Artificial Hair Integration Market Size 2025-2029

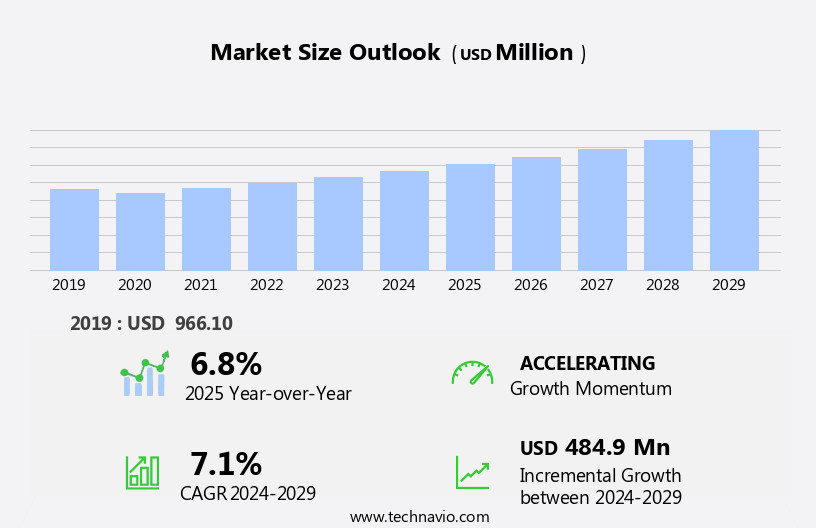

The artificial hair integration market size is forecast to increase by USD 484.9 million at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by various trends and challenges. New product launches and mergers and acquisitions are key growth factors, as companies seek to expand their offerings and increase market share. However, high costs and maintenance remain challenges for market participants. Consumers' increasing preference for natural-looking and customized hair solutions is driving demand for advanced artificial hair integration technologies. Additionally, the growing awareness of hair loss issues and the availability of financing options for hair restoration treatments are further fueling market growth. Despite these opportunities, market players must address the high costs associated with research and development, production, and marketing of artificial hair integration products to remain competitive. Overall, the market is expected to witness robust growth In the coming years, with continued innovation and investment in technology being essential for success.

What will be the Size of the Artificial Hair Integration Market During the Forecast Period?

- The market encompasses a range of solutions designed to address various hair concerns, including density issues, split ends, hair loss, and baldness. These offerings span from hairpieces and wigs to hair extensions and weaves. For those seeking cosmetic enhancements, multi-colored hair wigs and fashionable synthetic fibers provide aesthetic options. For individuals exploring non-surgical alternatives to hair loss, artificial hair integration solutions offer strong adhesion through base materials such as polymer blends, enhanced with nano-coating for UV, humidity, and chemical resistance. Hypoallergenic materials and eco-friendly synthetic fibers minimize scalp irritation and allergic reactions. Innovations in technology include 3D-printed bases and computer-designed hairlines for a more natural appearance.

- Artificial hair integration caters to both fashion and beauty enhancement, as well as therapeutic purposes.

How is this Artificial Hair Integration Industry segmented and which is the largest segment?

The artificial hair integration industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Female

- Male

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- APAC

By End-user Insights

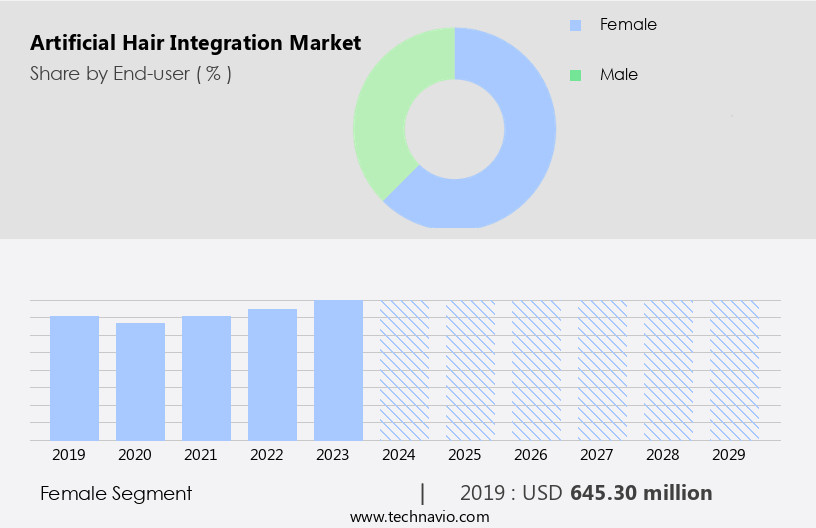

- The female segment is estimated to witness significant growth during the forecast period.

The global market for artificial hair integration solutions caters primarily to women experiencing hair thinning and loss due to various factors, such as aging, hormonal changes, stress, medical conditions, and genetics. These elements have fueled the demand for non-surgical alternatives to address hair loss concerns. Artificial hair integration products, encompassing wigs, extensions, and other solutions, provide a quick and effective response for women seeking to enhance their appearance and regain confidence. These offerings address issues related to hair density, split ends, and baldness, offering solutions that range from temporary adhesives and elasticized bands to more permanent options like keratin and 3D-printed bases.

Additionally, advancements in technology have led to the development of high-quality, hypoallergenic materials, UV and humidity resistance, and nano-coating for enhanced durability and natural-looking results. The market for artificial hair integration solutions continues to evolve, with offerings that cater to diverse consumer needs, including customized services, online consultations, and professional certification programs. Consumer education and online tutorials are also crucial components of the market, ensuring that customers make informed decisions when selecting products. The market for artificial hair integration solutions is a significant segment of the broader hair-related products industry, with applications in fashion, beauty enhancement, and therapeutic purposes.

Get a glance at the Artificial Hair Integration Industry report of share of various segments Request Free Sample

The Female segment was valued at USD 645.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

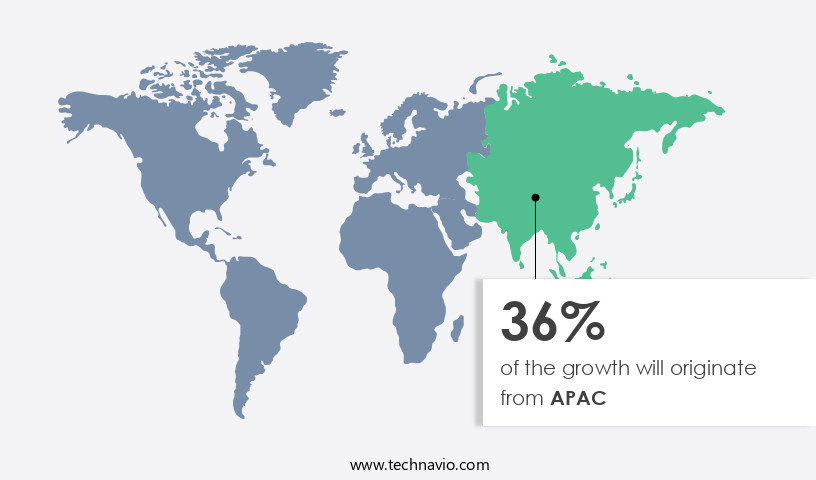

- APAC is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the Asia Pacific region is witnessing significant growth due to increasing consumer demand and strategic business expansions. This market caters to various hair-related concerns, including hair density, split ends, hair loss, and baldness, through hairpieces, wigs, hair extensions, and weaves. Both cosmetic and therapeutic purposes drive the demand for these solutions. While surgical treatments offer permanent solutions, non-surgical alternatives such as hair-related products and non-invasive solutions like artificial hair are gaining popularity due to their convenience and cost-effectiveness. Key factors influencing market growth include medical illnesses, hormonal imbalances, and social media trends. The market offers a range of options, from acrylic and synthetic fibers to human hair, catering to diverse consumer preferences.

High-quality products, lightweight fibers, and enhanced aesthetic appeal are essential features. Base materials, such as polymer blends, offer strong adhesion and resistance to UV, humidity, and chemicals. Hypoallergenic materials and eco-friendly synthetic fibers address scalp irritation and allergic reactions. Market players invest in research and development, focusing on advanced technologies like 3D-printed bases, computer-designed hairlines, and nano-coating for improved performance and durability. Consumer education, online consultations, and customized services are essential for enhancing the customer experience. Virtual try-ons, professional certification, safety testing, and online tutorials are essential tools for ensuring a natural look and maintaining consumer trust.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Artificial Hair Integration Industry?

New product launches is the key driver of the market.

- The market is experiencing growth due to the innovation of new products addressing consumer demands. For instance, BELLAMI, a renowned hair extensions brand, introduced The Ponytail in collaboration with celebrity hairstylist Andrew Fitzsimons on June 11, 2024. This product offers a voluminous ponytail look, catering to the desire for both style and convenience. The partnership with Fitzsimons boosts the product's credibility and attracts a broader audience, expanding its reach. Hair density, hair loss, baldness, and medical illnesses such as hormonal imbalances are significant factors driving the demand for artificial hair integration. Consumers seek non-surgical alternatives to surgical treatments, leading to an increased preference for hairpieces, wigs, hair extensions, and weaves.

- Innovative hair-related products, including multi-colored hair wigs, hair extension techniques like weft and clip-in hair extensions, and temporary adhesives like elasticized bands and keratin fibers, cater to various consumer needs. Base materials, such as polymer blends, nano-coating, UV resistance, humidity resistance, and chemical resistance, ensure the longevity and durability of these products. Manufacturers prioritize hypoallergenic materials and eco-friendly synthetic fibers to minimize scalp irritation, allergic reactions, and environmental impact. Consumers increasingly seek customized services, such as 3D-printed bases and computer-designed hairlines, for a natural look. Virtual try-ons, online consultations, consumer education, and professional certification programs enhance the shopping experience and ensure safety.

- Acrylic, polyester, and polyvinyl chloride (PVC) are popular base materials, while high-quality human and synthetic hair textures and lightweight fibers provide enhanced aesthetic appeal. The market for artificial hair integration is diverse, catering to aesthetic, fashion, beauty enhancement, and therapeutic purposes. It is a non-invasive solution for individuals undergoing chemotherapy and those experiencing hair loss due to medical conditions or hormonal changes. In conclusion, the market is a dynamic and evolving industry, driven by consumer preferences and technological advancements. Brands like BELLAMI and Cashmere Hair are leading the way with innovative products that cater to various consumer needs, ensuring a natural look and long-lasting durability.

What are the market trends shaping the Artificial Hair Integration Industry?

Merger and acquisition is the upcoming market trend.

- The market is experiencing a notable trend towards strategic collaborations and acquisitions, as companies aim to broaden their market reach and capitalize on synergies. For instance, in April 2023, Showpony Hair Extensions, an Australian market leader in hair extensions, announced a strategic partnership with the Kevin Murphy Group. This alliance underscores the increasing significance of strategic alliances withIn the industry. Driving this trend are several key factors. Companies are seeking to augment their product lines and enlarge their customer base. Through mergers and acquisitions, businesses can gain access to novel technologies, innovative products, and well-established distribution networks. Artificial hair integration solutions cater to various consumer needs, including addressing hair density issues, split ends, hair loss, and baldness.

- These concerns can stem from medical illnesses, hormonal imbalances, or simply the natural aging process. In response, the market offers a range of alternatives, including hairpieces, wigs, hair extensions, and weaves. Cosmetic and therapeutic purposes, as well as fashion and beauty enhancement, are primary motivators for consumers. To accommodate diverse preferences, the market provides multi-colored hair wigs, human hair, and synthetic hair options. Hair-related products are continually evolving, with advancements in base materials, such as polymer blends, elasticized bands, and temporary adhesives, as well as keratin fibers and nano-coating for enhanced aesthetic appeal and durability. Consumer education and accessibility are crucial market factors.

- Virtual try-ons, customized services, and online consultations enable potential buyers to make informed decisions. Professional certification, safety testing, and eco-friendly synthetic fibers further ensure product quality and customer satisfaction. The market caters to a wide range of hair textures and offers lightweight fibers, high-quality products, and non-invasive solutions. For individuals undergoing chemotherapy, artificial hair integration can provide a natural look and boost self-confidence. The market's growth is also influenced by the increasing affordability of non-surgical alternatives to hair loss treatments. The market is characterized by its dynamic nature, with continuous innovation and advancements in technology. Companies are investing in research and development to create 3D-printed bases, computer-designed hairlines, and specialized hair clinics offering personalized consultations and scalp assessments.

- In summary, the market is a thriving industry that caters to various consumer needs, offering a wide range of products and services. Strategic collaborations and acquisitions play a significant role in market growth, as companies seek to expand their offerings and reach new customers. The market's continuous innovation and commitment to quality and safety make it an essential solution for individuals dealing with hair-related concerns.

What challenges does the Artificial Hair Integration Industry face during its growth?

High costs and maintenance is a key challenge affecting the industry growth.

- The market encompasses a range of hair-related solutions, including wigs, hairpieces, hair extensions, and weaves. These products cater to various needs, from addressing hair loss due to medical illnesses or hormonal imbalances to enhancing aesthetic appeal for fashion and beauty purposes. High-cost barriers and maintenance requirements pose significant challenges to the market's growth. Premium products, such as those made from human hair, offer a natural look, durability, and comfort. However, their high prices limit their accessibility to a broader consumer base. Consumers seeking the best quality and most realistic appearance may find these products financially out of reach. Artificial hair products, including acrylic and synthetic fibers, offer more affordable alternatives.

- These materials are available in various textures, colors, and thicknesses, allowing for customized solutions. Base materials, such as polymer blends and elasticized bands, ensure strong adhesion and compatibility with different hair types. Market innovations include 3D-printed bases, computer-designed hairlines, and hypoallergenic materials. Nano-coating, UV resistance, humidity resistance, and chemical resistance add to the products' durability and versatility. Temporary adhesives and keratin fibers offer non-surgical alternatives to cosmetic and surgical treatments. Consumer education and online services, such as virtual try-ons, customized consultations, and professional certification, are essential in addressing the market's challenges. Safety testing and eco-friendly synthetic fibers further enhance the market's appeal.

- Despite these advancements, affordability and accessibility remain crucial factors in expanding the market's reach.

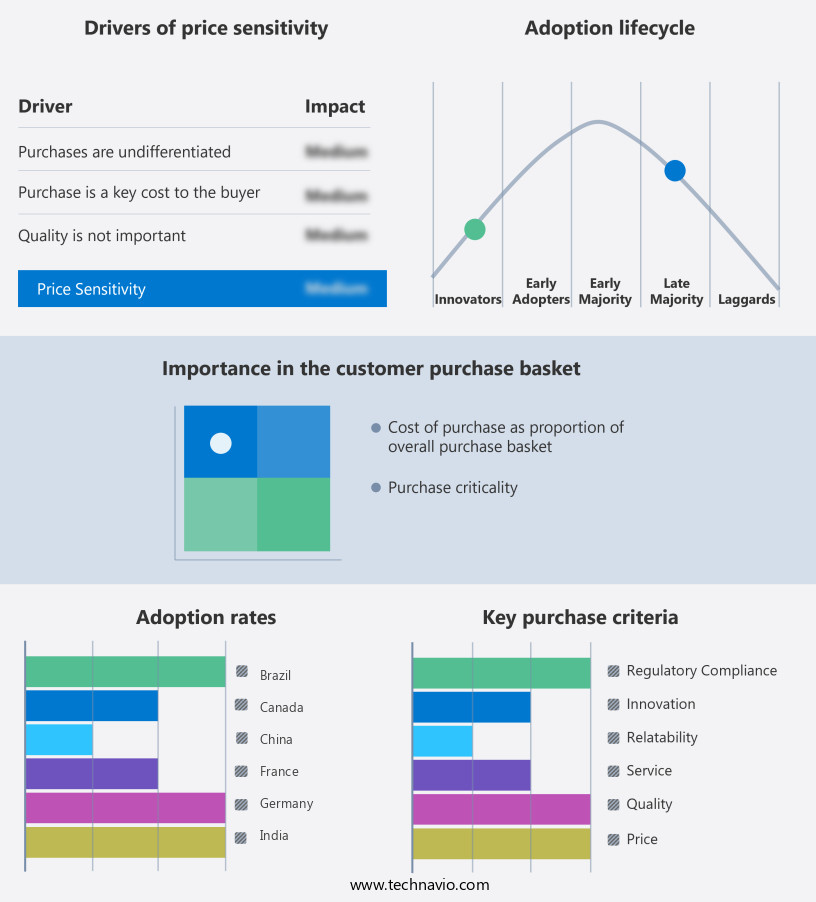

Exclusive Customer Landscape

The artificial hair integration market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the artificial hair integration market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, artificial hair integration market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

American Hairline - The company specializes in providing a diverse range of artificial hair integration solutions, featuring the Cafe, City, and Lux Collections. These offerings cater to various preferences and budgets, ensuring clients find the perfect match for their individual needs. Each collection showcases high-quality wigs and hairpieces, meticulously crafted to deliver natural-looking results.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- American Hairline

- Belle Tress Wigs

- Bono Hair

- CrownCouture

- Diva Divine Hair Extensions and Wigs

- Donna Bella OpCo LLC

- Eminere Hair Extensions

- Evergreen Products Group Ltd.

- Findingdream

- Hair and Compounds Inc

- Indique Hair LLC

- Jon Renau Collection

- Lordhair

- Morgans Wigs Ltd

- Nish Hair

- Rene of Paris

- The Wonderful Wig Company

- YUMMY HAIR EXTENSIONS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Artificial hair integration has emerged as a popular solution for individuals seeking to enhance their aesthetic appeal or address hair loss concerns. This market encompasses a range of offerings, including hairpieces, wigs, and extensions, which cater to various preferences and needs. Hair density is a significant factor influencing the demand for artificial hair integration solutions. Many individuals experience split ends, hair loss, and baldness due to various reasons, leading them to explore non-surgical alternatives. These alternatives offer a natural look, avoiding the need for cosmetic or surgical treatments. Artificial hair integration solutions are available in various forms, such as multi-colored wigs, hair extensions, and weaves.

These offerings cater to diverse fashion trends and personal preferences. Synthetic and human hair are the primary base materials used In these solutions, each with its unique advantages. Synthetic hair, often made from acrylic, polyester, or polyvinyl chloride (PVC), offers advantages like strong adhesion, UV resistance, humidity resistance, and chemical resistance. On the other hand, human hair extensions provide a more natural look and feel, making them a popular choice for those seeking a more subtle enhancement. Consumer education plays a crucial role In the growth of the market. With the rise of virtual try-ons, customized services, and online consultations, potential customers can explore various options and make informed decisions.

Professional certification, safety testing, and eco-friendly synthetic fibers are essential considerations for both manufacturers and consumers. The market for artificial hair integration solutions is continually evolving, with innovations such as 3D-printed bases, computer-designed hairlines, and hypoallergenic materials enhancing the offerings. These advancements cater to the growing demand for high-quality, lightweight, and non-invasive solutions. Furthermore, the market is not limited to aesthetic and fashion applications. Artificial hair integration solutions offer therapeutic benefits for individuals undergoing chemotherapy or experiencing hair loss due to medical illnesses or hormonal changes. In conclusion, the market presents a dynamic and diverse landscape, catering to various consumer needs and preferences.

With continuous innovation and consumer education, this market is poised for growth, offering both aesthetic and therapeutic benefits to individuals seeking to enhance their appearance and address hair loss concerns.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 484.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.8 |

|

Key countries |

US, China, India, Japan, South Korea, Canada, Germany, UK, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Artificial Hair Integration Market Research and Growth Report?

- CAGR of the Artificial Hair Integration industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the artificial hair integration market growth of industry companies

We can help! Our analysts can customize this artificial hair integration market research report to meet your requirements.