Anti-Fatigue Mat Market Size 2024-2028

The anti-fatigue mat market size is forecast to increase by USD 681 million at a CAGR of 4.83% between 2023 and 2028.

What will be the Size of the Anti-Fatigue Mat Market During the Forecast Period?

How is this Anti-Fatigue Mat Industry segmented and which is the largest segment?

The anti-fatigue mat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Non-residential

- Residential

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

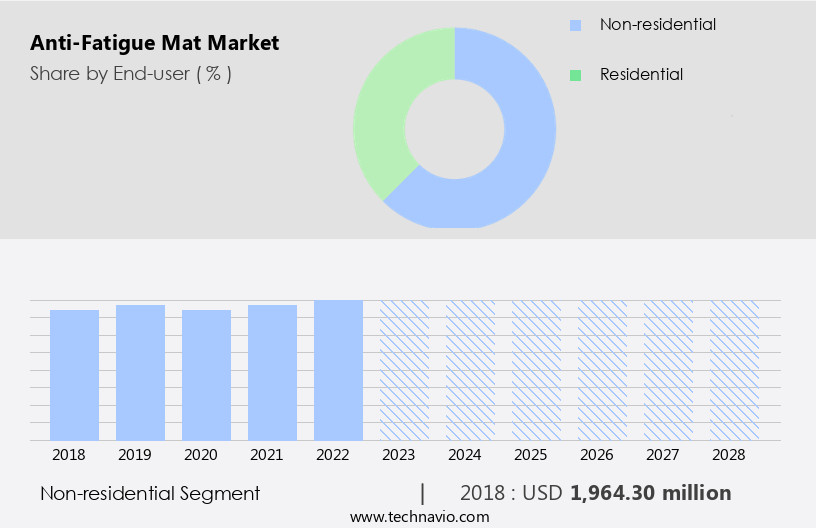

By End-user Insights

- The non-residential segment is estimated to witness significant growth during the forecast period.

Anti-fatigue mats are essential in various non-residential settings, including commercial, industrial, sports, and hospitality sectors. The industrial segment experiences significant demand due to the mandatory requirement for a healthy and safe work environment. Prolonged standing in industries can result in musculoskeletal disorders, leading to joint pain, muscle fatigue, and injury. Commercial users, such as office buildings, educational institutions, shopping malls, retail stores, restaurants, and hospitals, are the second-largest contributors to non-residential end-users. These establishments prioritize employee health and well-being, recognizing the importance of reducing the risks of work-related injuries and health issues. Anti-fatigue mats come in various types, including foam-based, rubber-based, and gel-based, offering features like textured surfaces, ergonomic designs, and shock absorption.

They are available in modular, perforated, printed, and hybrid designs, suitable for use in sit-stand desks, safety bodies, and facility safety equipment. The market for anti-fatigue mats is expanding to accommodate the growing need for foot problems solutions, particularly in shared workspaces, home offices, and warehousing facilities. The market caters to the retail, e-commerce, and warehousing sectors, offering gel-based solutions to mitigate wear and tear, improve blood circulation, and address musculoskeletal issues.

Get a glance at the Anti-Fatigue Mat Industry report of share of various segments Request Free Sample

The Non-residential segment was valued at USD 1964.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

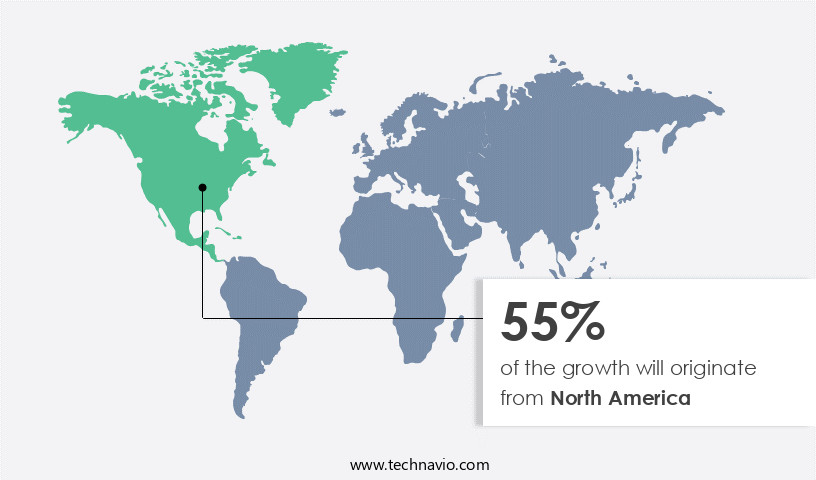

- North America is estimated to contribute 55% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market experiences growth due to increasing manufacturing, food and beverage industries, and stringent worker safety regulations in sectors like automotive. OSHA, a leading worker safety association, advocates for anti-fatigue mats in various publications and trainings for employers. These mats mitigate risks, such as muscle fatigue and joint pain, associated with prolonged standing and non-ergonomic workstations. They contribute to improved employee health and well-being, reducing work-related musculoskeletal disorders (MSDs) and increasing productivity. Anti-fatigue mats come in various types, including foam-based, rubber-based, and gel-based, catering to diverse industries and workspaces, from residential to industrial. Key features include textured surfaces, ergonomic designs, and adaptability to various floor coverings.

Employers in retail, commercial, and industrial sectors invest In these mats to ensure a safer, healthier work environment.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Anti-Fatigue Mat Industry?

Growth of organized retail sector is the key driver of the market.

What are the market trends shaping the Anti-Fatigue Mat Industry?

Increased demand for eco-friendly anti-fatigue mats is the upcoming market trend.

What challenges does the Anti-Fatigue Mat Industry face during its growth?

Huge competition from unorganized market is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The anti-fatigue mat market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-fatigue mat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-fatigue mat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

3M Co. - The company provides a range of anti-fatigue mats, including the 3M Safety Walk Cushion Matting 5270 and 5270E, and the 3M Clean Walk Replacement Pad 5842. These mats are designed to reduce employee fatigue and improve comfort underfoot, contributing to enhanced workplace safety and productivity. The 3M brand is recognized for its innovative solutions in safety and productivity, and these mats are no exception. They offer superior shock absorption and resistance to wear and tear, making them a smart investment for any workplace environment.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Alimed Inc.

- American Floor Mats LLC

- American Mat and Rubber Co.

- American Pro Marketing LLC

- Apache Mills

- Bardwell Matting

- BICO Group AB

- COBA International Ltd.

- Crown Matting Technologies

- Durable Corp.

- ES ROBBINS Corp.

- Floortex LLC

- Humane Manufacturing Co. LLC

- Justrite Mfg. Co. LLC

- KLEEN TEX Industries Inc.

- Lets Gel Inc.

- Mountville Mills Inc.

- Pro Tech Mats Industries Inc.

- Ranco Industries Inc.

- SATECH Inc.

- UniFirst Corp.

- Wearwell LLC

- Xiamen Sheep Anti Fatigue Mat Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Anti-fatigue mats have gained significant attention in various industries due to their ability to reduce worker fatigue and prevent related health issues. These mats are designed to provide comfort and support for individuals who spend long hours standing or working in one place. The market for anti-fatigue mats has seen steady expansion in recent years, driven by the increasing prevalence of prolonged standing in various sectors. The healthcare industry, for instance, has seen a rise In the use of these mats in hospitals, clinics, and other healthcare facilities to mitigate the risks associated with extended periods of standing. Similarly, the shift towards hybrid work models, with employees working both remotely and in-office, has led to an increase In the demand for anti-fatigue mats for home workspaces.

Employers have recognized the importance of employee health and well-being, leading to a greater focus on providing ergonomic solutions such as anti-fatigue mats. The market for anti-fatigue mats caters to a diverse range of industries and applications. In the industrial segment, these mats are used in manufacturing plants, warehouses, and construction sites to prevent foot problems and lower limb issues caused by prolonged standing and heavy workloads. In the commercial segment, they are used in retail stores, restaurants, and other customer-facing environments to provide a comfortable and hygienic work environment. Anti-fatigue mats come in various materials, including foam-based, rubber-based, and gel-based solutions.

Each material offers unique benefits, such as shock absorption, adaptability, and wear and tear resistance. Foam-based mats, for instance, provide excellent cushioning and are easy to clean, while rubber-based mats offer superior durability and resistance to spills and chemicals. Gel-based mats provide excellent shock absorption and are ideal for high-traffic areas. The design of anti-fatigue mats is also a critical factor In their effectiveness. Textured surfaces, ergonomic designs, and perforated mats are popular choices as they provide better grip, support, and breathability. Modular and printed mats offer flexibility in terms of size and design, making them suitable for various applications.

The market for anti-fatigue mats is expected to continue expanding, driven by the increasing awareness of the health risks associated with prolonged standing and the growing emphasis on employee well-being. The availability of a wide range of products and the ease of purchasing through both offline and online channels further enhances the market's accessibility. In conclusion, anti-fatigue mats play a crucial role in preventing work-related health issues and promoting employee well-being. The market for these mats is diverse and expanding, with various materials, designs, and applications catering to the needs of different industries and workplaces. Employers and individuals alike recognize the importance of investing in high-quality anti-fatigue mats to ensure a comfortable and productive work environment.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 681 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Key countries |

US, China, Germany, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Fatigue Mat Market Research and Growth Report?

- CAGR of the Anti-Fatigue Mat industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-fatigue mat market growth of industry companies

We can help! Our analysts can customize this anti-fatigue mat market research report to meet your requirements.