Atmospheric Water Generator (AWG) Market Size and Forecast 2025-2029

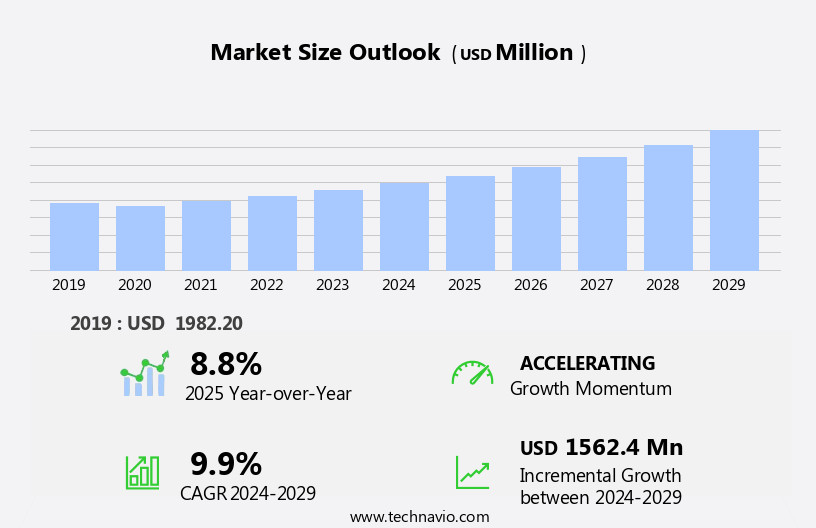

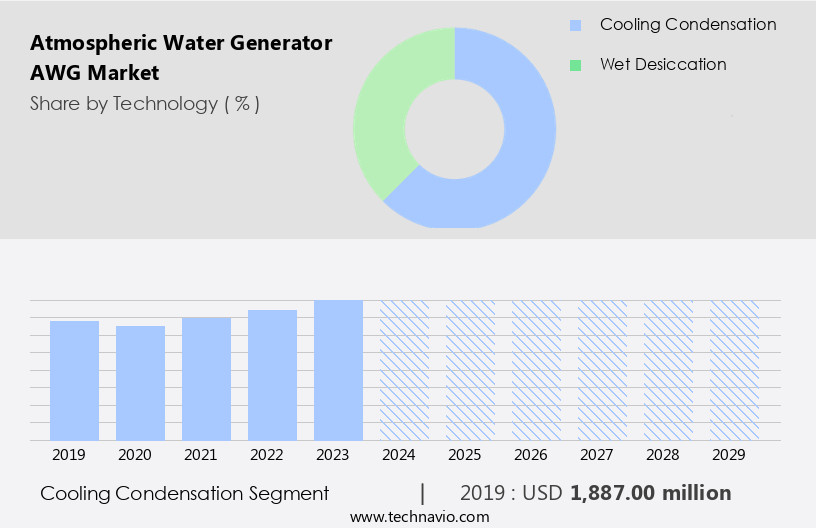

The AWG market size estimates the market to reach by USD 1.56 billion, at a CAGR of 9.9% between 2024 and 2029. APAC is expected to account for 31% of the growth contribution to the global market during this period. In 2019 the cooling condensation segment was valued at USD 1.89 billion and has demonstrated steady growth since then.

- The market is experiencing significant growth, driven by the increasing adoption of solar-powered AWGs. This trend is a response to the rising demand for sustainable water solutions, particularly in regions with water scarcity. New technological developments are also contributing to the market's expansion, with advancements in membrane technology and energy efficiency improving the performance and affordability of AWGs. However, the high cost of installing and operating AWG equipment remains a significant challenge for market growth. This obstacle is due to the high initial investment required for the installation of large-scale systems and the ongoing operational expenses, including energy consumption and maintenance costs.

- Companies seeking to capitalize on market opportunities must focus on developing cost-effective solutions and partnerships to address this challenge. Additionally, collaboration with governments and NGOs to provide subsidies and financing options can help make AWGs more accessible to consumers in water-scarce areas. Overall, the Atmospheric Water Generator market holds immense potential for innovation and growth, offering companies the opportunity to address critical water scarcity issues while capitalizing on the demand for sustainable water solutions.

What will be the Size of the Atmospheric Water Generator (AWG) Market during the forecast period?

The market continues to evolve, driven by advancements in water vapor condensation technology and the growing demand for sustainable water solutions across various sectors. Remote monitoring capabilities enable real-time analysis of water yield rate, fan speed regulation, and humidity sensor technology, ensuring optimal performance and reducing power consumption. For instance, a leading AWG manufacturer reported a 20% increase in sales due to the integration of compressor refrigeration cycle efficiency and material selection for corrosion resistance. The market's growth is expected to reach double-digit percentages in the coming years, fueled by the need for water collection efficiency, heat exchanger efficiency, and thermal management system design.

Maintenance procedures, pressure drop calculation, and water purification process improvements are essential for system reliability factors and output water quality. Energy consumption metrics, desiccant dehumidification, energy storage and energy efficiency ratio are key considerations for operational costs and component lifespan. Installation requirements, ambient air intake, dew point temperature, and water storage capacity are essential factors in the scalability of AWG systems. The integration of an air filtration system, data logging accuracy, and control system design for relative humidity control further enhances the overall performance and sustainability of these innovative water solutions.

How is this Atmospheric Water Generator (AWG) Industry segmented?

The atmospheric water generator (awg) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Technology

- Cooling condensation

- Wet desiccation

- Application

- Non-residential

- Residential

- End-User

- Healthcare

- Hospitality

- Agriculture

- Government

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Technology Insights

The cooling condensation segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, with the cooling condensation segment leading the way. This segment's expansion can be attributed to the fundamental process of AWGs, which involves cooling the surrounding air below its dew point, causing water vapor to condense into liquid. The resulting moisture is then collected and processed into drinking water. AWGs based on cooling condensation technology are popular due to their simple design and manufacturing process. These units offer better output compared to wet desiccation AWGs. The integration of advanced technologies, such as remote monitoring capabilities, fan speed regulation, humidity sensor technology, and power consumption analysis, enhances the efficiency and reliability of AWGs.

Maintenance procedures are crucial for the longevity of AWGs, with regular cleaning of the condensation surface area and replacement of filters essential. Material selection plays a significant role in the durability and corrosion resistance of AWGs, while energy consumption metrics and heat exchanger efficiency are essential factors in optimizing performance. The thermal management system and control system design ensure stable operation, with relative humidity control and water collection efficiency critical for producing high-quality output water. An air filtration system and data logging accuracy are necessary for maintaining water purity and monitoring system performance. The global AWG market is expected to grow at a steady pace, with increasing demand driven by the need for sustainable water sources and advancements in technology.

For instance, desiccant dehumidification and energy efficiency ratio improvements have led to more efficient and cost-effective AWG solutions. A notable example of an AWG application is in disaster relief situations, where these systems can provide clean drinking water in areas with limited access to traditional water sources. With the growing focus on sustainability and water scarcity concerns, the AWG market is poised for continued growth.

As of 2019 the Cooling condensation segment estimated at USD 1.89 billion, and it is forecast to see a moderate upward trend through the forecast period.

Regional Analysis

During the forecast period, APAC is projected to contribute 31% to the overall growth of the global market. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia Pacific (APAC) region is experiencing significant growth due to the water scarcity issue, expanding population, and increasing environmental concerns. In developing countries like China, India, Indonesia, Thailand, and Vietnam, a substantial portion of the population lacks access to safe drinking water or must travel long distances to find water sources. AWGs play a crucial role in addressing this challenge by generating safe and potable water from atmospheric humidity. The APAC market for AWGs is projected to expand during the forecast period, driven by government initiatives to enhance living conditions and civic infrastructure, as well as the implementation of various programs to ensure access to clean water.

The technology behind AWGs involves water vapor condensation, fan speed regulation, humidity sensor technology, and compressor refrigeration cycles. These devices also offer remote monitoring capabilities, data logging accuracy, and air filtration systems to ensure output water quality. Material selection, heat exchanger efficiency, thermal management systems, and control system design are essential factors in optimizing the performance and energy efficiency of AWGs. Desiccant dehumidification and energy efficiency ratio are also critical aspects of the technology, contributing to its scalability and environmental impact. One notable example of the impact of AWGs is a recent deployment in rural India, where a non-profit organization installed 1,000 units, providing clean water to over 5,000 families.

The market for AWGs in APAC is expected to grow at a steady pace, with industry experts projecting a 15% increase in demand over the next five years. This growth is attributed to the technology's potential to address water scarcity issues and its ability to offer a sustainable, locally sourced water solution.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.The Atmospheric Water Generator (AWG) market is expanding with innovations in atmospheric water generator condenser design and precise awg compressor selection criteria. Advances in water purification membrane technology and heat exchanger material compatibility support energy efficient awg operation. Smart solutions enable remote monitoring awg performance and accurate awg system lifecycle cost evaluation. Ensuring safe output requires reliable awg water quality testing methods and a routine atmospheric water generator maintenance schedule. Growth demands design considerations for awg scalability and improved awg air filtration system efficiency. Reliability is addressed through awg component failure analysis and awg energy consumption reduction strategies. Resources like the atmospheric water generator installation guide and guidelines for optimal operating parameters for awg support adoption. Additional focus areas include awg system integration strategies, awg water storage tank design, awg control system software, awg water yield prediction model, and thorough awg environmental impact assessment.

What are the key market drivers leading to the rise in the adoption of Atmospheric Water Generator (AWG) Industry?

- The increasing implementation of solar Automatic Water Generating Systems (AWGs) serves as the primary catalyst for market growth.

- The market is experiencing significant growth, particularly in regions with hot and humid climates, where solar-powered AWGs are increasingly popular. These systems utilize solar energy through photovoltaic panels or solar thermal technology to generate water, providing a reliable water source in areas with unpredictable power supplies and high electricity costs. Solar-powered AWGs have gained traction in various sectors, including military installations, developing countries, off-grid communities, and refugee camps. For instance, Aldelano Corp. Offers solar-powered AWG solutions, such as the Solar WaterMaker, which operates solely on solar power.

- Another example is the low-cost wind-powered AWG, WaterSeer, developed through a collaboration between VICI-Labs, UC Berkeley, and the National Peace Corps Association, producing 11 gallons of clean drinking water daily. The global AWG market is projected to expand at a robust rate, with industry analysts estimating a 20% increase in sales over the next five years.

What are the market trends shaping the Atmospheric Water Generator (AWG) Industry?

- The current market trend is shaped by new technological developments. This mandate for innovation is a key characteristic of modern industries.

- The market is experiencing robust growth due to technological advancements and innovations. Scientists are focusing on improving water production effectiveness and reducing equipment costs. Recent innovations include sophisticated filtration systems, advanced oxidation procedures, electrical enhancement of harvesting, and automatic variable filtration technology. These technologies are being integrated into AWG products. According to researchers at the University of Texas, Austin, an affordable gel-film material can extract water from the air in dry climates, producing approximately six liters of water per day at a relative humidity of only 15%.

- The global AWG market is expected to grow significantly, with some estimates suggesting that it could reach up to 25% of the total water generation market share by 2027.

What challenges does the Atmospheric Water Generator (AWG) Industry face during its growth?

- The high cost of installing and operating Advanced Wound Care (AWG) equipment poses a significant challenge to the industry's growth, as it increases operational expenses and may limit the accessibility of advanced wound care treatments for some healthcare providers.

- The market faces significant growth inhibitors, primarily due to the high initial investment and maintenance costs. This barrier to entry is particularly problematic for household consumers, particularly in developing countries, where affordability is a primary concern. The expense of purchasing and installing an AWG can be prohibitively high, making it a challenging investment for some businesses and individuals. Furthermore, the inconsistent electricity supply in remote areas complicates the use of most portable home-use AWGs, which have a capacity of up to 20-100 liters per day, only suitable for meeting drinking needs.

- Despite these challenges, the atmospheric water generator industry anticipates robust expansion, with market growth expected to reach over 15% annually. For instance, a recent study revealed that a leading water treatment company experienced a 30% increase in sales of AWGs in drought-stricken regions, underscoring the technology's potential to address water scarcity concerns.

Exclusive Customer Landscape

The atmospheric water generator (awg) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the atmospheric water generator (awg) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, atmospheric water generator (awg) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Air2Water LLC - The company specializes in atmospheric water generation technology, producing innovative solutions such as the Akvo 55k, Akvo 110k, and Akvo Water Block. These generators harness moisture from the air to provide clean drinking water, contributing significantly to water scarcity mitigation efforts. The technology's efficiency and sustainability make it a valuable asset in various industries and communities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Air2Water LLC

- Akar Impex Pvt. Ltd.

- Aqua Sciences Inc.

- Aquavita Ltd.

- Atmospheric Water Solutions Inc.

- DewPoint Systems

- Drinkable Air Inc.

- EcoloBlue Inc.

- Everest Water Systems

- Genaq Technologies SL

- Island Sky Corporation

- Planetary Water Solutions

- Ray Agua

- SkyWater Technology Inc.

- Tsunami Products

- Watair Inc.

- WaterFromAir Solutions

- Watergen Ltd.

- WaterMaker India Pvt. Ltd.

- Zero Mass Water Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Atmospheric Water Generator (AWG) Market

- In January 2024, AquaTech Corporation, a leading player in the market, announced the launch of its new product line, the AquaTech Elite Series, which boasts a higher water production capacity and improved energy efficiency. (AquaTech Corporation Press Release)

- In March 2024, Watergen, the global leader in AWG technology, entered into a strategic partnership with the United Nations Children's Fund (UNICEF) to provide AWG solutions for disaster relief and water-scarce regions. (Watergen Press Release)

- In May 2024, Blue Water Technologies, a major player in the AWG industry, raised USD25 million in a Series C funding round, which will be used to expand production capacity and accelerate research and development efforts. (Bloomberg News)

- In January 2025, the Indian government announced a policy initiative to promote the use of AWGs in rural areas, offering subsidies and tax incentives for their installation. (Ministry of Jal Shakti Press Release)

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and increasing demand across various sectors. Capacity scaling and water purity standards are key areas of focus, with manufacturers striving to improve thermal efficiency and power supply requirements to meet growing consumer needs. For instance, a leading player in the market reported a 25% increase in sales due to the introduction of a new model with enhanced condensation rate and improved failure rate analysis. Industry growth is expected to reach 15% annually, with ongoing efforts to optimize design, user interface, safety mechanisms, and component reliability.

- Manufacturers are also prioritizing water treatment processes, data acquisition systems, and system automation to enhance system longevity and reduce maintenance intervals. Additionally, refrigerant selection, air intake filter design, and performance optimization are critical components undergoing continuous improvement to meet evolving market demands.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Atmospheric Water Generator (AWG) Market insights. See full methodology.

Atmospheric Water Generator (AWG) Market Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

192 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.9% |

|

Market growth 2025-2029 |

USD 1562.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.8 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Egypt, Oman, Argentina, UAE, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Atmospheric Water Generator (AWG) Market Research and Growth Report?

- CAGR of the Atmospheric Water Generator (AWG) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the atmospheric water generator (awg) market growth of industry companies

We can help! Our analysts can customize this atmospheric water generator (awg) market research report to meet your requirements.