3D Cardiac Mapping Systems Market Size 2024-2028

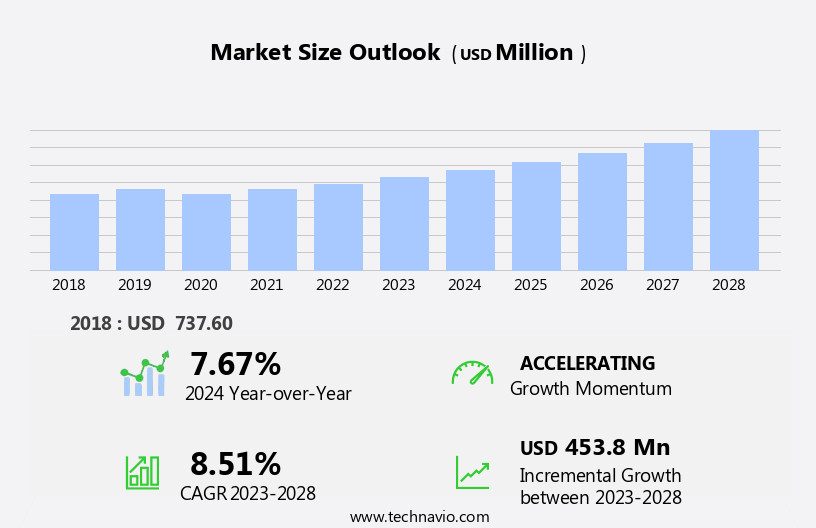

The 3D cardiac mapping systems market size is forecast to increase by USD 453.8 million at a CAGR of 8.51% between 2023 and 2028.

- The market is experiencing significant growth, driven by the rising incidence of cardiac diseases and increasing support from insurance providers. The growing number of strategic alliances between market players and healthcare institutions is further fueling market expansion. However, the lack of trained electrophysiologists and cardiologist surgeons poses a significant challenge, as the implementation and utilization of these advanced systems require specialized expertise. Regulatory hurdles and supply chain inconsistencies also temper growth potential, necessitating effective strategies for navigating these challenges. Companies seeking to capitalize on market opportunities must focus on addressing the shortage of skilled professionals through training programs and collaborations with academic institutions.

- Additionally, investing in robust regulatory compliance and supply chain management systems will be crucial for long-term success in the market.

What will be the Size of the 3D Cardiac Mapping Systems Market during the forecast period?

- The market is experiencing significant advancements in healthcare analytics, data security, and precision cardiac medicine. These technologies enable improved catheter guidance systems during ablation procedures, facilitating electrophysiological data acquisition and processing. Virtual and augmented reality technologies enhance procedural workflow optimization, allowing for more effective electrophysiological studies and cardiac simulation. Cardiac rhythm management and clinical decision support are also benefiting from these innovations. Patient-specific treatment planning and remote patient monitoring are increasingly integrated into the clinical trial management process. Data privacy remains a critical concern, with robust solutions ensuring secure electrogram analysis and data transfer. Cardiac electrophysiology is revolutionized through anatomical landmark identification and patient-specific therapies, resulting in more accurate cardiac modeling and electrocardiogram interpretation.

- Mobile health applications further expand access to cardiac device implantation and care, contributing to the overall growth of the market. In the realm of data processing, advanced algorithms and AI technologies enable real-time analysis of electrophysiological data, providing valuable insights for clinical decision making. The integration of clinical trial management systems and data privacy solutions further strengthens the market's potential, ensuring secure and efficient data handling. The market is poised for growth, driven by the increasing demand for personalized and effective cardiac treatments. The integration of healthcare analytics, data security, and advanced technologies is transforming the landscape of cardiac care, offering new opportunities for innovation and improved patient outcomes.

How is this 3D Cardiac Mapping Systems Industry segmented?

The 3d cardiac mapping systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Contact 3D cardiac mapping systems

- Non-contact 3D cardiac mapping systems

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

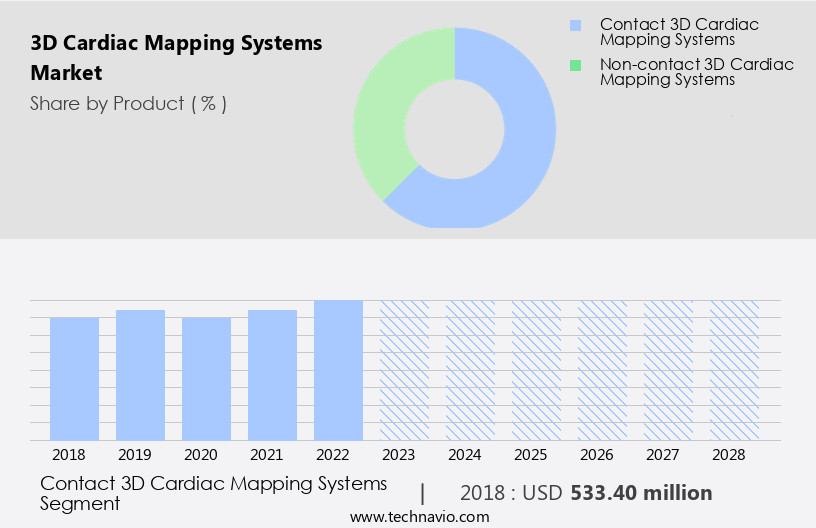

The contact 3D cardiac mapping systems segment is estimated to witness significant growth during the forecast period.

3D cardiac mapping systems have gained significant traction in the healthcare industry due to their ability to enhance electrophysiologists' understanding of real-time position management and cardiac anatomy. These systems enable accurate catheter navigation during electrophysiological procedures, improving the detection and treatment of complex cardiac arrhythmias such as atrial fibrillation (AF), atrial tachycardia (AT), atrial flutter (AFL), accessory pathway (AP) related arrhythmias, ventricular tachycardia, coronary artery disease (CAD), and dilated cardiomyopathy (DCM). The integration of 3D visualization, remote monitoring, and personalized medicine in these systems has led to more precise electrode placement and real-time data analysis. Additionally, the use of machine learning, predictive analytics, and data integration enables healthcare providers to make informed decisions, reduce healthcare costs, and improve patient safety.

Wearable technology and implantable defibrillators have further expanded the application of these systems in monitoring and managing cardiac rhythm disorders. In the realm of interventional cardiology, 3D cardiac mapping systems have streamlined procedural efficiency and treatment planning, leading to better treatment outcomes. The adoption of cloud computing and healthcare IT has facilitated data analysis, image fusion, and treatment outcome evaluation, enabling healthcare providers to deliver value-based care. Medical device regulations and subscription models ensure the safety and affordability of these systems, while artificial intelligence and precision medicine pave the way for future advancements. Ultrasound imaging, electromagnetic navigation, and computed tomography are some of the medical imaging techniques used in conjunction with 3D cardiac mapping systems to provide a comprehensive understanding of cardiac anatomy.

Overall, 3D cardiac mapping systems have revolutionized the diagnosis and treatment of cardiac arrhythmias, offering a harmonious blend of technology and healthcare expertise.

The Contact 3D cardiac mapping systems segment was valued at USD 533.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

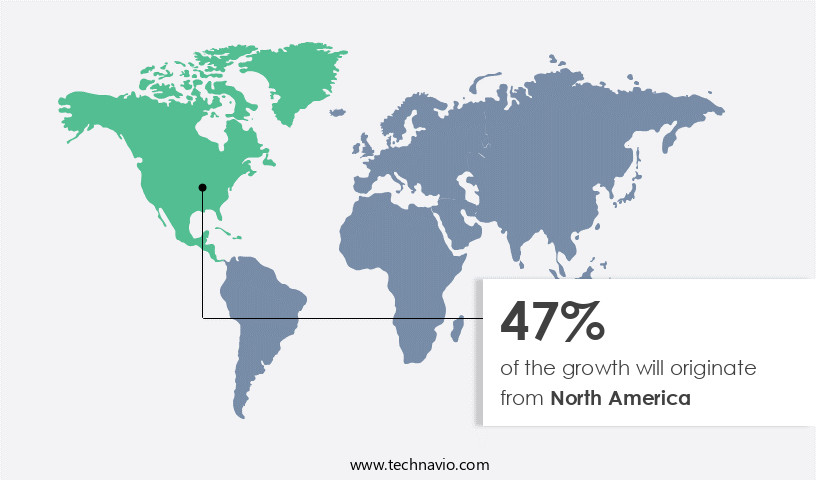

North America is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the high prevalence of cardiac rhythm disorders such as ventricular tachycardia and atrial fibrillation. Advanced technologies like 3D visualization, real-time imaging, and machine learning are transforming cardiac mapping and ablation procedures, leading to improved patient safety and treatment outcomes. Remote monitoring and wearable technology enable continuous cardiac monitoring, facilitating early detection and intervention. Value-based care and healthcare quality improvement initiatives are driving the adoption of these systems. Medical imaging modalities like computed tomography and magnetic resonance imaging are integral to the mapping process, providing precise cardiac anatomy data.

Cardiac surgery, interventional cardiology, and electrode placement procedures are becoming more efficient with the help of electromagnetic navigation and catheter navigation systems. Data integration, analysis, and predictive analytics are crucial for personalized medicine and treatment planning. The regulatory landscape is evolving to support the adoption of these advanced technologies, with medical device regulations encouraging the use of cloud computing and subscription models. Precision medicine, clinical trials, and patient engagement are key trends shaping the future of the market. The healthcare industry's focus on cost reduction and improving patient safety is also fueling the market growth. Radiofrequency ablation and implantable defibrillators are among the treatments benefiting from these advancements.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the 3D Cardiac Mapping Systems market drivers leading to the rise in the adoption of Industry?

- The surge in the prevalence of cardiac diseases and the expansion of insurance providers serve as the primary drivers in the market growth.

- The prevalence of heart valve diseases, such as coronary heart disease, aortic stenosis, and mitral heart valve diseases, is on the rise due to the increasing elderly population and their associated health risks. Heart disease treatment devices, including 3D cardiac mapping systems, are in high demand as a result. The growing number of Medicare providers, including hospitals and clinics, is also increasing due to the rising number of hypertension cases worldwide. Uncontrolled blood pressure or high blood pressure is a significant contributor to atrial fibrillation (AF), which can lead to stroke or heart attack. 3D cardiac mapping systems play a crucial role in the diagnosis and treatment of heart diseases, particularly in interventional cardiology.

- These systems enable electrode catheter placement for Holter monitoring, image fusion with magnetic resonance imaging (MRI), data integration, and treatment planning. Furthermore, advancements in artificial intelligence (AI) technology are facilitating improved treatment outcomes and healthcare cost reduction. The integration of AI in 3D cardiac mapping systems allows for more accurate and efficient analysis of patient data, leading to better treatment plans and improved patient outcomes.

What are the 3D Cardiac Mapping Systems market trends shaping the Industry?

- The increasing prevalence of strategic alliances represents a significant market trend. This business strategy, which involves collaborations between companies for mutual benefit, is becoming increasingly common in various industries.

- The market is experiencing significant growth due to various market dynamics. One of the key drivers is the integration of cloud computing technology, enabling remote access to ultrasound imaging data for healthcare IT systems. This leads to increased procedural efficiency and precision medicine, as real-time data analysis supports catheter navigation during radiofrequency ablation procedures. Medical device regulations ensure safety and quality improvement, while subscription models offer flexible pricing options for end-users. Clinical trials and patient engagement are also crucial factors, as accurate and timely data analysis contributes to better patient outcomes.

- Strategic alliances between companies, end-users, and government organizations further expand companies' global presence and accelerate market growth. These collaborations provide cost containment, extended product lines, and increased geographical reach, making the market an essential component of the healthcare equipment industry.

How does 3D Cardiac Mapping Systems market faces challenges face during its growth?

- The scarcity of adequately trained electrophysiologists and cardiothoracic surgeons poses a significant challenge to the expansion of the industry.

- The market has experienced shifts in demand due to several factors. The decline in the number of coronary artery bypass grafting (CABG) operations, which traditionally drove the market, decreased by 28% between 2015 and 2020. Conversely, the number of claims for cardiac stent placement, a procedure performed by cardiologists, increased by 121% during the same period. The approval and subsequent growth of drug-eluting stents for coronary artery disease saw a 145% increase between 2017 and 2018. The scarcity of cardiologists, with only 5,500 available in India for a population of 1.3 billion, further impacts the market. This translates to one cardiologist serving a population of 30,000.

- The market dynamics include the adoption of advanced technologies such as 3D visualization, remote monitoring, personalized medicine, laser ablation, medical imaging, wearable technology, and cardiac monitoring devices. Clinical data management, cardiac rhythm disorders, electromagnetic navigation, and computed tomography also play crucial roles in the market.

Exclusive Customer Landscape

The 3d cardiac mapping systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the 3d cardiac mapping systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, 3d cardiac mapping systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in advanced 3D cardiac mapping technology, including the EnSite X EP System.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Acutus Medical Inc.

- APN Health LLC

- BioSig Technologies Inc.

- BIOTRONIK SE and Co. KG

- Boston Scientific Corp.

- Catheter Precision Inc.

- CoreMap Inc.

- EPMap-System GmbH

- Johnson and Johnson Services Inc.

- Kardium Inc.

- Koninklijke Philips N.V.

- Medtronic Plc

- MicroPort Scientific Corp.

- Sichuan Jinjiang Electronic Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in 3D Cardiac Mapping Systems Market

- In February 2024, Medtronic, a leading medical technology company, announced the U.S. Food and Drug Administration (FDA) approval of its new 3D cardiac mapping system, the EnSite Precision⢠Cardiac Mapping System. This advanced technology enables real-time, high-resolution 3D mapping of the heart, enhancing the accuracy of ablation procedures for treating complex cardiac arrhythmias (Medtronic, 2024).

- In June 2025, Siemens Healthineers and Boston Scientific, two major players in the cardiac mapping market, entered into a strategic partnership to co-develop and commercialize integrated electroanatomical mapping and ablation systems. This collaboration aims to combine Siemens Healthineers' 3D mapping technology with Boston Scientific's ablation technology, offering healthcare providers a more efficient and effective solution for treating cardiac arrhythmias (Siemens Healthineers, 2025).

- In October 2024, Abbott Laboratories completed the acquisition of St. Jude Medical, a leading manufacturer of cardiac rhythm management and cardiac mapping systems. This acquisition significantly expanded Abbott's portfolio in the cardiac mapping market and strengthened its position as a global leader in the medical device industry (Abbott Laboratories, 2024).

- In March 2025, the European Union (EU) granted marketing authorization for the ECGnavigator, a novel 3D cardiac mapping system developed by Merit Medical. This system utilizes artificial intelligence and machine learning algorithms to create real-time, high-definition 3D maps of the heart, enabling more precise and efficient ablation procedures for the treatment of atrial fibrillation (Merit Medical, 2025).

Research Analyst Overview

The market continues to evolve, driven by advancements in technology and growing applications across various sectors. Cloud computing plays a significant role in enabling remote access to real-time imaging and data analysis, enhancing procedural efficiency and improving healthcare IT infrastructure. Ultrasound imaging and magnetic resonance imaging are increasingly being integrated with 3D cardiac mapping systems for more accurate diagnosis and treatment planning. Medical device regulations are evolving to accommodate the integration of emerging technologies, such as machine learning and artificial intelligence, into cardiac mapping systems. Subscription models are gaining popularity, offering healthcare providers access to advanced technologies and data analysis tools at a lower cost.

Healthcare quality improvement and patient safety are key priorities, leading to increased adoption of 3D cardiac mapping systems for the diagnosis and treatment of cardiac rhythm disorders, including atrial fibrillation and ventricular tachycardia. Precision medicine and personalized treatment plans are also driving demand for these systems, as they enable more accurate electrode placement and real-time data analysis. Clinical trials and data integration are critical components of the market, as they facilitate the development of new treatments and improve treatment outcomes. Patient engagement is also a growing focus, with wearable technology and Holter monitoring enabling remote cardiac monitoring and improving patient care.

Catheter navigation and electrode placement are essential components of cardiac ablation procedures, and 3D cardiac mapping systems are increasingly being used to enhance procedural efficiency and accuracy. Radiofrequency ablation and laser ablation are among the procedures benefiting from these advancements. Value-based care and healthcare cost reduction are also driving demand for 3D cardiac mapping systems, as they enable more accurate diagnosis and treatment, reducing the need for costly hospitalizations and procedures. Treatment planning and image fusion are critical components of these systems, enabling healthcare providers to develop personalized treatment plans based on the latest data and imaging technology.

In summary, the market is continuously unfolding, with ongoing advancements in technology and applications across various sectors. The integration of cloud computing, ultrasound imaging, healthcare IT, procedural efficiency, medical device regulations, subscription models, healthcare quality improvement, catheter navigation, precision medicine, clinical trials, patient engagement, radiofrequency ablation, and other emerging technologies is shaping the future of cardiac care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled 3D Cardiac Mapping Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 453.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

7.67 |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this 3D Cardiac Mapping Systems Market Research and Growth Report?

- CAGR of the 3D Cardiac Mapping Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the 3d cardiac mapping systems market growth of industry companies

We can help! Our analysts can customize this 3d cardiac mapping systems market research report to meet your requirements.