Airport Handling Services Market Size 2025-2029

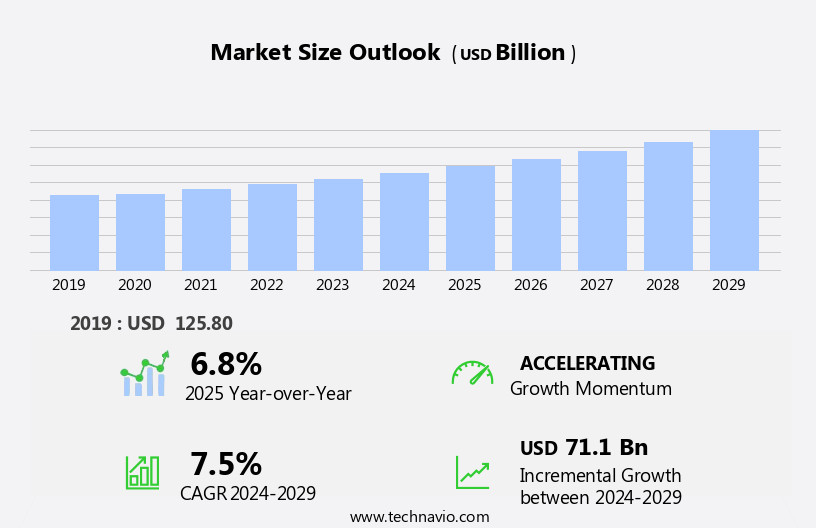

The airport handling services market size is forecast to increase by USD 71.1 billion at a CAGR of 7.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing infrastructure developments in the aviation industry. Airports worldwide are investing in modernization and expansion to accommodate the rising air travel demand. This trend is leading to an increased need for efficient and effective handling services to manage the growing number of passengers and aircraft. However, the market faces challenges that could hinder its growth potential. Regulatory hurdles impact adoption as various authorities impose strict regulations on airport operations, including safety and security protocols. Supply chain inconsistencies also pose a challenge, as the availability and reliability of airside equipment can significantly affect the quality of handling services provided.

- Furthermore, accidents and aircraft damages due to human error remain a persistent issue, necessitating continuous improvement in training and safety measures. To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on innovation, collaboration, and compliance. Investing in advanced technologies, such as automation and AI, can help improve operational efficiency and reduce human error. Collaborative arrangements, such as collective pooling of airside equipment, can help mitigate supply chain inconsistencies and lower costs. Lastly, prioritizing safety and regulatory compliance can help build trust and reputation in the market, ensuring long-term growth and success.

What will be the Size of the Airport Handling Services Market during the forecast period?

- The market is experiencing significant shifts, driven by various factors. Skill gaps and labor shortages are challenging service providers to implement targeted marketing strategies and offer competitive advantages. Industry standards dictate stringent service level agreements, necessitating a focus on emergency response preparedness and security threats to maintain brand reputation. Peak season demands and operational disruptions require strategic alliances and partnership agreements to ensure airport capacity and contingency planning.

- Innovation adoption, including technology integration and digital transformation, is essential to stay ahead of the curve. Best practices stress automation and training programs to enhance employee retention and mitigate the impact of peak demand. Contract negotiations remain crucial for market consolidation and ensuring operational efficiency.

How is this Airport Handling Services Industry segmented?

The airport handling services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- International

- Domestic

- Service

- GSHS

- CHS

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

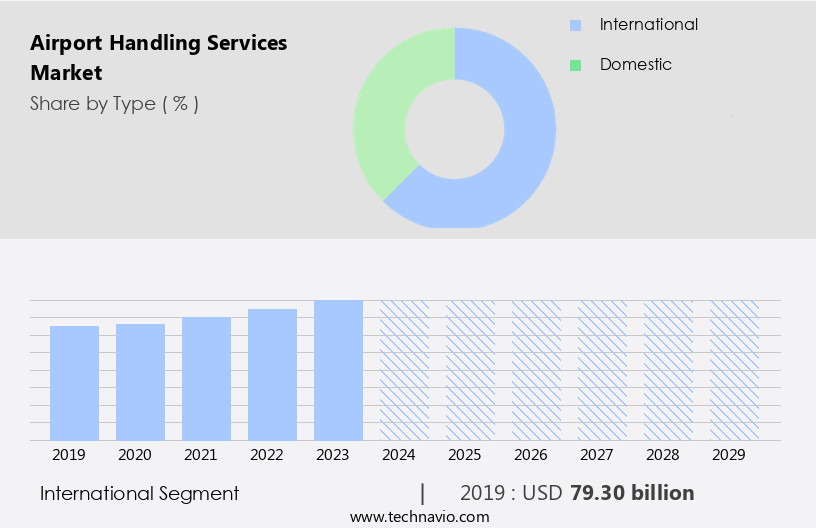

The international segment is estimated to witness significant growth during the forecast period.

The international market caters to a diverse range of requirements, encompassing ground handling, cargo handling, commercial baggage services, ticketing, gate assistance, and more. With the UN World Tourism Barometer reporting over 1.4 billion international tourist arrivals in 2024, representing a significant 11% increase from the previous year, the demand for efficient and effective airport services has become increasingly crucial. This rise in international travel necessitates seamless airport operations, including flight information displays, biometric authentication, baggage carousels, lounge services, and airport logistics. Ground support equipment, such as fuel trucks, belt loaders, baggage tugs, and aircraft de-icing systems, play a vital role in ensuring fuel efficiency and operational excellence.

Airport infrastructure, including terminal operations, data analytics, and airport technology, has become essential for managing passenger satisfaction, safety protocols, and cost optimization. Cloud-based systems and machine learning algorithms facilitate real-time data processing and analysis, enhancing airport efficiency and service quality. Passenger handling, including passenger assistance, boarding passes, and security screening, is a critical aspect of airport operations, requiring a high level of expertise and attention to detail. Sustainability initiatives, such as fuel efficiency and environmental compliance, are increasingly important in the market. Runway operations, air traffic control, gate management, and ramp handling are all integral components of airport operations that require precise coordination and collaboration between various stakeholders.

Airport concessions, retail services, catering trucks, and aircraft maintenance contribute to the overall passenger experience and operational efficiency. The international market is a dynamic and complex ecosystem that requires a holistic approach to managing the diverse needs of passengers and aircraft. From baggage handling and passenger assistance to fueling and aircraft maintenance, airport operations must prioritize safety, efficiency, and customer experience to meet the growing demands of international travel.

The International segment was valued at USD 79.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

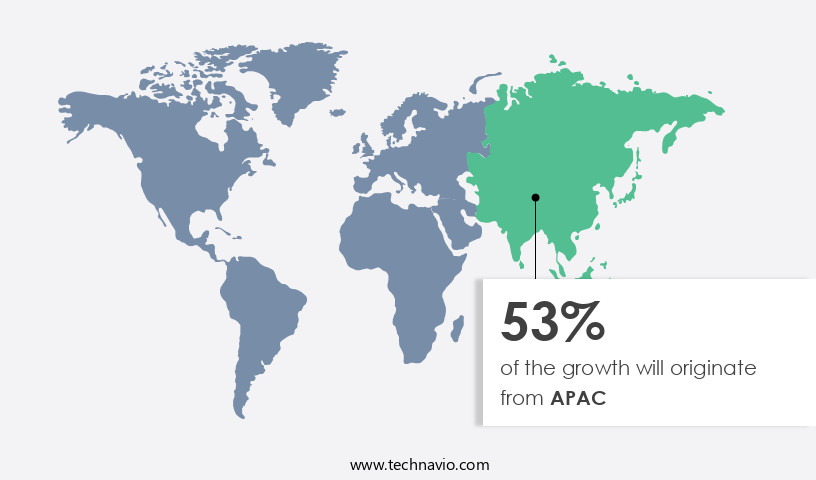

APAC is estimated to contribute 53% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific region is experiencing significant growth due to the increasing preference for air travel and government initiatives to expand airport capacity. Advanced technology-driven services, such as biometric authentication, RFID tracking, and machine learning, are in high demand to improve operational efficiency and enhance the passenger experience. Airport logistics, including fuel trucks, baggage carousels, and ground support equipment, are essential components of airport operations, ensuring seamless aircraft turnaround and baggage handling. Sustainability initiatives, such as fuel efficiency and environmental compliance, are also gaining importance in the market. Airline services, including passenger check-in, aircraft de-icing, and catering, are crucial elements of the aviation industry's value chain.

The integration of cloud-based systems, airport automation, and data analytics enables real-time monitoring and optimization of airport operations, leading to cost savings and improved passenger satisfaction. Additionally, airport infrastructure development and safety protocols are critical factors in the market's growth trajectory. Overall, the market in APAC is a dynamic and evolving landscape, driven by technological advancements, government initiatives, and the growing demand for air travel.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Airport Handling Services market drivers leading to the rise in the adoption of Industry?

- The aviation industry's infrastructure expansion serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing number of air travelers and the resulting airport infrastructure expansion. To address the escalating congestion in airports, countries are investing in enhancing their passenger and cargo-carrying capacity. This includes the implementation of advanced airport technology, such as airport automation and ground handling systems, for operational efficiency. Pushback tractors and catering trucks are essential components of ground handling services, ensuring the safe and timely movement of aircraft and the delivery of catering services. Airport parking and ground transportation are also crucial elements of airport infrastructure, catering to the growing demand for convenient and efficient travel experiences.

- Airline services, including aircraft maintenance and catering services, are integral to the market, ensuring the smooth operation of air travel. Environmental compliance is a critical factor in airport infrastructure development, with a focus on reducing carbon emissions and implementing safety protocols. Overall, the market is expected to grow at a steady pace, driven by the increasing demand for air travel and the need for efficient and sustainable airport infrastructure.

What are the Airport Handling Services market trends shaping the Industry?

- The collective pooling of airside equipment is an emerging trend in the aviation industry. This approach involves sharing and optimizing the use of equipment among multiple airlines or handling agencies to enhance efficiency and reduce costs.

- Ground handling services at airports involve the use of various equipment to ensure efficient and effective airport operations. Ground support equipment, including fuel trucks, baggage tugs, belt loaders, and baggage carousels, is essential for handling flights and managing baggage. However, the storage of excess equipment at airport terminals can lead to unnecessary costs for companies. To address this issue, airports have implemented a concept of collective pooling of airside equipment, enabling more efficient use and reducing excess capacity. Additionally, the integration of advanced technologies such as flight information displays, biometric authentication, cloud-based systems, and lounge services enhances the overall airport experience and streamlines operations.

- The focus on service quality and carbon emissions reduction further drives the adoption of ground handling solutions that optimize airport logistics and aircraft fueling.

How does Airport Handling Services market faces challenges face during its growth?

- Human error leading to accidents and aircraft damages is a significant challenge that negatively impacts the growth of the airport industry. This issue necessitates a heightened focus on enhancing safety protocols and reducing human errors to ensure the industry's continued expansion.

- Ground handling services play a crucial role in the aviation industry, ensuring the smooth and efficient operation of airports. However, accidents involving ground handling equipment or vehicles can pose significant financial risks to airlines. IATA reports approximately 25,000-28,000 ground handling accidents occur globally each year, with each airline experiencing around 100-200 incidents. These incidents, which can include collisions or mishaps during taxiing and towing, can result in costly airport service disruptions. To mitigate risks and enhance operational efficiency, airport handling services are increasingly incorporating advanced technologies such as RFID tracking, machine learning, and data analytics.

- These solutions enable real-time monitoring of passenger check-in processes, boarding pass scanning, and gate management. Additionally, sustainability initiatives, including aircraft de-icing methods and terminal operations, are becoming a priority to reduce environmental impact. Airport concessions, passenger assistance, air traffic control, and runway operations are other essential services that require precision and coordination. By integrating technology and data-driven insights, airport handling services can optimize these processes, ensuring a seamless passenger experience and minimizing the risk of accidents.

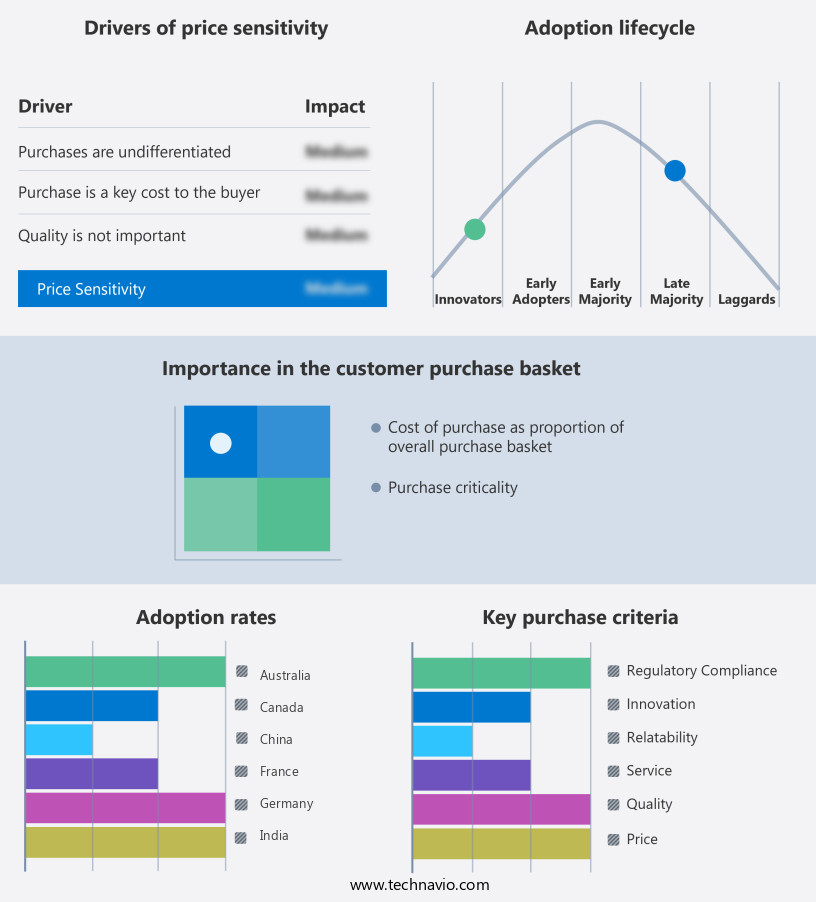

Exclusive Customer Landscape

The airport handling services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the airport handling services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, airport handling services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AHS Aviation Handling Services GmbH - This company specializes in providing comprehensive airport handling services, ensuring seamless security arrangements, mail processing, and cargo management for clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AHS Aviation Handling Services GmbH

- Air General Inc.

- Airport Nuremberg GmbH

- Alliance Ground International

- Ana Holdings Inc.

- Aviapartner

- Bangkok Flight Services

- Celebi Hava Servisi AS

- Fraport Group

- HAVAS

- Japan Airlines Co. Ltd.

- Menzies Aviation Ltd.

- Prime Flight Aviation Services

- Qatar Aviation Services

- Sats Ltd.

- Signature Aviation Ltd.

- SmartLynx Airlines

- Swissport International AG

- The Emirates Group

- Universal Weather and Aviation Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Airport Handling Services Market

- In February 2023, Swissport International AG, a leading provider of ground and air cargo handling services, announced the launch of its innovative digital solution, Swissport Cargo Community. This platform aims to streamline communication and processes between airport stakeholders, improving efficiency and reducing errors in the handling of air cargo (Swissport International AG, 2023).

- In March 2024, dnata, a global air services provider, entered into a strategic partnership with Etihad Airways Engineering to expand its aircraft maintenance, repair, and overhaul (MRO) services. This collaboration will enable dnata to offer comprehensive ground handling services under one roof, enhancing its competitiveness in the market (dnata, 2024).

- In May 2025, SATS Ltd, a leading provider of F&B and gateway services at Changi Airport, Singapore, raised SGD 200 million (approximately USD 147 million) through a private placement to fund its expansion plans. The funds will be used to strengthen its presence in existing markets and explore new opportunities (SATS Ltd, 2025).

- In July 2025, the European Union Aviation Safety Agency (EASA) approved the use of autonomous ground vehicles (AGVs) for airport ground handling operations. This approval marks a significant technological advancement in the industry, paving the way for increased automation and improved efficiency in airport handling services (European Union Aviation Safety Agency, 2025).

Research Analyst Overview

The market is characterized by its continuous evolution and dynamic nature, with various sectors integrating advanced technologies and sustainability initiatives to enhance operational efficiency and improve passenger experience. Carbon emissions are being addressed through the adoption of fuel-efficient ground support equipment and the implementation of sustainability programs. Flight information displays provide real-time updates, while biometric authentication streamlines passenger check-in and security screening processes. Baggage handling is optimized through the use of conveyor systems, RFID tracking, and automated baggage tugs. Airport logistics is facilitated by cloud-based systems, data analytics, and machine learning, ensuring seamless integration of airport operations, baggage claim, lounge services, and airport concessions.

Aircraft fueling is carried out efficiently with ground support equipment, while aircraft maintenance is ensured through collaborative efforts between airlines and ground handling companies. Airport infrastructure is continually updated to accommodate the latest airport technology, including aircraft de-icing systems, gate management, runway operations, and air traffic control. Safety protocols and passenger satisfaction are prioritized through special needs assistance, passenger handling, and customer experience initiatives. Cost optimization is achieved through operational excellence, aircraft cleaning, and cost-effective ground transportation solutions. In the realm of aviation services, airline services, cargo handling, retail services, and airport parking are all interconnected and optimized to provide a comprehensive airport experience.

The market is further enhanced by the integration of artificial intelligence and airport automation, improving service quality and operational efficiency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Airport Handling Services Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 71.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, Japan, India, UK, South Korea, Germany, Canada, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Airport Handling Services Market Research and Growth Report?

- CAGR of the Airport Handling Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the airport handling services market growth of industry companies

We can help! Our analysts can customize this airport handling services market research report to meet your requirements.