Decorative Coatings Market Size 2024-2028

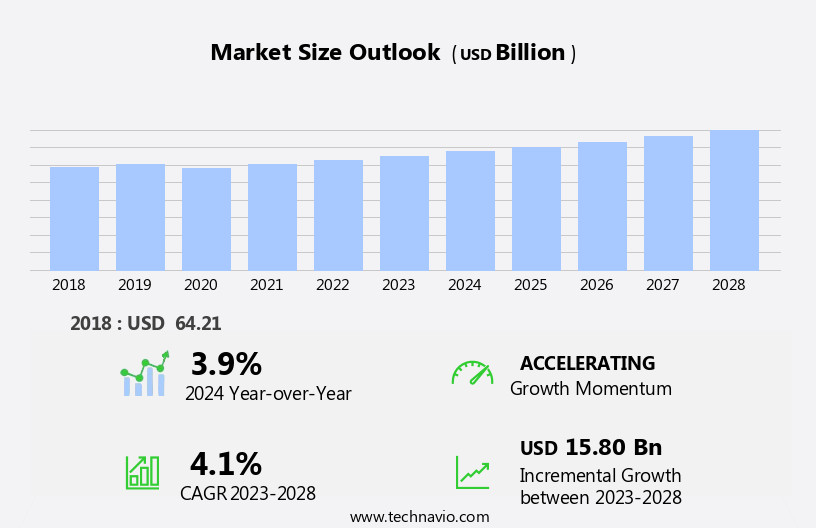

The decorative coatings market size is forecast to increase by USD 15.80 billion at a CAGR of 4.1% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing demand from emerging economies and the expanding construction sector. The market is expected to grow at a steady pace due to the rising disposable income and urbanization in developing countries. Additionally, there is a growing trend towards the use of eco-friendly and bio-based coatings, as consumers and regulatory bodies become increasingly conscious of the environmental impact of traditional coatings. However, the market faces challenges from stringent regulations on the use of certain coatings and raw materials, which can increase production costs and limit market access for some players.

- Companies seeking to capitalize on market opportunities and navigate these challenges effectively should focus on innovation, sustainability, and regulatory compliance. By investing in research and development of eco-friendly coatings and expanding their presence in emerging markets, decorative coatings manufacturers can position themselves for long-term success.

What will be the Size of the Decorative Coatings Market during the forecast period?

- The market in the US has experienced significant growth in recent years, driven by the human desire to beautify interior and exterior spaces in the modern age. This market encompasses a wide range of products, including paints, stains, and specialty coatings that offer various colors, finishes, marks, drawings, textures, and styles. Decorative coatings are used in various applications, from enhancing the aesthetics of furniture and walls in living rooms to providing outdoor resistance for commercial premises and civilizations' historical structures.

- The cultural movement towards sustainable and eco-friendly solutions has also impacted the market, leading to the development of water-based and low-VOC coatings. The market is a sizeable business, with continued growth expected due to the increasing demand for renovating and upgrading both residential and commercial spaces.

How is this Decorative Coatings Industry segmented?

The decorative coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- Waterborne coatings

- Solvent-borne coatings

- Powder coatings

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Technology Insights

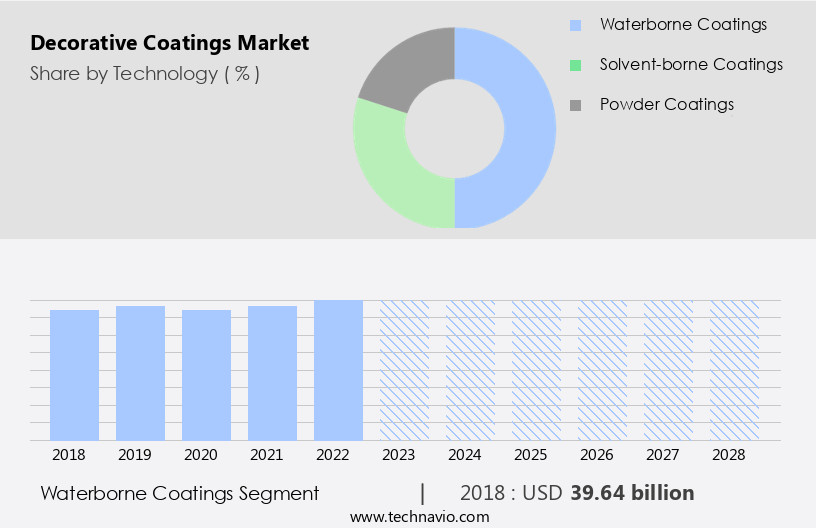

The waterborne coatings segment is estimated to witness significant growth during the forecast period.

Decorative waterborne coatings, primarily composed of acrylic and vinyl resins, serve as both primers and enhancers for various surfaces due to their heat and abrasion resistance, as well as superior adhesion. These coatings offer advantages such as lower toxicity and flammability, attributed to their minimal volatile organic compounds (VOC) and hazardous air pollutants (HAP) emissions. The market for these coatings experiences growth due to increasing construction investments and the escalating demand for design services. Waterborne coatings find applications in diverse sectors, including furniture, plastics, wood, and printing inks. Their surface properties, including anti-sealing effects, high gloss, and rub resistance, contribute to their popularity.

The renaissance era and modern age have seen an increased focus on creative expression and enhancing the appearance of interior and exterior spaces. Decorative coatings have been used since ancient civilizations to beautify objects, walls, and rooms, and their versatility continues to be a significant factor in their appeal. Modern advancements in paint technology have led to novel texture options, such as matte finishes, water resistance, and breathability. These innovations cater to various industries, including commercial premises and residential renovation cycles. Floors, bathrooms, and kitchens are popular areas for decorative coating applications, as they can significantly impact the overall design and functionality of a space.

The versatility of decorative coatings extends to various styles and textures, offering businesses and individuals the ability to transform their spaces with minimal disruption and maximum impact. As the market continues to evolve, we can expect further developments in water resistance, color options, and application techniques to cater to the ever-changing needs of interior and exterior design.

Get a glance at the market report of share of various segments Request Free Sample

The Waterborne coatings segment was valued at USD 39.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

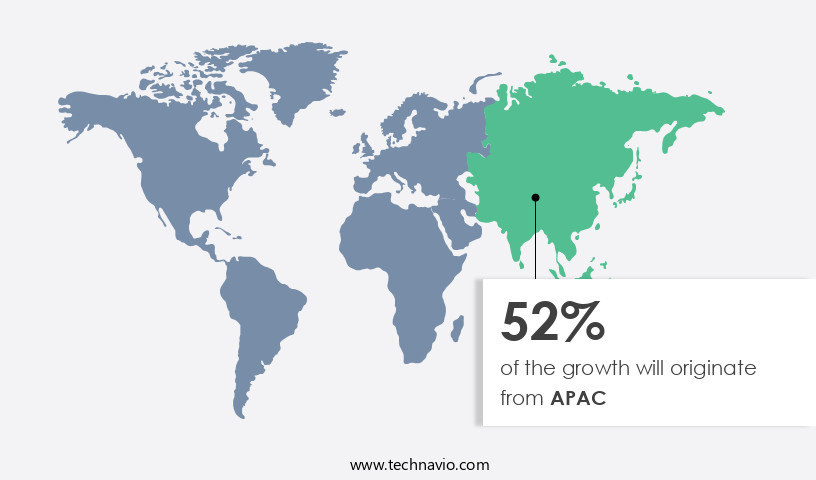

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Decorative coatings have long been a crucial element in creative expression and enhancing the appearance of interior and exterior spaces. From the Renaissance era to modern times, civilizations have utilized decorative finishes to add personality to kitchens, living rooms, and commercial premises. Application techniques, such as brushwork and textures, have transformed spaces, adding novel texture options and breathability to walls, floors, and furniture. In the contemporary market, water-based paints and latex formulations offer versatility and environmental stressor resistance, allowing for reinforcing durability and repelling moisture. Decorative coatings impact various industries, including interior design and exterior design, with applications ranging from caves to bathrooms and furniture.

Asia Pacific (APAC) holds a substantial market share in the global decorative coatings industry due to the region's construction growth. Countries like China, India, and Singapore contribute significantly to the construction market, with numerous projects underway. China's construction sector is projected to expand at a considerable rate, driving demand for decorative coatings. India's infrastructure focus and economic reforms are expected to strengthen its position in the market during the forecast period. Decorative coatings offer versatility, enhancing the human experience by beautifying spaces and providing water resistance and outdoor resistance. Businesses can choose from a wide range of finishes, colors, and styles to suit their needs, making it a versatile decorating method for underlying substrates.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Decorative Coatings Industry?

- Growing demand from emerging economies is the key driver of the market.

- Decorative coatings are essential components in the construction industry, used for both aesthetic and protective purposes on buildings and associated structures. The growth in urbanization and infrastructure investment in developing countries, such as India and Indonesia, is driving demand for decorative coatings due to the increasing demand from end-user industries like residential and non-residential infrastructure. The expanding manufacturing and building sectors in these economies, fueled by rising GDP, are expected to significantly contribute to the growth of the market over the next five years.

What are the market trends shaping the Decorative Coatings Industry?

- Increasing focus on bio-based and eco-friendly products is the upcoming market trend.

- The market is experiencing notable growth due to the increasing consumer preference for eco-friendly and sustainable products. Numerous studies have identified the commercial potential of bio-based resins and polymers in coatings. In developed regions, stringent regulations aimed at minimizing the environmental impact of products are propelling the expansion of the market. The demand for bio-based, recyclable, and renewable coating materials is particularly high in the US and Europe.

- For instance, BASF offers bio-based polyol for VOC-free 2K polyurethane applications under the Sovermol 830 brand name. This trend is expected to continue as environmental regulations become more stringent, leading to increased consumption of bio-based polymer coatings.

What challenges does the Decorative Coatings Industry face during its growth?

- Stringent regulations on use of coatings is a key challenge affecting the industry growth.

- Solvent-borne decorative coatings, comprised of volatile chemicals, pose environmental concerns. Regulatory bodies in Europe and North America have implemented strict regulations to mitigate the harmful effects. The Clean Air Act regulates volatile organic compounds (VOC) and hazardous air pollutants (HAP) emissions, setting performance standards for various coating types, including solvent-based ones. The Clean Water Act restricts the concentration of toxic chemicals in these coatings and wastewater streams.

- Recently, the Occupational Safety and Health Administration (OSHA) has strengthened regulations regarding solvent-based coatings. These regulations cover VOC and hydroxyapatite emissions, storage and flammability, and employee health. These measures aim to ensure a safer and more sustainable the market.

Exclusive Customer Landscape

The decorative coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the decorative coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, decorative coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Akzo Nobel NV - The company specializes in supplying decorative coatings, including Dulux, Sikkens, International, and Interpon brands. These high-quality coatings enhance the aesthetic appeal of various surfaces while providing durable protection. With a commitment to innovation and sustainability, the company's offerings cater to diverse industries and applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Asian Paints Ltd.

- BASF SE

- Benjamin Moore and Co.

- Carpoly Chemical Group Co. Ltd.

- Cloverdale Paint Inc.

- Cromology

- DAW SE

- Diamond Vogel

- Fujikura Co. Ltd.

- Guangdong Maydos Building Materials Ltd. Co.

- Hempel AS

- Jotun AS

- Kansai Paint Co. Ltd.

- Lanco Paints

- Masco Corp.

- PPG Industries Inc.

- RPM International Inc.

- STO Corp.

- The Sherwin Williams Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Decorative coatings have been an essential element in enhancing the visual appeal and overall aesthetic of various interior and exterior spaces throughout history. From the renaissance era to the modern age, civilizations have utilized decorative finishes to beautify objects, walls, and surfaces, reflecting cultural movements and personal expressions. Decorative coatings offer versatility in terms of application techniques and novel texture options. They can be used to transform spaces, reinforcing durability and providing water resistance for both interior and exterior applications. In the realm of interior design, these coatings can add a matte finish to living rooms or add a splash of color to kitchens, enhancing the personality of the space.

The underlying substrate plays a crucial role in the selection and application of decorative coatings. Proper preparation ensures the coating adheres effectively, providing a high-quality finish. Water-based paints have gained popularity in recent times due to their environmental friendliness and ease of use. Latex paints, for instance, offer excellent coverage and are suitable for various surfaces, including walls and floors. Decorative coatings can impact commercial premises significantly, influencing the overall ambiance and attracting customers. Businesses often opt for textures and finishes that align with their brand image and cater to the preferences of their clientele. Breathability is an essential factor in the selection of decorative coatings, particularly for areas prone to environmental stressors such as moisture.

Repelling moisture is crucial in maintaining the longevity and integrity of the coating, ensuring it continues to beautify the space. The decorative coating market is a vast and dynamic one, with continuous advancements in paint technology leading to the development of new formulations and styles. Brushwork and finishes have evolved, offering businesses and homeowners a wide range of options to choose from. Decorative coatings can be used to enhance the appearance of various objects, from furniture to caves. They serve as an extension of our human expression, reflecting our personalities and preferences. Whether it's for a renovation project or a simple upgrade, decorative coatings offer a versatile technique to beautify and transform spaces.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2024-2028 |

USD 15.80 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.9 |

|

Key countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Decorative Coatings Market Research and Growth Report?

- CAGR of the Decorative Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the decorative coatings market growth of industry companies

We can help! Our analysts can customize this decorative coatings market research report to meet your requirements.