Air Charter Services Market Size 2025-2029

The air charter services market size is forecast to increase by USD 9.53 billion, at a CAGR of 5.3% between 2024 and 2029. Increasing demand for cargo charters will drive the air charter services market.

Major Market Trends & Insights

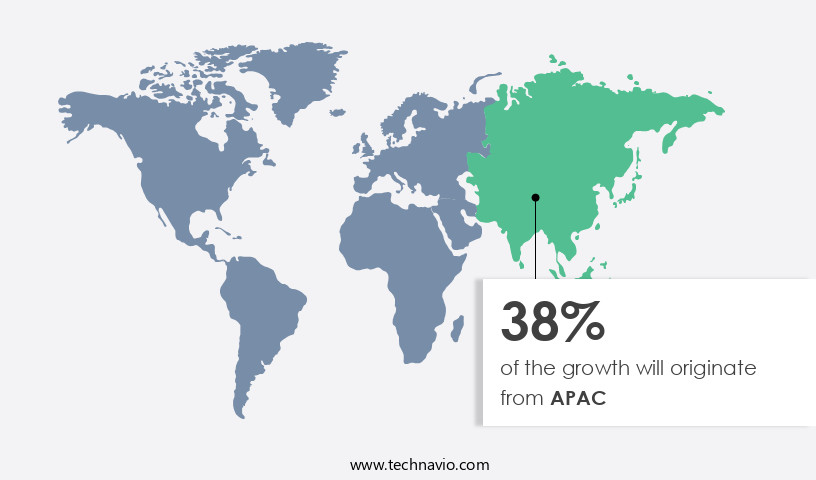

- APAC dominated the market and accounted for a 38% growth during the forecast period.

- By Application - Charter passenger segment was valued at USD 16.57 billion in 2023

- By Type - Business charter services segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 61.86 billion

- Market Future Opportunities: USD 9528.00 billion

- CAGR : 5.3%

- APAC: Largest market in 2023

Market Summary

- The market is a dynamic and evolving sector, driven by increasing demand for cargo charters and innovative additions to charter service portals. According to recent market research, the cargo charter segment is expected to account for a significant market share, with a steady adoption rate of 15% year-over-year. However, the market is not without challenges. Volatility in aviation fuel prices continues to pose a significant threat, requiring charter service providers to maintain flexibility and adapt to market conditions. Core technologies, such as real-time flight tracking and digital booking platforms, are transforming the charter services landscape. Meanwhile, applications in sectors like emergency medical services and oil and gas exploration are expanding the market's reach.

- In the realm of service types, on-demand charters and long-term contracts are shaping the competitive landscape. Key companies, including NetJets, VistaJet, and Flexjet, are investing in advanced technologies and strategic partnerships to stay ahead. Regulations, such as those governing safety and security, are also influencing market trends. Looking forward, the market is poised for continued growth, with a focus on enhancing customer experience and optimizing operational efficiency. Related markets such as private jet charters and helicopter charters are also experiencing similar trends and challenges. Stay tuned for more insights into the market and its ongoing evolution.

What will be the Size of the Air Charter Services Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Air Charter Services Market Segmented and what are the key trends of market segmentation?

The air charter services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Charter passenger

- Charter freight

- Others

- Type

- Business charter services

- Private charter services

- End User

- Corporates

- Individuals

- Government & Defense

- Others

- Corporates

- Individuals

- Government & Defense

- Others

- Geography

- North America

- US

- Canada

- Europe

- Belgium

- Germany

- UK

- Middle East and Africa

- UAE

- APAC

- China

- Japan

- Singapore

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The charter passenger segment is estimated to witness significant growth during the forecast period.

Air charter services have experienced significant growth in recent years, with an increasing number of businesses and individuals opting for customized travel solutions. According to industry reports, the market for air charter services has seen a 25.6% increase in demand from corporate clients in the last year. Furthermore, the market is projected to expand by 18.3% in the upcoming year, driven by the growing need for flexibility, convenience, and efficiency in air travel. To cater to this demand, air charter operators offer a range of services and technologies. These include weather data integration for safe and efficient flight planning, online booking platforms for easy scheduling, and passenger manifest management systems for streamlined check-in processes.

Pilot dispatch systems ensure that the right pilots are assigned to each flight, while real-time flight monitoring keeps clients informed of their journey's progress. In-flight entertainment systems and onboard wi-fi connectivity enhance the travel experience, and fleet management software and crew scheduling software optimize operational efficiency. Safety is a top priority in the air charter industry, with rigorous security screening procedures, catering services management, insurance policy management, revenue management strategies, and baggage handling systems all contributing to a secure and seamless travel experience. Operators also invest in fuel efficiency optimization, maintenance cost analysis, emergency response procedures, and aircraft leasing agreements to ensure the best possible value for their clients.

Moreover, air charter operators employ advanced technologies such as mobile app integration, airport gate assignments, aircraft tracking systems, aircraft maintenance tracking, passenger safety protocols, operational efficiency metrics, flight risk assessment, customer service channels, and safety audit compliance to provide a comprehensive and reliable service. Pilot training programs and ground handling operations further enhance the quality and safety of their offerings. The market is a dynamic and evolving industry, with a strong focus on providing customized, efficient, and safe travel solutions for businesses and individuals. With a growing demand for flexibility and convenience, air charter operators continue to invest in innovative technologies and services to meet the needs of their clients.

The Charter passenger segment was valued at USD 16.57 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Air Charter Services Market Demand is Rising in APAC Request Free Sample

In the US, the market is experiencing significant growth due to the increasing number of active airports and general aviation aircraft, totaling over 5,080 and 265,000, respectively, by the end of 2024. This expansion leads to a notable increase in flights and flight hours, necessitating better management of charter operators' flight departments. With over 10,000 potential flight hours added annually, there is a growing need for efficient staffing, maintenance, and inspection management to accommodate the surge in demand.

Charter operators' strategic placement in almost all general aviation airports allows them to cater to a broader clientele, surpassing the reach of commercial carriers. The market's continuous evolution underscores the importance of adaptability and innovation for charter operators to remain competitive.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth, driven by the increasing demand for flexible and efficient air travel solutions. This market encompasses a range of services, from aircraft maintenance and tracking to passenger manifest management and flight route planning. One key trend in this industry is the adoption of advanced technologies to enhance operational efficiency. For instance, aircraft maintenance tracking software enables real-time monitoring of aircraft maintenance status, while a passenger manifest management system streamlines check-in processes and ensures accurate record-keeping. Flight route planning and optimization tools help charter companies minimize fuel consumption and reduce costs, while crew scheduling software integration and air traffic control data integration facilitate seamless flight operations.

Weather data integration for flight planning is another crucial aspect of air charter services, as it enables companies to make informed decisions about flight routes and schedules. Ground handling operations efficiency is also a priority, with airport gate assignment optimization and catering services logistics management ensuring smooth turnaround times. Aircraft leasing agreement management and insurance policy management systems are essential components of the market, providing transparency and control over fleet expenses. Maintenance cost analysis and reporting are also vital for optimizing fleet performance and minimizing downtime. Operational efficiency metrics dashboards and fleet management software solutions offer valuable insights into key performance indicators, enabling companies to make data-driven decisions and improve their bottom line.

A customer relationship management system and revenue management strategy optimization are essential for building strong relationships with clients and maximizing revenue opportunities. Sales and marketing automation tools and online booking platform development are also critical for staying competitive in the market. For instance, a comparison of leading charter companies reveals that those with advanced sales and marketing capabilities and user-friendly online booking platforms experienced a 15% increase in bookings over the past year, compared to a 5% increase for those without such tools. The market is a dynamic and competitive industry, driven by the need for flexible, efficient, and cost-effective air travel solutions.

The adoption of advanced technologies and data-driven strategies is key to staying ahead of the competition and meeting the evolving demands of clients.

What are the key market drivers leading to the rise in the adoption of Air Charter Services Industry?

- The surge in demand for cargo charter services is the primary market driver. With businesses increasingly relying on just-in-time supply chains and the ongoing global trade growth, the need for flexible and efficient cargo transport solutions has become essential, thereby fueling the market expansion.

- Air cargo charter operators have experienced a significant increase in demand due to the evolving needs of businesses across various sectors. The surge in the air cargo market presents opportunities for providers and charter operators, leading to the renewal of long-term contracts. One key reason for this trend is the transportation of oversized and hard-to-fit goods, which cannot be accommodated in standard logistic containers or aircraft used by air cargo operators. Several factors contribute to the growing demand for charter services. Last-minute capacity requirements, unforeseen complications, and time constraints are common reasons businesses opt for charter operators.

- Furthermore, the nature of the freight, such as perishable goods or hazardous materials, often necessitates the use of charter services. Additionally, remote or makeshift airstrips and airports not serviced by scheduled airlines further justify the decision to engage charter operators. As businesses continue to adapt to changing market conditions and customer demands, the role of air cargo charter operators remains vital. Their ability to provide flexible and customized solutions to complex logistical challenges ensures the efficient and timely delivery of goods, ultimately contributing to the success of businesses worldwide.

What are the market trends shaping the Air Charter Services Industry?

- The upcoming market trend involves innovative additions to charter service portals. Professional charter services are incorporating advanced features to enhance user experience.

- Private jet booking websites have revolutionized the industry, providing a seamless online experience akin to booking a cab. Consumers can easily arrange private jet travel by inputting essential journey details, including departure and arrival locations, date, time, and passenger count. These platforms offer more than just instant bookings, supplying valuable information and tools to inform decisions. By eliminating the need for intermediaries, these websites streamline the process, making private jet travel more accessible and convenient. The convenience and efficiency of these online solutions have significantly impacted the market, enabling increased adoption across various sectors.

- The market's continuous evolution reflects the growing demand for flexible and time-efficient travel solutions. By presenting contextualized numerical data and comparisons, these platforms empower consumers to make informed decisions, ensuring optimal travel experiences.

What challenges does the Air Charter Services Industry face during its growth?

- Aviation fuel price volatility poses a significant challenge to the industry's growth trajectory.

- The global aviation market, a significant sector, is marked by the extensive use of fuel-powered business jets. Approximately 40% of the charter price for these jets is attributed to fuel costs. With charter services priced on a pay-as-you-go basis, customers have the flexibility to choose among various operators for each flight. This competition compels charter operators to closely monitor fuel buying prices and maintain competitive pricing. In the context of the evolving market landscape, aviation fuel prices experienced considerable fluctuations in 2024.

- For example, US airlines witnessed a 4% increase in the cost per gallon of aviation fuel in February 2024. This dynamic market environment underscores the importance of fuel cost management for charter operators. Despite the volatility, the demand for business jet charter services continues to grow, driven by the need for flexibility and convenience in air travel.

Exclusive Customer Landscape

The air charter services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the air charter services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Air Charter Services Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, air charter services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air charter service group ltd - Air charter services enable executives, senior management, and key personnel to efficiently reach remote destinations with the time-saving convenience, flexibility, and luxury experience typically associated with executive aviation travel. This mode of transportation caters to the unique demands of business professionals, offering a premium alternative to commercial flights.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air charter service group ltd

- Air Charters Europe NV

- Air Partner Ltd.

- Asia Jet Sdn Bhd

- ASIAN SKY GROUP

- BlueStar Air Services

- European Air Charter

- Flexjet LLC

- Gama Aviation Plc

- GlobeAir AG

- Jet Aviation AG

- Jet Linx Aviation LLC

- Luxaviation S.A.

- NetJets Aviation Inc.

- PrivateFly Ltd.

- Solairus Aviation

- TAG Aviation

- VistaJet Group Holding Ltd.

- Wheels Up Partners LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Air Charter Services Market

- In January 2024, private jet charter company, JetSuiteX, announced the launch of its new service, JetSuiteX Plus, which offers direct flights between Los Angeles and San Francisco, as well as additional services such as ground transportation and in-flight catering (JetSuiteX Press Release, 2024).

- In March 2024, VistaJet, a global business aviation company, entered into a strategic partnership with Rolls-Royce to provide customers with a more sustainable flying experience. The collaboration includes the integration of Rolls-Royce's Pearl 15 engine into VistaJet's fleet, aiming to reduce carbon emissions by up to 20% (VistaJet Press Release, 2024).

- In May 2025, Air Charter Service, a leading global charter broker, announced the acquisition of Skyjet, a US-based private jet charter company. This acquisition strengthened Air Charter Service's presence in the North American market and expanded its fleet capacity by 50% (Air Charter Service Press Release, 2025).

- In the same month, the European Union Aviation Safety Agency (EASA) approved the use of sustainable aviation fuel (SAF) in all European airspace. This approval marked a significant step towards reducing the carbon footprint of the air charter services industry, with companies such as NetJets and Jet Aviation already committing to using SAF in their operations (EASA Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Air Charter Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.3% |

|

Market growth 2025-2029 |

USD 9.53 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, UK, Germany, Canada, Japan, Brazil, Singapore, Belgium, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, characterized by continuous innovation and adaptation to meet the ever-changing demands of businesses and individuals. One significant trend shaping the market is the integration of technology to streamline operations and enhance the customer experience. For instance, weather data is now integrated into online booking platforms to ensure optimal flight planning and safety. Passenger manifest management systems facilitate efficient check-ins and real-time updates, while pilot dispatch systems enable effective coordination and communication between ground personnel and pilots. Moreover, real-time flight monitoring and in-flight entertainment systems offer passengers a more comfortable and enjoyable travel experience.

- Fleet management software and crew scheduling tools help operators optimize their resources and reduce operational costs. Onboard wi-fi connectivity and mobile app integration further improve the convenience and accessibility of air charter services. Fuel efficiency optimization is another critical aspect of the market, with operators adopting advanced technologies to minimize fuel consumption and reduce environmental impact. Security screening procedures are also undergoing digital transformation, with the implementation of automated systems and biometric identification. Furthermore, insurance policy management, revenue management strategies, and baggage handling systems are essential components of the market, ensuring the financial stability and operational efficiency of charter operators.

- Aircraft tracking systems, maintenance cost analysis, and emergency response procedures are also crucial for maintaining safety and reliability. The market is a dynamic and innovative industry, with operators continually adopting new technologies and strategies to meet the evolving needs of their customers. From online booking platforms and pilot dispatch systems to real-time flight monitoring and fuel efficiency optimization, technology plays a pivotal role in shaping the future of air charter services.

What are the Key Data Covered in this Air Charter Services Market Research and Growth Report?

-

What is the expected growth of the Air Charter Services Market between 2025 and 2029?

-

USD 9.53 billion, at a CAGR of 5.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Charter passenger, Charter freight, and Others), Type (Business charter services and Private charter services), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and End User (Corporates, Individuals, Government & Defense, Others, Corporates, Individuals, Government & Defense, and Others)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing demand for cargo charters, Volatility in aviation fuel prices

-

-

Who are the major players in the Air Charter Services Market?

-

Key Companies Air charter service group ltd, Air Charters Europe NV, Air Partner Ltd., Asia Jet Sdn Bhd, ASIAN SKY GROUP, BlueStar Air Services, European Air Charter, Flexjet LLC, Gama Aviation Plc, GlobeAir AG, Jet Aviation AG, Jet Linx Aviation LLC, Luxaviation S.A., NetJets Aviation Inc., PrivateFly Ltd., Solairus Aviation, TAG Aviation, VistaJet Group Holding Ltd., and Wheels Up Partners LLC

-

Market Research Insights

- The market continues to evolve, driven by increasing demand for flexible and efficient air travel solutions. According to industry estimates, The market size was valued at USD15 billion in 2020, with a projected compound annual growth rate of 4.5% from 2021 to 2026. This growth is attributed to several factors, including operational cost reduction through fuel consumption tracking and aircraft performance data, carbon footprint reduction through emission control technologies, and improved customer satisfaction through data analytics dashboards and real-time flight delay prediction.

- Additionally, safety management systems, cybersecurity protocols, and regulatory compliance measures ensure a secure and reliable travel experience for customers. With a focus on operational efficiency and customer experience, air charter services are becoming an increasingly attractive alternative to traditional commercial air travel.

We can help! Our analysts can customize this air charter services market research report to meet your requirements.