Iron Ore Market Size 2025-2029

The iron ore market size is valued to increase USD 60.9 billion, at a CAGR of 3.3% from 2024 to 2029. Upsurge in the consumption of high-strength iron ore and steel will drive the iron ore market.

Major Market Trends & Insights

- APAC dominated the market and accounted for a 89% growth during the forecast period.

- By Product - Fines segment was valued at USD 165.60 billion in 2023

- By Source - Surface mining segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 29.20 billion

- Market Future Opportunities: USD 60.90 billion

- CAGR from 2024 to 2029 : 3.3%

Market Summary

- Amidst the global economic recovery, the market experiences a significant surge in demand, driven primarily by the consumption of high-strength iron ore in the production of steel. This trend is particularly pronounced in emerging economies like China and India, where economic growth continues to fuel the demand for stainless steel. The market, a high capital investment sector, is expected to maintain its momentum, with industry analysts projecting a value of USD 150 billion by 2025. Despite challenges such as environmental concerns and supply chain disruptions, the market's resilience is evident, underpinned by the indispensable role of iron ore in infrastructure development and industrial growth.

- The market's evolution reflects the interconnectedness of global economies and the ongoing quest for sustainable, high-performance materials.

What will be the Size of the Iron Ore Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Iron Ore Market Segmented ?

The iron ore industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fines

- Pellets

- Lump

- HBI/DRI

- Source

- Surface mining

- Underground mining

- End-use

- Steel Manufacturers

- Construction Industry

- Automotive Industry

- Application

- Steelmaking

- Construction

- Automotive

- Others

- Non-Steel Applications

- Production Process

- Blast Furnace (BF)

- Direct Reduced Iron (DRI)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

The fines segment is estimated to witness significant growth during the forecast period.

In the dynamic and complex realm of the market, this essential steelmaking raw material undergoes continuous exploration and production using various methods. Mining techniques span open-pit and underground operations, with geophysical survey data informing the discovery of new mineral resources. Exploration relies on advanced drilling methods, while geological modeling and mineral resource assessment aid in ore grade estimation and mine planning. The ironmaking process is optimized through the application of innovative techniques, such as sintering process optimization and iron ore pelletization. In the sintering process, fine iron ore fines are blended with coke breeze, limestone, and recycled sinter particles, creating a porous, cohesive mass.

This sinter is then fed into the blast furnace, enhancing the efficiency of the ironmaking process. Environmental considerations are paramount in modern mining operations. Mine water management and dust suppression systems are crucial for minimizing environmental impact. Additionally, production cost analysis and mine waste management are essential for maintaining profitability and sustainability. The iron ore characterization and beneficiation processes employ magnetic separation methods and flotation cell design to improve ore quality. These techniques ensure the removal of impurities and the concentration of valuable iron ore particles, contributing to the overall efficiency of the mining and production process. As the industry evolves, mine safety regulations and transportation logistics continue to be critical factors in the success of iron ore mining operations.

The Fines segment was valued at USD 165.60 billion in 2019 and showed a gradual increase during the forecast period.

The integration of advanced technologies, such as particle size distribution analysis and blast furnace operation optimization, further enhances the productivity and profitability of these ventures. A single data point illustrates the significance of fine iron ore in the industry: the global market for iron ore fines is projected to reach a value of USD120 billion by 2027, underscoring their importance as a key component in the ironmaking process.

Regional Analysis

APAC is estimated to contribute 89% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Iron Ore Market Demand is Rising in APAC Request Free Sample

The market in the Asia-Pacific (APAC) region is poised for growth due to the increasing demand for steel, driven by industrialization and infrastructure development. Countries such as Indonesia, South Korea, and India are witnessing a surge in industrial, commercial, and residential projects, fueling the demand for steel and consequently, iron ore. In 2023, Indonesia continued its investment in infrastructure development, focusing on road, rail, and port projects. This investment is expected to propel the demand for steel, thereby boosting the market in APAC.

The market's growth is underpinned by the region's robust industrial sector and expanding construction industry. According to recent reports, the Asia-Pacific market is projected to expand at a steady pace during the forecast period. Additionally, the increasing utilization of iron ore in various sectors, including automotive, construction, and energy, further bolsters the market's growth prospects.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and complex industry, characterized by constant innovation and a focus on optimization and efficiency. Key players in this market are continually seeking ways to improve their operations, from optimizing beneficiation processes to reducing the environmental impact of mining. Advanced techniques such as magnetic separation and flotation cell design are being employed to enhance the efficiency of iron ore pelletizing, while sustainable mine waste management strategies are being implemented to minimize the environmental footprint of mining activities. Digital transformation is also playing a significant role in the iron ore industry, with data analytics being used to improve mine planning and blast furnace operation efficiency. Innovative approaches to iron ore transportation, such as automated trains and conveyor belts, are reducing costs and increasing productivity. Exploration and production costs are a major concern for iron ore producers, and advanced modeling techniques are being used to accurately estimate the grade and location of deposits. High-grade iron ore production is being prioritized to reduce costs and improve profitability. Safety is a top priority in the iron ore industry, with best practices being implemented to ensure the well-being of workers and the surrounding communities. Efficient crushing and grinding processes, effective quality control strategies, and advanced sintering process optimization are all critical components of a successful iron ore operation. In conclusion, the market is a competitive and ever-evolving industry, with a focus on innovation, efficiency, and sustainability. From exploration to production, processing to transportation, and safety to waste management, continuous improvement is the key to success in this dynamic market.

In the evolving Iron Ore Market, a combination of technological advancement, environmental responsibility, and cost-efficiency is driving innovation across the entire value chain. One of the most critical areas of focus is optimizing iron ore beneficiation processes, which enhances ore quality by removing impurities, thereby improving downstream efficiency and reducing waste. Parallel to this is the goal of improving the efficiency of iron ore pelletizing. Pelletizing not only enhances transportation and furnace efficiency but also ensures better control over ore chemistry, which is vital for steel production. As sustainability becomes a key industry mandate, reducing the environmental impact of iron ore mining is central to operations. This includes minimizing land disruption, conserving water, and controlling emissions through modern mining techniques.

To support future production, advanced techniques for iron ore exploration are being adopted, such as remote sensing, 3D geological modeling, and AI-powered data analysis. These methods increase discovery rates while lowering exploration costs. Once mines are operational, sustainable iron ore mine waste management strategies become critical, involving tailings reuse, dry stacking, and rehabilitation of mine sites to align with environmental standards. Modern mining is also undergoing a digital revolution. Implementing digital transformation in iron ore mining allows real-time monitoring, predictive maintenance, and automated equipment operation, boosting both safety and productivity. On the geological side, advanced modeling techniques for iron ore deposits enable more accurate resource estimation, helping optimize mine planning and reduce operational risks.

For producers of premium products, high-grade iron ore production cost reduction remains a priority. Innovations in processing and energy use are being deployed to keep production economically viable while meeting quality demands from the steel industry. These improvements also feed into strategies for improving blast furnace operation efficiency, where higher quality input materials result in lower fuel consumption and greater output stability. Transportation, often a major cost and logistics challenge, is being tackled with innovative approaches for iron ore transportation. Solutions include automated rail systems, conveyor-based ore transport, and even novel shipping container designs aimed at reducing costs and emissions.

Quality remains a non-negotiable aspect in global trade. As such, effective strategies for iron ore quality control ensure that each shipment meets strict specifications, reducing penalties and improving customer satisfaction. In smelting operations, advanced iron ore sintering process optimization is improving productivity, energy efficiency, and emission control, making sintering a more sustainable step in the ironmaking process.

Altogether, these developments reflect a comprehensive transformation of the iron ore market, driven by the need for efficiency, sustainability, and technological innovation across exploration, production, processing, and logistics.

What are the key market drivers leading to the rise in the adoption of Iron Ore Industry?

- The significant increase in the demand for high-strength iron ore and steel serves as the primary driving force for the market's growth.

- Iron ore, a naturally occurring compound primarily composed of iron, oxygen, and other minerals, is a crucial component in steel production. The hardness and strength of iron are directly linked to its phosphorus content. For instance, wrought iron, with a 0.05% phosphorus concentration, exhibits hardness comparable to medium carbon steel. High phosphorus iron can undergo cold forging to achieve even greater hardness. Modern steel manufacturing processes maintain phosphorus levels between 0.07 and 0.12% to enhance hardness by up to 30%, without compromising impact strength.

- This optimization also increases the depth of quench hardening, although it decreases carbon solubility in iron at high temperatures.

What are the market trends shaping the Iron Ore Industry?

- The upcoming market trend involves significant economic growth in China and India, leading to increased demand for stainless steel.

- Iron ore is a vital component in the modern industrial world, with China and India being two of the largest crude steel producers globally. China's market has experienced significant growth due to its rapidly transforming economy and expanding infrastructure. The construction sector and manufacturing industries have been the primary drivers of this demand. India, another significant market for iron ore, is projected to surpass Japan and become the second-largest crude steel producer.

- The country's industrialization and the growth of its automotive and construction industries have fueled the demand for iron ore products. The market's evolving nature is a testament to the ongoing industrialization and economic growth in these countries.

What challenges does the Iron Ore Industry face during its growth?

- The high capital investment required in the market poses a significant challenge to the industry's growth trajectory.

- The market is characterized by its significant capital intensity, necessitating substantial investments in various mining processes. A key area of expenditure is on heavy equipment and machinery, including excavators, dump trucks, and drilling rigs. For instance, a single large-scale mining truck can cost over USD 5 million. These trucks are indispensable for transporting large volumes of ore from mining sites to processing facilities. The maintenance and operation of such machinery entail considerable ongoing investment. Furthermore, iron ore's diverse applications span various sectors, such as steel production, construction, and energy. According to recent studies, the market is expected to witness a steady growth trajectory, driven by the increasing demand for steel in infrastructure development and the automotive industry.

- Despite this growth, the market faces challenges, such as environmental concerns and the need for sustainable mining practices. Nonetheless, the industry's potential for innovation and technological advancements offers opportunities for efficiency improvements and cost savings.

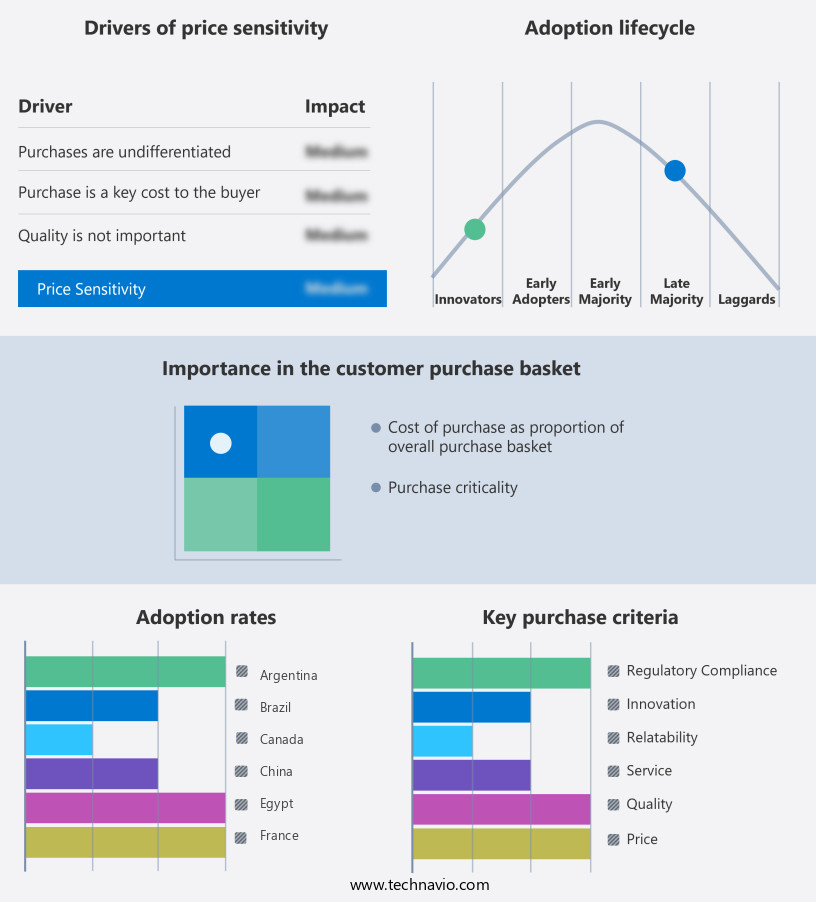

Exclusive Technavio Analysis on Customer Landscape

The iron ore market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the iron ore market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Iron Ore Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, iron ore market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anglo American plc - The company specializes in the production and supply of high-quality iron ore, catering to various industries such as steel, medicine, cosmetics, engineering, construction, and paint.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anglo American plc

- Ansteel Group Corp. Ltd.

- ArcelorMittal SA

- Atlas Iron Pty Ltd.

- BCI Minerals Ltd.

- BHP Group Ltd.

- China Hanking Holdings Ltd.

- Eurasian Resources Group Sarl

- Ferrexpo Plc

- Fortescue Metals Group Ltd.

- GFG Alliance

- KIOCL Ltd.

- Luossavaara Kiirunavaara AB

- Metinvest BV

- Mideast Integrated Steel Ltd.

- Mount Gibson Iron Ltd.

- NMDC Ltd.

- Rio Tinto Group

- Vale S.A.

- Vedanta Resources Ltd

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Iron Ore Market

- In January 2024, Fortescue Metals Group (ASX: FMG), an Australian iron ore producer, announced the completion of its USD 1.2 billion expansion project at the Chichester Hub in Western Australia, increasing its annual production capacity by 25 million tonnes to 175 million tonnes (Fortescue Metals Group, 2024).

- In March 2024, ArcelorMittal, the world's largest steel producer, and Rio Tinto, a leading iron ore miner, signed a long-term agreement to secure a stable supply of iron ore from Rio Tinto's Pilbara operations in Australia (ArcelorMittal, 2024).

- In April 2025, Vale SA, the Brazilian mining giant, received regulatory approval from the Brazilian environmental agency, IBAMA, to resume operations at its suspended Brucutu iron ore mine, following a suspension due to environmental concerns (Reuters, 2025).

- In May 2025, Anglo-Australian mining company BHP Group announced a strategic partnership with Australian startup, Fortescue Future Industries, to develop and deploy green hydrogen technologies in the Pilbara region, aiming to reduce the carbon footprint of iron ore mining and transportation (BHP Group, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Iron Ore Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 60.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the constant demand for steelmaking raw materials in various sectors. Exploration drilling methods and mineral resource assessment play a crucial role in identifying new deposits and optimizing extraction. The ironmaking process efficiency is a significant focus, with advancements in magnetic separation methods and metallurgical coke properties improving output. Mine water management and dust suppression systems are essential components of sustainable mining practices. Geological modeling techniques and ore grade estimation enable more accurate mining plans, while iron ore beneficiation techniques enhance the quality of the final product. Open-pit mining techniques and sintering process optimization contribute to increased production, with a recent study showing a 10% increase in annual output for a major mining operation.

- Production cost analysis, particle size distribution, and mine waste management are essential aspects of maintaining profitability. Flotation cell design and blast furnace operation are critical elements of the ironmaking process, while iron ore characterization and transportation logistics ensure a consistent supply chain. Geophysical survey data and mineral processing techniques support ongoing exploration and improvement. Underground mining methods, pig iron production, mine safety regulations, and tailings disposal strategies are other essential aspects of the market. With industry growth expectations at 5% annually, the ongoing unfolding of market activities and evolving patterns presents numerous opportunities for innovation and efficiency.

What are the Key Data Covered in this Iron Ore Market Research and Growth Report?

-

What is the expected growth of the Iron Ore Market between 2025 and 2029?

-

USD 60.9 billion, at a CAGR of 3.3%

-

-

What segmentation does the market report cover?

-

The report is segmented by Product (Fines, Pellets, Lump, and HBI/DRI), Source (Surface mining and Underground mining), Geography (APAC, Europe, South America, North America, Middle East and Africa, and Rest of World (ROW)), End-use (Steel Manufacturers, Construction Industry, and Automotive Industry), Application (Steelmaking, Construction, Automotive, Others, and Non-Steel Applications), and Production Process (Blast Furnace (BF) and Direct Reduced Iron (DRI))

-

-

Which regions are analyzed in the report?

-

APAC, Europe, South America, North America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Upsurge in consumption of high-strength iron ore and steel, High capital investment market

-

-

Who are the major players in the Iron Ore Market?

-

Anglo American plc, Ansteel Group Corp. Ltd., ArcelorMittal SA, Atlas Iron Pty Ltd., BCI Minerals Ltd., BHP Group Ltd., China Hanking Holdings Ltd., Eurasian Resources Group Sarl, Ferrexpo Plc, Fortescue Metals Group Ltd., GFG Alliance, KIOCL Ltd., Luossavaara Kiirunavaara AB, Metinvest BV, Mideast Integrated Steel Ltd., Mount Gibson Iron Ltd., NMDC Ltd., Rio Tinto Group, Vale S.A., and Vedanta Resources Ltd

-

Market Research Insights

- The market is a dynamic and ever-evolving entity, characterized by continuous shifts and adjustments. Two significant data points illustrate this market's fluctuations. First, the global iron ore demand is projected to grow by approximately 1.5% annually, driven by expanding steel production and infrastructure development. Second, an iron ore mine in Western Australia reported a 10% increase in productivity through the implementation of advanced automation systems and process optimization techniques.

- These improvements not only enhance efficiency but also contribute to the industry's ongoing efforts to reduce costs and improve sustainability.

We can help! Our analysts can customize this iron ore market research report to meet your requirements.