Acrylic Resin Market Size 2024-2028

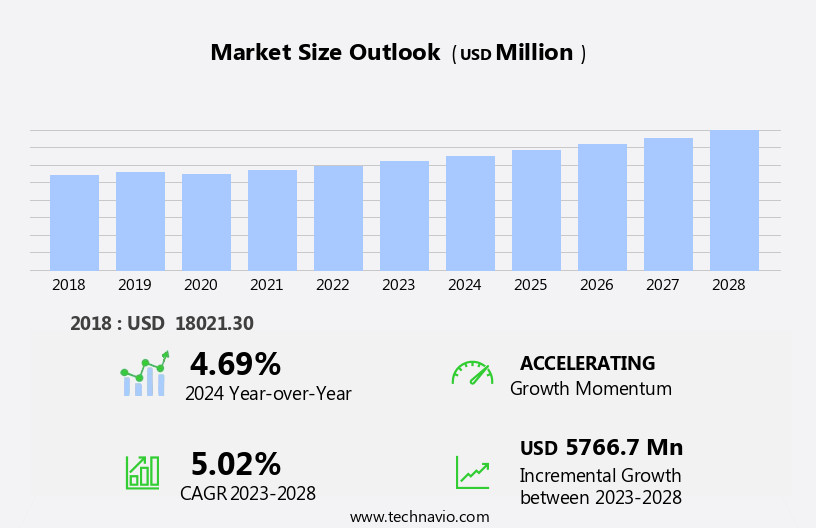

The acrylic resin market size is forecast to increase by USD 5.77 billion at a CAGR of 5.02% between 2023 and 2028.

- The market is experiencing significant growth due to the in infrastructural and construction activities worldwide. This sector's increasing demand is driven by the superior properties of acrylic resins, including their durability, chemical resistance, and transparency. Moreover, the automotive industry's growing reliance on acrylic resins for manufacturing components such as headlights and taillights further bolsters market expansion. However, market growth is not without challenges. Fluctuating raw material prices pose a significant threat to market stability, necessitating careful supply chain management and price negotiations. Companies seeking to capitalize on market opportunities must stay informed of price trends and invest in research and development to innovate and maintain a competitive edge.

- In summary, the market presents substantial growth potential, fueled by infrastructure and construction activities and the automotive industry. However, raw material price volatility poses a challenge that requires strategic planning and agility. Companies that effectively navigate these dynamics will be well-positioned to capitalize on this market's expanding opportunities.

What will be the Size of the Acrylic Resin Market during the forecast period?

- The market in the United States continues to exhibit growth, driven by the versatility and wide-ranging applications of acrylic resins. These resins, derived from acrylate polymers and acrylic acid derivatives, are valued for their excellent weatherability, chemical resistance, and thermal stability. Key industries utilizing acrylic resins include electrical equipment, fibre coatings, and automotive components. Acrylic resins are available in various forms, such as solvent-based systems, aqueous emulsions, and powder resins. Their unique properties, including viscosity control and chemical bonding, make them suitable for diverse applications. For instance, they are used in the production of acrylate monomers like methacrylic ester monomers, which are essential in the manufacture of vinyl polymers and styrenic plastics.

- Moreover, acrylic resins are increasingly being used in advanced applications, such as ballistic molding and parabolic reflectors, due to their high impact resistance and optical clarity. The market's size is significant, with continued growth expected, driven by factors like increasing demand for high-performance materials and ongoing research and development in acrylic resin technology.

How is this Acrylic Resin Industry segmented?

The acrylic resin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Paints and coatings

- Construction

- Textile and fibers

- Plastics

- Others

- Type

- Methacrylate

- Acrylates

- Hybrids

- Geography

- APAC

- China

- Japan

- Europe

- France

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

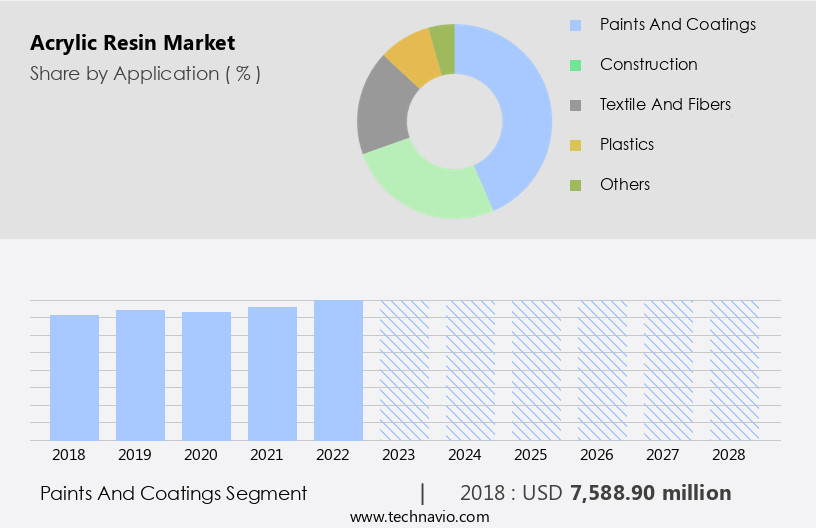

The paints and coatings segment is estimated to witness significant growth during the forecast period.

Acrylic resins, derived from acrylic monomers, are synthetic polymers extensively utilized in various industries for painting and coatings applications. Acrylic monomers, including esters and monomers of acrylic and methacrylic acids, are the primary building blocks. These monomers can be functionalized with different chemical groups or incorporated into polymer chains for enhanced properties or cost reduction. Acrylic resins exhibit excellent chemical bonding, thermal stability, and weatherability, making them suitable for diverse applications. In the industrial sector, they are employed in solvent-based and water-based systems for coatings, adhesives, and sealants. In the architectural sector, they are used for decorative and protective coatings due to their high-temperature resistance and UV stability.

Moreover, acrylic resins are employed in engineering thermoplastics, ballistic materials, and impact modifiers. In ballistic applications, they are used for hard molded armor due to their oxidative stability and high-temperature polymerization. In the automotive industry, they are used for the production of automotive components, such as headlamp housings and bumper beams. In the solar energy sector, they are used for parabolic reflectors due to their high thermal stability and resistance to degradation. Acrylic resins also find applications in various other industries, such as electrical equipment, solar energy systems, and surfboards. They are used as thickeners, gel formation agents, and additives in various applications to enhance their properties.

Acrylic monomers, such as methacrylic ester monomers and acrylamide, are used as initiators and monomers in free-radical polymerization. Acrylic resins are also used in the production of fibre coatings, acrylic multipolymers, and acrylic polymers. They are used as binders in the production of handgun bullets and golf cars. Acrylic acid derivatives, such as MMA, cyanoacrylic acid, and styrenic plastics, are used as monomers and additives in the production of various polymers. Acrylic resins are essential in various industries due to their unique properties, such as chemical bonding, thermal stability, and weatherability. They are used in various applications, including coatings, adhesives, sealants, engineering thermoplastics, ballistic materials, and solar energy systems.

Acrylic resins are versatile and can be functionalized with various chemical groups to enhance their properties or reduce costs. They are also used as monomers and additives in the production of various polymers and materials.

Get a glance at the market report of share of various segments Request Free Sample

The Paints and coatings segment was valued at USD 7.59 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 50% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Acrylic resins, a type of synthetic polymer, are in high demand in the Asia-Pacific (APAC) region due to the increasing infrastructure development and construction projects. China, as the largest producer of automobiles and a leading manufacturer of paints and coatings, is a significant contributor to the market. India, Japan, Singapore, Thailand, Indonesia, and Vietnam are other major consumers of acrylic resins in APAC. Acrylic resins find extensive applications in various industries, including automotive components, solar energy systems, coatings, and ballistic materials. In the automotive sector, acrylic resins are used in the production of engineering thermoplastics, impact modifiers, and thermoplastic acrylic coatings.

In the solar energy industry, acrylic resins are used in the manufacturing of parabolic reflectors and photovoltaic panels. The demand for acrylic resins is driven by their excellent chemical bonding, thermal stability, oxidative stability, and weatherability. Acrylate polymers, such as methacrylates and acrylic acid derivatives, are commonly used in the production of acrylic resins. The market for acrylic resins is expected to grow due to the increasing demand for acrylic multipolymers, esters, and cyclobutanes in various applications. The production of acrylic resins involves high-temperature polymerization, free-radical polymerization, and the use of initiators, such as peroxide and nitrile initiators, and additives.

Acrylic resins are also used in the production of MMA, polyacrylates, SAN, and PVC. The market for acrylic resins is expected to grow due to the increasing demand for acrylic resins in various industries, including electrical equipment and golf cars.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Acrylic Resin Industry?

- Increased infrastructural and construction activities is the key driver of the market.

- Acrylic resins have gained significant popularity in the architectural coatings market due to their extensive usage in construction and structural applications. The expanding real estate and construction industry, driven by the increasing demand for office spaces, commercial complexes, and residential buildings, is a key factor fueling the growth of the acrylic resins market. Urbanization and substantial investments in infrastructure development in developing economies, such as China, India, Indonesia, Korea, and Australia, are significantly contributing to the construction industry's growth. Acrylic resins are versatile materials used extensively in interior and exterior finishing applications as a paint or coating compound.

- The global population's surging growth is driving demand for housing and infrastructure development, further boosting the market's growth. These resins offer several advantages, including excellent adhesion, chemical resistance, and durability, making them a preferred choice for various applications. Additionally, their ease of application, low volatile organic compound (VOC) emissions, and cost-effectiveness are further contributing to their popularity. Overall, the acrylic resins market is expected to continue its growth trajectory, driven by the construction industry's expansion and the increasing demand for sustainable and cost-effective coating solutions.

What are the market trends shaping the Acrylic Resin Industry?

- Increasing demand for acrylic resins in automotive industry is the upcoming market trend.

- Acrylic resins, primarily derived from methacrylate monomers, are a crucial component in the automotive industry. These resins offer desirable properties for coating and protecting metal surfaces with varnish and paint. Methacrylate monomers provide automotive coatings with a shiny, seamless appearance and excellent protection. Beyond coating applications, acrylic resins are utilized in the manufacturing of various automotive components, such as headlamp lenses, instrument panels, taillights, and trim components.

- The durability and impact resistance of acrylic resins contribute significantly to their popularity. Moreover, their flexibility enables the creation of intricate shapes, enhancing aesthetics and improving safety. Acrylic resins' versatility and benefits make them an essential ingredient in the automotive sector.

What challenges does the Acrylic Resin Industry face during its growth?

- Fluctuation in raw material prices is a key challenge affecting the industry growth.

- Acrylic resin is a significant type of plastic material, either thermoplastic or thermosetting, primarily composed of acrylic acid, methacrylic acid, and acrylate monomers like butyl acrylate and methyl methacrylate. Industrial-scale production of acrylic resins necessitates substantial raw material requirements. Price variations in these materials significantly impact producers. Acrylic resins, binders, and additives' prices are volatile due to their dependence on crude oil prices. As such, their prices are subject to fluctuations based on the global market's prevailing natural gas and crude oil prices.

- As a , it's essential to understand the market dynamics of acrylic resins. Their production and pricing are intricately linked to the crude oil market, making them a vital component in various industries.

Exclusive Customer Landscape

The acrylic resin market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the acrylic resin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, acrylic resin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allnex GMBH - The company specializes in providing acrylic resins, including Solventborne Acrylics, marketed as SETALUX and MACRYNAL. These resins enhance the performance of polyurethane topcoats and clearcoats in diverse industrial and automotive applications, ensuring superior durability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allnex GMBH

- Anhui Elite Industrial Co. ltd.

- Arkema Group.

- BASF SE

- CHANSIEH ENTERPRISES CO. LTD

- Chevell Performance Material Group

- Covestro AG

- DIC Corp.

- Dow Chemical Co.

- Eternal Materials Co. Ltd.

- Evonik Industries AG

- Formula Chemicals Inc.

- Henkel AG and Co. KGaA

- Koninklijke DSM NV

- Mitsubishi Chemical Group Corp.

- Mitsui Chemicals Inc.

- NIPPON SHOKUBAI CO. LTD

- Resonac Holdings Corp.

- Solvay SA

- Sumitomo Chemical Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of applications, driven by the versatility and unique properties of acrylic polymers. These polymers, which include acrylics, methacrylics, and other acrylate derivatives, exhibit excellent chemical resistance, thermal stability, and weatherability. Acrylic resins are used extensively in various industries, including automotive and transportation, solar energy, coatings, and engineering thermoplastics. In the automotive sector, they are employed in the production of automotive components, such as bumper systems, headlamp housings, and exterior trim. In the solar energy industry, acrylic resins are utilized in the manufacture of solar energy systems, specifically in the production of parabolic reflectors and encapsulant materials.

In the coatings sector, acrylic resins are used to produce thermoplastic acrylic coatings, which offer excellent adhesion, flexibility, and chemical resistance. These coatings are used in a variety of applications, including protective coatings for industrial equipment and architectural coatings for buildings. Acrylic resins are also used in the production of ballistic materials, including hard molded armor and ballistic molding applications. The high thermal stability and oxidative stability of acrylic resins make them ideal for these applications, where protection against high temperatures and impact is crucial. In the field of electronics, acrylic resins are used in the production of electrical equipment, including insulators and encapsulants.

The excellent electrical insulating properties of acrylic resins make them ideal for these applications. Acrylic resins are also used in the production of various types of fibre coatings, including those used in the textile industry. These coatings offer excellent chemical resistance and durability, making them ideal for use in the production of high-performance fabrics. The production of acrylic resins involves various processes, including free-radical polymerization, high-temperature polymerization, and chemical bonding. Initiators, such as peroxides and nitrile initiators, are used to initiate the polymerization process. The viscosity of the resin can be controlled through the use of additives, such as thickeners and gel formation agents.

Acrylic resins are also used in the production of various types of adhesives and sealants, including injectable systems and aqueous emulsions. These products offer excellent bonding properties and are used in a variety of applications, including construction and automotive manufacturing. Acrylic resins are also used in the production of various types of plastics, including styrenic plastics and PVC. Impact modifiers, such as linear unsaturated dimers and acrylamide, are used to improve the impact resistance of these plastics. Acrylic resins are also used in the production of various types of monomers, including methacrylic ester monomers and alkyl acrylates.

These monomers are used in the production of various types of polymers, including acrylic multipolymers and esters. The production of acrylic resins involves the use of various types of initiators, such as peroxides and nitrile initiators. The pH range of the reaction mixture is also important, as it can affect the polymerization process. Acrylic resins are also used in various applications where high thermal stability and UV stability are important, such as in the production of handgun bullets and golf cars. In these applications, the acrylic resins offer excellent resistance to heat and UV radiation, ensuring optimal performance and longevity.

In summary, the market is a diverse and dynamic industry, driven by the unique properties of acrylic polymers. These polymers are used extensively in various industries, including automotive, solar energy, coatings, electronics, and textiles, among others. The production of acrylic resins involves various processes, including free-radical polymerization, high-temperature polymerization, and chemical bonding, and the use of various types of initiators and additives. The versatility and performance characteristics of acrylic resins make them an essential component in a wide range of applications.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.02% |

|

Market growth 2024-2028 |

USD 5766.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.69 |

|

Key countries |

China, US, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acrylic Resin Market Research and Growth Report?

- CAGR of the Acrylic Resin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acrylic resin market growth of industry companies

We can help! Our analysts can customize this acrylic resin market research report to meet your requirements.