Aircraft Evacuation Systems Market Size 2024-2028

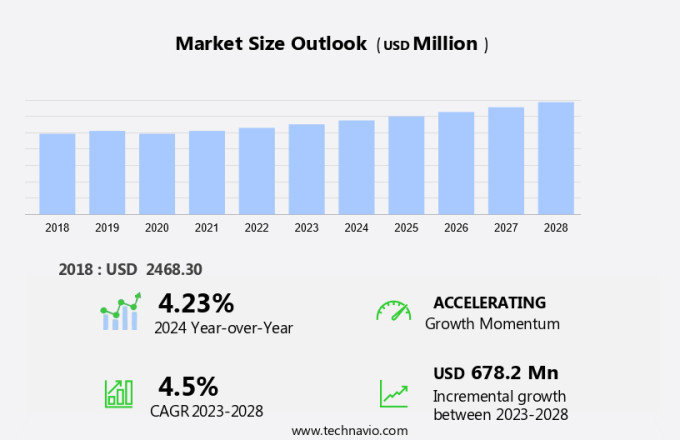

The aircraft evacuation systems market size is forecast to increase by USD 678.2 million, at a CAGR of 4.5% between 2023 and 2028. Augmented safety protocols in aviation enhance the overall safety and reliability of air travel, fostering increased confidence among passengers and stakeholders. This heightened focus on safety drives demand for advanced technologies and solutions. Additionally, the adoption of new aircraft into service significantly impacts market growth, as modern aircraft offer improved fuel efficiency, performance, and passenger comfort, leading to increased operational efficiency and competitiveness for airlines. Furthermore, the growth in potential business opportunities within the aviation sector, including expanded routes, emerging markets, and new service offerings, stimulates investment and innovation. These factors collectively drive market expansion by addressing evolving industry needs and creating new opportunities for growth and development.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is a significant sector in the aviation industry, focusing on ensuring the safe and efficient evacuation of passengers and crew members during emergencies. The Federal Aviation Administration (FAA) sets stringent regulations for aircraft evacuation systems to ensure passenger safety. Key players in the market include Survitec Group Limited, Martin-Baker Aircraft Co, Trelleborg AB, IRKUT CORPORATION, Bombardier Inc, Sukhoi Civil Aircraft, Illyushin, and Tupolev. The Evacuation Slides Segment dominates the market due to its simplicity and effectiveness. In the Asia-Pacific region, countries like India, with airlines such as Air India, IndiGo Airlines, and Akasa Air, are expected to drive market growth due to increasing air travel demand. Notable incidents, such as those involving FlyersRights and the Allied Pilots Association, have emphasized the importance of efficient evacuation systems. Key market players are investing in research and development to innovate and improve their offerings. Companies like Martin-Baker Aircraft Co and Trelleborg AB are focusing on advanced technologies like inflatable slides and inflatable rafts for enhanced safety and efficiency.

Key Market Driver

Augmented safety protocols in aviation is notably driving market growth. The Federal Aviation Administration (FAA) plays a crucial role in ensuring the safety of aircraft through processes like type certification. This regulatory framework ensures that new aircraft designs conform to existing statutes and regulations, and sets standards for manufacturers and airline operators in the design, production, operation, and maintenance phases. In the realm of aircraft safety, significant advancements have been made in evacuation systems. The FAA mandates that a full evacuation of a passenger aircraft must be accomplished in 90 seconds or less. Furthermore, the FAA is also focusing on other aviation norms, such as standardizing airplane seat size and legroom.

Airline operators, including Air India, IndiGo Airlines, and Akasa Air, are investing in safety technologies, collaborating with global aircraft manufacturers and manufacturing facilities, and aircraft component manufacturers to enhance evacuation procedures and evacuation equipment. In the event of a mid-flight emergency, the quick response of emergency response systems and safety drills can save lives. The Economic Times reports that the commercial aircraft market is expected to witness substantial growth in the future, creating investment pockets for ground-based evacuation systems, such as escape slides, and other safety equipment. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The use of polyurethane-coated fabric for aircraft evacuation system components is the key trend in the market. The market has witnessed significant advancements since the introduction of Polyolefin Coated Fabric (PCF) in aviation in 1995 by Zodiac Aero Evacuation Systems. PCF, an alternative to rubber, offers superior resistance to abrasion, making it ideal for constructing durable life rafts that can withstand harsh terrain. Unlike rubber, PCF does not crack, especially around electrical equipment where ozone concentrations can be high. The use of PCF also reduces the cost of machining due to its pourable and castable properties, enabling the fabrication of complex parts. The versatility of PCF is further enhanced by its availability in various grades and compatibility with a wide range of pigments and dyes, allowing for the production of rafts in various colors. Key industry players, including the Federal Aviation Administration (FAA), FlyersRights, Allied Pilots Association, Air India, IndiGo Airlines, and Akasa Air, have implemented stringent regulations regarding evacuation procedures and equipment. Global aircraft manufacturers and manufacturing facilities, as well as aircraft component manufacturers, have invested heavily in safety technologies to ensure compliance with these regulations.

In the event of mid-flight emergencies, evacuation equipment, such as escape slides, play a crucial role in the safety of airline operators and passengers. The Commercial aircraft market's growth, coupled with the increasing number of economic flights, has led to a surge in demand for efficient and effective evacuation systems. As a result, ground safety drills and emergency response systems have become essential components of airline operations. Future estimations suggest that the Investment pockets in this market will continue to grow, driven by the need for advanced safety technologies and the increasing number of passengers flying globally. The Economic Times reports that the market for aircraft evacuation systems is expected to reach new heights in the coming years. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Need for frequent maintenance is the major challenge that affects the growth of the market. Aircraft evacuation systems play a crucial role in ensuring the safety of airline passengers during mid-flight emergencies or during ground situations. The Federal Aviation Administration (FAA) and various aviation organizations such as FlyersRights and the Allied Pilots Association, emphasize the importance of adhering to strict regulations regarding evacuation procedures and equipment. Airline operators like Air India, IndiGo Airlines, and Akasa Air invest significantly in safety technologies to maintain their evacuation systems and associated components. Manufacturing facilities of global aircraft manufacturers and component manufacturers undergo rigorous inspections to ensure the quality of evacuation equipment. The FAA mandates that materials used for constructing flotation chambers and decks must withstand the detrimental effects of exposure to fuels, oils, and hydraulic fluids.

Further, periodic checks ensure that coated fabrics used in evacuation devices retain at least 90% of their original physical properties even after their shelf life of approximately 18 months. Evacuation equipment, including escape slides, are subjected to regular inspections and testing to maintain their functionality. Regulations require that these systems be inspected at least once every 12 months, with additional inspections following any significant use or damage. In the event of lockdowns or emergencies at airports, efficient evacuation procedures and well-maintained equipment can save lives. The commercial aircraft market continues to grow, and investment pockets in safety technologies and emergency response systems remain significant areas of focus for stakeholders. Future estimations indicate a continued emphasis on enhancing aircraft safety and evacuation capabilities. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

EAM Worldwide - The company offers aircraft evacuation systems such as Slide Raft.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alliance Marine

- Astronics Corp.

- C and M Marine Aviation Services Inc.

- Deutsche Lufthansa AG

- Eaton Corp. Plc

- JAMCO Corp.

- Martin-Baker Aircraft Co. Ltd.

- RTX Corp.

- Safety Marine Australia Pty Ltd.

- Safran SA

- Survitec Group Ltd.

- Switlik Parachute Co.

- The MEL Group

- TransDigm Group Inc.

- Trelleborg AB

- Tulmar Safety Systems

- Wing Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

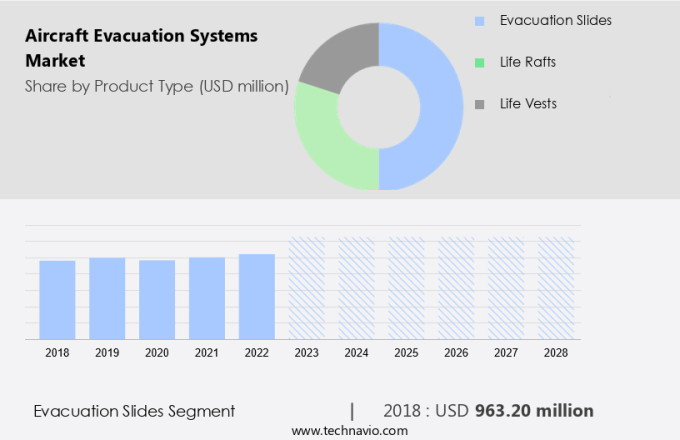

By Product Type

The evacuation slides segment is estimated to witness significant growth during the forecast period. The Federal Aviation Administration (FAA) sets stringent regulations for aircraft evacuation systems to ensure the safety of airline passengers in case of mid-flight emergencies. Organizations like FlyersRights and Allied Pilots Association advocate for improved evacuation procedures and equipment. Airline operators, such as Air India, IndiGo Airlines, and Akasa Air, invest in safety technologies from manufacturers like Survitec Group Limited, providing escape slides and other evacuation equipment.

Get a glance at the market share of various regions Download the PDF Sample

The evacuation slides segment was the largest and was valued at USD 963.20 million in 2018. Global aircraft manufacturers and manufacturing facilities collaborate to produce advanced commercial aircraft with integrated emergency response systems. Market investments in safety drills and economic times call for continuous improvements in evacuation systems. Future estimations suggest investment pockets in ground-based evacuation equipment and technologies, ensuring a secure travel experience for all.

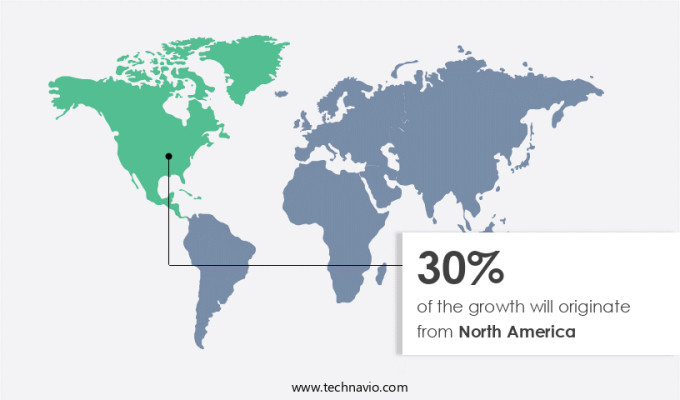

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Federal Aviation Administration (FAA) sets stringent regulations for aircraft evacuation systems to ensure the safety of airline passengers during mid-flight emergencies. Organizations like FlyersRights and the Allied Pilots Association advocate for improved evacuation procedures and equipment. Airline operators, including Air India, IndiGo Airlines, and Akasa Air, invest in safety technologies from manufacturers like Survitec Group Limited, providing evacuation equipment such as escape slides. Global aircraft manufacturers and manufacturing facilities collaborate to produce advanced commercial aircraft with integrated emergency response systems. Aircraft component manufacturers also play a crucial role in producing essential components for evacuation systems. Lockdowns and airport closures have highlighted the importance of efficient evacuation procedures and equipment. The Commercial aircraft market is expected to grow, with future estimations pointing towards significant investment pockets in ground-based evacuation systems. Economic Times reports that safety drills and continuous improvements in evacuation technologies are essential for addressing the challenges of mid-flight emergencies.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Type Outlook

- Evacuation slides

- Life rafts

- Life vests

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Air Charter Services Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, UK, Germany, China, Singapore - Size and Forecast

- Air Ambulance Market Analysis North America, Europe, APAC, Middle East and Africa, South America - US, Canada, China, Germany, UK - Size and Forecast

- eVTOL Aircraft Market Analysis Europe, North America, APAC, Middle East and Africa, South America - US, Germany, France, UK, China - Size and Forecast

Market Analyst Overview

Aircraft evacuation systems play a crucial role in ensuring the safety of airline passengers in case of mid-flight emergencies. The Federal Aviation Administration (FAA) sets stringent regulations for aircraft evacuation procedures and equipment to ensure the safety of flyers. Companies like Survitec Group Limited are leading providers of evacuation equipment, offering solutions such as escape slides and rafts. Airline operators like Air India, IndiGo Airlines, and Akasa Air invest significantly in safety technologies to comply with FAA regulations and prioritize passenger safety. Global aircraft manufacturers and manufacturing facilities also prioritize the integration of advanced evacuation systems in their commercial aircraft. In the wake of lockdowns and travel restrictions, the market has faced challenges, but the importance of safety technologies, including evacuation systems, remains unwavering. In addition, the Economic Times reports that future estimations indicate investment pockets in ground-based evacuation systems and emergency response systems. Safety drills are essential for airline staff and passengers to familiarize themselves with evacuation procedures.

Additionally, Allied Pilots Association and FlyersRights advocate for regular safety drills and improved evacuation equipment to enhance passenger safety. Water is a critical factor in evacuation procedures, and manufacturers continue to innovate to ensure efficient and effective use of water in evacuation systems. In conclusion, the market is a vital component of the aviation industry, ensuring the safety of millions of airline passengers worldwide. Regulations, safety technologies, and investments in advanced evacuation systems continue to drive market growth, despite economic challenges. The market is influenced by several key factors. The National Transportation Safety Board and European Union Aviation Safety Agency set stringent safety standards, impacting system requirements. Association of Flight Attendants and China Aviation Supplies (CASC) drive safety innovations. Collins Aerospace (RTX Corporation) plays a significant role in technology advancements. Increased global air passenger traffic and enhanced airport passenger security equipment further fuel market growth, improving evacuation efficiency for air passengers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 678.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 30% |

|

Key countries |

US, China, Canada, Germany, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Alliance Marine, Astronics Corp., C and M Marine Aviation Services Inc., Deutsche Lufthansa AG, EAM Worldwide, Eaton Corp. Plc, JAMCO Corp., Martin-Baker Aircraft Co. Ltd., RTX Corp., Safety Marine Australia Pty Ltd., Safran SA, Survitec Group Ltd., Switlik Parachute Co., The MEL Group, TransDigm Group Inc., Trelleborg AB, Tulmar Safety Systems, and Wing Group |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies