3D Projector Market Size 2024-2028

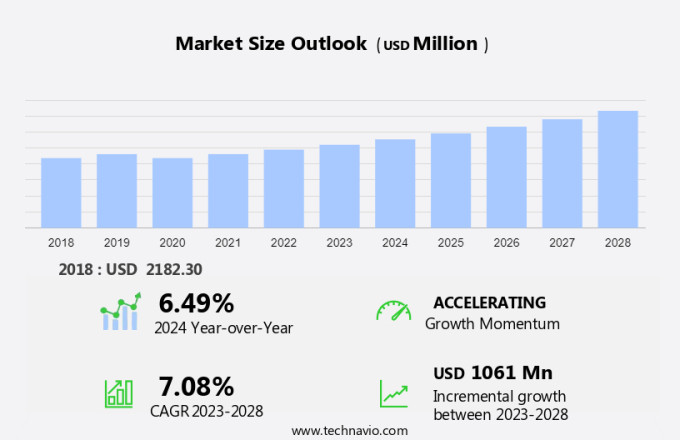

The 3D projector market size is forecast to increase by USD 1.06 billion at a CAGR of 7.08% between 2023 and 2028. The market is witnessing significant growth due to the increasing adoption of 3D technology in various industries. One of the primary drivers is the expanding use of 3D projectors in education, events, and large venues, cinema, business presentations, home theater, and gaming. The integration of advanced display technology, such as multiple-lens camera systems in smartphones, is fueling the demand for 3D projectors. However, the high cost compared to traditional projectors remains a challenge. The market is witnessing several innovations, including the development of new data stream types and formats, to address this issue. The use of 3D glasses and the brightness of the projector are crucial factors influencing the market's growth. The report provides a comprehensive analysis of these trends and challenges, offering valuable insights into the future of the market.

The market is experiencing significant growth due to the increasing popularity of 3D technology in various industries. The use of 3D projectors goes beyond the realm of films and home theater systems, extending to business presentations, event management, and corporate simulations. These projectors convert 3D data into stunning visuals on a two-dimensional surface, creating an illusion of depth that engages viewers and enhances their experience. The technology behind 3D projectors enables the display of images and videos in three dimensions, adding a new dimension to screens and simulations. Audience members wearing 3D glasses can enjoy a more great experience, making it an ideal choice for events and business presentations.

Furthermore, the market caters to diverse data stream types, ensuring compatibility with various sources and applications. Overall, the market for 3D projectors is poised for continued growth as the technology becomes increasingly integrated into various industries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Technology

- DLP

- LCD

- LCoS

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Technology Insights

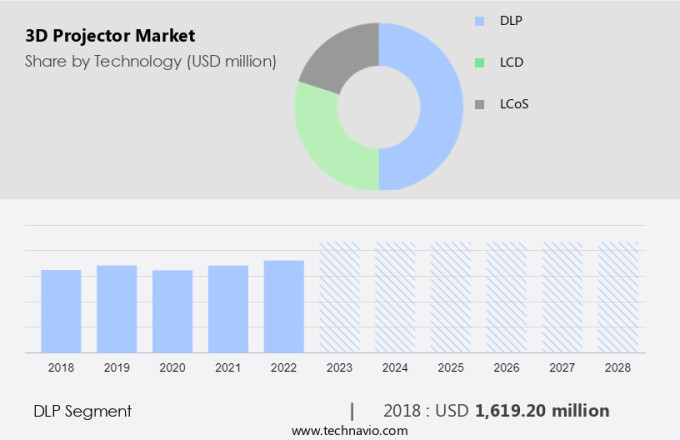

The DLP segment is estimated to witness significant growth during the forecast period.DLP technology is the predominant choice for 3D projectors in the market, utilizing small mirrors to direct light to and from the screen. This technology is commonly found in 3D models, which may employ a color wheel or DLP chips for color creation. High-end 3D projectors can feature up to three DLP chips (red, green, and blue). Pricing for DLP-based 3D projectors ranges from a few thousand US dollars for entry-level models to tens of thousands of US dollars for premium versions. The advantages of DLP technology in 3D projectors are numerous. Superior image quality is a significant benefit, as DLP offers high contrast and minimal pixelation, resulting in an exceptional visual experience for viewers.

Furthermore, the technology's ability to create an illusion of depth on a 2D surface, combined with the use of 3D data, enhances simulation and engagement for audiences, making it an ideal solution for game makers and other industries that rely on great experiences. Cloud computing and artificial intelligence (AI) are also being integrated into 3D projectors, further expanding their capabilities and applications. Handheld and portable 3D projectors are becoming increasingly popular, offering flexibility and convenience for various use cases.

Get a glance at the market share of various segments Request Free Sample

The DLP segment was valued at USD 1.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

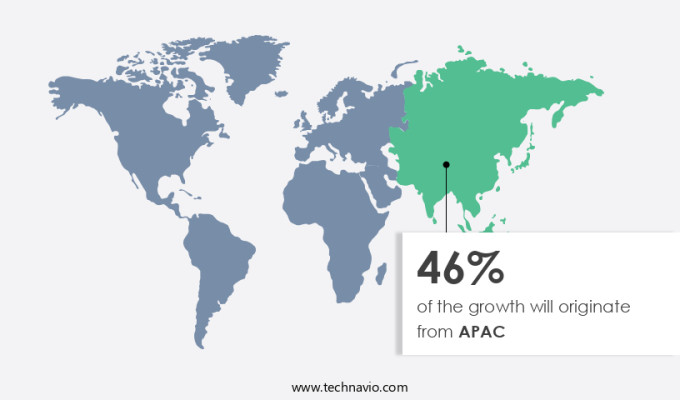

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in APAC is witnessing significant growth due to the increasing adoption of advanced technologies in the film and education industries. Major leading companies in the region are catering to various applications, such as home theater, cinema halls, large public events, and educational institutions, with their innovative 3D projectors. The illusion of depth created by these projectors enhances the viewer's experience, making them increasingly popular. Moreover, the expanding number of offices and business parks in countries like India is expected to boost market growth. In China, there is a growing preference for 3D movies among the audience, further fueling the demand for 3D projectors.

Furthermore, the integration of cloud computing, artificial intelligence (AI), and handheld or portable 3D projectors is revolutionizing the way 3D data is displayed on a 2D surface, offering a more great and interactive experience for the audience.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising adoption of 3D projectors in theaters and cinema halls is the key driver of the market. The market is experiencing significant growth due to the increasing adoption of 3D technology in various sectors, including home theater, corporate presentations, event management, and the education sector. This technology allows images and videos to be displayed with a sense of depth on a two-dimensional surface, providing a great experience that uniquely engages audiences. In the film industry, 3D projectors are increasingly being used in cinema halls to enhance the cinematic experience and attract consumers. Digitalization is a major trend in the cinema industry, with more theaters and halls installing digital screens to offer a more complete and engaging experience.

Furthermore, the use of 3D projectors, along with other advanced technologies is helping to keep consumers engaged and attract new audiences. The education sector is also benefiting from the use of 3D projectors, as they provide a more interactive and engaging learning experience for students. Overall, the market is expected to continue growing as more industries discover the benefits of this innovative technology.

Market Trends

The integration of multiple-lens camera systems in smartphones is the upcoming trend in the market. The market is witnessing significant growth due to the increasing adoption of 3D technology in various sectors. This technology adds depth and dimension to images and videos, making them more engaging and realistic. The home theater industry is a major contributor to this market, as consumers seek to create great and cinematic experiences in their homes.

Furthermore, corporate presentations and event management are also adopting 3D projectors to make their content more captivating and memorable. In the education sector, 3D projectors are being used to enhance learning experiences, particularly in fields such as science, engineering, and architecture. Cinema halls continue to be a significant market for 3D projectors, with digitalization replacing traditional film projectors. The integration of 3D technology in projectors is expected to drive market growth during the forecast period.

Market Challenge

The high cost compared with traditional projectors is a key challenge affecting the market growth. The market has witnessed significant growth due to the increasing demand for advanced technology in various sectors. One of the primary differences between a traditional projector and a 3D projector lies in the ability to manipulate images in real time, providing better depth perception and a more great experience.

Furthermore, this technology is increasingly being adopted for home theater systems, corporate presentations, event management, and cinema halls. However, the added cost for 3D capability is substantial, with commercial models averaging USD 15,000 and residential versions costing around USD 20,000. N The digitalization of education and the entertainment industry further fuels the demand for 3D projectors, making them an essential investment for those seeking superior image quality and an engaging experience.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acer Inc.: The company offers 3D projector that includes portable LED, brightness lm projector , under the brand name of Acer Inc.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acer Inc.

- ASUSTeK Computer Inc.

- Barco NV

- BenQ Corp.

- Canon Inc.

- Coretronic Corp.

- Dell Technologies Inc.

- Delta Electronics Inc.

- Digital Projection Ltd.

- Hitachi Ltd.

- InFocus

- JVCKENWOOD Corp.

- NEC Corp.

- Panasonic Holdings Corp.

- Seiko Epson Corp.

- Sony Group Corp.

- Ushio Inc.

- ViewSonic Corp.

- Wolf Cinema

- Xiaomi Global Community

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for great viewing experiences in various industries. The technology, which projects 3D images and videos onto a two-dimensional surface, creates an illusion of depth and adds a new dimension to film, home theater, corporate presentations, event management, education, and game-making. The use of 3D projectors in cinema halls for 3D movies and in the education sector for simulation and learning outcomes is driving the market's growth. Digitalization, innovation, and crisis in production are key factors leading to the adoption of 3D projectors in various end-use sectors. The market is witnessing the emergence of handheld and portable 3D projectors, making it more accessible to businesses and individuals.

Furthermore, the market is segmented into education, events & large venues, cinema, business, and home theater & gaming. The cinema industry is a significant contributor to the market's growth due to the need for a realistic viewing experience for 3D films. The education sector is also adopting 3D projectors for simulation and creativity in learning. The market is witnessing the emergence of advanced display technologies, such as LCOS projector solutions with liquid crystal chips and mirrored backing, and laser and hybrid light sources, which offer higher brightness and longer lifespan. The gaming industry is also investing in 3D projectors for a lifelike viewing experience and gaming specifications. The future estimations suggest that the market will continue to grow due to the increasing demand for engagement and involvement in various industries. The market is expected to witness significant investment pockets in the form of cloud computing, artificial intelligence, and projection mapping technologies.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.08% |

|

Market growth 2024-2028 |

USD 1.06 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.49 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 46% |

|

Key countries |

China, US, Japan, India, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acer Inc., ASUSTeK Computer Inc., Barco NV, BenQ Corp., Canon Inc., Coretronic Corp., Dell Technologies Inc., Delta Electronics Inc., Digital Projection Ltd., Hitachi Ltd., InFocus, JVCKENWOOD Corp., NEC Corp., Panasonic Holdings Corp., Seiko Epson Corp., Sony Group Corp., Ushio Inc., ViewSonic Corp., Wolf Cinema, and Xiaomi Global Community |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch