Arts And Crafts Tools Market Size 2024-2028

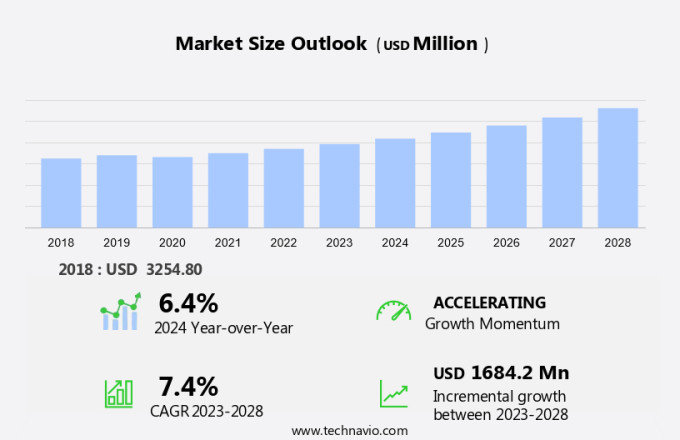

The arts and crafts tools market size is forecast to increase by USD 1.68 billion at a CAGR of 7.4% between 2023 and 2028. The market is experiencing significant growth due to the increasing popularity of DIY projects and paper crafts. The demand for decorative items and artwork is on the rise, leading to an increased need for high-quality cutting tools and art supplies. Art exhibitions continue to be a popular platform for showcasing creative work, further fueling the demand for arts and crafts tools. Social media platforms have also played a crucial role in the market's growth, allowing artists and crafters to share their work and inspire others to create. Advancements in crafting tools have made them more accessible and affordable, making it possible for individuals on a budget to engage in arts and crafts activities. Despite financial constraints, the high demand for arts and crafts tools among students and hobbyists ensures a steady growth trajectory for this market. Despite this, the market is expected to continue expanding as the importance of arts and crafts in education and personal development becomes increasingly recognized.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant growth, fueled by the increasing popularity of DIY culture and the demand for handcrafted goods. This sector caters to a wide range of consumers, from those seeking eco-friendly and sustainable materials for their crafting projects to individuals looking for therapeutic activities. The disposable income of consumers has played a crucial role in the growth of this market. With more people opting for unique, handmade gifts and decorative items, the demand for arts and crafts tools has risen. Furthermore, cultural diversity has contributed to the expansion of this market, as consumers seek to explore various artistic traditions and techniques.

Also, technology integration has also influenced the market. Digital art tools, such as graphic tablets and drawing software, have gained popularity among artists and hobbyists alike. These tools offer increased precision and flexibility, making them attractive alternatives to traditional drawing and painting tools. However, the market faces challenges related to accessibility issues. Some consumers may find it difficult to access specialized arts and crafts tools due to their high cost or limited availability. To address this, manufacturers have started producing mass-produced alternatives, making these tools more accessible to a broader audience. The market encompasses a diverse range of products, including drawing tools, painting tools, cutting tools, paper crafts, decorative items, and art supplies. Consumers are increasingly seeking out eco-friendly and sustainable materials, such as recycled paper, natural fibers, and biodegradable plastics (biodegradable plastics market), for their DIY projects. This trend is particularly strong among millennials and Gen Z consumers, who have disposable income and a strong desire for unique, handmade gifts. Crafting workshops and classes are also gaining popularity, providing access to knowledge and expertise that can help overcome knowledge barriers. Socail media (Social media analytics market) platforms and art exhibitions are also playing a role in promoting arts and crafts activities and increasing the demand for art supplies and tools.

Moreover, art exhibitions and DIY projects showcase the creativity and innovation of artists and crafters, driving demand for these tools. Social media platforms have become essential marketing channels for arts and crafts businesses. They allow businesses to reach a global audience and showcase their unique designs and customized packaging. Online purchasing and brick-and-mortar stores offer consumers convenience and flexibility when it comes to purchasing arts and crafts tools. Manufacturing plants produce a wide variety of arts and crafts tools, ensuring that there is a constant supply to meet the growing demand. The availability of online purchasing options and the convenience of brick-and-mortar stores make it easy for consumers to access these tools and engage in their favorite arts and crafts activities.

In conclusion, the market is experiencing steady growth due to the increasing popularity of DIY culture, demand for handcrafted goods, and technology integration. While accessibility issues remain a challenge, the market offers a diverse range of products and catering to various consumer (consumer stationery retailing market) needs.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Material

- Wood

- Metal

- Plastic

- Composite materials

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Distribution Channel Insights

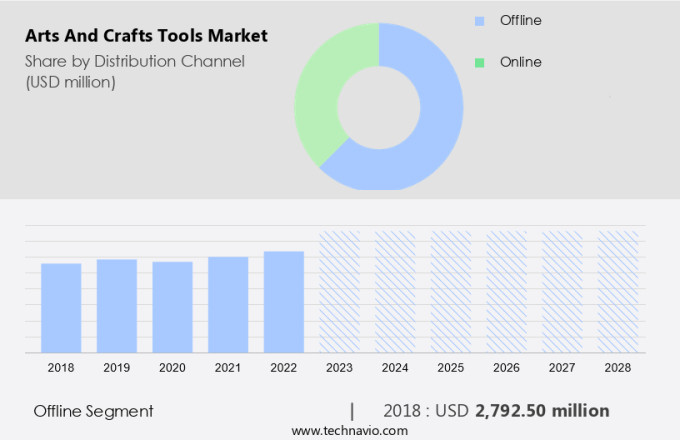

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses a wide range of products used for various art activities, including digital art and traditional mediums. Offline distribution plays a pivotal role in this market, with brick-and-mortar stores remaining a preferred choice for many customers. Household retailers like supermarkets and hypermarkets, as well as educational institutes and specialty stores, cater to a diverse clientele, from hobbyists to professional artists. The tactile nature of arts and crafts tools is a significant factor driving sales in physical stores. Customers value the ability to touch and feel the tools and materials before making a purchase. Technology integration, such as digital art and 3D printing (3D printing market), is expanding the scope of arts and crafts activities and attracting a new generation of artists and hobbyists. The offline segment thrives on the growing DIY (Do-It-Yourself) culture, particularly in areas with a rich crafting heritage. This trend continues to fuel demand for arts and crafts tools in traditional retail outlets.

Get a glance at the market share of various segments Request Free Sample

The offline segment accounted for USD 2.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

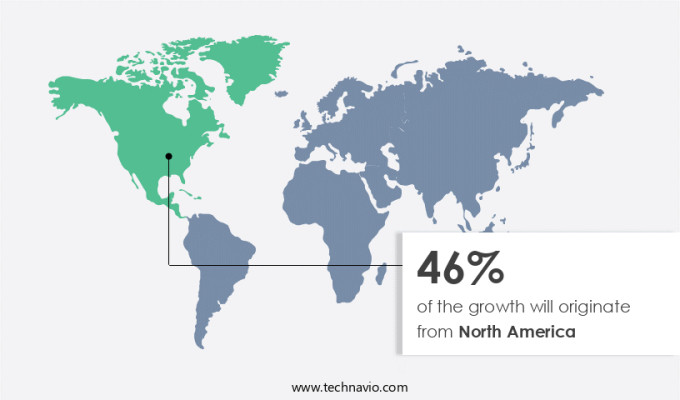

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is witnessing notable expansion due to the rising DIY culture and the growing popularity of handcrafted goods. Consumers' increasing preference for eco-friendly products and sustainable materials is also fueling market growth. Furthermore, the therapeutic benefits of crafting activities have led to an increase in demand, particularly among those with disposable income. In response to this trend, crafting workshops and classes have become increasingly popular, offering cultural diversity and unique experiences. A recent development in the market is the partnership between DoorDash and Michaels, enabling consumers to order crafting supplies, DIY essentials, and home décor online for same-day delivery. This collaboration marks DoorDash's entry into the arts and crafts retail category, catering to the convenience-seeking consumer.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

High demand for arts and crafts tools among school children is the key driver of the market. The market experiences a spike in demand during the back-to-school season in the United States. Parents and educators prioritize purchasing essential supplies for young students to facilitate hands-on learning and creative activities that are crucial for early education. Fundamental tools include crayons, colored pencils, markers, scissors, and smocks. Crayons, offered in various sizes and hues, are a must-have, with teachers often suggesting sets of 8, 16, or 24 standard colors.

Also, handmade gifts continue to be popular, fueling the demand for arts and crafts tools. However, technology integration poses accessibility issues and knowledge barriers for some consumers. Mass-produced alternatives are readily available, but the allure of traditional materials and recycled materials remains strong among artisans and hobbyists. Intellectual property concerns also arise in the market. As the industry evolves, it's essential to navigate these challenges while maintaining the accessibility and affordability of these tools for a diverse user base.

Market Trends

Advancements in crafting tools is the upcoming trend in the market. The market in the United States has experienced notable growth, fueled by the increasing number of individuals embracing crafting as a leisure activity. According to recent statistics, around 26% of Americans participate in arts and crafts projects. This substantial demand for arts and crafts tools presents an opportunity for innovation. One of the challenges faced by crafters is the limited space available for their projects. To address this issue, manufacturers have been developing more compact and multifunctional tools. One notable company leading the charge in this sector is xTool, a prominent player in the laser engraving and craft machine industry.

With an extensive patent portfolio of over 240 patents, xTool continues to advance crafting technology, offering innovative solutions to crafters. Paper crafts, decorative items, and DIY projects have gained popularity on social media platforms, further fueling the demand for arts and crafts tools. Art exhibitions and galleries also showcase the creativity and talent of artists, increasing the appeal of arts and crafts as a hobby. Art supplies, including cutting tools, are essential for various arts and crafts projects. As the market continues to evolve, it is crucial for businesses to stay updated on the latest trends and consumer preferences to cater to the growing demand for arts and crafts tools.

Market Challenge

Financial constraints involved in purchasing arts and crafts tools for students is a key challenge affecting the market growth. Arts and crafts tools are essential for both children's and adult's creative pursuits, including mixed media projects. However, the cost of purchasing these tools can pose a significant financial burden, particularly for art students. College students, especially those from economically disadvantaged backgrounds, often face higher expenses for specialized art supplies and materials. Unlike other majors, such as business or political science, art students require a diverse range of tools and materials for their coursework. These expenses can significantly vary depending on the institution and specific program requirements. For instance, while business students primarily invest in textbooks and digital resources, art students must buy items such as paints, brushes, canvases, sketchbooks, and various crafting tools.

Also, Brick-and-mortar retailers and online platforms offer a wide range of arts and crafts tools for both children's and adult's crafting needs. These platforms cater to various age groups and artistic abilities, providing a vast selection of drawing and painting tools. Senior citizens also benefit from these tools to engage in creative activities, fostering mental and emotional well-being. In conclusion, the financial demands for arts and crafts tools can pose a challenge for students, especially art students, due to the specialized nature of the required supplies. Brick-and-mortar retailers and online platforms offer a solution, providing a wide range of tools for various age groups and artistic abilities.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

3M Co. - The company offers arts and crafts such as cutting tools, page markers, glues and others.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ACCO Brands Corp.

- Colart International Ltd

- Copic

- Crayola

- DA Vinci Paint Co.

- Fabbrica Italiana Lapis ed Affini S.p.A.

- Faber Castell Aktiengesellschaft

- General Pencil Co. Inc

- Hindustan Pencils Pvt. Ltd.

- ITC Ltd.

- KOKUYO Co. Ltd.

- Maped

- Newell Brands Inc.

- Pentel of America Ltd.

- Sakura Color Products Corp.

- Schwanhausser Industrie Holding GmbH and Co. KG

- Staedtler Mars GmbH and Co. KG

- tomatotomatocreative

- XTool

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing a growth in demand due to the growing DIY culture and the increasing popularity of handcrafted goods. With eco-friendly products and sustainable materials becoming a priority for consumers, the market for arts and crafts tools is expanding. The therapeutic activity of crafting is also gaining traction, particularly among adults with disposable income. Crafting workshops and cultural diversity are driving the demand for arts and crafts tools. Handmade gifts have become a preferred choice for special occasions, and technology integration is making crafting more accessible. However, accessibility issues and knowledge barriers can limit the growth of the market.

Intellectual property rights and traditional materials are also important considerations. Recycled materials and mixed media are gaining popularity in the market. Children's crafts, adult crafts, and senior crafts all have distinct needs, and brick-and-mortar retailers and online platforms cater to these different segments. Art exhibitions and DIY projects are driving artwork demand, and social media platforms are providing a new avenue for artists to showcase their work. Art supplies, drawing tools, painting tools, cutting tools, paper crafts, decorative items, and art activities are some of the key product categories in the market. Digital art and household items are also gaining popularity.

E-commerce platforms, hypermarkets, supermarkets, and online stores are the major distribution channels. Art therapy and craft video content are emerging trends in the market. Mobile phone functionalities are also being integrated into crafting tools to make them more convenient and accessible. Creative activities and unique designs are key drivers of growth in the market. Customized packaging and online purchasing are also important considerations for consumers.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.4% |

|

Market growth 2024-2028 |

USD 1.68 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.4 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, China, Germany, Japan, UK, France, Italy, India, Canada, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

3M Co., ACCO Brands Corp., Colart International Ltd, Copic, Crayola, DA Vinci Paint Co., Fabbrica Italiana Lapis ed Affini S.p.A., Faber Castell Aktiengesellschaft, General Pencil Co. Inc, Hindustan Pencils Pvt. Ltd., ITC Ltd., KOKUYO Co. Ltd., Maped, Newell Brands Inc., Pentel of America Ltd., Sakura Color Products Corp., Schwanhausser Industrie Holding GmbH and Co. KG, Staedtler Mars GmbH and Co. KG, tomatotomatocreative, and XTool |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch