Air Insulated Switchgear Market Size 2024-2028

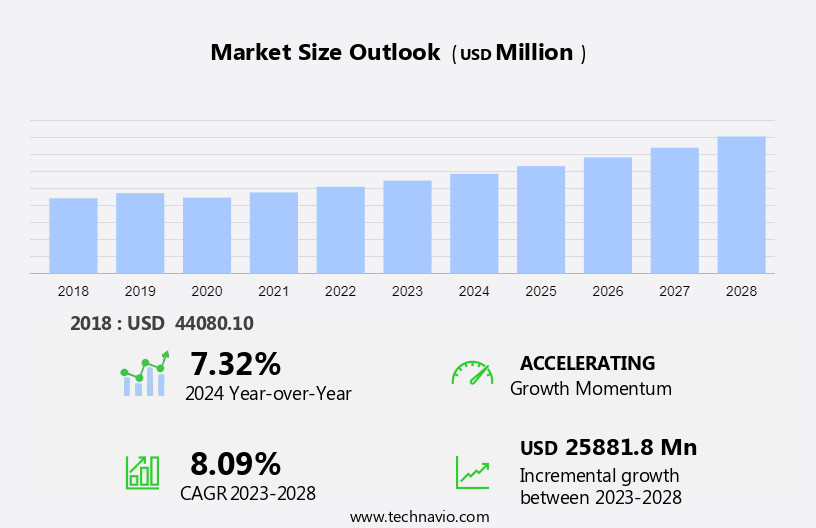

The air insulated switchgear market size is forecast to increase by USD 25.88 billion at a CAGR of 8.09% between 2023 and 2028.

- The Air Insulated Switchgear (AIS) market is witnessing significant growth due to the increasing adoption of renewable energy sources and the expansion of smart electricity grid infrastructure in North America. The shift towards clean energy and reducing carbon footprint is driving the demand for AIS in various applications, including renewable energy, lighting, HVAC, and automation. Moreover, the growing trend of energy storage integration with switchgear is further boosting the market growth. Despite the advantages of Gas-Insulated Switchgear (GIS), the preference for AIS remains high due to its cost-effectiveness and ease of installation. However, the market is facing challenges from intense competition posed by local and regional companies. The market analysis report provides a comprehensive study of these trends and challenges, offering insights into the future growth prospects of the market.

What will be the Size of the Air Insulated Switchgear Market During the Forecast Period?

- The air insulated switchgear (AIS) market encompasses commercial activities centered around the production and application of electrical equipment used in power distribution and transmission. This market is driven by the increasing electricity demand and the need for grid resiliency In the energy sector. AIS, a type of switchgear insulated with air instead of gas, plays a crucial role in power utility segments, particularly In the integration of renewable energy sources and the retrofit and refurbishment of aging infrastructure. Key components of AIS include circuit breakers, bushings, and current transformers. Compact substations, which house these components, are gaining popularity due to their space-saving design and lower operational costs. The use of steel, cement, and insulation materials in AIS manufacturing contributes to the environmental impact, leading to a growing focus on the development of eco-friendly alternatives.

- The market is also witnessing the emergence of hybrid switchgear-based substations that combine AIS and gas-insulated switchgear (GIS) for optimal efficiency and performance. The electricity industry's focus on grid resilience and security, peak load demand management, and the integration of smart meters and renewable energy sources further fuels the growth of the AIS market. Excise duties and other import regulations may impact market dynamics, but the overall trend is towards the modernization and expansion of energy grid infrastructure.

How is this Air Insulated Switchgear Industry segmented and which is the largest segment?

The air insulated switchgear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Power Rating

- Low voltage

- Medium voltage

- High voltage

- Deployment

- Indoor

- Outdoor

- Geography

- APAC

- China

- Japan

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Power Rating Insights

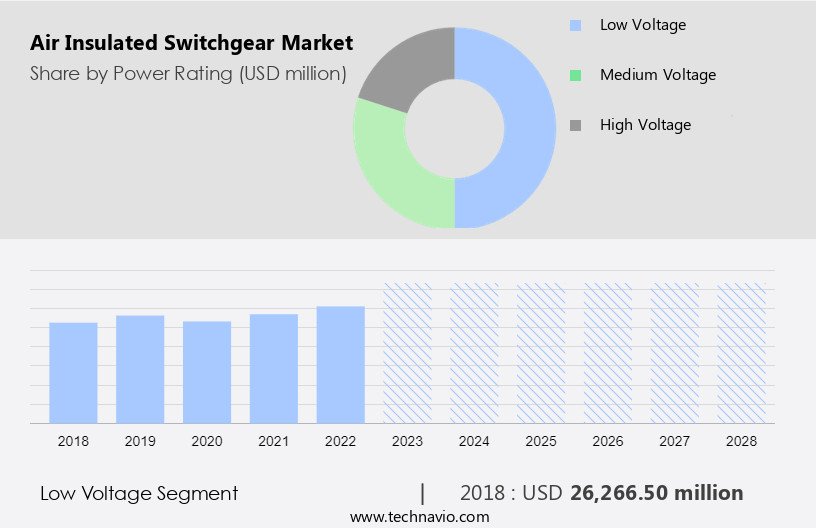

- The low voltage segment is estimated to witness significant growth during the forecast period.

The market encompasses low voltage switchgear, which operates up to 1 kV, playing a pivotal role due to its extensive applications. This segment caters to power distribution in residential, commercial, and industrial sectors, along with infrastructure and transportation projects. Notable industries utilizing low voltage air insulated switchgear are data centers, hospitals, malls, airports, and petrochemical and manufacturing industries. Major companies, such as ABB Ltd., provide these solutions worldwide. The power utility segment, driven by electricity demand and infrastructural developments, fuels the growth of the market. Additionally, the energy sector's paradigm shift towards renewable integration, grid resiliency, and energy efficiency further boosts market expansion.

Developing economies, with their increasing industrialization and urbanization, present significant opportunities for market growth. Despite challenges like import excise duties, raw material prices, and supply chain disruptions, the market remains robust due to favorable regulatory policies and the need for reliable, secure, and advanced equipment.

Get a glance at the market report of share of various segments Request Free Sample

The low voltage segment was valued at USD 26.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

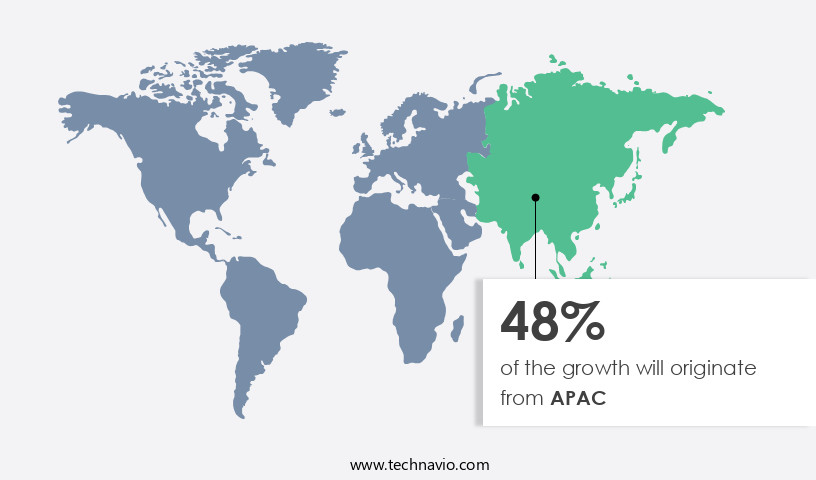

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Air Insulated Switchgear (AIS) market In the Asia Pacific (APAC) region is projected to expand due to factors such as increasing electricity demand, infrastructure development, and commercial activities in sectors like power utilities, construction, and industry. Key commercial activities, including power distribution, load centers, and transmission line networks, require reliable and advanced AIS equipment for efficient energy transmission. However, the environmental impact of switchgear, particularly its contribution to greenhouse gas emissions, is a concern. To address this, companies are focusing on developing eco-friendly solutions, such as hybrid switchgear-based substations, using natural components and clean air technology. Additionally, favorable regulatory policies and the integration of renewable energy sources are expected to boost the market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Air Insulated Switchgear Industry?

Growing renewable power generation is the key driver of the market.

- The global Air-insulated Switchgear (AIS) market is experiencing growth due to the escalating electricity demand and the expansion of power grids to accommodate renewable energy sources. Renewable energy production is a priority for governments worldwide as concerns over environmental pollution and global warming intensify. AIS plays a crucial role in power control and safety at electricity generating points and transmission networks. The integration of renewable energy into existing grid infrastructure necessitates the upgradation and refurbishment of switchgear systems. Commercial activities, particularly In the power utility segment, are driving the demand for advanced, reliable, and secure AIS. Compact substations, load centers, and hybrid switchgear-based substations are gaining popularity due to their space-saving design and efficiency. Developing economies are investing in infrastructure developments, including energy grid infrastructure, to support their rapid industrialization and commercialization. The AIS market is influenced by various factors, including the aging power infrastructure, the need for grid resiliency, and the integration of renewable energy sources. Operational costs, peak load demand, and energy storage are essential considerations for companies in this market. The market dynamics are also impacted by factors such as import excise duties, raw material prices, and the voltage segment. The shift towards clean energy, energy efficiency, and sustainable energy solutions is shaping the future of the AIS market.

- The use of advanced equipment, such as circuit breakers, bushings, current transformers, and smart meters, is becoming increasingly common. The market is also witnessing the emergence of clean air technology, natural components, and ambient air insulation. Despite these opportunities, the AIS market faces challenges such as supply chain disruptions, fiscal resource diversion, and the need for grid security. Favorable regulatory policies, low-emission electric components, and the adoption of advanced technologies, such as 8DJH 24 switchgear and RMUs, are expected to mitigate these challenges. Thus, the global Air-insulated Switchgear market is poised for growth due to the increasing demand for reliable, efficient, and secure power infrastructure. The market is driven by factors such as the expansion of power grids, the integration of renewable energy sources, and the need for grid resiliency. companies in this market must focus on innovation, sustainability, and cost-effectiveness to remain competitive.

What are the market trends shaping the Air Insulated Switchgear Industry?

Growth of smart electricity grid infrastructure is the upcoming market trend.

- Air-insulated switchgear (AIS) plays a crucial role in commercial activities withIn the energy sector, particularly in power distribution networks. However, the aging power infrastructure and increasing electricity demand necessitate upgradation and refurbishment. Traditional AIS components, such as circuit breakers, bushings, and current transformers, are being replaced with advanced, reliable, and secure equipment to ensure grid resiliency. The power utility segment is witnessing a paradigm shift towards compact substations, hybrid switchgear-based substations, and smart meters. Developing economies are investing in infrastructure developments, including energy grid infrastructure, to cater to the growing energy needs of their populations. Infrastructural developments also include the integration of renewable energy sources, which requires energy storage solutions and grid security measures. The energy sector faces challenges such as import excise duties, raw material prices, and supply chain disruptions due to lockdowns and fiscal resource diversion. To address these challenges, there is a growing focus on energy efficiency, favorable regulatory policies, and the use of low-emission electric components. Advanced switchgear systems, such as 8DJH 24 switchgear, RMUs, and clean air technology, are being adopted to ensure reliable and affordable energy supply.

- The voltage segment is witnessing upgradation and refurbishment to cater to the needs of small-sized industries, commercial establishments, and high-tension power networks. The use of natural components, such as ambient air, in insulation systems is gaining popularity due to its environmental benefits and cost-effectiveness. The transition towards clean energy plants and sustainable energy sources is also driving the demand for energy-efficient switchgear systems. Thus, the Air-insulated switchgear market is witnessing significant growth due to the increasing demand for reliable and efficient power distribution networks, infrastructure developments, and the integration of renewable energy sources. The market is expected to continue its growth trajectory, driven by the need for grid resiliency, energy efficiency, and sustainable energy solutions.

What challenges does the Air Insulated Switchgear Industry face during its growth?

Intense competition from local and regional market players is a key challenge affecting the industry growth.

- The Air-insulated Switchgear (AIS) market experiences intense competition due to the involvement of numerous large and diversified players, including Siemens AG and General Electric Co., alongside a substantial number of regional companies. This market dynamic leads to price and margin compression, as local competitors often offer lower prices. In the medium voltage AIS segment, the company population is more substantial than In the high-voltage segment. Small and medium-sized enterprises face manufacturing constraints, resulting in lower profits, particularly In the medium voltage AIS segment. Key components of AIS include circuit breakers, bushings, current transformers, and voltage transformers. These components are integral to power distribution, power transmission, and grid resiliency In the energy sector.

- The power utility segment is a significant consumer of AIS due to the aging grid infrastructure and the need for upgradation and retrofit. Developing economies are investing in energy infrastructure, including compact substations and hybrid switchgear-based substations, to meet growing electricity demand. Infrastructural developments and the integration of renewable energy sources necessitate the adoption of advanced, reliable, and secure equipment. The AIS market is influenced by various factors, including economic recovery, fiscal resource diversion, and supply chain disruptions due to lockdowns. The market is also driven by the need for reliable, energy-efficient, and fire-resistant equipment. Favorable regulatory policies and the integration of clean energy plants, such as wind and solar, are further market growth factors.

- Import excise duties and raw material prices, particularly for iron, steel, metals, cement, and cooling components, impact market costs. The voltage segment, including upgradation and refurbishment, is a significant market opportunity for companies. Energy storage and smart meters are emerging trends In the AIS market.

Exclusive Customer Landscape

The air insulated switchgear market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air insulated switchgear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air insulated switchgear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- alfanar Group

- C and S Electric Ltd.

- CG Power and Industrial Solutions Ltd.

- Eaton Corp. Plc

- ELATEC POWER DISTRIBUTION GmbH

- EPE Switchgear M Sdn. Bhd.

- General Electric Co.

- Larsen and Toubro Ltd.

- Lucy Group Ltd.

- Mitsubishi Electric Corp.

- Schneider Electric SE

- Siemens AG

- Sumitomo Electric Industries Ltd.

- Tavrida Electric GmbH

- Tokyo Electric Power Co. Holdings Inc.

- Toshiba Corp.

- UNISUN ELECTRIC

- VELATIA S.L

- ZPUE S.A.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Air-insulated switchgear (AIS) is a crucial component of the electricity sector, playing a vital role in power distribution and transmission networks. The global demand for electricity continues to rise, driven by industrialization, urbanization, and the increasing adoption of clean energy sources. This trend is particularly prominent in developing economies, where infrastructure development and commercial activities are expanding at a rapid pace. The energy sector is undergoing a paradigm shift, with a focus on grid resiliency, renewable energy integration, and energy efficiency. Aging power infrastructure in various regions necessitates upgradation and refurbishment of existing grid networks. In this context, AIS remains an essential solution for power utility segments, offering reliable, secure, and advanced equipment for power distribution and transmission. AIS is an alternative to gas-insulated switchgear (GIS) and is gaining popularity due to its cost-effectiveness, ease of installation, and maintenance. AIS utilizes ambient air as an insulating medium, making it a more sustainable choice compared to GIS, which uses fluorinated gases. The use of natural components in AIS insulation is also a step towards climate-neutral insulation. The power distribution sector is witnessing significant growth, with a focus on compact substations, load centers, and smart meters. The increasing adoption of clean energy plants and the integration of renewable energy sources require advanced switchgear systems to ensure reliable energy supply and grid security.

The demand for AIS is also driven by the need for grid resilience and reliability, especially in areas with peak load demand and aging grid infrastructure. Infrastructural developments, including transmission line networks and rural electrification projects, further boost the market for AIS. The market dynamics for AIS are influenced by various factors, including raw material prices, import excise duties, and favorable regulatory policies. The availability of advanced, energy-efficient, and fire-resistant equipment is also a significant factor In the growth of the AIS market. The AIS market is diverse, catering to various industries, including commercial establishments, small-sized industries, and clean energy plants. The market is expected to grow further due to the increasing demand for reliable and secure equipment In the energy sector. Thus, the air-insulated switchgear market is poised for growth, driven by the increasing demand for electricity, the focus on grid resiliency and renewable energy integration, and the need for reliable and advanced equipment In the energy sector. The market is influenced by various factors, including raw material prices, regulatory policies, and technological advancements. The market is diverse, catering to various industries and applications, making it an essential component of the global energy sector.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 25.88 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

China, US, Japan, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Insulated Switchgear Market Research and Growth Report?

- CAGR of the Air Insulated Switchgear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air insulated switchgear market growth of industry companies

We can help! Our analysts can customize this air insulated switchgear market research report to meet your requirements.