Antimicrobial Susceptibility Testing Market Size 2025-2029

The antimicrobial susceptibility testing market size is valued to increase USD 1.22 billion, at a CAGR of 5.1% from 2024 to 2029. Rising antimicrobial resistance will drive the antimicrobial susceptibility testing market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 35% growth during the forecast period.

- By Type - Antibacterial testing segment was valued at USD 2.52 billion in 2023

- By Application - Clinical diagnostics segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 60.42 million

- Market Future Opportunities: USD 1224.70 million

- CAGR : 5.1%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and evolving sector that plays a crucial role in combating antimicrobial resistance and ensuring effective treatment of infections. This market encompasses core technologies, such as disk diffusion, broth dilution, and automated systems, and applications in various sectors, including hospitals, clinical laboratories, and research institutions. The rise in point-of-care testing and increasing demand for rapid and accurate results are major drivers for market growth. However, regulatory and reimbursement hurdles pose significant challenges.

- This forecast underscores the ongoing importance and evolution of this market, as it continues to address the pressing need for effective antimicrobial resistance solutions. Related markets such as diagnostics and pharmaceuticals also contribute to the broader context of infection control and treatment.

What will be the Size of the Antimicrobial Susceptibility Testing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Antimicrobial Susceptibility Testing Market Segmented and what are the key trends of market segmentation?

The antimicrobial susceptibility testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Antibacterial testing

- Antifungal testing

- Antiparasitic testing

- Antiviral testing

- Application

- Clinical diagnostics

- Drug discovery and development

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The antibacterial testing segment is estimated to witness significant growth during the forecast period.

Antimicrobial susceptibility testing is a crucial process in determining the effectiveness of antimicrobial agents against various microorganisms, including bacteria, fungi, parasites, and viruses. Clinical microbiology laboratories employ several methods to assess antimicrobial susceptibility, such as checkerboard titration, pharmacokinetic/pharmacodynamic analysis, and growth curves. Checkerboard titration is a technique used to determine the interaction between two antimicrobial agents, revealing synergistic or antagonistic effects. Pharmacokinetic/pharmacodynamic analysis considers the relationship between the concentration of an antimicrobial agent in the body and its effect on microbial growth. Disk diffusion testing is a widely used method where antibiotic-impregnated disks are placed on agar plates inoculated with bacteria, and the zone of growth inhibition around the disks is measured to determine susceptibility.

Fungal and parasite susceptibility testing is essential for managing infections caused by these microorganisms. Automated systems and molecular diagnostics, such as the eTest method, point-of-care testing, and rapid diagnostic tests, are increasingly popular due to their speed and accuracy. Time-kill assays measure the time required for a specific antimicrobial agent to kill a certain number of colony forming units (CFUs) of bacteria, providing valuable information on the bactericidal activity of antimicrobial agents. Infection control and antimicrobial stewardship programs rely on antimicrobial susceptibility testing to guide treatment decisions, prevent the spread of antibiotic-resistant bacteria, and optimize antibiotic usage.

The Antibacterial testing segment was valued at USD 2.52 billion in 2019 and showed a gradual increase during the forecast period.

Antiviral susceptibility testing is essential for identifying resistance mechanisms and guiding antiviral therapy. The market is expanding, with a growing number of laboratories adopting advanced technologies for rapid and accurate testing. According to recent reports, the market is expected to grow by 15.3% in the next five years, driven by the increasing prevalence of infectious diseases and the rising demand for rapid and accurate testing methods. Additionally, the market is witnessing significant growth in the development of automated systems for bacterial identification, susceptibility profiles, and minimum inhibitory concentration (MIC) testing. In conclusion, antimicrobial susceptibility testing plays a vital role in managing infections caused by bacteria, fungi, parasites, and viruses.

The market for antimicrobial susceptibility testing is growing rapidly, driven by the increasing prevalence of infectious diseases and the demand for rapid and accurate testing methods. The ongoing development of advanced technologies, such as automated systems and molecular diagnostics, is expected to further drive market growth.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Antimicrobial Susceptibility Testing Market Demand is Rising in North America Request Free Sample

The Antimicrobial Susceptibility Testing (AST) market is a significant and dynamic sector, with North America leading the global landscape. The region's dominance is attributed to advanced healthcare systems, diagnostic technology adoption, and robust regulatory frameworks. The US, specifically, holds the largest market share due to high AMR prevalence, substantial healthcare expenditure, and early implementation of automated and molecular AST technologies. As per the CDC, at least 2 million Americans develop antibiotic-resistant infections annually, necessitating continuous innovation and investment in AST solutions.

In Canada and Mexico, the market growth is driven by expanding healthcare sectors and increasing focus on disease prevention and control. The AST market in the US is mature and innovation-driven, with a focus on developing advanced technologies to combat AMR.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a range of techniques used to determine the ability of microorganisms to resist the effects of antimicrobial agents. MIC determination using methods such as broth microdilution and disk diffusion tests plays a crucial role in this market. The broth microdilution method provides a quantitative measurement of the minimum inhibitory concentration (MIC) of an antimicrobial agent required to inhibit bacterial growth. Interpretation guidelines for disk diffusion tests help clinicians identify zones of inhibition and determine susceptibility categories for common bacterial pathogens. Technological advancements have led to the emergence of rapid diagnostic tests and automated antimicrobial susceptibility testing systems.

The etest method, for instance, offers a rapid and accurate alternative to traditional methods, delivering results within hours. Molecular methods, such as polymerase chain reaction (PCR) and next-generation sequencing, are increasingly being used to detect antibiotic resistance genes. Quality control procedures and standard operating procedures are essential to ensure the accuracy and reliability of antimicrobial susceptibility testing results. Clinical breakpoints for common bacterial pathogens provide a standardized framework for interpreting test results and guiding antimicrobial therapy. Pharmacokinetic/pharmacodynamic modeling plays a vital role in optimizing antibiotic dosing and improving therapeutic outcomes. Comparing various antimicrobial susceptibility testing methods, automated systems have shown a significant reduction in turnaround time compared to manual methods.

For instance, the time taken for automated systems to perform broth microdilution tests is approximately 2 hours, while manual methods can take up to 16 hours. The use of whole genome sequencing in resistance studies offers valuable insights into the molecular mechanisms of antibiotic resistance and the potential for personalized treatment approaches. Combination therapy with antimicrobial agents and the assessment of synergistic and antagonistic effects are essential strategies to combat multidrug-resistant bacteria. Time-kill assays and checkerboard titration are valuable tools for determining antimicrobial activity and assessing drug interactions. Validation of antimicrobial susceptibility testing methods and reporting susceptibility data to clinicians are crucial components of infection control and epidemiological studies.

Integrating susceptibility testing into infection control programs can help improve patient outcomes and reduce the spread of antibiotic-resistant bacteria.

What are the key market drivers leading to the rise in the adoption of Antimicrobial Susceptibility Testing Industry?

- Antimicrobial resistance poses a significant challenge to the healthcare industry, driving market growth as the urgent need for new and effective treatments continues to increase.

- The market is experiencing significant growth due to the escalating issue of Antimicrobial Resistance (AMR). AMR arises when microorganisms, including bacteria, viruses, fungi, and parasites, develop resistance to antimicrobials such as antibiotics, antivirals, antifungals, and antiparasitics. These antimicrobials are indispensable for combating infectious diseases in various sectors, including human healthcare, veterinary medicine, and agriculture. However, the misuse and overuse of these medications have expedited resistance development, making conventional treatments less effective. As infections become increasingly difficult or impossible to treat, the demand for precise and timely antimicrobial susceptibility testing (AST) has intensified. AST plays a vital role in identifying the specific antimicrobial agents that can effectively combat resistant microorganisms.

- This information enables healthcare professionals to make informed decisions on the most suitable treatment options, ultimately improving patient outcomes and reducing the spread of AMR. The continuous evolution of microorganisms and the ongoing development of resistance necessitate the adoption of advanced AST technologies and methods to maintain the efficacy of antimicrobial treatments.

What are the market trends shaping the Antimicrobial Susceptibility Testing Industry?

- Point-of-care testing is experiencing significant growth in the market. This trend reflects the increasing demand for quick and convenient diagnostic solutions.

- The market is witnessing a significant shift towards Point-of-Care (POC) testing solutions. Traditional methods, which rely on centralized laboratory infrastructure, skilled personnel, and time-consuming culture-based processes, can significantly delay appropriate treatment. In contrast, POC antimicrobial susceptibility testing (AST) devices offer faster, decentralized, and patient-friendly testing directly at primary care or bedside settings. These devices are particularly advantageous in outpatient clinics, emergency departments, and resource-limited environments where quick decisions are crucial. POC AST solutions enable timely identification of pathogens and their antibiotic susceptibility, reducing inappropriate antibiotic use, supporting personalized therapy, and curbing the spread of antimicrobial resistance (AMR).

- The benefits of POC AST devices are increasingly recognized, leading to their growing adoption. Compared to traditional methods, POC AST devices offer several advantages. They reduce turnaround time, allowing for prompt treatment decisions. They are portable and easy to use, making them suitable for various settings. Additionally, they require minimal sample preparation and can test multiple samples simultaneously. These factors contribute to the increasing popularity of POC AST devices in the healthcare sector. In summary, the market is evolving, with a clear trend towards POC testing solutions. These devices offer numerous advantages, including faster results, portability, ease of use, and the ability to test multiple samples simultaneously.

- By addressing the limitations of traditional methods, POC AST devices are transforming infectious disease management and contributing to better patient outcomes.

What challenges does the Antimicrobial Susceptibility Testing Industry face during its growth?

- The growth of the industry is significantly impeded by regulatory and reimbursement challenges, which present formidable hurdles that must be addressed by industry professionals.

- The market faces substantial regulatory hurdles, with regulatory bodies like the FDA and EMA requiring rigorous clinical validation to ensure product accuracy, reliability, and safety. This process can significantly impede the market entry of innovative antimicrobial testing solutions, particularly those incorporating advanced technologies such as microfluidics, biosensors, and AI. The regulatory landscape's complexity is further compounded by the lack of harmonization across countries.

- According to a study, the market size was valued at USD 4.8 billion in 2020 and is projected to reach USD 8.2 billion by 2027, growing at a compound annual growth rate (CAGR) of 7.2% during the forecast period. Despite this growth, regulatory challenges persist, necessitating extensive investment in clinical validation and regulatory compliance.

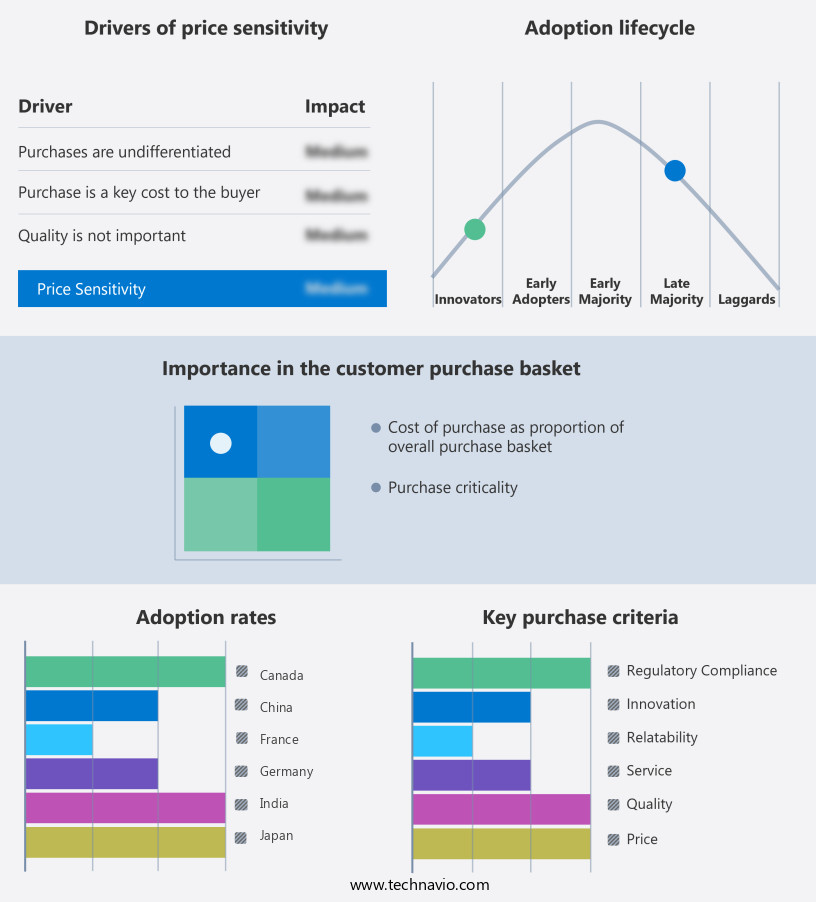

Exclusive Customer Landscape

The antimicrobial susceptibility testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the antimicrobial susceptibility testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Antimicrobial Susceptibility Testing Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, antimicrobial susceptibility testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accelerate Diagnostics Inc. - The company specializes in antimicrobial susceptibility testing, providing innovative solutions like the WAVE system and arc system, streamlining laboratory workflows and enhancing microbial identification accuracy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accelerate Diagnostics Inc.

- ALIFAX Srl

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- BioMerieux SA

- Bruker Corp.

- Creative Diagnostics

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- Hardy Diagnostics

- HiMedia Laboratories

- LABORATORIOS CONDA S.A

- Liofilchem Srl

- Mast Group Ltd.

- Merck KGaA

- Resistell AG

- Synbiosis

- Thermo Fisher Scientific Inc.

- Tulip Diagnostics Pvt. Ltd.

- Zhuhai DL Biotech Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Antimicrobial Susceptibility Testing Market

- In January 2024, Thermo Fisher Scientific, a leading life sciences solutions provider, announced the launch of the new version of its Vitek® MS system, an automated microbial identification and antimicrobial susceptibility testing (AST) solution. This system uses matrix-assisted laser desorption ionization-time of flight mass spectrometry (MALDI-TOF MS) for faster and more accurate identification and AST of bacteria and fungi (Thermo Fisher Scientific Press Release, 2024).

- In March 2024, Merck KGaA, a leading science and technology company, entered into a strategic collaboration with bioMérieux, a world leader in the field of in vitro diagnostics, to expand their antimicrobial resistance (AMR) testing offerings. The collaboration aimed to combine Merck's expertise in AMR research and development with bioMérieux's diagnostic solutions (Merck KGaA Press Release, 2024).

- In May 2024, Becton, Dickinson and Company (BD), a global medical technology company, completed the acquisition of 23andMe's diagnostic and research business. This acquisition included 23andMe's laboratory certified under the Clinical Laboratory Improvement Amendments (CLIA) and College of American Pathologists (CAP) accreditation, enhancing BD's capabilities in molecular diagnostics and antimicrobial susceptibility testing (BD Press Release, 2024).

- In February 2025, the U.S. Food and Drug Administration (FDA) granted marketing authorization for the VersaTREK Compact System, a portable AST device from Trek Diagnostic Systems. This device enables rapid AST for bacteria directly from positive blood cultures, reducing turnaround time and improving patient care (FDA Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Antimicrobial Susceptibility Testing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 1224.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

US, China, Germany, UK, India, Canada, France, Japan, South Korea, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, underpinned by the ongoing need for effective infection control and antimicrobial stewardship. This market encompasses various testing methods, including checkerboard titration and disk diffusion tests, which have long been the cornerstone of clinical microbiology laboratories. Pharmacokinetic/pharmacodynamic (PK/PD) approaches, such as time-kill assays and growth curves, have gained prominence due to their ability to provide a more comprehensive understanding of the interaction between antimicrobials and microorganisms. Synergistic and antagonistic effects of combination therapy are increasingly being explored, necessitating the development of advanced testing methods like molecular diagnostics and automated systems.

- Fungal and parasite susceptibility testing is a growing segment of the market, with the need for accurate identification and susceptibility profiles becoming increasingly crucial. Minimum inhibitory concentration (MIC) and minimum bactericidal concentration (MBC) tests, such as broth microdilution and disk diffusion, play a pivotal role in determining the susceptibility of microorganisms to antimicrobial agents. Quality control measures, including the use of reference standards and breakpoint tables, are essential to ensure the accuracy and reliability of antimicrobial susceptibility testing results. The market is also witnessing the emergence of rapid diagnostic tests and point-of-care testing, which offer faster turnaround times and improved convenience for healthcare professionals.

- Resistance mechanisms, such as mutation of antibiotic resistance genes and whole genome sequencing, continue to pose challenges to the market. The development of new testing methods and technologies, like molecular diagnostics and genotyping methods, is crucial to address these challenges and ensure the continued effectiveness of antimicrobial therapies. In conclusion, the market is a dynamic and evolving landscape, driven by the ongoing need for effective infection control and antimicrobial stewardship. The market encompasses a range of testing methods, from traditional approaches like disk diffusion and broth microdilution to advanced technologies like molecular diagnostics and automated systems.

- The market is also witnessing the emergence of new testing methods and technologies to address the challenges posed by resistance mechanisms and ensure the continued effectiveness of antimicrobial therapies.

What are the Key Data Covered in this Antimicrobial Susceptibility Testing Market Research and Growth Report?

-

What is the expected growth of the Antimicrobial Susceptibility Testing Market between 2025 and 2029?

-

USD 1.22 billion, at a CAGR of 5.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Antibacterial testing, Antifungal testing, Antiparasitic testing, and Antiviral testing), Application (Clinical diagnostics, Drug discovery and development, and Others), and Geography (North America, Europe, Asia, and Rest of World (ROW))

-

-

Which regions are analyzed in the report?

-

North America, Europe, Asia, and Rest of World (ROW)

-

-

What are the key growth drivers and market challenges?

-

Rising antimicrobial resistance, Regulatory and reimbursement hurdles

-

-

Who are the major players in the Antimicrobial Susceptibility Testing Market?

-

Key Companies Accelerate Diagnostics Inc., ALIFAX Srl, Becton Dickinson and Co., Bio Rad Laboratories Inc., BioMerieux SA, Bruker Corp., Creative Diagnostics, Danaher Corp., F. Hoffmann La Roche Ltd., Hardy Diagnostics, HiMedia Laboratories, LABORATORIOS CONDA S.A, Liofilchem Srl, Mast Group Ltd., Merck KGaA, Resistell AG, Synbiosis, Thermo Fisher Scientific Inc., Tulip Diagnostics Pvt. Ltd., and Zhuhai DL Biotech Co. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of technologies and services, facilitating clinical trials, resistance monitoring, and infection prevention in various healthcare settings. With the increasing prevalence of antimicrobial resistance, the market's significance continues to grow. According to recent estimates, the market size was valued at USD 5.5 billion in 2020, projected to reach USD 8.5 billion by 2026, representing a compound annual growth rate of 7.3% during the forecast period. Two key factors driving market expansion include the growing demand for automation software and reporting systems to enhance test performance and interpretative criteria. For instance, the limit of detection for some automated systems can be as low as 0.001 McF/mL, significantly improving the accuracy and precision of test results.

- In contrast, manual methods may have a limit of detection as high as 0.06 McF/mL, leading to potential misdiagnoses and ineffective treatment regimens. By streamlining the testing process and providing real-time, actionable insights, these advanced technologies contribute to more accurate epidemiological studies, therapeutic guidelines, and outbreak investigations.

We can help! Our analysts can customize this antimicrobial susceptibility testing market research report to meet your requirements.