Air Sports Equipment Market Size 2025-2029

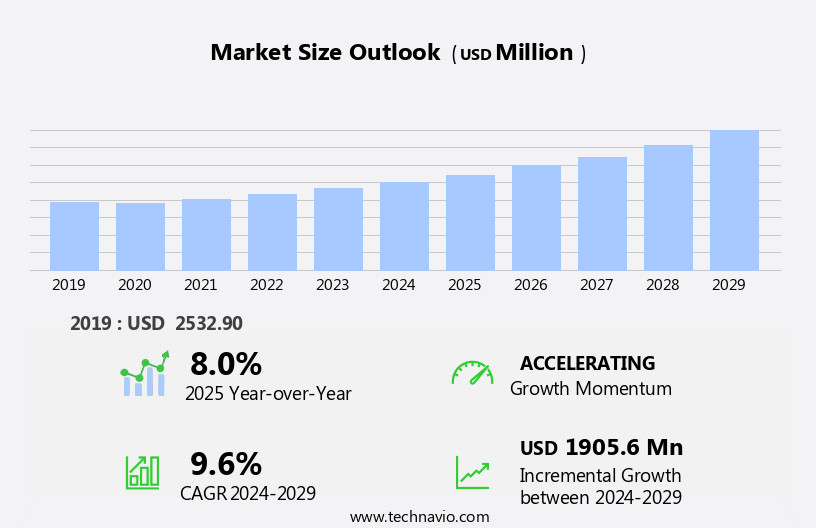

The air sports equipment market size is forecast to increase by USD 1.91 billion at a CAGR of 9.6% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing popularity of competitive air sports. This trend is driven by the thrill and adventure that air sports offer, leading more individuals to participate in activities such as skydiving, paragliding, and hang gliding. Additionally, technological innovations continue to enhance the performance and safety of air sports equipment, making the experience more appealing to both novice and experienced participants. However, the market faces challenges related to the inherent risks associated with air sports.

- Fatal falls and severe injuries remain a concern, necessitating stringent safety regulations and continuous research and development to mitigate these risks. Companies in the market must prioritize safety while also capitalizing on the growing demand for innovative and high-performance equipment to stay competitive and meet the evolving needs of consumers.

What will be the Size of the Air Sports Equipment Market during the forecast period?

- The market continues to evolve, driven by the ever-growing demand from thrill seekers and adrenaline junkies. From base jumping rigs and wingsuit flying to windsurf boards and hot air ballooning, the industry caters to various sectors, including extreme sports, adventure tourism, and sports tourism. Strategic planning and online platforms play a crucial role in meeting the needs of customers, providing after-sales support, and ensuring safety regulations are met. Flight schools and air sports clubs offer training courses for those looking to explore the world from new heights. Protective gear and lightweight materials are at the forefront of research and development, prioritizing safety and performance.

- Pricing strategies vary, with some catering to recreational enthusiasts and others focusing on professional athletes. Environmental impact and brand reputation are increasingly important considerations for market players. Data analysis and competitor analysis help companies stay competitive and adapt to industry trends. Safety gear remains a priority, with continuous innovation in design and materials. Social media and customer service are essential tools for reaching and engaging with customers. Sports equipment manufacturers and event management companies collaborate to create memorable experiences for customers, from air shows to leisure activities. The growth potential in the air sports market is vast, with ongoing research and development and a commitment to customer satisfaction.

How is this Air Sports Equipment Industry segmented?

The air sports equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Paraglider/canopy/reserve parachute

- Container and harness

- Protective gear

- Others

- Application

- Skydiving

- Paragliding

- BASE jumping

- Bungee jumping

- Distribution Channel

- Offline

- Online

- End-user

- Competitive sports

- Recreational sports

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

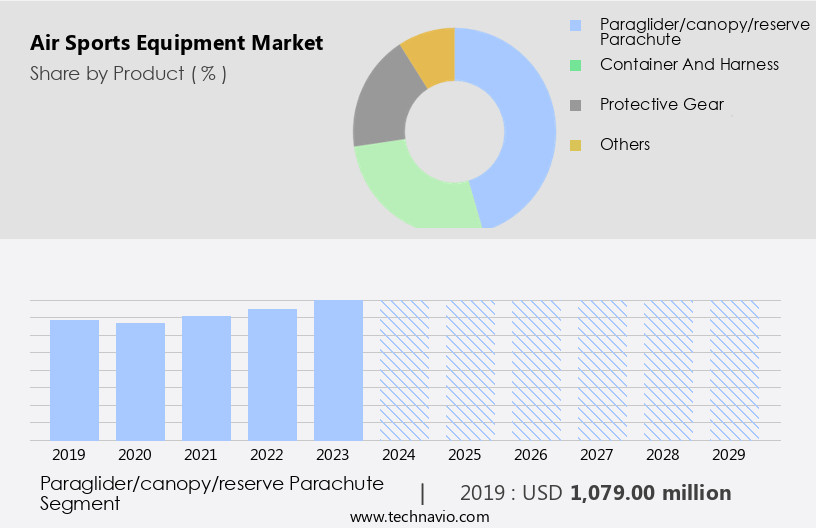

By Product Insights

The paraglider/canopy/reserve parachute segment is estimated to witness significant growth during the forecast period.

Paragliding equipment, including base jumping rigs and wingsuits, caters to the thrill-seeking market of adrenaline junkies. Strategic planning is crucial for manufacturers to meet consumer demands, such as lightweight and durable materials for wings or paragliders. Key materials include threads, rubber, and non-absorbent fabrics like ripstop polyester or nylon. Innovative manufacturing methods may incorporate nitinol, a metal alloy, for future paraglider production. Safety regulations are paramount, with protective gear and after-sales support essential for customer satisfaction. Flight schools, air sports clubs, and training courses offer opportunities for recreational enthusiasts to learn the ropes. Industry trends include online platforms for sales and event management, as well as social media marketing.

Windsurf boards and hot air ballooning also fall under the air sports umbrella. Customer service and brand reputation are vital in this competitive landscape, with professional athletes and lightweight materials driving growth potential. Data analysis and research and development contribute to pricing strategies and safety gear advancements. Competitor analysis and intellectual property protection are crucial elements of the supply chain. Adventure tourism and sports tourism further expand the market, with leisure activities such as base jumping, hang gliding, and wingsuit flying continuing to gain popularity.

The Paraglider/canopy/reserve parachute segment was valued at USD 1.08 billion in 2019 and showed a gradual increase during the forecast period.

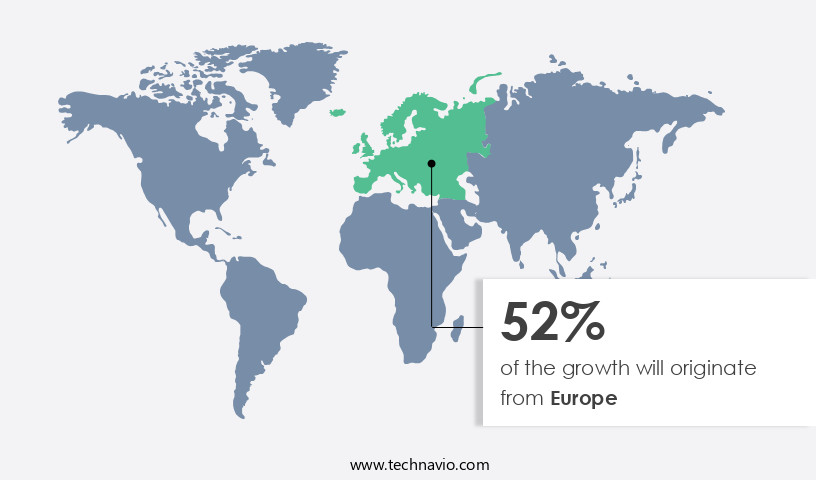

Regional Analysis

Europe is estimated to contribute 52% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market is experiencing significant growth due to the increasing popularity of adventure tourism and leisure activities. With numerous emerging tourist destinations across Europe, the region is a hotspot for various air sports such as skydiving, paragliding, and BASE jumping. Top destinations include Innsbruck in Austria, Seville in Spain, and Mt Etna in Italy for skydiving, Hautes Alpes in France, Dune du Pyla in Gironde, and Neuschwanstein Castle in Germany for paragliding, and Verzasca Dam in Switzerland and Niouc Bridge in Switzerland for bungee jumping. Additionally, the rise of online platforms has made it easier for adrenaline junkies to access information and purchase equipment.

Strategic planning by manufacturers and suppliers, coupled with after-sales support, is crucial in meeting the increasing demand for air sports equipment. Safety regulations are stringently enforced to ensure customer satisfaction and minimize environmental impact. Lightweight materials and intellectual property protection are key considerations in research and development. Professional athletes and recreational enthusiasts alike require safety gear and training courses offered by flight schools and air sports clubs. Hot air ballooning and windsurf boards also contribute to the market's growth. Industry trends indicate a focus on data analysis, brand reputation, and customer service. Competitor analysis is essential to maintain a competitive edge in the market.

Air shows and event management provide opportunities for showcasing airborne sports and increasing market exposure. Leisure activities and sports tourism continue to drive growth potential in the market. The supply chain must be efficient to meet the demand for sports equipment and cater to thrill seekers worldwide. The European market is thriving due to the growing interest in adventure tourism and leisure activities. The demand for equipment in various air sports is increasing, and manufacturers and suppliers must focus on safety, innovation, and customer service to meet this demand. The market's future looks promising, with opportunities for growth in both recreational and professional applications.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Air Sports Equipment Industry?

- The increasing popularity and prominence of competitive air sports serve as the primary market driver.

- Air sports have gained significant traction as both recreational activities and competitive pursuits, attracting a global following. The Federation Aeronautique International (FAI) governs international air sports competitions, including numerous annual championships. In the US, the United States Parachute Association (USPA) hosts national championships featuring various disciplines, drawing participants from around the world. Other prominent tournaments include the Skydiving World Cup, UK National Skydiving Competition, Australian National Skydiving Competition, and New Zealand National Skydiving Competition. Protective gear is essential for all air sports enthusiasts, ensuring safety during training courses and flights. Flight schools and air sports clubs offer training programs, allowing individuals to learn and hone their skills under expert guidance.

- Hot air ballooning, a popular form of adventure tourism, offers a unique and immersive experience. Industry trends focus on enhancing customer service and satisfaction, with social media playing a crucial role in marketing and community building. Extreme sports enthusiasts seek adrenaline-pumping experiences, driving the growth of the air sports market. As the industry continues to evolve, it remains committed to preserving a harmonious balance between safety, adventure, and innovation.

What are the market trends shaping the Air Sports Equipment Industry?

- The market is currently witnessing a significant trend toward technological advancements, with the primary objective being to boost product performance. Enhancements in technology are increasingly prioritized to meet consumer expectations for improved efficiency and quality.

- The market is driven by technological innovations that prioritize safety, security, and comfort for users. Key competitors in this industry continually invest in research and development to enhance their product offerings. One notable innovation is the automatic activation device (AAD), which automatically deploys a reserve parachute when jumpers are unable to do so. This technology has significantly improved safety in air sports. Other areas of innovation include fabric design, system engineering, mechanical design, control systems, and rigging and packaging. These advancements cater to both professional athletes and recreational enthusiasts, as well as the growing sports tourism and outdoor recreation industries.

- Effective supply chain management is crucial for maintaining brand reputation and meeting demand. Data analysis plays a significant role in understanding market trends and customer preferences, allowing companies to tailor their offerings accordingly. Overall, the market is characterized by continuous innovation and a commitment to enhancing the user experience.

What challenges does the Air Sports Equipment Industry face during its growth?

- The expansion of the air sports industry is significantly hindered by the elevated risks of fatal falls and severe injuries. These hazards pose a substantial challenge, necessitating rigorous safety measures and continuous efforts to mitigate potential harm.

- Air sports, a subset of adventure sports, cater to thrill seekers who crave the excitement of being airborne. The market for air sports equipment exhibits significant growth potential due to the increasing popularity of these activities as leisure pursuits. However, safety concerns, such as injuries and fatal accidents, pose a challenge to market expansion. Fear of heights, or acrophobia, may deter potential participants, limiting the market's reach. Furthermore, exhaustion, resulting from depletion of muscle fuels, accumulation of metabolic by-products, low blood glucose, muscular cramps, microtrauma, and central fatigue, can discourage individuals from engaging in air sports.

- Market research and development efforts are crucial to address these challenges and ensure the safety and comfort of participants. Pricing strategies and the availability of high-quality safety gear are essential factors influencing market growth.

Exclusive Customer Landscape

The air sports equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air sports equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, air sports equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advance Paragliders - The company specializes in high-performance air sports equipment, including the Hybrid ALIEN and LD5 Ultra Light models.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advance Paragliders

- Aerodyne Research LLC

- Airborne Systems Ltd.

- Apco Aviation Ltd.

- Axis Airsports Ltd.

- Dudek Paragliders

- Firebird USA LLC

- Gingliders

- Gradient s.r.o.

- ICARO Paragliders

- Intrudair

- Niviuk Gliders

- Nova Performance Paragliders

- Ozone Gliders Ltd.

- Paraavis

- Paratech

- Skywalk GmbH & Co. KG

- Supair

- UP International GmbH

- Velocity Sports Equipment

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Sports Equipment Market

- In March 2024, Paragliding Equipment Manufacturer, Nova Nordisk, announced the launch of their revolutionary new wing design, the "Nova Mentor," which offers enhanced safety features and improved performance (Nova Nordisk Press Release, 2024). This innovation marks a significant advancement in paragliding equipment, addressing concerns around safety and performance.

- In October 2024, Sky Ventures, a leading air sports equipment manufacturer, raised USD 20 million in a Series C funding round, led by Sequoia Capital (Sequoia Capital Press Release, 2024). This investment will be used to expand production capacity, accelerate research and development, and enter new markets.

- In February 2025, the European Union Aviation Safety Agency (EASA) approved the use of electric-powered paragliders for commercial operations (EASA Press Release, 2025). This approval marks a significant milestone in the market, paving the way for the adoption of more eco-friendly and quieter alternatives to traditional fuel-powered equipment.

Research Analyst Overview

The market is experiencing significant shifts, driven by advancements in technology and evolving consumer preferences. Carbon fiber, a popular composite material, is increasingly used in the production of lighter and stronger equipment, giving manufacturers a competitive advantage. Market share analysis reveals that customer journey plays a crucial role in purchasing decisions, with safety protocols and environmental regulations being key considerations. Brands are forming partnerships to expand their reach and enhance their value proposition, while pricing models are being optimized to cater to diverse target audiences. Innovation grants and government subsidies are fueling innovation in areas like altitude sensors, GPS tracking, and weather forecasting.

Risk management and responsible tourism are also gaining importance, with brands focusing on sustainable practices and conservation efforts to attract customer loyalty. Product lifecycle management and online communities are essential tools for manufacturers to reduce costs and improve manufacturing efficiency. Influencer marketing and event sponsorships are effective strategies for reaching new customers and expanding market penetration. Video recording, live streaming, and social media marketing are essential components of modern marketing strategies, helping brands connect with their audience and build a strong brand image.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Sports Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2025-2029 |

USD 1905.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.0 |

|

Key countries |

Germany, US, France, Japan, UK, China, Italy, India, Canada, Brazil, UAE, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Air Sports Equipment Market Research and Growth Report?

- CAGR of the Air Sports Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the air sports equipment market growth of industry companies

We can help! Our analysts can customize this air sports equipment market research report to meet your requirements.