Auditing Services Market Size 2024-2028

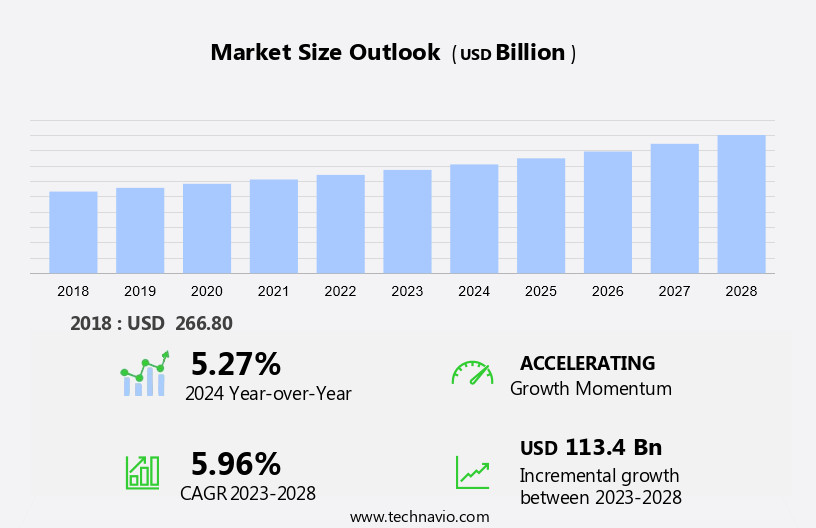

The auditing services market size is forecast to increase by USD 113.4 billion at a CAGR of 5.96% between 2023 and 2028.

- Market is experiencing substantial growth, driven by key trends shaping the industry. A major factor fueling this expansion is the rising adoption of audit management services, as organizations look to enhance efficiency and streamline their auditing processes with the help of audit software. Additionally, the growing need for regulatory compliance is prompting more companies to outsource their auditing functions.

- However, the high costs and ongoing maintenance associated with auditing services present challenges for some businesses, potentially hindering widespread adoption of essentials tools like expense management software. Despite these obstacles, the market is poised for continued growth as companies prioritize compliance and seek more efficient auditing solutions.

What will be the Auditing Services Market Size During the Forecast Period?

- The market, encompassing both auditing firms and accounting firms, continues to evolve in response to business complexities and regulatory requirements. Companies seek assurance In the reliability and credibility of their systems and processes, driving demand for comprehensive audit services. Long-term value is a key consideration, with operating metrics such as volumes and capacity increasingly important in evaluating audit firms.

- Integrated audits, including strategic audits and internal controls assessments, offer valuable insights for businesses and investors. Audit regulators play a crucial role in maintaining industry standards, while audit procedures extend beyond financial statements to include non-audit service lines and subsidiaries. Global accounting firms have expanded their offerings to meet diverse client needs related to accounting software, ensuring a robust and dynamic market landscape.

How is this Auditing Services Industry segmented and which is the largest segment?

The auditing services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Service

- Assurance

- Tax

- Advisory

- Type

- External

- Internal

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Service Insights

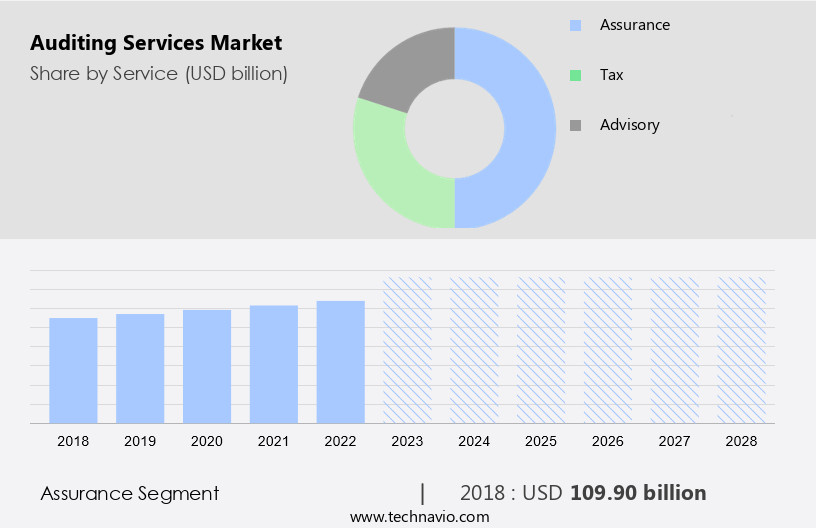

- The assurance segment is estimated to witness significant growth during the forecast period.

Assurance services refer to independent professional evaluations conducted by certified public accountants, aimed at enhancing the reliability and context of information for decision-makers. The International Professional Practices Framework (IPPF) of the Institute of Internal Auditors (IIA) defines assurance services as an objective examination of evidence to provide an independent assessment of an organization's risk management, governance, and control processes. These services encompass various engagements such as performance, financial, system security, compliance, and due diligence. In today's digital age, assurance services are increasingly crucial with the adoption of cloud-based infrastructure, data analytics, big data, machine learning, mobile computing, business intelligence, and strict regulations. Assurance services help organizations ensure revenue generation and maintaIn their core business by providing unbiased opinions and reducing the risk of incorrect information.

Get a glance at the Auditing Services Industry report of share of various segments Request Free Sample

The Assurance segment was valued at USD 109.90 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

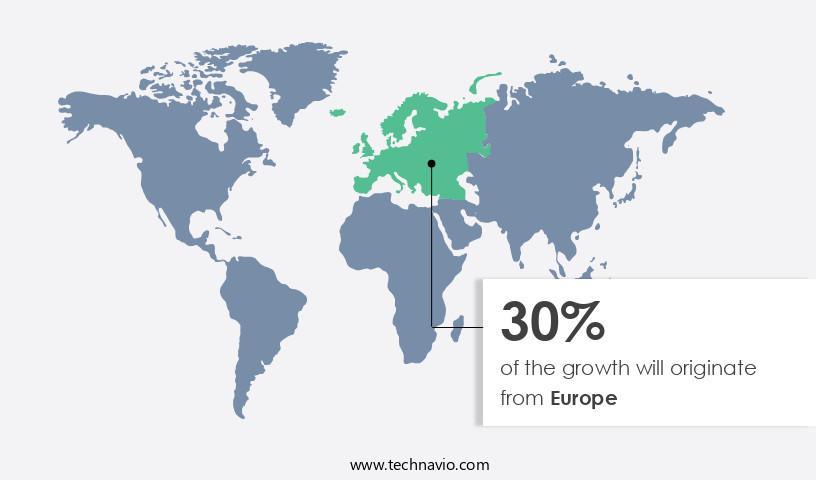

- Europe is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is experiencing steady growth due to the increasing importance of financial structure optimization and regulatory compliance. The US and Canada are the primary contributors to the market's revenue. In the US, organizations face challenges in managing emerging risks during financial structuring and aligning their strategies with their financial structures. Effective auditing procedures are in high demand to address these issues. The market caters to various end-user industries, including IT telecommunications, accounting practices, financial institutions, and banks. Government regulations mandate regular disclosures, further increasing the demand for auditing services. The market is served by numerous auditing service firms that offer expertise in various areas, ensuring adherence to accounting practices and financial reporting standards.

Market Dynamics

Our auditing services market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Auditing Services Industry?

Increasing adoption of audit management services is the key driver of the market.

- Auditing services play a crucial role in ensuring the reliability and credibility of organizations' financial records through independent reporting processes. Auditing firms, which can be accounting firms or specialized audit firms, execute systems and processes that provide long-term value to businesses by evaluating their financial statements, cash management procedures, accounting policies and controls, trial balance accounts, creditor relationships, and new business initiatives. These firms conduct both internal and external audits, with internal audits focusing on a company's operational efficiency and external audits performed by third-party auditors to ensure compliance with strict regulations and disclosure requirements. In today's digital age, auditing services have evolved to incorporate technology tools such as cloud-based infrastructure, data analytics, big data, machine learning, mobile computing, business intelligence, and automation.

- These advancements enable auditing firms to provide actionable insights and improve companies' performance by analyzing operational metrics, production capacity, production volumes, operating expenses, and service delivery models. The IT telecommunication industry and the BFSI industry are significant end-users of auditing services due to their complex systems and the need for strict regulatory compliance. Auditing firms offer integrated audits, strategic audits, and regulatory services to help these organizations navigate the complexities of their industries and maintain compliance with various regulations. The future of auditing services lies In the integration of artificial intelligence (AI) and automation, which will enable auditors to analyze vast amounts of data more efficiently and effectively, providing valuable insights to help companies optimize their operations and improve their financial performance.

- However, a lack of awareness and understanding of these advanced technologies among some organizations may hinder their adoption. In conclusion, auditing services are essential for organizations to ensure the accuracy and reliability of their financial statements and maintain compliance with regulatory requirements. With the increasing adoption of technology tools and the integration of AI and automation, auditing services will continue to evolve and provide valuable insights to help businesses optimize their operations and improve their financial performance.

What are the market trends shaping the Auditing Services Industry?

Need of organizations to comply with auditing regulations is the upcoming market trend.

- The market is experiencing significant growth due to the increasing importance of regulatory compliance for organizations. Auditing firms and accounting firms play a crucial role in ensuring organizations' financial records are accurately reported through an independent process. This objective evaluation provides organizations with actionable insights into their financial performance indicators, operating metrics, and capacity. Auditing services encompass various types, including financial, operational, and investigation audits, as well as integrated and strategic audits. In today's digital age, auditing services have evolved to incorporate advanced technologies such as cloud-based infrastructure, data analytics, big data, machine learning, mobile computing, business intelligence, and artificial intelligence (AI).

- These technologies enable auditors to analyze vast amounts of data, identify trends, and provide valuable insights that can improve companies' performance and credibility. Strict regulations in various industries, such as the IT telecommunications and BFSI sectors, necessitate the involvement of external auditors. These regulations require organizations to adhere to specific accounting practices and financial statement reporting standards. Mergers and acquisitions, as well as global expansion, further increase the need for auditing services. Internal audits are also essential for organizations to maintain effective internal controls, manage cash management procedures, accounting policies, and trial balance accounts. Auditing service firms provide advisory consulting, regulatory services, and investigation services to help organizations navigate complex regulatory environments and mitigate financial risks.

- In conclusion, the market is driven by the need for organizations to comply with regulatory requirements, manage financial risks, and maintain credibility. The integration of advanced technologies and the evolution of auditing practices ensure that auditing services continue to provide value to organizations In the long term.

What challenges does the Auditing Services Industry face during its growth?

High cost and maintenance of auditing services is a key challenge affecting the industry growth.

- Auditing services play a crucial role in ensuring the reliability and credibility of organizations' financial records through an independent reporting process. Auditing firms, including accounting firms that offer auditing services, utilize systems and processes to evaluate an organization's financial statements, cash management procedures, accounting policies and controls, trial balance accounts, creditor relationships, and new business initiatives. These services provide actionable insights and help companies improve their performance indicators, such as production capacity, production volumes, operating expenses, and revenue generation. Strict regulations in industries like BFSI and IT telecommunications necessitate regular auditing, leading to significant corporate spending on auditing services.

- The auditing process includes both internal and external audits, with external auditors providing objective evaluation and disclosure to stakeholders. With the increasing use of cloud-based infrastructure, data analytics, big data, machine learning, mobile computing, business intelligence, and automation in auditing, the market is evolving. Auditing firms offer various types of audits, including integrated audits, strategic audits, and investigation audits, to cater to the diverse needs of organizations. The future of auditing services lies In the adoption of artificial intelligence (AI) and advanced technology tools to streamline workflows and enhance efficiency. Despite the benefits, the high costs associated with auditing services may limit their frequency for some organizations, particularly smaller ones.

- However, the long-term value of accurate financial reporting and regulatory compliance justifies the investment. The market is subject to various regulations and is influenced by factors such as mergers and acquisitions, service delivery models, and economic conditions. Audit regulators play a crucial role in ensuring the quality and integrity of auditing services. Organizations in various end-user industries, including financial institutions, banks, and insurance companies, rely on auditing services to maintaIn their financial health and meet their reporting obligations.

Exclusive Customer Landscape

The auditing services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the auditing services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, auditing services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Baker Tilly International Ltd. - The company provides specialized auditing services, including internal control reviews, ensuring financial integrity and regulatory compliance for businesses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Tilly International Ltd.

- BDO International Ltd.

- CBIZ Inc.

- CliftonLarsonAllen LLP

- CohnReznick LLP

- Crowe LLP

- Deloitte Touche Tohmatsu Ltd.

- Eide Bailly LLP

- Ernst and Young Global Ltd.

- Evelyn Partners Group Ltd.

- Grant Thornton International Ltd.

- JPMorgan Chase and Co.

- KPMG International Ltd.

- Mazars Group

- Moore Global Network Ltd.

- Nexia International Ltd.

- Plante and Moran PLLC

- PricewaterhouseCoopers LLP

- Robert Half International Inc.

- RSM International Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Auditing services play a crucial role in ensuring the reliability and credibility of an organization's financial records. The independent reporting process provided by auditors is an essential component of maintaining transparency and accountability in business operations. In this article, we will explore the market dynamics of auditing services and their significance in various industries. Auditing services encompass a range of offerings, including financial, operational, investigation, and advisory consulting. These services help organizations evaluate their financial statements, internal controls, accounting policies and procedures, and cash management practices. By providing actionable insights, auditors contribute to the long-term value of businesses.

The need for auditing services is driven by several factors. Strict regulations require organizations to disclose accurate financial information to stakeholders, investors, and regulatory bodies. The IT telecommunication industry and the BFSI industry, in particular, face stringent regulations due to the sensitive nature of their operations. The digital transformation of businesses has led to the adoption of cloud-based infrastructure, data analytics, big data, machine learning, and mobile computing. These technologies have revolutionized the way auditing services are delivered. Auditors now use business intelligence tools to analyze vast amounts of data and provide valuable insights to their clients. The automation of various processes, coupled with the increasing use of artificial intelligence (AI), has led to a shift In the focus of auditing services from conventional operating metrics to more strategic areas.

Production capacity, production volumes, and operating expenses are no longer the sole focus. Instead, auditors now provide valuable insights into companies' performance, workflow, and service delivery models. Despite the benefits, there are challenges in the market. The lack of awareness about the importance of auditing services among small and medium-sized enterprises (SMEs) is a significant barrier. Additionally, the economic downturn and travel restrictions due to the pandemic have led to a decrease in audit engagements. The market is diverse and caters to various end-user industries. IT telecommunications, accounting practices, financial institutions, and multinational establishments are some of the key sectors that rely on auditing services.

Mergers and acquisitions also create a demand for auditing services as organizations seek to ensure the reliability and credibility of their financial records during these transactions. In conclusion, auditing services play a vital role in ensuring the reliability and credibility of an organization's financial records. The digital transformation of businesses and the increasing regulatory requirements have led to a shift In the focus of auditing services from conventional operating metrics to more strategic areas. Despite the challenges, the market for auditing services continues to grow, driven by the need for transparency, accountability, and actionable insights.

|

Auditing Services Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

168 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.96% |

|

Market growth 2024-2028 |

USD 113.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.27 |

|

Key countries |

US, UK, Germany, China, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Auditing Services Market Research and Growth Report?

- CAGR of the Auditing Services industry during the forecast period

- Detailed information on factors that will drive the Auditing Services growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the auditing services market growth of industry companies

We can help! Our analysts can customize this auditing services market research report to meet your requirements.