Anti-Tank Missile System Market Size 2024-2028

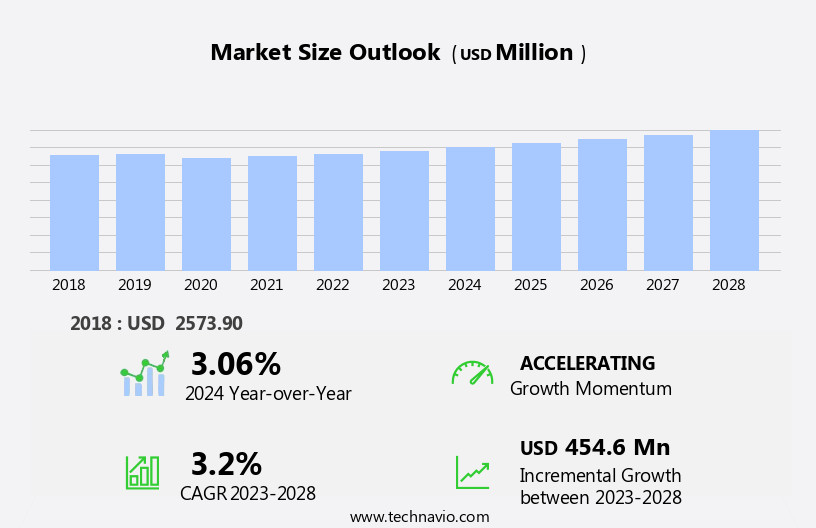

The anti-tank missile system market size is forecast to increase by USD 454.6 million at a CAGR of 3.2% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for extended-range missile systems from defense forces worldwide. This trend is driven by the need to enhance border security and protect troops from enemy attacks at greater distances. Furthermore, the development of next-generation anti-tank missiles, featuring advanced guidance systems and increased warhead capacity, is fueling market expansion. However, the market is not without challenges. Delays in weapon procurement processes, due to budget constraints and political instability in some regions, pose a significant hurdle to market growth.

- Companies seeking to capitalize on this market's opportunities must stay informed of technological advancements and government procurement trends while navigating the complex regulatory landscape. Effective strategic planning and operational agility are essential for success in this dynamic market.

What will be the Size of the Anti-Tank Missile System Market during the forecast period?

- The market for anti-tank missile systems encompasses various types, including long-range and shoulder-launched missiles, as well as those designed for use on aerial vehicles. Military agencies worldwide continue to invest in these weapons to counteract the threat posed by tanks and other armored vehicles. Communication towers and electronic jammers are also integral components of anti-tank missile systems, ensuring effective communication and countermeasures against enemy defenses. The ground-based segment of the anti-tank missile market includes vehicle-mounted and ammunition depot-stored missiles, while homeland security agencies utilize man-portable options for infantry forces. Unmanned aerial vehicles and active protection systems are increasingly being integrated into anti-tank missile systems to enhance their capabilities.

- Defence expenditures remain a significant driver for the anti-tank missile market, with operational range and ammunition capacity being crucial factors in the selection process. Anti-tank missiles are essential weapons for various military applications, including armored vehicles, helicopters, and light assault aircraft, making the market a vital sector for defence and security establishments.

How is this Anti-Tank Missile System Industry segmented?

The anti-tank missile system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Homeland

- Defense

- Product

- Vehicle-mounted

- Man-portable

- Geography

- North America

- US

- APAC

- China

- India

- Europe

- Russia

- UK

- Middle East and Africa

- South America

- North America

By Application Insights

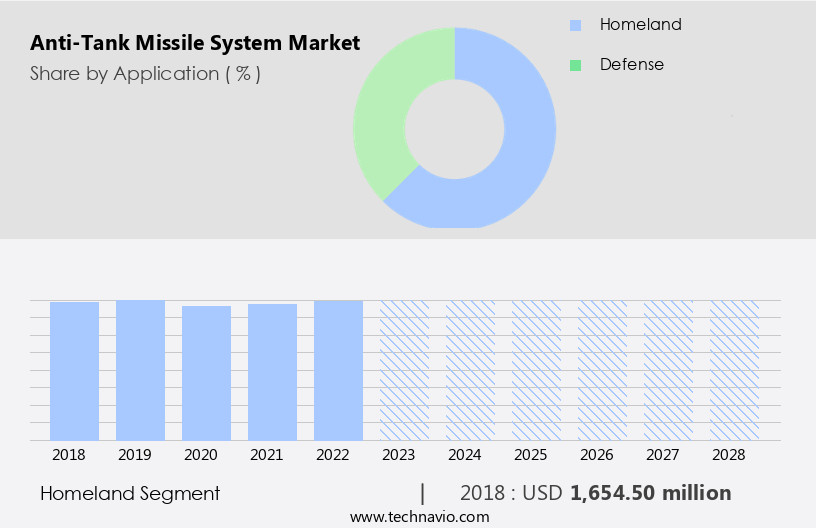

The homeland segment is estimated to witness significant growth during the forecast period.

The market is experiencing substantial growth due to escalating geopolitical tensions and the necessity for advanced defense technology. The homeland sector is a significant contributor to this market expansion. In this context, the homeland segment of the market prioritizes the deployment of these systems domestically to strengthen a nation's defense capabilities against potential threats. This sector encompasses military forces, law enforcement agencies, and border control personnel. The demand for anti-tank missile systems is influenced by several factors. Primarily, nations are investing more in upgrading their defense infrastructure to protect critical assets and secure their borders from external aggression.

Additionally, the integration of advanced technologies such as fire & forget capabilities, active protection systems, and electronic warfare in anti-tank missile systems is driving market growth. Furthermore, the development of long-range anti-tank missiles and man-portable systems is catering to the evolving needs of various military applications, including ground warfare, naval warfare, and airborne platforms. The commercial segment, including vehicle-mounted and man-portable systems, is also experiencing growth due to the increasing demand for light assault aircrafts and unmanned aerial vehicles (UAVs) in various industries, such as homeland security and commercial aviation. The integration of anti-tank missile systems with precision targeting and communication technologies is further enhancing their utility and appeal.

Moreover, the market is witnessing the integration of cybersecurity measures to protect these advanced systems from potential cyber threats. The development of advanced weapons systems, such as hypersonics and active protection systems, is also fueling market growth. Overall, The market is poised for significant expansion as it addresses the evolving defense needs of various sectors.

Get a glance at the market report of share of various segments Request Free Sample

The Homeland segment was valued at USD 1654.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

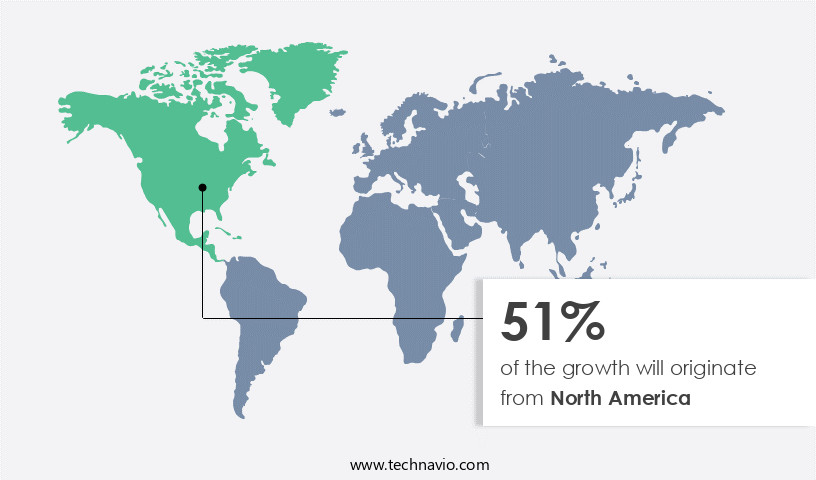

North America is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The United States, as the world's largest economy and a dominant political power, has consistently prioritized military investments to safeguard its interests and those of its allies. With an extensive military infrastructure, the country boasts the largest fleet of platforms, including main battle tanks, aircraft carriers, and attack helicopters, as well as the largest military bases. In the market, the US continues to play a significant role. Fire and forget capabilities are increasingly sought after in anti-tank missile systems, enabling soldiers to engage targets without the need for further guidance once the missile is launched. Helicopters, a vital component of US military forces, are often equipped with aerial anti-tank missiles for enhanced capabilities.

Space technology is also being integrated into anti-tank missile systems, expanding their operational range and precision. War establishments and military agencies are investing in advanced weapons systems, such as long-range anti-tank missiles, to counteract the evolving threat landscape. Active protection systems, including reactive and composite armor, are being integrated into armored vehicles to improve survivability. Cybersecurity and electronic warfare are also essential considerations in the development of these systems to protect against potential threats. Defense contractors are at the forefront of research and development in the anti-tank missile market. They are focusing on hypersonic technology, man-portable systems, and precision targeting to provide the military with cutting-edge capabilities.

Commercial segments, including light assault aircrafts and unmanned aerial vehicles, are also adopting anti-tank missile systems to enhance their operational capabilities. The military segment, which includes ground warfare and naval warfare, is a significant consumer of anti-tank missile systems. Ground-based platforms, such as communication towers and tanks, are also being equipped with these systems for enhanced protection. Missile defense and power generating management systems are also essential components of the market. In the commercial segment, anti-tank missile systems are being adopted by various industries, including general aviation and homeland security, to protect against potential threats. The market is also witnessing the integration of anti-tank missile systems into infantry and ground infantry operations.

In the US, military expenditures continue to be a significant driver of the anti-tank missile market. The ground-based segment, which includes anti-tank guided missiles and long-range anti-tank missiles, is expected to witness significant growth due to the increasing demand for advanced capabilities to counteract evolving threats. The market is also witnessing the integration of advanced technologies, such as electronic jammers and advanced weapons systems, to enhance the capabilities of anti-tank missile systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Anti-Tank Missile System Industry?

- Increased demand for extended-range missiles is the key driver of the market.

- Anti-tank missile systems with extended-range capabilities are essential for military forces to counteract the advancements in armored vehicles and tanks. Long-range missiles enable troops to engage adversaries from a safer distance, broadening operational possibilities and reducing risks to infantry personnel. Extended-range missiles offer a significant tactical advantage as they can target enemies beyond their line of sight, equipped with advanced target acquisition systems, sensors, and data link capabilities.

- This enhanced situational awareness leads to fewer collateral damages and successful disabling of opponent armor. The integration of technology in these missile systems ensures real-time engagement and improved accuracy, making them indispensable in modern warfare.

What are the market trends shaping the Anti-Tank Missile System Industry?

- Development of next-generation anti-tank missiles is the upcoming market trend.

- In contemporary military conflicts, covert operations often necessitate the use of advanced weapons to penetrate obstructions and neutralize enemy targets with precision. Traditional weapons like rifles and machine guns have limitations in this regard. Therefore, the development of advanced anti-tank missile systems has become essential. These missiles offer extended range and the ability to penetrate bunkers, walls, and vehicle armor. For instance, Saab's NLAW anti-tank missile system features selectable overfly top attack (OTA) and direct attack (DA) modes. OTA is effective against armored targets, while DA can neutralize non-armored targets such as other vehicles, vessels, and enemy troops inside buildings.

- The evolving nature of warfare necessitates weapons that impart maximum lethality while minimizing collateral damage. Anti-tank missile systems represent a significant investment for military forces seeking to maintain a technological edge.

What challenges does the Anti-Tank Missile System Industry face during its growth?

- Delays in weapon procurement is a key challenge affecting the industry growth.

- The market encounters significant challenges due to procurement delays. Political instability, budget constraints, and bureaucratic hurdles are among the primary causes of these delays. The consequences of these delays are profound, impacting operational readiness. A shortage of anti-tank missile systems for military forces can result from procurement delays, limiting their ability to respond effectively to emergencies, particularly in high-risk conflict zones.

- Troops may be compelled to use outdated or inferior equipment, increasing risks and potential casualties. Delays in acquisition can also hinder the modernization of military capabilities. As a , it is crucial to the severity of these challenges and their potential impact on military operations.

Exclusive Customer Landscape

The anti-tank missile system market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the anti-tank missile system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, anti-tank missile system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The Turkish defense technology firm, Roketsan, showcases its advanced capabilities with the L UMTAS anti-tank missile. This state-of-the-art weapon system boasts superior precision and effectiveness against armored targets. Its innovative design and advanced guidance system enable it to adapt to various terrain types and engage threats at range. Roketsan's commitment to research and development ensures the L UMTAS remains at the forefront of anti-tank missile technology.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- BAE Systems Plc

- Denel Dynamics

- Elbit Systems Ltd.

- General Dynamics Corp.

- Hanwha Corp.

- Lockheed Martin Corp.

- Northrop Grumman Corp.

- Rafael Advanced Defense Systems Ltd.

- Roketsan AS

- Rostec

- RTX Corp.

- Saab AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of technologies designed to provide effective countermeasures against armored vehicles and military aircraft. These systems offer "fire and forget" capabilities, enabling operators to engage targets with minimal interaction once the missile is launched. One segment of this market comprises helicopter-mounted anti-tank missiles, which offer enhanced operational range and versatility in aerial engagements. War establishments continue to invest in advanced weapons systems, including active protection systems for armored vehicles and electronic warfare systems for military aircraft. In the ground warfare domain, vehicle-mounted anti-tank missile systems have gained significant traction. These systems are increasingly being integrated with cybersecurity measures to counteract potential threats.

The commercial segment also contributes to the market's growth, with an increasing number of companies offering man-portable anti-tank missile solutions. The market for anti-tank missiles is not limited to military applications. Unmanned aerial vehicles (UAVs) have emerged as a viable platform for long-range anti-tank missile systems, providing precision targeting capabilities and reducing the risk to personnel. The military segment dominates the anti-tank missile market, with ground warfare and naval warfare being the primary focus areas. Ground-based platforms, such as communication towers and ammunition depots, are also targeted by anti-tank missiles. Defense expenditures continue to drive the market's growth, with defense contractors investing in research and development of advanced weapons systems, including hypersonic anti-tank missiles.

The man-portable segment is also experiencing significant growth due to its ease of deployment and flexibility. In addition to traditional anti-tank missile systems, emerging technologies such as active protection systems and reactive armor are gaining popularity. Composite armor and electronic jammers are also being integrated into anti-tank systems to enhance their effectiveness. The anti-tank missile market is not limited to land-based applications. Airborne platforms, such as light assault aircraft and helicopters, are increasingly being used to deliver anti-tank missiles, providing greater operational flexibility. Regional conflicts and homeland security concerns continue to fuel the demand for anti-tank missile systems.

Ground infantry and general aviation are also potential targets for these systems, highlighting their versatility and importance in modern warfare. The anti-tank missile market is a dynamic and evolving landscape, with constant innovation and advancements in technology driving its growth. Power generating management systems, communication towers, and other critical infrastructure are increasingly being targeted, underscoring the importance of effective countermeasures.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 454.6 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

US, China, Russia, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Anti-Tank Missile System Market Research and Growth Report?

- CAGR of the Anti-Tank Missile System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the anti-tank missile system market growth of industry companies

We can help! Our analysts can customize this anti-tank missile system market research report to meet your requirements.