All-Terrain Crane Market Size 2024-2028

The all-terrain crane market size is forecast to increase by USD 3.82 billion at a CAGR of 4.36% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the expanding construction industry. This sector's surge is fueling the demand for versatile crane solutions capable of navigating various terrain types. Another key trend shaping the market is the increasing adoption of telematics technology in all-terrain cranes. This innovation enhances operational efficiency and safety, offering valuable insights into crane performance and maintenance. However, market growth faces challenges. Volatility in raw material prices poses a significant hurdle, as manufacturers must balance cost pressures with maintaining product competitiveness.

- Additionally, regulatory requirements vary across regions, impacting adoption rates and necessitating customized solutions. Supply chain inconsistencies also temper growth potential, as delays in component sourcing can disrupt production schedules and delivery commitments. Companies seeking to capitalize on market opportunities must navigate these challenges effectively, focusing on innovation, cost management, and regulatory compliance.

What will be the Size of the All-Terrain Crane Market during the forecast period?

- The market exhibits dynamic activity, driven by advancements in fault diagnostics, tire technology, and load hoisting systems. Suspension systems with all-wheel drive and axle configuration innovations enable superior off-road performance. Environmental regulations mandate access control, crane maintenance logs, and jobsite safety protocols. Crane control systems integrate wind sensors, lifting plans, virtual reality training, and data analytics for efficient and safe operations.

- Augmented reality guidance, service intervals, load moment indicators, and remote monitoring further optimize performance. Ground pressure sensors, traction control, torque control, and operator interface enhance crane maneuverability. Boom oscillation and load positioning technologies ensure precision in various terrains. Crane simulation and remote monitoring services facilitate proactive maintenance and improved productivity.

How is this All-Terrain Crane Industry segmented?

The all-terrain crane industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Capacity

- Less than 200 tons

- 200-500 tons

- More than 500 tons

- Application

- Construction

- Industrial

- Utilities

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

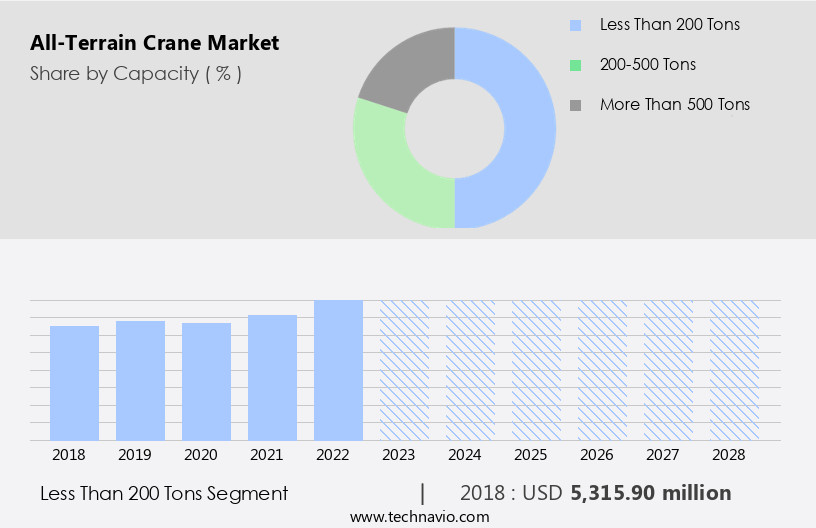

By Capacity Insights

The less than 200 tons segment is estimated to witness significant growth during the forecast period.

All-terrain cranes, with lifting capacities below 200 tons, play a significant role in small-scale construction projects, particularly in confined urban areas. The European market, with its high rate of building renovations, is driving the growth of this segment. However, the market share may slightly decrease due to the limited applications of these cranes. These cranes are engineered specifically for customers requiring compact all-terrain models to navigate confined spaces. Fuel efficiency and terrain adaptability are crucial factors in their design. Sensor technology and hydraulic systems ensure precise load balancing and stability control. Crane services, heavy equipment transport, and spare parts are integral to their operation.

Infrastructure development projects, including hydroelectric power, oil and gas, and renewable energy, also utilize these cranes for heavy component installation and foundation work. Safety features, such as remote control, load testing, and machine learning, enhance their functionality and efficiency. Regulatory compliance and predictive maintenance are essential for ensuring optimal performance and longevity. Cranes with telescoping booms and outrigger systems facilitate heavy lifting and off-road mobility. Crane rental services cater to various industries, including construction projects, offshore wind, bridge construction, and modular construction. Logistics management, weight distribution, and project management are critical aspects of their operation. Engine power and maintenance requirements are essential considerations for crane operators.

The Less than 200 tons segment was valued at USD 5.32 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

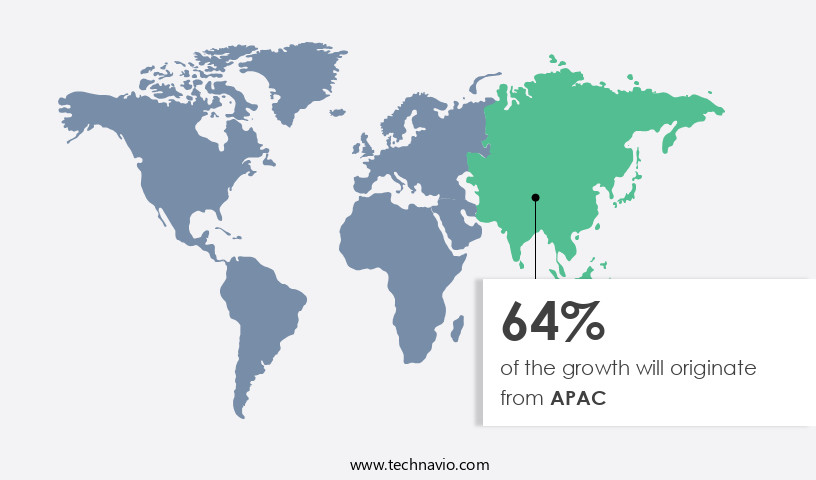

APAC is estimated to contribute 64% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is experiencing notable growth due to the construction and industrial sectors' increasing demand. The construction sector holds a substantial market share in APAC. Innovations in crane technology, particularly all-terrain cranes, have attracted significant attention from the utilities sector, leading to increased demand. In countries like China, India, South Korea, Indonesia, Thailand, Vietnam, and Japan, all-terrain cranes are increasingly used for wind farm development. These countries are major contributors to the market's growth. All-terrain cranes' versatility in various terrains and their ability to lift heavy components make them indispensable for infrastructure development projects, heavy lifting, and hydroelectric power generation.

Fuel efficiency, sensor technology, and load balancing are essential features that enhance the cranes' performance and efficiency. Safety features, such as remote control, maintenance schedules, and winch systems, ensure safe and efficient operation. Additionally, the market is witnessing the integration of machine learning, digital twin, and predictive maintenance to optimize crane performance and reduce downtime. The market in APAC is expected to continue its growth trajectory, driven by the renewable energy sector's expansion and the increasing demand for heavy lifting and terrain adaptability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the All-Terrain Crane market drivers leading to the rise in the adoption of Industry?

- The construction industry's continued growth serves as the primary catalyst for market expansion.

- The market is poised for growth due to the expanding construction industry, particularly in countries like China, the US, and India. The construction sector encompasses commercial, residential, and industrial development, as well as infrastructural projects such as dams, roads, and real estate assets. These initiatives contribute significantly to a nation's economic prosperity. Government investment plays a crucial role in driving the construction industry, making it a vital component of global economic sustainability. All-terrain cranes are essential for various construction applications, including modular construction, foundation work, and precast concrete. These cranes offer superior weight distribution and maneuverability, making them indispensable in diverse terrain conditions.

- In addition, project management and regulatory compliance require operator training and regular crane inspections for safety and maintenance. Advancements in technology are revolutionizing the crane industry, with digital twin simulations, artificial intelligence, and predictive maintenance enhancing operational efficiency and safety. Engine power and maintenance requirements continue to be essential factors in the market. By addressing these aspects, all-terrain crane manufacturers and operators can ensure optimal performance and longevity.

What are the All-Terrain Crane market trends shaping the Industry?

- The market is witnessing a significant trend towards the increased adoption of telematics technology. This advanced technology is gaining popularity for its ability to enhance operational efficiency, improve safety, and enable remote monitoring and diagnostics.

- All-terrain cranes are essential equipment in the construction industry, particularly in projects with limited space. Navigating these cranes through tight areas can be challenging for end-users. To address this issue, technology innovations are transforming the market. For instance, Japanese crane manufacturer Tadano's partnership with HeavyGoods in January 2023 resulted in an online software application. This app enables users to simulate crane maneuvers on Google Maps or based on their drone aerial imagery, improving efficiency and safety. Fuel efficiency is another crucial factor driving the market. Manufacturers are integrating sensor technology and hydraulic systems to optimize fuel consumption. Furthermore, load charts, lifting capacity, boom length, and jib extension are essential considerations in the selection and operation of all-terrain cranes.

- These cranes are employed in various sectors, including high-rise construction, steel fabrication, oil and gas, hydropower, and infrastructure development. The integration of advanced technologies, such as hydroelectric power and telematics, is expected to enhance the functionality and versatility of all-terrain cranes, making them indispensable in the construction sector. Additionally, spare parts availability and efficient heavy equipment transport are essential aspects of the market.

How does All-Terrain Crane market faces challenges face during its growth?

- The volatility in raw material prices poses a significant challenge to the industry's growth trajectory. In order to maintain competitiveness and profitability, companies must closely monitor and adapt to fluctuations in the prices of essential inputs. This unpredictability can lead to increased operational costs, supply chain disruptions, and decreased profitability. Consequently, effective supply chain management, price risk mitigation strategies, and diversification of raw material sources are crucial for mitigating the impact of price volatility on industry growth.

- All-terrain cranes are essential equipment in various industries, particularly construction and power generation. The production cost of these cranes is significantly influenced by the price fluctuations of their major raw materials, including steel, hardened steel, and aluminum. In December 2022, iron ore was priced at approximately USD111.84 per dry metric ton unit. These macroeconomic factors, such as inflation, labor costs, and regulatory policy changes, directly impact the production cost of all-terrain cranes. Crane service providers, including crane rental companies, must consider these price fluctuations when estimating project costs for construction projects, site preparation, heavy lifting, offshore wind, and renewable energy.

- The increasing demand for crane services in these industries necessitates the need for terrain adaptability, load balancing, safety features, telescoping booms, and remote control to ensure efficient and safe operations. Specialized trailers are also crucial for transporting all-terrain cranes to various job sites. The crane market's dynamics remain influenced by these raw material price fluctuations, making cost management a critical factor for crane service providers.

Exclusive Customer Landscape

The all-terrain crane market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the all-terrain crane market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, all-terrain crane market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Action Construction Equipment Ltd. - The company specializes in providing a range of all-terrain cranes, including the 25XW, 40XW, and 75XW models. These cranes are engineered for optimal performance in diverse terrain conditions. With advanced features and robust design, they deliver exceptional lifting capacity and maneuverability. Our team of experienced research analysts continually evaluates industry trends and technological advancements to ensure our crane offerings remain at the forefront of innovation. By investing in cutting-edge equipment and providing exceptional customer service, we empower our clients to tackle their most complex lifting projects with confidence.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Action Construction Equipment Ltd.

- Altec Inc.

- Bocker Maschinenwerke GmbH

- Broderson Manufacturing Corp.

- Elliott Equipment Inc.

- FURUKAWA Co. Ltd.

- Guangxi Liugong Machinery Co. Ltd.

- KATO WORKS CO. LTD.

- Kobe Steel Ltd.

- Liebherr International AG

- Manitex Inc.

- Sany Group

- Sumitomo Heavy Industries Ltd.

- Tadano Ltd.

- Terex Corp.

- The Manitowoc Co. Inc.

- TIL Ltd.

- Xuzhou Construction Machinery Group Co. Ltd.

- Zoomlion Heavy Industry Science and Technology Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in All-Terrain Crane Market

- In January 2024, Terex Corporation, a leading crane manufacturer, introduced the new Terex RT900E-2 All-Terrain Crane, featuring a maximum capacity of 90 tonnes and an advanced five-section boom system (Terex press release). This innovation expanded Terex's product portfolio, catering to the growing demand for high-capacity all-terrain cranes.

- In March 2025, Liebherr-Werk Ehingen GmbH, a renowned crane manufacturer, announced a strategic partnership with Siemens Energy to integrate renewable energy solutions into their cranes, making them more sustainable and eco-friendly (Liebherr press release). This collaboration aimed to reduce crane emissions and promote sustainable construction practices.

- In August 2024, Manitowoc Crane Group, a global crane manufacturer, acquired Demag Cranes AG, a German crane manufacturer, to strengthen its position in the European market and expand its product offerings (Manitowoc press release). The acquisition brought Demag's extensive portfolio of all-terrain cranes and expertise to Manitowoc, enhancing its market presence and capabilities.

- In December 2025, the European Union passed the new Construction Products Regulation (CPR), which includes stricter safety requirements for all-terrain cranes (European Parliament press release). The regulation, effective in 2027, will significantly impact manufacturers, forcing them to invest in research and development to meet the new safety standards and maintain their market position.

Research Analyst Overview

The market continues to evolve, driven by the diverse requirements of various sectors. In high-rise construction, these cranes' ability to adapt to uneven terrain and reach great heights makes them indispensable. Fuel efficiency is a significant concern, leading to advancements in hydraulic systems and engine power. Sensor technology and load charts ensure precise lifting capacity and boom length, essential for handling heavy components in industries like oil and gas and steel fabrication. Crane services extend beyond construction, with applications in power generation, infrastructure development, and renewable energy. Chassis design, load balancing, and outrigger system adaptability are crucial for off-road mobility and terrain adaptability.

Crane rental companies offer specialized trailers for transporting these versatile machines, ensuring efficient logistics management. Safety features, such as stability control and remote control, are increasingly important, as is compliance with emission standards and regulatory requirements. Machine learning and predictive maintenance help optimize maintenance schedules and improve overall performance. The crane market also caters to specialized applications, like heavy lifting, bridge construction, and wind energy projects. Telescoping booms, winch systems, and digital twin technology contribute to the ongoing advancements in crane technology. Operator training and regulatory compliance are essential aspects of the industry, ensuring safe and efficient crane operation.

The market's continuous dynamism is reflected in its ability to adapt to the ever-changing needs of industries, from precast concrete and solar energy to offshore wind and autonomous operation.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled All-Terrain Crane Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.36% |

|

Market growth 2024-2028 |

USD 3823.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.11 |

|

Key countries |

China, Japan, US, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this All-Terrain Crane Market Research and Growth Report?

- CAGR of the All-Terrain Crane industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the all-terrain crane market growth of industry companies

We can help! Our analysts can customize this all-terrain crane market research report to meet your requirements.