EVTOL Aircraft Market Size 2025-2029

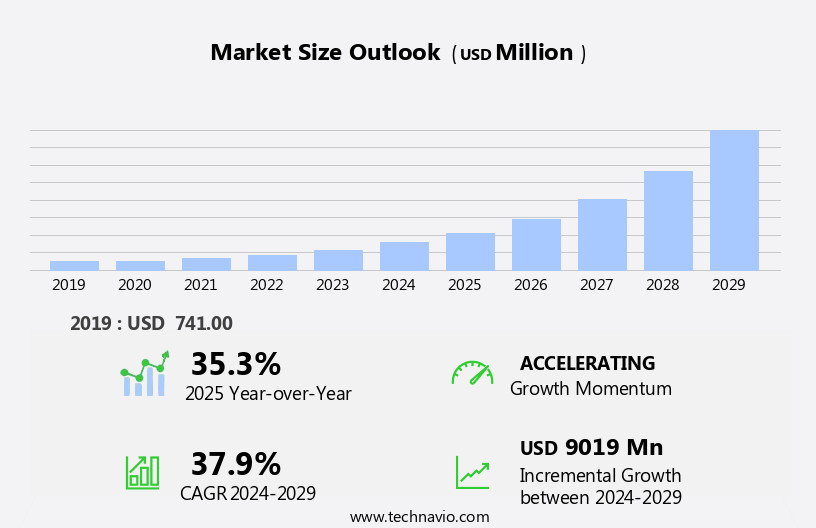

The evtol aircraft market size is forecast to increase by USD 9.02 billion, at a CAGR of 37.9% between 2024 and 2029.

- The Electric Vertical Takeoff and Landing (eVTOL) aircraft market is experiencing significant growth, driven by the increasing demand for enhanced customer service and the potential of eVTOL in various industries, including transportation, logistics, and emergency medical services. The versatility of eVTOL aircraft to provide quick and efficient solutions in these sectors is a major market catalyst. However, the high production cost of eVTOL aircraft poses a significant challenge for market growth.

- Manufacturers must focus on reducing production costs through technological advancements, economies of scale, and strategic partnerships to remain competitive and capitalize on the market's potential. Companies that successfully navigate this challenge and deliver cost-effective eVTOL solutions will reap substantial rewards in the rapidly expanding market.

What will be the Size of the EVTOL Aircraft Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its development across various sectors. Fuselage design innovations are ongoing, focusing on optimizing payload capacity and reducing weight through the use of lightweight materials and advanced manufacturing processes. Cargo transport applications are gaining traction, with the need for efficient supply chain management driving demand for electric propulsion systems and charging infrastructure. Turbine-electric propulsion is at the forefront of this evolution, offering improved operational costs and energy efficiency. Operational altitude and motor technology advancements are also crucial, enabling hybrid-electric Vtol aircraft to offer increased performance and propulsion efficiency. Battery technology continues to advance, with a focus on increasing energy density and reducing charging times.

Passenger transport is another growing sector, with the potential for air taxi services and autonomous flight control systems revolutionizing urban mobility. Certification standards, such as EASA and FAA, are essential for market penetration, with safety regulations and noise reduction technologies being key considerations. GPS navigation, wing design, and redundancy systems are also critical components, ensuring safe and efficient flight operations. The evolving nature of the market is further highlighted by the integration of autonomous flight control, obstacle avoidance, and flight simulation technologies. Environmental impact is a significant concern, with ongoing research focusing on reducing emissions and improving overall sustainability. Customer adoption and public acceptance are key challenges, with ongoing efforts to address safety concerns and ensure regulatory compliance.

Design optimization, sensor fusion, and maintenance and repair strategies are also crucial for ensuring the long-term success of this dynamic and evolving market.

How is this EVTOL Aircraft Industry segmented?

The evtol aircraft industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Urban Air Mobility

- Regional Transport

- Emergency Services

- Technology

- Lift plus cruise

- Multirotor

- Vectored thrust

- Tiltrotor

- Type

- Piloted

- Autonomous

- Semi-autonomous

- Payload Capacity

- Less than 250 kg

- 250-500 kg

- 500-1500 kg

- More than 1500 kg

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

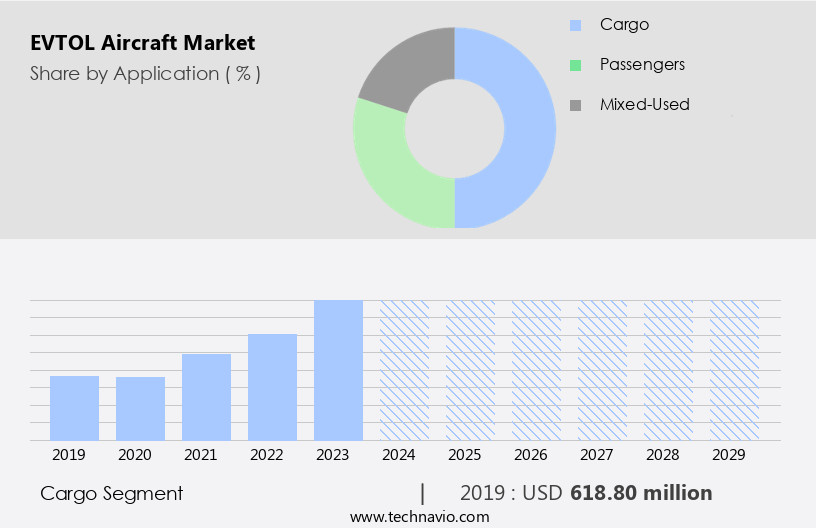

By Application Insights

The urban air mobility segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, with cargo transport leading the segment due to the increasing demand for efficient and sustainable urban logistics solutions. Many eVTOL aircraft are designed for urban air mobility, medical assistance, and personal use, making them valuable assets in various industries. Companies are collaborating to create eVTOL aircraft that save lives and reduce environmental impact. For instance, Vertical Aerospace secured up to USD50 million in funding for its VX4 aircraft, which offers a range of options, including emergency medical services (EMS). The collaboration between medical service providers and eVTOL aircraft manufacturers is crucial in delivering effective and secure solutions for emergency missions.

EVTOL aircraft are designed with advanced technologies such as turbine-electric propulsion, hybrid-electric propulsion, and electric propulsion, which improve propulsion efficiency and reduce operational costs. The use of composite materials, lightweight materials, and weight reduction strategies further enhances the aircraft's energy efficiency and performance. The market also prioritizes safety certifications, including EASA and FAA, and focuses on autonomous flight control, obstacle avoidance, and noise reduction technologies to ensure public acceptance. Manufacturing processes and flight simulation are essential in optimizing design and ensuring the highest safety standards. The market is also exploring the potential of sensor fusion, safety regulations, and market penetration to enhance the overall functionality and appeal of eVTOL aircraft.

The Urban Air Mobility segment was valued at USD 618.80 billion in 2019 and showed a gradual increase during the forecast period.

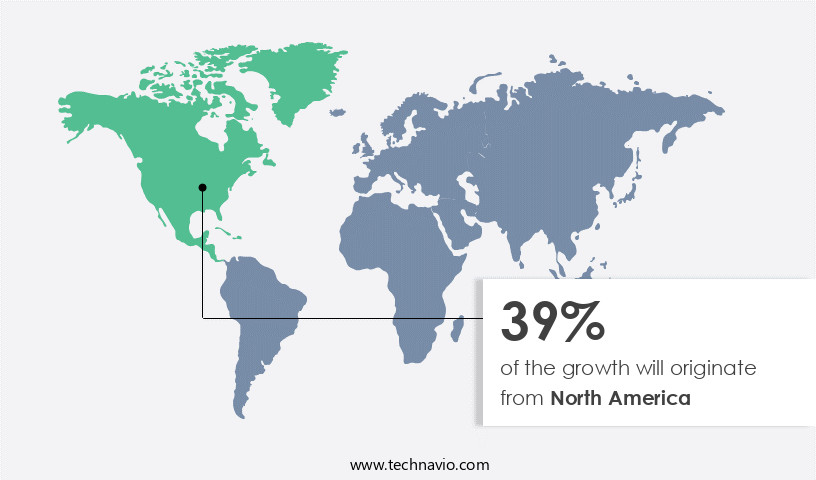

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European market holds the largest share in the global eVTOL aircraft industry, with significant growth expected due to increased investment in commercial drones and electric vertical takeoff and landing (eVTOL) aircraft in Western European countries. The UK, Germany, France, Spain, and Italy are leading the charge, with Germany emerging as an attractive hotspot for eVTOL aircraft development. Notable players, including luxury car manufacturers, are repurposing their expertise to create flying cars, further fueling market expansion. The European market's growth is underpinned by advancements in motor and battery technology, energy efficiency, and certification standards. Supply chain management, charging infrastructure, and performance testing are crucial aspects being addressed to ensure seamless integration of eVTOL aircraft into the transportation landscape.

The market's evolution also includes the development of hybrid-electric propulsion systems, redundancy systems, noise reduction technologies, and autonomous flight control. As eVTOL aircraft gain public acceptance, safety certifications from regulatory bodies like EASA and FAA become increasingly important. Design optimization, sensor fusion, and safety regulations are key focus areas to ensure market penetration and customer adoption. The European market's eVTOL aircraft industry is poised for growth, driven by a combination of technological innovation, government support, and commercial opportunities.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market represents a burgeoning sector in the aviation industry, characterized by innovative electrically-powered vertical takeoff and landing (eVTOL) aircraft. These game-changing aircraft combine the advantages of helicopters and fixed-wing aircraft, offering vertical takeoff and landing capabilities with the efficiency and range of fixed-wing aircraft. EVTOL aircraft are poised to revolutionize urban air mobility, enabling quick and efficient transportation in congested urban areas. The market is driven by several factors, including increasing urbanization, growing demand for sustainable transportation, and technological advancements in battery technology and aerodynamics. Key players in the market include manufacturers, suppliers, regulators, and investors, all collaborating to bring these innovative aircraft to market. The market is expected to experience significant growth in the coming years, with potential applications ranging from air taxi services to cargo delivery and passenger transportation. The integration of eVTOL aircraft into the aviation landscape is set to redefine mobility, offering a future where the skies are accessible to all.

What are the key market drivers leading to the rise in the adoption of EVTOL Aircraft Industry?

- The primary factor fueling market growth is the increasing demand for superior customer service experiences.

- The eVTOL (electric vertical takeoff and landing) aircraft market is experiencing significant growth due to the increasing global urban population and resulting traffic congestion. According to the World Bank, approximately 57% of the world's population lived in urban areas in 2023, and this figure is projected to reach 68% by 2050. To address the mobility demands in metropolitan settings, eVTOL aircraft manufacturing for air mobility solutions is gaining traction among businesses and municipal organizations. In March 2024, SkyDrive made a notable advancement by initiating production of its highly anticipated SD-05 aircraft. Manufacturing processes for eVTOL aircraft are undergoing continuous innovation to improve efficiency and reduce environmental impact.

- Flight simulation technology plays a crucial role in testing and optimizing design and performance. Autonomous flight, obstacle avoidance, and advanced flight control systems are essential features being prioritized for safety certifications. Design optimization, sensor fusion, and safety regulations are key market dynamics shaping the industry. The integration of these technologies is expected to revolutionize urban air mobility and enhance customer adoption.

What are the market trends shaping the EVTOL Aircraft Industry?

- The emerging trend in various industries involves the increasing potential of Electric Vertical Takeoff and Landing (eVTOL) technology. This innovative transportation solution is gaining significant traction due to its potential to revolutionize industries such as aviation, logistics, and urban mobility.

- The eVTOL (electric vertical takeoff and landing) aircraft market is experiencing significant growth and innovation in the global aerospace industry. This sector's momentum is expected to persist throughout the forecast period, motivating manufacturers to act swiftly and establish a competitive edge. EVTOL aircraft are gaining traction in various industries, including transportation, agriculture, emergency medical services (EMS), and more. In the transportation sector, companies are developing air taxi services to cater to specific traveler segments, offering lower infrastructure costs and increased efficiency compared to traditional terrestrial transportation.

- EVTOL aircraft's versatility and potential for reducing travel time and emissions make them an attractive alternative for various applications.

What challenges does the EVTOL Aircraft Industry face during its growth?

- The high production costs of electric Vertical Takeoff and Landing (eVTOL) aircraft represent a significant challenge to the industry's growth trajectory.

- The eVTOL (electric vertical takeoff and landing) aircraft market is gaining traction due to its potential to transform urban and regional transport with reduced travel times and improved mobility options. However, the high investment requirements for infrastructure and research and development, as well as the lack of global 5G infrastructure, pose significant challenges to market growth. The larger the size of the eVTOL aircraft, the greater the production and maintenance costs, which may deter initial implementation. The research and development phase is a significant expense for eVTOL technology, with a focus on motor technology, battery technology, and fuselage design to enhance energy efficiency and operational costs.

- Turbine-electric propulsion systems are being explored to strike a balance between energy efficiency and operational altitude. Supply chain management is another critical aspect, as the establishment of charging infrastructure is essential for the widespread adoption of eVTOL aircraft. In conclusion, the market holds immense potential for passenger and cargo transport, but the high investment requirements and production costs necessitate careful consideration. Ongoing research and development efforts aim to address these challenges and bring this innovative technology to the forefront of transportation solutions.

Exclusive Customer Landscape

The evtol aircraft market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the evtol aircraft market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, evtol aircraft market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Joby Aviation Inc. (United States) - The company introduces advanced eVTOL aircraft, including CityAirbus NextGen, revolutionizing urban transportation through efficient, emission-reducing flight solutions. Designed for urban mobility, these innovative aircraft elevate commuting experiences and redefine modern connectivity.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Joby Aviation Inc. (United States)

- Lilium GmbH (Germany)

- Vertical Aerospace Ltd. (United Kingdom)

- Archer Aviation Inc. (United States)

- Volocopter GmbH (Germany)

- EHang Holdings Ltd. (China)

- Airbus SE (France)

- Boeing Company (United States)

- Beta Technologies (United States)

- Wisk Aero LLC (United States)

- Urban Aeronautics Ltd. (Israel)

- Pipistrel d.o.o. (Slovenia)

- AeroMobil (Slovakia)

- Terrafugia Inc. (United States)

- Aurora Flight Sciences (United States)

- Embraer S.A. (Brazil)

- Ascendance Flight Technologies (France)

- AutoFlight (China)

- Zunum Aero (United States)

- SkyDrive Inc. (Japan)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in EVTOL Aircraft Market

- In January 2024, Bell Textron Inc., a Textron Inc. Company, announced the successful first flight of their Bell Nexus electric vertical takeoff and landing (eVTOL) aircraft, marking a significant step forward in the development of urban air mobility (UAM) solutions (Bell Textron Inc. Press release, 2024).

- In March 2024, Airbus and Rolls-Royce signed a Memorandum of Understanding to collaborate on the development of eVTOL propulsion systems, combining Airbus' expertise in aircraft design with Rolls-Royce's advanced electric and hybrid-electric propulsion technologies (Airbus press release, 2024).

- In April 2025, Joby Aviation, a California-based eVTOL manufacturer, raised a record-breaking USD500 million in a Series C funding round, bringing their total funding to over USD1.2 billion. This investment will support the development, certification, and production of their eVTOL aircraft, the Joby S4 (Joby Aviation press release, 2025).

- In May 2025, the Federal Aviation Administration (FAA) issued a Certificate of Authorization for Beta Technologies to conduct commercial eVTOL flights in the United States, marking a major regulatory milestone for the emerging industry (FAA press release, 2025).

Research Analyst Overview

- The market exhibits significant growth potential, driven by regional markets' increasing demand for sustainable aviation solutions. Community engagement and pilot training programs are crucial for fostering public perception and acceptance of these innovative aircraft. Maintenance programs and distribution channels require strategic planning to ensure parts supply and efficient sales strategies. Infrastructure investment and business models are essential for economic viability, while technology partnerships and human-machine interface (HMI) advancements enhance customer needs. Global markets' shifting focus on reducing carbon emissions propels the integration of propulsion systems and power distribution systems. Prices and pricing strategies remain critical, balancing affordability and technological advancements.

- Infrastructure investments and infrastructure development are vital for the market's expansion. The evtol aircraft industry's success hinges on effective marketing strategies and partnerships. Pilot training programs and blade design innovations cater to customer needs and revenue streams. Thermal management and cockpit display systems optimize performance and safety. Infrastructure investments and infrastructure development are essential for the industry's growth and long-term sustainability. Sales strategies and infrastructure investment are crucial for the market's economic viability and investment opportunities. The industry's future depends on addressing customer needs, integrating advanced propulsion systems, and fostering public perception through community engagement and pilot training programs.

- Strategic partnerships and technology collaborations will play a significant role in the market's growth and success.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled EVTOL Aircraft Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

247 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37.9% |

|

Market growth 2025-2029 |

USD 9019 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

35.3 |

|

Key countries |

US, China, Germany, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this EVTOL Aircraft Market Research and Growth Report?

- CAGR of the EVTOL Aircraft industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the evtol aircraft market growth of industry companies

We can help! Our analysts can customize this evtol aircraft market research report to meet your requirements.