Keratin Market Size 2024-2028

The keratin market size is forecast to increase by USD 1.79 billion at a CAGR of 7.7% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for this protein in various industries. In the healthcare sector, keratin is used in the production of empty capsules and powders for its immunity-boosting properties. In the cosmetics industry, hydrolyzed keratin, amino acids, and peptides derived from keratin are popular ingredients in facial moisturizers and premium cosmetics. As an effective humectant and antistatic agent, keratin is also used in the manufacturing of textiles and plastics. The stringent regulations in the cosmetics industry are driving companies to innovate and launch new keratin-based products. The market is expected to continue growing as research and development in the field of keratin continues to uncover new applications for this versatile protein.

What will be the Size of the Market During the Forecast Period?

- The market is witnessing significant growth in the personal care and hair care industries due to the unique properties of keratin, a fibrous structural protein, in addressing issues related to dead skin cells, skin oil levels, blemishes, and hair damage. This protein is present in various forms, including bio-based and synthetic, and is utilized in a wide range of products such as shampoos, conditioners, and hair care treatments.

- The increasing consumer preference for natural and bio-based products is driving the demand for keratin-based personal care and hair care products. Keratin, being a natural protein, is a popular choice among consumers seeking effective solutions for skin and hair concerns. Moreover, the versatility of keratin in various forms, including alphakeratin, betakeratin, hydrolyzed keratin, keratin amino acids, and bio peptide keratin, caters to diverse market segments. Keratin treatments, such as hair straightening and hair damage repair, are popular applications of keratin in the hair care industry. These treatments provide long-lasting results, making them a preferred choice among consumers. Additionally, keratin-based products, including leave-in conditioners and hair masks, are gaining popularity due to their ability to improve hair health and manage frizz.

How is this market segmented and which is the largest segment?

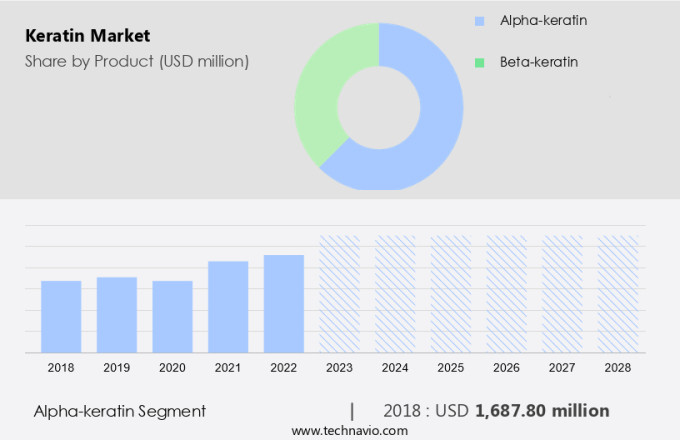

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Alpha-keratin

- Beta-keratin

- Geography

- APAC

- China

- Europe

- UK

- North America

- Canada

- Mexico

- US

- South America

- Middle East and Africa

- APAC

By Product Insights

- The alpha-keratin segment is estimated to witness significant growth during the forecast period.

Alpha-keratin, a protein derived from mammals, is the primary structural component in various tissues such as hair, wool, nails, and the epidermal layer of the skin. This protein is rich in essential amino acids, which form a secondary structure, making it a valuable resource for various industries. One of its most common sources is sheep wool, which contains approximately 95% pure keratin. The keratin protein derived from sheep wool is similar in structure and surface to human hair and skin, making it an effective natural repair and protection agent for the skin. It offers antioxidant benefits, enhancing its appeal in healthcare and premium cosmetics. Hydrolyzed keratin, a derivative of alpha-keratin, is widely used in facial moisturizers and other skincare products due to its ability to improve skin elasticity and hydration.

Additionally, it functions as an excellent humectant and antistatic agent, providing a smoother, more radiant complexion. In the healthcare sector, hydrolyzed keratin is used in capsules and powders as a dietary supplement, boosting immunity and overall health. The increasing demand for premium cosmetics and healthcare products, coupled with the growing awareness of the benefits of natural ingredients, is driving the market's expansion. In conclusion, alpha-keratin, derived from various sources, is a valuable resource due to its rich amino acid content and diverse applications. Its use in skincare, healthcare, and other industries is expected to continue growing, making it a promising investment opportunity.

Get a glance at the market report of share of various segments Request Free Sample

The alpha-keratin segment was valued at USD 1.69 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

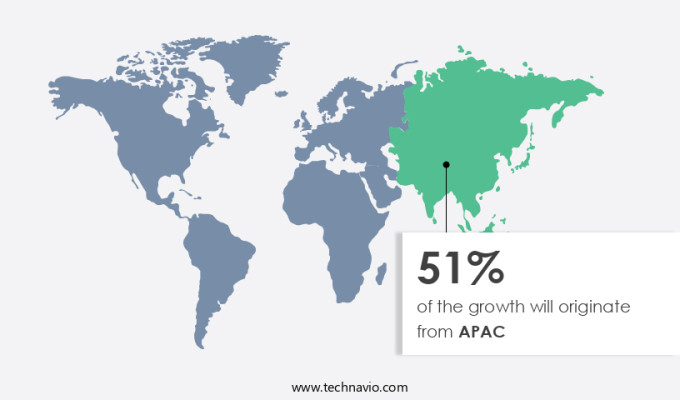

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in the Asia Pacific region is experiencing notable growth due to the increasing preference for natural and organic hair care and pharmaceutical products. This trend has led to an uptick in the demand for bio-keratin, which is derived from both animal-based and plant-based sources, as well as lab-grown keratin. In response, numerous companies in the cosmetics industry are focusing on the development and production of keratin-based products for professional salon use and home applications. Additionally, the medical sector is witnessing an upsurge in the utilization of keratin in wound treatment products, such as medical creams and antiseptics. As a result, the demand for keratin is projected to continue growing in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Keratin Market ?

Growing demand for keratin in medical industry is the key driver of the market.

- Keratin, a fibrous protein, is a significant structural component of various tissues, including hair, skin, and nails. Its role in the development of healthy skin tissues makes it a valuable asset in the medical industry, particularly for wound treatment. The protein's quick healing properties have led to the creation of various keratin-based materials for medical applications. For instance, keratin proteins derived from sheep wool have extensive uses in managing acute wounds and treating various skin disorders such as epidermolysis bullosa. In the realm of beauty and personal care, keratin treatments have gained immense popularity due to their effectiveness in hair care.

- These treatments, which include hair straightening procedures, help reduce hair damage caused by chemical treatments. The market for keratin-based products, including leave-in conditioners and hair masks, has seen significant growth due to the increasing demand for natural and synthetic keratin alternatives that cater to diverse consumer preferences. These products offer various benefits, such as improving hair texture, enhancing shine, and promoting hair growth. Overall, the market continues to expand as research and development efforts lead to innovative applications for this versatile protein.

What are the market trends shaping the Keratin Market?

Keratin-based new product launches is the upcoming trend in the market.

- The market is witnessing an expansion as an increasing number of personal care and skincare companies introduce keratin-based products. These offerings cater to the needs of consumers seeking solutions for dead skin cells, uneven skin oil levels, and blemishes. The popularity of bio-based products in the market is driving the demand for keratin-infused shampoos, conditioners, and other hair care products. New product launches by manufacturers in this sector aim to attract consumers and broaden their customer base.

- For instance, in the hair care segment, various companies have recently introduced keratin-based offerings, making it a notable trend in the industry. This trend is expected to fuel the growth of the market in the upcoming years.

What challenges does Keratin Market face during the growth?

Stringent regulations in cosmetics industry is a key challenge affecting the market growth.

- The market is a significant segment of the global personal care industry, encompassing cosmetics and DIY hair care products. Keratin, a fibrous protein, is sourced from various origins, including animal-based, plant-based, and lab-grown sources. The use of keratin in cosmetics and personal care products is driven by its benefits, such as frizz reduction and tissue regeneration. However, the market growth is influenced by regulatory bodies' stringent regulations, particularly in the US and certain European countries.

- For instance, the US Food and Drug Administration (FDA) regulates the cosmetics industry under the Federal Food, Drug, and Cosmetic Act (FDCA), mandating companies and individuals to ensure product safety. Other countries, such as Australia and some EU member states, also have similar regulations in place. These regulations pose challenges to market growth but ensure consumer safety.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akola Chemicals Ltd.

- BASF SE

- Church and Dwight Co. Inc.

- Clariant International Ltd

- Croda International Plc

- GREENTECH SA

- ICHIMARU PHARCOS Co. Ltd.

- Industrias Asociadas S.L.

- Keraplast Technologies LLC

- Keratin Express

- Lonza Group Ltd.

- Making Cosmetics Inc.

- Organic Beauty Solution Inc.

- Proteina

- Rejuvenol

- Roxlor LLC

- Symrise Group

- TORFO wellness Pvt. Ltd.

- Unilever PLC

- Wella International Operations Switzerland Sarl

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Keratin, a fibrous protein, is a popular ingredient in personal care products, particularly in hair care and skincare. It is known for its ability to improve the appearance and health of hair and skin. In hair care, keratin is used in shampoos, conditioners, and various other treatments to help smoothen and strengthen damaged hair. It works by penetrating the hair shaft to fill in gaps caused by dead skin cells and low skin oil levels, reducing the appearance of blemishes and improving overall hair texture. Keratin is also used in skincare products such as facial moisturizers and premium cosmetics. It functions as a humectant, helping to retain moisture in the skin, and as an antistatic agent, reducing unwanted frizz. Keratin comes in various forms including hydrolyzed keratin, amino acids, peptides, and bio-peptide keratin. These forms can be found in powders, liquids, tablets, capsules, and even plant-based and lab-grown options.

Further, beyond personal care, keratin is used in industrial and pharmaceutical applications for tissue regeneration and wound healing. It is also used in professional salons for hair straightening treatments and at home for DIY hair care. Both animal-based and plant-based keratin options are available, with the latter being a more ethical and sustainable choice. Keratin-based products offer numerous benefits for hair and skin, including frizz reduction, improved texture, and enhanced appearance. They can also contribute to overall health and immunity by providing essential amino acids and other nutrients. Whether used in hair care, skincare, or pharmaceutical applications, keratin continues to be a popular and effective ingredient in personal care and healthcare products.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2024-2028 |

USD 1.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.0 |

|

Key countries |

US, China, UK, Canada, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch