Canada Air Quality Control Systems Market Size 2024-2028

The Canada air quality control systems market size is forecast to increase by USD 2.15 billion at a CAGR of 7.8% between 2023 and 2028.

- The market is witnessing significant growth due to various factors. Government policies enacted to regulate air quality are driving the market's expansion. The increasing focus on smart cities initiatives also contributes to the market's growth. However, the high capital cost and limited flexibility associated with air quality control systems pose challenges to market growth. Respiratory illnesses and other health issues associated with atmospheric pollution have raised public awareness, leading to a demand for indoor control systems and outdoor control systems integrated into smart city infrastructure. Furthermore, renewable energy sources are gaining popularity in Canada, and the integration of these sources into the power grid is expected to drive the demand for air quality control systems. Adherence to stringent regulations and the need for cleaner air in urban areas are key trends propelling market growth. The market's future looks promising, with ongoing technological advancements and increasing awareness of air quality's importance. Companies are investing in research and development to create cost-effective and flexible solutions to cater to the evolving market demands. The market's growth trajectory is expected to remain positive In the coming years.

What will be the size of the Canada Air Quality Control Systems Market during the forecast period?

- The Canadian air quality control systems market is experiencing significant growth due to increasing concerns over atmospheric pollution and its impact on both environmental stability and human health. Strict government standards, driven by the Clean Air Act and similar regulations, are pushing businesses in manufacturing, oil and gas, and other industries to invest in advanced air quality control technologies. These systems address various pollutants, including sulphur oxides (SO2), nitrogen oxides (NOx), mercury, and fine particulate emissions, through technologies such as electrostatic precipitators, scrubbers, and flue gas desulfurizers.

- Moreover, sensor networks and intelligent systems are becoming increasingly important in monitoring and managing emissions in real-time, ensuring compliance with regulations and maintaining optimal air quality. Additionally, the market is responding to the challenge of controlling chemical pollutants and reducing emissions of carbon monoxide, NOx, and SO2 from various sources.

How is this market segmented and which is the largest segment?

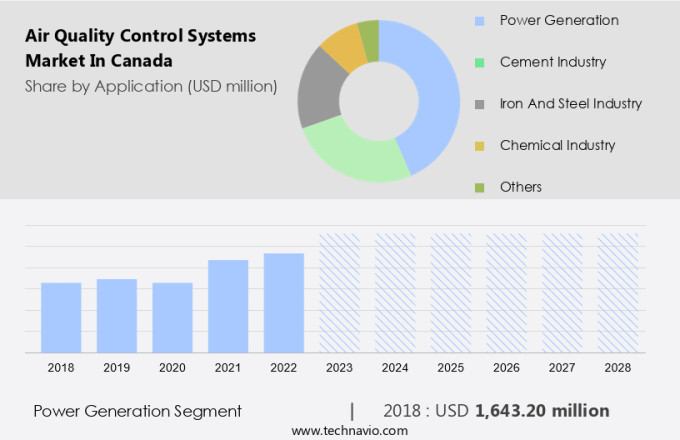

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Power generation

- Cement industry

- Iron and steel industry

- Chemical industry

- Others

- Type

- Electrostatic precipitators (ESP)

- Flue gas desulfurization (FGD)

- Selective catalytic reduction (SCR)

- Others

- Geography

- Canada

By Application Insights

- The power generation segment is estimated to witness significant growth during the forecast period.

The Canadian air quality control systems market holds significant importance due to stringent regulations, such as the Clean Air Act, which mandate the reduction of emissions from power generation and industrial sectors. Air quality control systems, including ESPs and selective catalytic reduction systems, play a crucial role in mitigating emissions of pollutants like SO2, Mercury, and NOx. Sensor networks and intelligent systems enable real-time monitoring and efficient control of these systems. Power generation, particularly coal and gas-fired plants, is the largest market segment due to the need to minimize emissions and ensure engine efficiency. Renewable energy sources, such as wind and solar, are expected to witness growth due to their increasing adoption and the need for air quality control In these applications. Overall, the market is driven by health risks associated with air pollution, regulatory compliance, and the shift towards renewable energy.

Get a glance at the market share of various segments Request Free Sample

The power generation segment was valued at USD 1.64 billion in 2018 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Canada Air Quality Control Systems Market?

Government policies for air quality regulations is the key driver of the market.

- The Canadian government is committed to addressing atmospheric pollution and its associated health risks through the implementation of stringent air quality control systems. The Air Quality Management System (AQMS) approach, overseen by the Canadian Council of Ministers of the Environment (CCME), focuses on maintaining Canadian Ambient Air Quality Standards (CAAQSs), establishing Base Level Industrial Emission Requirements (BLIERs), managing local air quality, and collaborating to reduce mobile source emissions. In addition, the government mandated industrial air pollution emission standards in June 2016. These measures aim to mitigate the risks of respiratory illnesses, cardiovascular diseases, and other health concerns associated with atmospheric pollution.

- Moreover, environmental stability is a priority, with a focus on reducing emissions of contaminants such as sulphur oxides (SO2), nitrogen oxides (NOx), fine particulate emissions, mercury, and volatile organic compounds. Various control systems are employed, including electrostatic precipitators, scrubbers, and flue gas desulfurizers. The manufacturing sector, particularly oil and gas, and power generation industries are significant contributors to these emissions and are subject to these regulations. Public awareness and education play a crucial role in reducing emissions and improving air quality. The Clean Air Act and the implementation of sensor networks and intelligent systems contribute to the monitoring and management of emissions.

What are the market trends shaping the Canada Air Quality Control Systems Market?

Rise of smart cities initiatives is the upcoming trend In the market.

- The market is experiencing significant growth due to increasing government regulations and public awareness surrounding atmospheric pollution and its health risks. This market encompasses various pollutant types, including sulphur oxides (SO2), nitrogen oxides (NOx), fine particulate emissions, and volatile organic compounds (VOCs), among others. These pollutants are prevalent in various industries such as manufacturing, oil and gas, and power generation, leading to concerns over workplace safety and respiratory illnesses. Government standards, such as the Canadian Clean Air Act, set stringent emission limits for industries to mitigate the environmental and health impacts of atmospheric pollution. To meet these regulations, various control systems are employed, including electrostatic precipitators, scrubbers, and flue gas desulfurizers.

- Furthermore, these systems help reduce emissions of SO2, mercury, and NOx, among other contaminants. The integration of intelligent systems and sensor networks in air quality control systems is a significant trend In the market. These systems enable real-time monitoring and analysis of pollutant levels, allowing for proactive interventions to maintain environmental stability and mitigate the health risks associated with atmospheric pollution. Renewable energy sources, such as wind and solar power, are also driving growth In the market as they produce fewer emissions compared to traditional energy sources. Despite the economic growth potential of the market, challenges persist. High costs, raw material shortages, and shipping delays can impact procurement levels.

What challenges does Canada Air Quality Control Systems Market face during the growth?

High capital cost and low flexibility associated with air quality control system is a key challenge affecting the market growth.

- The market has gained significant attention due to the increasing awareness of atmospheric pollution and its health risks, including respiratory illnesses and cardiovascular diseases. Government standards, such as the Clean Air Act, play a crucial role in regulating emissions from various industries, including manufacturing, oil and gas, and renewable energy. These industries are major contributors to pollutants like SO2, Mercury, NOx, fine particulate emissions, and volatile organic compounds. The market for air quality control systems includes various technologies like sensor networks, intelligent systems, and indoor and outdoor control systems. These systems help mitigate the risks of contaminants such as acid rain, carbon monoxide, nitrogen oxides, and sulphur oxides.

- However, the high costs associated with advanced air quality control systems, such as Flue Gas Desulfurization, Scrubbers, and Flue Gas Desulfurizers, pose a challenge for end-users. Additionally, the large space requirements and inflexibility of some systems hinder their adoption. The economic growth of various industries and trade practices, such as multi-trip policies, can impact the demand for air quality control systems. Factors like raw material shortages and shipping delays can also affect the market dynamics. A strategic analysis of the market reveals that the procurement level of air quality control systems depends on the specific pollutant type and end-user industry.

Exclusive Canada Air Quality Control Systems Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Aeroqual Ltd.

- Babcock and Wilcox Enterprises Inc.

- Burns and McDonnell

- Cerex Monitoring Solutions LLC

- Donaldson Co. Inc.

- Emerson Electric Co.

- GEA Group AG

- General Electric Co.

- Hamon S.A.

- HORIBA Ltd.

- Mitsubishi Heavy Industries Ltd.

- Pine

- Siemens AG

- Teledyne Technologies Inc.

- Thermax Ltd.

- Thermo Fisher Scientific Inc.

- Tisch Environmental Inc.

- TSI Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Air quality control systems play a crucial role in mitigating atmospheric pollution and ensuring environmental stability in Canada. These systems are designed to minimize the release of various pollutants into the air, thereby reducing the risks associated with respiratory illnesses and other health concerns. Government standards and regulations have been instrumental in driving the demand for air quality control systems in various industries. Manufacturing sectors, oil and gas operations, and power generation plants are among the primary end users of these systems. The importance of workplace safety and public awareness have also contributed to the growing adoption of air quality control technologies.

Moreover, air quality control systems encompass a range of technologies, including sensor networks, intelligent systems, and various types of filtration and scrubbing mechanisms. Electrostatic precipitators, scrubbers, and flue gas desulfurizers are some of the commonly used technologies for controlling emissions of sulphur oxides (SO2), nitrogen oxides (NOx), and fine particulate matter. Indoor control systems are equally important in maintaining good air quality, particularly in commercial and residential buildings. These systems help manage emissions from heating, ventilation, and air conditioning (HVAC) systems and reduce the levels of contaminants such as carbon monoxide, nitrogen oxides, sulphur oxides, and volatile organic compounds (VOCs).

In addition, the market for air quality control systems in Canada is influenced by several factors, including economic growth, trade practices, and regulatory frameworks. High costs and a lack of awareness are some of the challenges that can hinder the growth of this market. Raw material shortages and shipping delays can also impact the procurement levels of air quality control systems. The market for air quality control systems is diverse, with various end user industries adopting different technologies based on their specific requirements. For instance, the oil and gas industry may prioritize the use of flue gas desulfurization systems to reduce SO2 emissions, while the manufacturing sector may focus on fabric filters and mercury control systems to manage particulate matter and heavy metal emissions.

Moreover, the use of intelligent systems and sensor networks in smart city infrastructure is another emerging trend that is expected to shape the market dynamics of air quality control systems in Canada. Therefore, the market is driven by various factors, including government regulations, health risks, and environmental concerns. The market is diverse and dynamic, with various end user industries adopting different technologies to manage emissions and maintain good air quality. The challenges and opportunities in this market are shaped by economic factors, technological advancements, and regulatory frameworks.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.8% |

|

Market growth 2024-2028 |

USD 2.15 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.1 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Canada

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch