Automated Analyzers Market Size 2024-2028

The automated analyzers market size is forecast to increase by USD 1.72 billion at a CAGR of 5.8% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for rapid and accurate medical diagnostic tests. The market is driven by the rising prevalence of various diseases, particularly infectious ones, which necessitate the need for quick and precise diagnosis. Additionally, the clinical diagnostic use of immunoassay analyzers for various applications, such as cancer diagnosis and drug discovery, is on the rise. Another trend influencing market growth is the integration of advanced technologies like machine learning (ML) and artificial intelligence (AI) in medical diagnostic equipment for improved accuracy and efficiency. However, the shortage of skilled professionals In the field of proteomics and biomarker analysis poses a challenge to market growth.

- Overall, the market holds immense potential for innovation and growth In the healthcare sector.

What will be the Size of the Automated Analyzers Market During the Forecast Period?

- The market encompasses a range of robotic and advanced automation techniques used in laboratory procedures, including workstations for data management, integrated healthcare systems, and commercial solutions. This market caters to various sectors, including immuno-based analyzers for medical instruments and diagnostic solutions, biochemistry analyzers, hematology analyzers, and high-throughput screening systems. These technologies play a pivotal role in healthcare, drug discovery, and diagnostics, addressing chronic diseases, point-of-care testing, and personalized medicine. The integration of artificial intelligence (AI) and machine learning (ML) enhances the capabilities of these systems, enabling high-throughput screening, chemiluminescence immunoassay, and other advanced assays. Legacy systems continue to coexist with commercial solutions, necessitating interoperability and compatibility considerations.

- Overall, the market is experiencing significant growth due to the increasing demand for efficient, accurate, and cost-effective laboratory processes.

How is this Automated Analyzers Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Biochemistry analyzers

- Immuno-based analyzers

- Hematology analyzers

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The biochemistry analyzers segment is estimated to witness significant growth during the forecast period. The automated biochemistry analyzers market is experiencing notable expansion due to technological advancements and the rising demand for accurate diagnostic solutions. Biochemistry analyzers are indispensable medical instruments used to measure various biochemical parameters in biological samples, such as blood and urine, in clinical diagnostics, research, and healthcare settings. These analyzers provide valuable insights into a patient's health status by detecting conditions related to infectious diseases, cancer, cardiac diseases, autoimmune diseases, clinical chemistry, immunoassay, hepatitis, illegal drugs, sodium levels, fertility problems, endocrine function, blood clots, and immunochemistry. Fully automated systems are preferred due to their efficiency in processing large sample volumes, minimizing turnaround times, and reducing human error.

This market segment encompasses immuno-based analyzers, hematology analyzers, and biochemistry analyzers, which are integral to drug discovery, genomics, proteomics, analytical chemistry, clinical diagnostics, and chronic diseases. The integration of artificial intelligence (AI), machine learning (ML), high-throughput screening (HTS), chemiluminescence immunoassay, biosensors, lab-on-a-chip, quality control, interoperability, and academic research institutions further enhances the market's growth potential.

Get a glance at the market report of share of various segments Request Free Sample

The Biochemistry analyzers segment was valued at USD 2.29 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing consistent growth due to substantial investments in healthcare research and testing In the United States. In 2020, US healthcare spending reached USD3.8 trillion, a 4.6% increase from the previous year, as reported by the Centers for Medicare and Medicaid Services (CMS). The strong distribution network of automated analyzers in countries like the US and Canada, along with manufacturers' emphasis on offering comprehensive automated solutions portfolios, including analyzers, to hospitals and diagnostic centers, are key factors fueling market expansion In the region. Automated analyzers play a pivotal role in various healthcare applications, such as clinical chemistry, immunoassay, hepatitis testing, illegal drug screening, sodium level measurement, fertility problem diagnosis, endocrine function assessment, blood clot detection, and immunochemistry analysis.

These analyzers are integral to healthcare facilities, clinical diagnostic labs, and academic research institutions, enabling minimal human assistance in processing biological samples and determining chemical compositions. Furthermore, the integration of advanced technologies like artificial intelligence (AI), machine learning (ML), high-throughput screening (HTS), chemiluminescence immunoassay, biosensors, lab-on-a-chip, quality control, and interoperability enhances the capabilities of automated analyzers in healthcare applications. The market encompasses various product categories, including biochemistry analyzers, immunobased analyzers, hematology analyzers, drug discovery, genomics, proteomics, analytical chemistry, clinical diagnostics, chronic diseases, point-of-care testing, and diagnostic technologies. Automated analyzers are instrumental in addressing various health concerns, including infectious diseases like hepatitis and HIV, cardiac diseases, autoimmune diseases, and cancer.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automated Analyzers Industry?

- The rising prevalence of infectious diseases is the key driver of the market. The market experiences significant growth due to the increasing prevalence of chronic diseases, such as cancer, cardiac diseases, autoimmune diseases, and infectious diseases. These conditions necessitate timely and accurate diagnostic solutions, driving the demand for automated analyzers in clinical diagnostic labs. Traditional laboratory procedures, like culture-based techniques, can be time-consuming and may delay patient care. In contrast, automated analyzers, which include immuno-based analyzers, hematology analyzers, and biochemistry analyzers, offer minimal human assistance, high-throughput screening, and rapid results. Advanced technologies, such as chemiluminescence immunoassay, biosensors, lab-on-a-chip, artificial intelligence (AI), and machine learning (ML), contribute to the enhanced efficiency and accuracy of these systems.

- In the realm of healthcare, diagnostic solutions, assays, and laboratory automation are essential components of integrated healthcare systems and commercial solutions. Furthermore, automated analyzers play a crucial role in drug discovery, genomics, proteomics, and analytical chemistry. The integration of these advanced technologies into clinical diagnostics has led to point-of-care testing, personalized medicine, and high-throughput screening, ultimately improving health status and quality control. Ensuring interoperability and compatibility with legacy systems is essential for seamless implementation in academic research institutions and diagnostic testing facilities.

What are the market trends shaping the Automated Analyzers Industry?

- Rising clinical diagnostic of immunoassay analyzers for various applications is the upcoming market trend. Immunoassays are essential laboratory techniques that utilize antibodies' specificity to detect and quantify various analytes in biological samples. These techniques offer versatility for numerous applications, including disease diagnosis, therapeutic drug monitoring, and allergy testing. With the growing demand for accurate and swift diagnostic solutions, immunoassay analyzers have become indispensable tools in clinical laboratories. These analyzers automate the immunoassay process, enhancing efficiency and throughput while minimizing human error. Precise results delivered quickly are crucial in clinical settings, where timely decision-making significantly impacts patient outcomes. Immunoassays play a vital role in diagnosing infectious diseases such as HIV and hepatitis, monitoring hormone levels, and assessing therapeutic drug concentrations, thereby contributing significantly to personalized medicine.

- Immunoassay analyzers are integral to clinical diagnostics, enabling high-throughput screening for chronic diseases, drug discovery, genomics, proteomics, and analytical chemistry. Integration with healthcare systems, legacy systems, and commercial solutions ensures interoperability and quality control. Immunochemistry analyzers, chemiluminescence immunoassay, biosensors, lab-on-a-chip, and autoimmune disease testing are some applications of immunoassay analyzers. Machine learning and artificial intelligence technologies further enhance their capabilities, making them indispensable diagnostic tools in healthcare.

What challenges does the Automated Analyzers Industry face during its growth?

- A shortage of skilled professionals is a key challenge affecting the industry's growth. In the healthcare sector, the implementation of automated analyzers utilizing robotics and advanced automation techniques has become essential for enhancing laboratory procedures and diagnostic capabilities. These systems, including immuno-based analyzers, hematology analyzers, and biochemistry analyzers, facilitate minimal human assistance in processing biological samples and determining chemical compositions. The market for these diagnostic solutions encompasses various applications, such as infectious disease testing for conditions like hepatitis and illegal drugs, as well as cancer, cardiac diseases, autoimmune diseases, and fertility problems. Clinical diagnostic labs rely on these analyzers to assess health status through clinical chemistry, immunoassay, and other assays, enabling high-throughput screening and personalized medicine.

- However, the integration of these advanced technologies into healthcare systems comes with challenges. The lack of adequately trained personnel to operate and maintain these systems can lead to operational inefficiencies and suboptimal resource utilization. As the demand for automation in healthcare continues to grow, the skills gap becomes more pronounced, with many laboratories struggling to find qualified professionals to manage these sophisticated systems. This shortage can result in increased workloads for existing staff, potentially leading to burnout and higher turnover rates, further exacerbating the issue. To address this challenge, diagnostic solutions providers are integrating artificial intelligence (AI) and machine learning (ML) technologies into their offerings.

Exclusive Customer Landscape

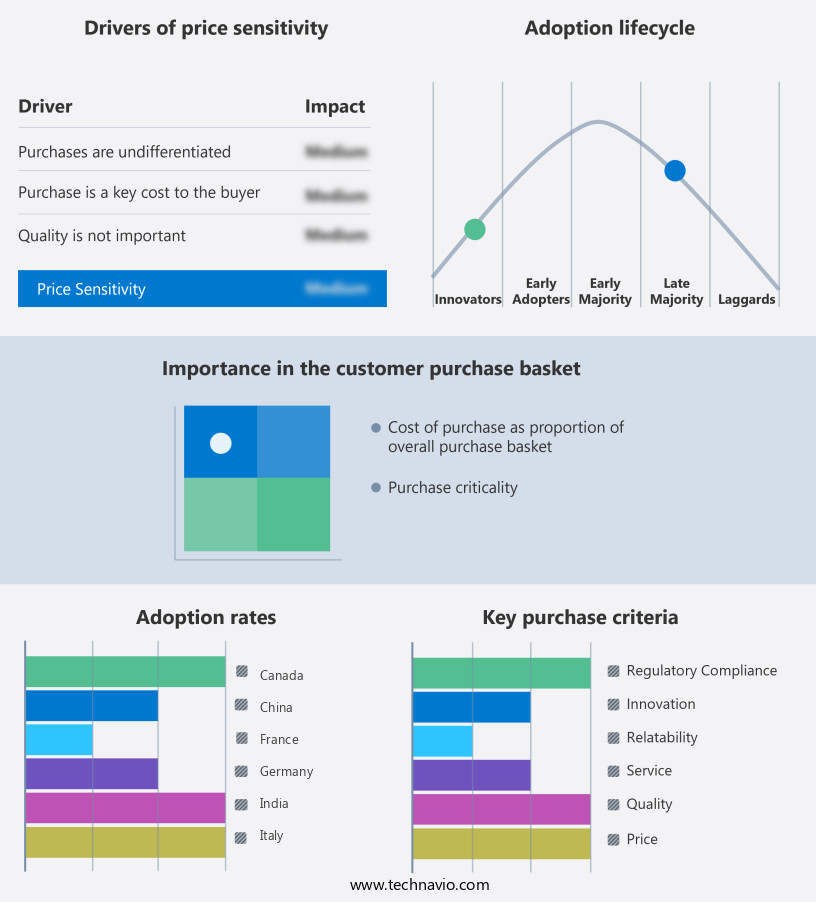

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Aurora Biomed Inc.

- Beckman Coulter Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Drucker Diagnostics LLC

- Eppendorf SE

- F. Hoffmann La Roche Ltd.

- Hitachi High Tech Corp.

- Honeywell International Inc.

- Hudson Robotics Inc.

- KPM Analytics

- Medsource Ozone Biomedicals Pvt. Ltd.

- Perkin Elmer Inc.

- Shimadzu Corp.

- Siemens Healthineers AG

- Synchron Lab Automation

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Tosoh Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of advanced technologies and solutions designed to streamline laboratory procedures and enhance diagnostic capabilities in various healthcare applications. These analyzers employ sophisticated automation techniques to minimize human intervention, ensuring minimal errors and increased efficiency. Automated analyzers are integral to clinical chemistry, immunoassay, hematology, and biochemistry laboratories, among others. They facilitate the analysis of biological samples, enabling the determination of chemical compositions and health statuses related to a multitude of conditions. These include but are not limited to, infectious diseases such as hepatitis, cardiac diseases, autoimmune diseases, and cancer. Immuno-based analyzers play a significant role in this market, offering accurate and reliable detection of specific antigens and antibodies.

Moreover, they contribute to the diagnosis of various conditions, including fertility problems, endocrine function imbalances, and blood clots. Additionally, they are employed In the detection of illegal drugs and sodium levels, providing valuable insights for healthcare professionals and researchers. Integrated healthcare systems and commercial solutions leverage automated analyzers to improve overall healthcare delivery and diagnostic capabilities. These systems enable seamless data management and interoperability, ensuring accurate and timely results. Moreover, they facilitate high-throughput screening, allowing for the analysis of large volumes of samples in a short timeframe. Legacy systems are increasingly being replaced by automated analyzers due to their advantages in terms of accuracy, efficiency, and reduced human error.

Furthermore, the adoption of these systems is driven by the growing demand for personalized medicine and point-of-care testing. Advancements in artificial intelligence (AI), machine learning (ML), and high-throughput screening (HTS) technologies are further propelling the growth of the market. These technologies enable faster and more accurate analysis, as well as improved data interpretation and quality control. The market for automated analyzers is diverse, catering to the needs of academic research institutions, clinical diagnostic labs, and healthcare providers. Applications include drug discovery, genomics, proteomics, and analytical chemistry, among others. Despite the numerous benefits offered by automated analyzers, challenges remain, including the need for standardization and regulatory compliance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2024-2028 |

USD 1.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, UK, China, Germany, France, Japan, Canada, India, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automated Analyzers Market Research and Growth Report?

- CAGR of the Automated Analyzers industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automated analyzers market growth of industry companies

We can help! Our analysts can customize this automated analyzers market research report to meet your requirements.