Apparel Market Size 2025-2029

The apparel market size is valued to increase USD 707.4 billion, at a CAGR of 7.1% from 2024 to 2029. Sustainability and ethical practices will drive the apparel market.

Major Market Trends & Insights

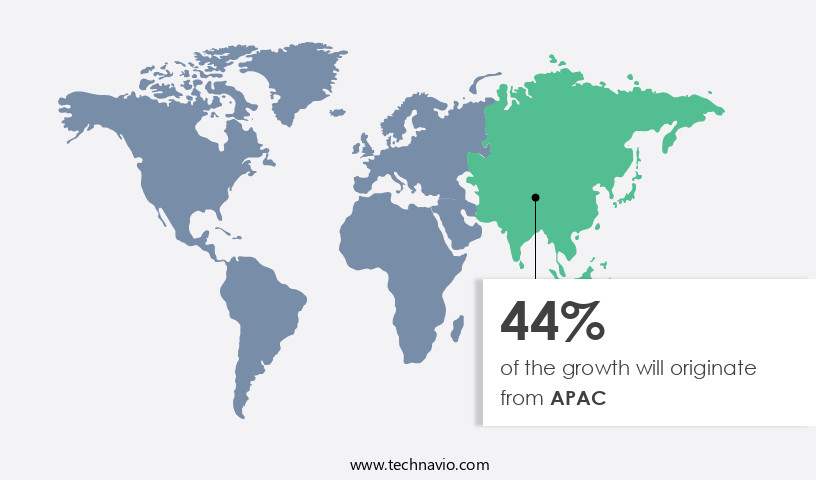

- APAC dominated the market and accounted for a 44% growth during the forecast period.

- By End-user - Women segment was valued at USD 686.90 billion in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 68.66 billion

- Market Future Opportunities: USD 707.40 billion

- CAGR : 7.1%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and ever-evolving industry, driven by advancements in core technologies and applications, as well as shifting consumer preferences. Technological innovations, such as augmented reality and virtual fitting rooms, are revolutionizing the shopping experience, offering personalized and interactive solutions for customers. Additionally, the growing adoption of sustainable and ethical practices is becoming a significant market trend, with an increasing number of brands prioritizing eco-friendly materials and ethical labor practices. The service types and product categories within the market are also expanding, with a focus on customization and personalization. Online penetration continues to grow, with local and unorganized players increasingly entering the digital marketplace.

- According to recent data, e-commerce sales in the fashion industry are projected to account for over 30% of total sales by 2025. Regulations and regional mentions also play a crucial role in shaping the market, with varying regulations and consumer preferences influencing market dynamics across different regions. Overall, the market presents numerous opportunities for growth and innovation, as well as challenges that require strategic planning and adaptation.

What will be the Size of the Apparel Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Apparel Market Segmented and what are the key trends of market segmentation?

The apparel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Women

- Men

- Children

- Distribution Channel

- Offline

- Online

- Type

- Mass

- Premium

- Luxury

- Wear Type

- Casual Wear

- Formal Wear

- Sportswear

- Sleepwear

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

The women segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth and transformation, with key trends shaping its evolution. Currently, the women's segment holds the largest market share, driven by changing fashion trends, increasing purchasing power, and evolving lifestyles. Fashion trends continuously evolve, with women often leading the way in adopting new styles and designs, resulting in a persistent demand for new clothing items, accessories, and footwear. Moreover, the apparel industry is focusing on various initiatives to reduce water consumption, implement ethical sourcing practices, and enhance customer relationship management. Quality control systems, virtual fitting technologies, and supply chain management are crucial aspects of the industry's ongoing improvements.

Product assortment planning, energy efficiency improvements, and wearable sensor integration are also gaining traction, with material traceability systems, apparel design software, and 3D garment design becoming essential tools. In the realm of sustainability, there is a growing emphasis on sustainable textiles, digital textile printing, circular economy models, and inventory management. Fabric dyeing, garment manufacturing, labor standards compliance, textile printing methods, product lifecycle management, automated cutting systems, e-commerce platforms, and pattern cutting techniques are all undergoing advancements to meet the evolving needs of consumers and businesses. Furthermore, the industry is exploring innovations such as smart clothing technology, sales analytics, computer-aided design, and textile recycling processes.

These advancements are expected to drive future growth, with industry experts anticipating a 15% increase in demand for adaptive clothing solutions and a 12% rise in the adoption of computer-aided manufacturing technologies. In conclusion, the market is a dynamic and ever-evolving industry, with continuous innovation and improvement shaping its future. The focus on sustainability, customer experience, and technological advancements is driving growth and transforming the way apparel is designed, produced, and sold.

The Women segment was valued at USD 686.90 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Apparel Market Demand is Rising in APAC Request Free Sample

The market in APAC held the largest market share in 2024, driven by economic growth and increasing disposable income in Asian countries like China, India, and Southeast Asian nations. Urbanization has transformed lifestyles and consumer preferences, providing a larger customer base and access to global fashion trends. With a young and growing population, APAC represents a significant consumer base for the apparel industry. Younger generations, who are more fashion-conscious and eager to adopt new trends, further fuel demand for apparel.

According to recent data, the middle class in Asia is projected to reach 1.7 billion by 2025, signifying immense potential for the market. Additionally, the region's e-commerce sector is booming, offering a convenient shopping experience and contributing to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the Apparel Market, automated cutting systems for apparel and computer aided design for fashion apparel enhance production efficiency, while computer aided manufacturing for fashion streamlines operations. Embracing implementation of circular economy models in fashion and advanced textile recycling processes and technologies supports sustainability efforts, complemented by advanced fabric dyeing techniques for sustainability. Integrating wearable sensor integration for health monitoring and virtual fitting technologies in apparel retail improves customer experience. Strong supply chain management strategies for apparel and logistics optimization strategies for apparel ensure timely delivery, while e-commerce platform optimization for apparel and customer relationship management for apparel brands boost engagement. Additionally, product lifecycle management in apparel industry, demand forecasting for apparel, sales analytics for apparel, and product assortment planning for apparel help brands stay competitive. Ethical practices like ethical sourcing and labor standards in garment production further build trust.

The market is a dynamic and innovative industry, characterized by the integration of advanced technologies and sustainable practices. Automated cutting systems are increasingly adopted to optimize fabric usage and reduce waste, aligning with the industry's shift towards more sustainable textile fiber production methods. The impact of 3D design on garment manufacturing is significant, enabling virtual prototyping and reducing the need for physical samples. Circular economy models are gaining traction in the fashion sector, with brands implementing closed-loop systems for textile recycling using advanced processes and technologies. Ethical sourcing and labor standards are non-negotiable, with product lifecycle management becoming a priority to minimize environmental impact.

Sustainable advanced fabric dyeing techniques and digital textile printing technologies are transforming the industry, offering eco-friendly alternatives to traditional methods. Computer-aided design (CAD) and manufacturing (CAM) solutions are revolutionizing the fashion apparel industry, enabling faster design iterations and more accurate production. Wearable sensors for health monitoring and virtual fitting technologies are enhancing the retail experience, while supply chain management strategies and customer relationship management systems are optimizing brand-consumer interactions. E-commerce platforms are dominating the apparel industry, accounting for a substantial share of sales. Logistics optimization and demand forecasting are essential for ensuring timely delivery and stock management. Sales analytics and product assortment planning are crucial for maximizing revenue and customer satisfaction.

Adoption rates of advanced technologies in the apparel industry vary significantly across regions and segments. For instance, more than 80% of new product developments in Europe focus on sustainability, while only 50% of Asian manufacturers have adopted computer-aided manufacturing systems. This disparity presents opportunities for collaboration and technology transfer between regions.

What are the key market drivers leading to the rise in the adoption of Apparel Industry?

- The market is driven by the prioritization of sustainability and ethical practices. This commitment to responsible business conduct is a mandatory expectation from consumers and industry professionals alike.

- The apparel industry is witnessing a significant shift towards sustainability, as consumers become increasingly conscious of the environmental and social impact of their clothing choices. Brands are responding to this demand by implementing various sustainable practices. For instance, the use of organic and recycled materials in clothing production has gained popularity. Patagonia, a leading brand, expanded its Worn Wear program in May 2024, encouraging customers to trade in used gear for store credit. This initiative promotes sustainability by extending product lifecycles and reducing waste.

- Patagonia also emphasizes repairs over replacements, offering repair guides and services to customers. These efforts reflect a broader trend in the industry, with numerous brands adopting ethical labor standards and reducing waste throughout their supply chains. This shift towards sustainability is a continuous process, with new innovations and practices emerging regularly.

What are the market trends shaping the Apparel Industry?

- The growing trend in markets is the increasing penetration of online platforms. This phenomenon is a significant development in the business world.

- The digital shift in consumer behavior has significantly impacted the apparel retail sector, with online sales gaining substantial traction. This trend is driven by the unmatched convenience offered to shoppers, enabling them to explore a vast array of apparel choices from anywhere, at any time. The absence of physical space constraints for online retailers empowers them to stock an extensive inventory, catering to diverse customer preferences in terms of styles, sizes, colors, and brands.

- This shift is not a passing fad but a continuous evolution, as more consumers embrace the convenience and accessibility of online shopping. The apparel industry's digital transformation is a game-changer, redefining retail dynamics and setting new standards for customer experience.

What challenges does the Apparel Industry face during its growth?

- The expansion of local and unorganized players poses a significant challenge to the industry's growth trajectory. These entities, despite being numerous, often lack the regulatory compliance and operational efficiencies of larger, organized players. Consequently, they can undercut prices and disrupt market equilibrium, making it essential for established industry players to adapt and innovate to remain competitive.

- The market experiences ongoing competition from local and unorganized players, posing challenges to major brands such as Zara and H&M. These competitors offer lower prices due to minimal overheads and less stringent regulatory compliance, attracting price-sensitive consumers. In numerous supermarkets, local labels occupy substantial shelf space in the women's clothing section, directly competing with established brands. This price advantage allows local competitors to capture a significant market share, particularly in price-sensitive regions. The apparel industry's landscape undergoes continuous transformation, with evolving consumer preferences and technological advancements shaping market dynamics. For example, the increasing popularity of sustainable and ethical fashion is driving innovation in textile production and supply chain management.

- Additionally, the adoption of digital technologies, such as augmented reality and virtual fitting rooms, enhances the shopping experience and fosters customer engagement. These trends underscore the importance of agility and adaptability for apparel companies in a rapidly evolving market.

Exclusive Technavio Analysis on Customer Landscape

The apparel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the apparel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Apparel Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, apparel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in designing and manufacturing athletic apparel and footwear for various fitness activities, leveraging innovative materials and technologies to enhance performance and comfort for consumers worldwide.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- ASOS Plc

- Balenciaga SA

- Champion LLC

- GU

- Guccio Gucci Spa

- H and M Hennes and Mauritz GBC AB

- Jack and Jones

- Levi Strauss and Co.

- Massimo Dutti

- Mountain Hardwear

- Nike Inc.

- prAna

- PVH Corp.

- Ralph Lauren Corp.

- Ross Stores Inc.

- The Gap Inc.

- The TJX Companies Inc.

- Under Armour Inc.

- UNIQLO Co. Ltd.

- VERO MODA

- VF Corp.

- Zara

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Apparel Market

- In January 2024, H&M, the Swedish multinational clothing retailer, announced the launch of its new sustainable denim collection, "Conscious Denim," made from 100% recycled or more sustainably sourced materials (H&M Press Release, 2024). This initiative underscores the growing consumer demand for eco-friendly apparel and the industry's response to address sustainability concerns.

- In March 2024, Inditex, the parent company of Zara, announced a strategic partnership with Google to implement RFID technology in its stores, enabling real-time inventory management and faster product delivery (Inditex Press Release, 2024). This collaboration marks a significant technological advancement in the retail sector, enhancing the shopping experience and improving operational efficiency.

- In April 2025, Adidas and Allbirds, two leading athletic apparel brands, announced a merger to create a global sports apparel powerhouse, combining Adidas' market leadership and Allbirds' sustainable focus (Adidas Press Release, 2025). The merger, valued at approximately USD2.5 billion, aims to capitalize on the growing demand for eco-friendly athletic wear and expand their market share.

- In May 2025, the European Union passed the Sustainable Textiles Regulation, which sets strict rules for the use of hazardous chemicals in textile production and requires companies to disclose their supply chain information (European Parliament Press Release, 2025). This regulatory initiative marks a significant step towards a more sustainable apparel industry, addressing environmental and social concerns and ensuring greater transparency for consumers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Apparel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 707.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Japan, Canada, India, UK, South Korea, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various trends and innovations continue to shape the industry's landscape. One significant area of focus is demand forecasting, enabling brands to anticipate consumer preferences and adjust production accordingly. Another crucial aspect is water consumption reduction, with companies implementing sustainable practices to minimize their environmental footprint. Ethical sourcing practices have gained prominence, with brands prioritizing transparency and compliance with labor standards. Customer relationship management and quality control systems ensure customer satisfaction and maintain brand reputation. Virtual fitting technologies offer personalized shopping experiences, while supply chain management optimizes logistics and inventory. Product assortment planning and energy efficiency improvements are essential strategies to reduce waste and enhance sustainability.

- Wearable sensor integration and material traceability systems provide valuable insights into product performance and origin. Apparel design software, 3D garment design, and computer-aided manufacturing streamline the design and production process. Sustainable textiles, digital textile printing, and circular economy models are key trends in textile production. Inventory management, fabric dyeing, and garment manufacturing are continually evolving with the integration of advanced technologies. Smart clothing technology and sales analytics offer new opportunities for data-driven decision-making. Logistics optimization, waste reduction strategies, and automated cutting systems contribute to increased efficiency and cost savings. E-commerce platforms and pattern cutting techniques cater to the growing demand for online shopping and customized fits.

- Textile recycling processes and product lifecycle management ensure a closed-loop system for textile production. In summary, the market is characterized by continuous innovation and adaptation to consumer demands and environmental concerns. Brands are leveraging technology to improve efficiency, reduce waste, and enhance sustainability, while maintaining a focus on customer satisfaction and ethical practices.

What are the Key Data Covered in this Apparel Market Research and Growth Report?

-

What is the expected growth of the Apparel Market between 2025 and 2029?

-

USD 707.4 billion, at a CAGR of 7.1%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Women, Men, and Children), Distribution Channel (Offline and Online), Type (Mass, Premium, and Luxury), Geography (APAC, North America, Europe, Middle East and Africa, and South America), and Wear Type (Casual Wear, Formal Wear, Sportswear, and Sleepwear)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Sustainability and ethical practices, Expanding presence of local and unorganized players

-

-

Who are the major players in the Apparel Market?

-

Key Companies Adidas AG, ASOS Plc, Balenciaga SA, Champion LLC, GU, Guccio Gucci Spa, H and M Hennes and Mauritz GBC AB, Jack and Jones, Levi Strauss and Co., Massimo Dutti, Mountain Hardwear, Nike Inc., prAna, PVH Corp., Ralph Lauren Corp., Ross Stores Inc., The Gap Inc., The TJX Companies Inc., Under Armour Inc., UNIQLO Co. Ltd., VERO MODA, VF Corp., and Zara

-

Market Research Insights

- The market continues to evolve, driven by consumer preferences for sustainability and supply chain transparency. According to market research, the global sustainable fashion market is projected to reach USD9.81 billion by 2025, growing at a CAGR of 10.2% from 2020. In contrast, traditional apparel production relies heavily on textile engineering, pattern making, and sewing techniques. Smart fabrics, a key innovation in the apparel industry, are gaining traction. These fabrics offer enhanced functionality, such as moisture-wicking and temperature regulation. For instance, a leading apparel brand reported that 25% of their sales came from smart fabric products in 2021, up from 15% in 2020.

- Quality assurance, customer loyalty programs, and online marketing strategies, including social media, are essential components of successful apparel brands. Retail analytics and sales forecasting help optimize inventory control and pricing strategies. Fashion technology, including digital fashion, garment technology, and wearable tech, is transforming the industry. Brands employ fashion design software, brand management, and distribution channels to stay competitive. Ethical manufacturing and textile innovation are becoming increasingly important, as consumers demand transparency and eco-friendly production methods. Overall, the market is characterized by continuous innovation, consumer-driven trends, and a focus on sustainability and transparency.

We can help! Our analysts can customize this apparel market research report to meet your requirements.