Accelerometers Market Size 2024-2028

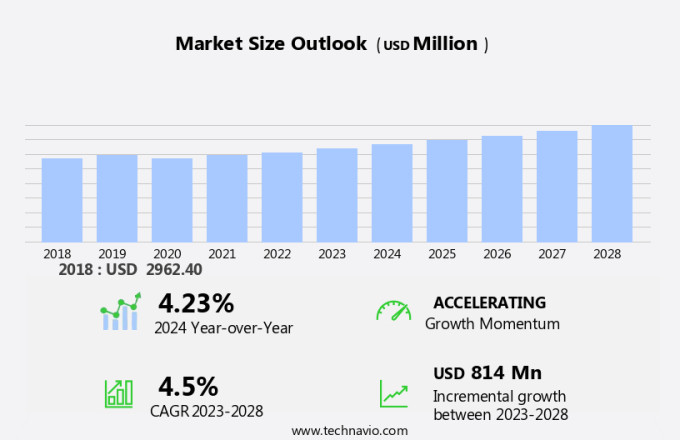

The accelerometers market size is forecast to increase by USD 814 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing demand from various end-user industries, including screen rotation in portable devices and industrial automation in manufacturing hubs. This trend is particularly noticeable in the Asia Pacific region, where the market is witnessing robust expansion. However, the market's growth trajectory is not without challenges. One such challenge is the relatively low accuracy of accelerometers in certain industries, such as the semiconductor industry, which may hinder their widespread adoption. Despite this obstacle, companies can capitalize on the market's growth potential by focusing on innovation and improving the accuracy of their accelerometer offerings. Strategic collaborations and partnerships can also help overcome this challenge and expand market reach.

- In summary, the market presents a compelling growth opportunity for companies, with increasing demand from end-users, particularly in the Asia Pacific region, offset by the challenge of maintaining high accuracy levels. Companies that can effectively navigate these dynamics and deliver innovative, high-performing accelerometer solutions will be well-positioned to capitalize on this market's potential.

What will be the Size of the Accelerometers Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and increasing applications across various sectors. Capacitive accelerometers, with their high sensitivity and low power consumption, are gaining popularity in automotive and consumer electronics. Mounting configurations for these sensors are becoming more diverse, with silicon microstructures enabling compact designs and improved performance. Inertial measurement units (IMUs) are another key market trend, integrating acceleration data logging, environmental testing, and signal processing algorithms to measure both linear and angular motion. Impact force measurement and tilt sensing are essential applications for IMUs in industries like construction and aerospace. Three-axis accelerometers, based on MEMS technology, are increasingly used for vibration measurement and motion tracking.

Sensor fusion techniques enable the combination of data from multiple sensors, enhancing accuracy and reliability. Linear acceleration sensors and angular rate sensors are crucial components in this context. Industry growth in the market is expected to reach double-digit percentages, fueled by the increasing demand for advanced sensing technologies in various applications. For instance, a leading automotive manufacturer reported a 15% increase in sales due to the integration of advanced accelerometer systems in their latest vehicle models. Dynamic range specifications, interface protocols, packaging techniques, reliability testing, and calibration procedures are essential considerations for accelerometer manufacturers. Bandwidth specifications, power consumption, noise reduction filters, and shock detection systems are other critical factors influencing market dynamics.

In conclusion, the market is characterized by continuous innovation and evolving patterns, with applications ranging from automotive to aerospace and consumer electronics. The integration of advanced technologies like MEMS, sensor fusion, and digital output is driving growth and enhancing performance.

How is this Accelerometers Industry segmented?

The accelerometers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Industrial

- Automotive

- Consumer electronics

- Aerospace and defense

- Others

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

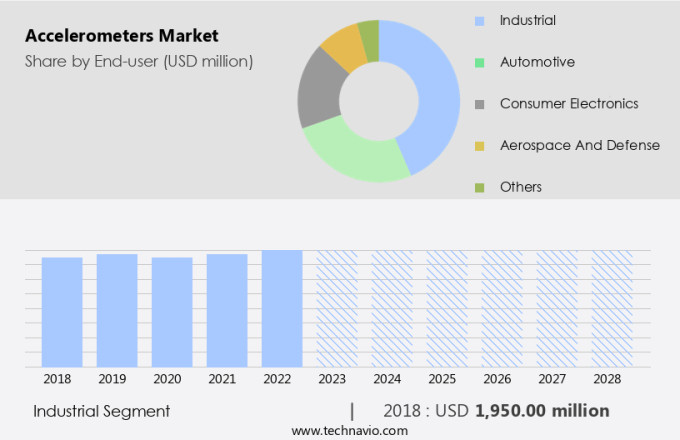

The industrial segment is estimated to witness significant growth during the forecast period.

The global accelerometer market is witnessing significant growth due to the increasing adoption of automation in various industries. Industrial applications accounted for the largest market share in 2021, driven by the use of robots and industrial automation systems. Companies offer rugged industrial accelerometers with features such as stainless steel casing, low-frequency response, and waterproofing. For instance, Dytran's model 3185D accelerometer is a rugged IEPE accelerometer with a built-in Faraday shield for electrostatic noise immunity, a sensitivity of 100 mV/g, and a response at low frequencies. Advancements in technology have fueled the growth of automation, leading to the adoption of inertial measurement units (IMUs) and 3-axis accelerometers in various applications.

IMUs are used in motion tracking sensors, tilt sensing, vibration measurement, and shock detection systems. For example, MEMS (Micro-Electro-Mechanical Systems) technology is widely used in the production of 3-axis accelerometers due to their small size, low power consumption, and high sensitivity. Sensor fusion techniques, such as Kalman filtering, are used to combine data from multiple sensors to improve accuracy and reliability. Linear acceleration sensors and angular rate sensors are essential components of IMUs, providing data for calculating acceleration and angular velocity, respectively. Calibration procedures and temperature compensation techniques are crucial to ensure the accuracy and reliability of these sensors.

The market for accelerometers is expected to grow at a steady pace in the coming years due to the increasing demand for motion tracking sensors in various applications, such as automotive, healthcare, and consumer electronics. For instance, the automotive industry is expected to be a significant contributor to the market growth, driven by the increasing adoption of advanced driver assistance systems (ADAS) and electric vehicles (EVs). In summary, the global accelerometer market is witnessing significant growth due to the increasing adoption of automation in various industries, driven by advances in technology and the need for accurate and reliable motion tracking sensors.

The use of MEMS technology, sensor fusion techniques, and calibration procedures are essential to ensure the accuracy and reliability of these sensors. The market is expected to grow steadily in the coming years, driven by the increasing demand for motion tracking sensors in various applications, particularly in the automotive industry.

The Industrial segment was valued at USD 1950.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

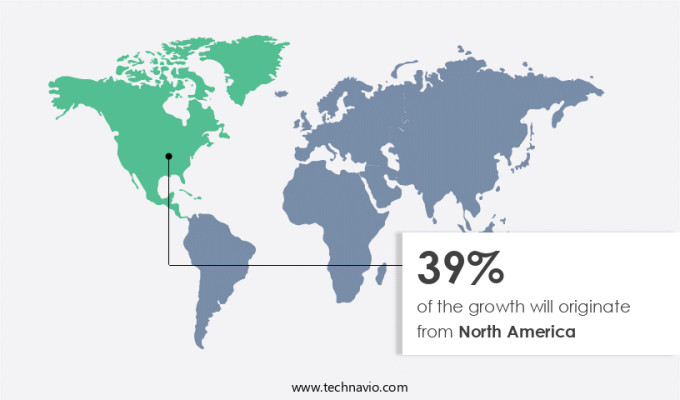

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant advancements, with capacitive accelerometers and inertial measurement units (IMUs) gaining popularity due to their high sensitivity and precision. Mounting configurations and silicon microstructures continue to evolve, enabling versatile applications in various industries. Acceleration data logging and environmental testing are crucial aspects of accelerometer development, ensuring reliability and accuracy under diverse conditions. Signal processing algorithms, such as noise reduction filters and shock detection systems, enhance the functionality of these sensors. Impact force measurement and vibration measurement are essential in industries like automotive and aerospace, where safety and performance are paramount.

Three-axis accelerometers and MEMS technology enable motion tracking and tilt sensing, while sensor fusion techniques and linear acceleration sensors offer improved accuracy and efficiency. The market growth is expected to reach double digits, with North America leading the way, capturing the highest share in 2023. The region's growth is driven by the increased investment in developing high-performance accelerometers and the US defense sector's focus on precision-guided munitions (PGMs), which accounted for approximately 30% of the US military's procurement budget in 2021. These PGMs rely on advanced accelerometers for optimal functionality, contributing to the market's expansion.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Accelerometers Industry?

- The primary catalyst for market growth is the increasing demand from end-users.

- Accelerometers play a pivotal role in various industries, particularly in the automobile sector, where they optimize performance, enhance system reliability, and reduce costs. In automobiles, accelerometers are integral to detecting accidents and deploying airbags by identifying sudden deceleration. MEMS (Micro-Electromechanical Systems) accelerometers have revolutionized airbag control modules, replacing expensive switches and fueling the demand for these sensors. MEMS accelerometers' versatility extends beyond automobiles, finding applications in consumer electronics as well. The global accelerometer market is expected to grow robustly due to these factors, with industry analysts forecasting a significant increase in demand.

- For instance, the use of accelerometers in smartphones has led to advancements in features like motion sensing and activity tracking. This trend, among others, is likely to propel the market growth during the forecast period.

What are the market trends shaping the Accelerometers Industry?

- In the Asia-Pacific region, a significant rise in demand represents the emerging market trend. This increasing demand signifies a promising business opportunity for companies in the APAC market.

- The APAC region, with its large number of manufacturers in China and low raw material costs, is poised for significant growth in the accelerometer market. APAC is projected to lead the global market, particularly for low-end users in consumer and automotive electronics. India, in turn, is expected to dominate the APAC market due to shifting safety regulations in the infrastructure and automobile industries. Additionally, the global accelerometer market is experiencing a transformation, fueled by the increasing adoption of micro-electromechanical system (MEMS) accelerometers in various applications.

- According to recent estimates, the MEMS segment is expected to account for over 60% of the global accelerometer market share by 2025. This growth is attributed to the MEMS technology's advantages, such as small size, low power consumption, and high accuracy.

What challenges does the Accelerometers Industry face during its growth?

- The low accuracy of accelerometers in specific industries poses a significant challenge, impeding industry growth. In order to mitigate this issue, advancements in accelerometer technology and calibration techniques are essential to enhance precision and reliability, ultimately driving industry expansion.

- Accelerometers, electronic sensors that measure acceleration forces on objects to determine their position and monitor movement, hold significant importance in various sectors, including medical applications, navigation, transport, and consumer electronics. For instance, the Belgian government promotes the use of accelerometer-based step counters to encourage citizens to walk thousands of steps daily. In addition, Herman Digital Trainer utilizes these sensors to measure strike force during physical training. Accelerometers have proven valuable in calculating gait parameters, such as stance and swing phases, enabling the monitoring of human movement.

- The market is poised for substantial growth, with industry analysts projecting a 20% increase in demand over the next few years. This surge is driven by the increasing adoption of wearable devices and advancements in sensor technology.

Exclusive Customer Landscape

The accelerometers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the accelerometers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, accelerometers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aeron Systems Pvt. Ltd. - The company specializes in producing advanced accelerometers, including the SPIN INC2D model, providing precise measurement solutions for various industries.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeron Systems Pvt. Ltd.

- Analog Devices Inc.

- Honeywell International Inc.

- Innalabs Ltd.

- iXblue SAS

- Kistler Group

- L3Harris Technologies Inc.

- MEMSIC Semiconductor Co. Ltd.

- Navigation Electronics Inc.

- Parker Hannifin Corp.

- Physical Logic Ltd.

- Robert Bosch GmbH

- Safran Colibrys SA

- SBG Systems SAS

- Sensonor AS

- STMicroelectronics International N.V.

- TDK Corp.

- TE Connectivity Ltd.

- Thales Group

- VectorNav Technologies LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Accelerometers Market

- In January 2024, Bosch Sensortec, a leading supplier of micro-electromechanical systems (MEMS) sensors, announced the launch of its new Sensortec SCA21-G series of high-performance, miniature accelerometers. These sensors offer improved sensitivity and accuracy, making them suitable for applications in automotive, industrial, and consumer electronics sectors (Bosch Sensortec press release).

- In March 2024, STMicroelectronics and Texas Instruments entered into a strategic collaboration to co-develop and co-market a new generation of automotive-grade MEMS accelerometers. This partnership aimed to enhance their combined market presence and cater to the growing demand for advanced safety and driver assistance systems (STMicroelectronics press release).

- In May 2024, Analog Devices, a global leader in semiconductor solutions, completed the acquisition of Honeywell's Sensing and Controls business. This acquisition included Honeywell's MEMS accelerometer portfolio, expanding Analog Devices' offerings and strengthening its position in the industrial and automotive markets (Analog Devices press release).

- In April 2025, the European Union (EU) announced the approval of new regulations for the use of accelerometers in transportation applications. The new rules set stricter safety requirements and increased testing frequency, driving demand for advanced and reliable accelerometer technologies (European Commission press release).

Research Analyst Overview

- The market for accelerometers continues to evolve, driven by advancements in sensor technology and increasing applications across various sectors. Sensor arrays, featuring both low-g and high-g accelerometers, are integral to sensor networks, enabling data analysis software to extract valuable insights from position estimation and orientation sensing data. Sensor sensitivity and accuracy are paramount, with drift compensation and gyro sensor integration essential for precision measurement in applications such as process automation and quality control. In the realm of predictive maintenance, wireless accelerometers play a pivotal role in vibration monitoring and impact analysis, ensuring machinery operates at optimal performance levels.

- Structural health monitoring is another burgeoning area, with real-time data streaming facilitating early detection of potential issues and minimizing downtime. The industry anticipates a growth of over 10% in the next five years, fueled by the integration of application-specific ICs, microcontroller interfaces, and signal conditioning techniques. For instance, a leading manufacturing company experienced a 15% increase in production efficiency by implementing accelerometer-based predictive maintenance in their assembly lines.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Accelerometers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

141 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 814 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Germany, China, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Accelerometers Market Research and Growth Report?

- CAGR of the Accelerometers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the accelerometers market growth of industry companies

We can help! Our analysts can customize this accelerometers market research report to meet your requirements.