India, Japan, South Korea, and Southeast Asian nations, there has been a significant increase in the construction of manufacturing facilities, warehouses, logistics centers, and industrial parks.

This growth has fueled the demand for long-lasting and protective liquid floor coatings. Water-based coatings with low volatile organic compounds (VOCs) are gaining popularity due to their eco-friendliness and compliance with regulations. Decorative coatings are also in demand for enhancing the aesthetic appeal of floors in commercial and residential spaces. Substrate insights for various applications, including metal, wood, and ceramic, are crucial in selecting the appropriate liquid floor coating for specific projects.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rapid urbanization and infrastructure growth is the key driver of the market. The expansion of urban areas and the development of new infrastructure projects are significant factors fueling the demand for liquid floor coatings in the United States. As cities grow and industries evolve, there is an increasing need for durable flooring solutions that can withstand the demands of commercial and industrial applications. These flooring systems must offer superior properties, such as resistance to abrasion, impact, and chemicals, to ensure the safety and sustainability of modern facilities. Urbanization also brings a heightened focus on safety and environmental concerns, leading to stringent regulations and standards for industrial operations. Facility managers are responding to these requirements by adopting advanced flooring solutions that meet the latest norms.

Also, liquid floor coatings, with their attractive finishes and robust performance characteristics, are becoming indispensable components of modern industrial facilities. Plastic resins, including epoxy, polyurethane, acrylic, polyester, and vinyl, are commonly used in the production of liquid floor coatings. These resin types offer various benefits, such as ease of application through methods like spraying, rolling, brushing, or troweling, and a wide range of finish types to suit diverse industrial and commercial requirements.

In summary, the market is driven by the need for high-performance flooring solutions that can withstand the rigors of industrial and commercial activities while adhering to evolving safety and environmental regulations. The use of various plastic resins and their application techniques, such as spraying, rolling, brushing, and troweling, make liquid floor coatings an essential investment for facility managers seeking to maintain safe, sustainable, and aesthetically pleasing industrial and commercial spaces.

Market Trends

Strong demand for moisture-resistant liquid floor coatings is the upcoming trend in the market. The market for liquid floor coatings in the United States is witnessing significant growth due to the increasing demand for moisture-resistant solutions. These coatings offer protection against damage caused by moisture, such as warping, delamination, and microbial growth. By creating an impervious barrier, these coatings preserve the structural integrity of floors, thereby minimizing the need for costly repairs and downtime. Moisture-resistant liquid floor coatings are especially important in settings with high humidity or frequent water exposure, such as cold storage facilities and beverage production plants. In these environments, these coatings prevent the growth of mold, mildew, and fungi, which can compromise hygiene and product quality. Resin Types such as Epoxy Resin, Polyurethane Resin, Acrylic Resin, Polyester Resin, and Vinyl Resin offer distinct benefits. Application Methods like Spraying, Rolling, Brushing, and Troweling cater to diverse project requirements. Finish Types, including Glossy, Matte, Anti-Slip, Textured, and Metallic, add to the versatility of liquid floor coatings. Low VOC Emissions make these coatings more environmentally friendly, while Decorative Coatings add an artistic touch to spaces. The market for liquid floor coatings is vast and diverse, catering to various sectors and applications, making it an exciting area for innovation and growth.

Also, inhibiting the spread of microorganisms helps maintain a clean and safe working environment. silicone-based coatings, such as those offered by Sterling Flooring Coatings, are popular choices for moisture-resistant applications due to their exceptional durability and resistance to chemicals and temperature fluctuations. These coatings provide long-lasting protection, ensuring the longevity of floors and reducing maintenance costs. When selecting liquid floor coatings, it is crucial to consider factors such as the specific application requirements, the flooring material, and the environmental conditions. By choosing the right coating for the job, businesses can ensure optimal performance and a long-lasting, protective flooring solution.

Market Challenge

Stricter government regulations related to liquid floor coatings is a key challenge affecting the market growth. The market is witnessing increased demand for eco-friendly and compliant coating formulations due to stringent regulations aimed at reducing Volatile Organic Compounds (VOC) emissions. The Environmental Protection Agency (EPA) and other regulatory bodies have set VOC concentration limits for architectural coatings, reflecting a commitment to enhancing indoor air quality. These regulations undergo regular reviews to ensure their continued relevance and effectiveness. For instance, Environment and Climate Change Canada (ECCC) conducted an internal review, leading to the publication of a renewed Federal Agenda on the Reduction of Emissions of VOC from Consumer and Commercial Products in July 2022. This agenda outlines actions to be implemented from 2022 to 2030, targeting further reductions in VOC emissions from various products, including floor coatings.

Also, professionals in the floor coatings industry are responding to these regulations by developing and promoting durable, aesthetically pleasing, and chemically resistant coatings. These coatings come in various finishes such as glossy, matte, textured, metallic, and anti-slip, catering to diverse customer preferences. The coatings offer enhanced wear resistance and are suitable for various sectors, including healthcare, ensuring a safe and hygienic environment. By adhering to these regulations, the industry is not only contributing to environmental sustainability but also offering high-performance, long-lasting flooring solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akzo Nobel NV - The company offers a variety of liquid floor coating products which include Interpon, Resicoat, Dulux, Sikkens and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ardex Endura India Pvt Ltd.

- Armorpoxy Inc

- Axalta Coating Systems Ltd.

- BASF SE

- Colorado Liquid Floors LLC

- Ecoflor

- Hempel AS

- Jotun AS

- Liquid Floors

- Liquid Floors USA of Central Florida

- Mapei SpA

- Milamar Coatings LLC

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- The Sherwin Williams Co.

- Tnemec Co Inc

- Westcoat Specialty Coating Systems

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Liquid floor coatings are a popular choice for various industries and applications due to their durability, resistance to wear and tear, and ability to provide both functional and aesthetic benefits. These coatings are suitable for concrete floors in houses, hotels, offices, warehouses, and other structures. They offer protection against weather conditions, reducing the risk of floor damage. Liquid floor coatings come in different types, including epoxy, polyurethane, and polyaspartic, each with unique properties. Epoxy coatings provide excellent chemical resistance and high-gloss finish, while polyurethane coatings offer flexibility and resistance to abrasion. Polyaspartic coatings are known for their fast curing time and high-performance characteristics.

Anti-static, waterproof, anti-vibration, antiskid, and non-slip coatings are some of the specialized types of liquid floor coatings available. These coatings cater to specific industries and applications, such as educational institutes, restaurants, medical facilities, and commercial retail stores, where safety and hygiene are paramount. Surface preparation is crucial before applying liquid floor coatings. Proper adhesion and moisture content are essential factors to ensure the longevity of the coating. Raw material prices and coating technologies, such as self-leveling and decorative seamless floors, also impact the overall cost and performance of the coatings. Liquid floor coatings are used in various coating applications, including industrial flooring solutions, Green building strategies, and sustainable coatings. These coatings include Antimicrobial Coatings and Anti-slip Coatings, which ensure Hygiene and Sanitation in healthcare facilities and other high-traffic areas.

In summary, they offer eco-friendly options, such as low VOC emissions and antimicrobial coatings. Coating formulations vary depending on the substrate, including metal, wood, ceramic, and plastic. Coating technologies, such as spraying, rolling, brushing, and troweling, are used to apply the coatings. Finish types, including glossy, matte, anti-slip, textured, and metallic, cater to different aesthetic preferences and functional requirements. Overall, liquid floor coatings offer a wide range of benefits for various industries and applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.7% |

|

Market growth 2024-2028 |

USD 1.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.2 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

US, China, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akzo Nobel NV, Ardex Endura India Pvt Ltd., Armorpoxy Inc, Axalta Coating Systems Ltd., BASF SE, Colorado Liquid Floors LLC, Ecoflor, Hempel AS, Jotun AS, Liquid Floors, Liquid Floors USA of Central Florida, Mapei SpA, Milamar Coatings LLC, Nippon Paint Holdings Co. Ltd., PPG Industries Inc., RPM International Inc., Sika AG, The Sherwin Williams Co., Tnemec Co Inc, and Westcoat Specialty Coating Systems |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch