Automated Liquid Handling Systems Market Size 2024-2028

The automated liquid handling systems market size is forecast to increase by USD 721 billion at a CAGR of 11.64% between 2023 and 2028. The market is experiencing significant growth, driven by increasing investments in drug discovery and research initiatives. The integration of advanced software programs enabling better data analysis and improved accuracy further bolsters market expansion. However, the market faces challenges, particularly in the adoption by small-scale and medium-scale laboratories due to high initial investment costs and the need for extensive infrastructure upgrades. Despite these hurdles, the market is expected to continue its upward trajectory, fueled by the benefits of increased efficiency and automation, reduced errors, and enhanced productivity in anatomic pathology laboratories.

The market is witnessing significant growth due to the increasing demand from the life science industry. These systems, which include Automated Pipetting Systems and Automated Microplate Washers, utilize advanced technologies such as pipetting technology and washing technology to automate assay processes in laboratories. Manual handling techniques are being replaced by these systems due to their ability to increase assay throughput, reduce contamination risk, and handle sample volumes with high precision. In bioprocess applications, these systems are used extensively in clinical research laboratories, universities, and pharmaceutical companies for high-throughput testing. The modality of these systems includes contact dispensing, ultrasound, piezoelectric, and solenoid.

Furthermore, the integration of artificial intelligence and machine learning in automated liquid handling systems is a key trend in the market. These technologies enable next-generation sequencing and genome sequencing applications, further expanding the market's scope. The market is expected to grow at a steady pace due to the increasing demand for lab automation and the need to reduce human error and increase efficiency in laboratory processes.

Market Segmentation

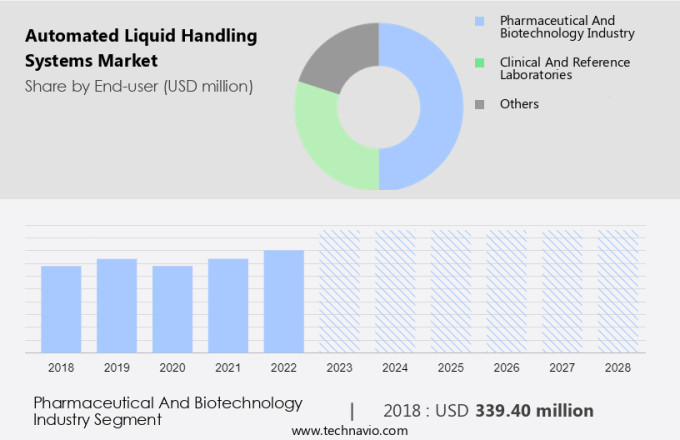

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Pharmaceutical and biotechnology industry

- Clinical and reference laboratories

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By End-user Insights

The pharmaceutical and biotechnology industry segment is estimated to witness significant growth during the forecast period. The market is witnessing significant growth in the life science industry due to the adoption of advanced technologies. These systems are increasingly being utilized in laboratories for assay throughput enhancement and automation of bioprocesses. Manual handling techniques are being replaced by automated pipetting systems and microplate washers, which offer increased sample preparation throughput and reduced contamination risk. Pharmaceutical liquid handling applications, such as dispensing and washing, benefit significantly from these systems. Advanced technologies, including air displacement technology, ultrasound, piezoelectric, solenoid, and contact dispensing, are used in automated liquid handlers to ensure precise sample volumes and high throughput testing. Automated pipetting systems and microplate washers employ centrifugal force technology and cross-contamination reduction techniques, respectively.

Furthermore, automation in lab processes, driven by machine learning and artificial intelligence, is revolutionizing the way professionals handle samples. Next-generation sequencing applications, which require the handling of small droplets, are also benefiting from these advanced systems. Key players in the market include Bio Molecular Systems, Thermo Fisher Scientific, and Qiagen, among others. These companies offer a range of automated liquid handling solutions catering to the needs of clinical research laboratories, universities, and academic research laboratories.

Get a glance at the market share of various segments Request Free Sample

The pharmaceutical and biotechnology industry segment was valued at USD 339.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

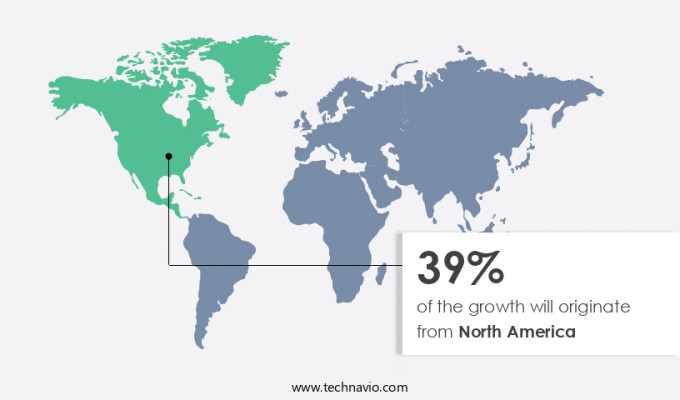

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth in the life science industry due to the adoption of advanced technologies. These systems are increasingly being utilized in laboratories for assay throughput enhancement, especially in bioprocess applications. Manual handling techniques are being replaced with automated pipetting systems and microplate washers, which offer increased pipetting and washing technology modality. Automated liquid handlers are essential tools for clinical research laboratories, universities, and pharmaceutical companies, enabling high throughput testing and reducing contamination risk. Automated pipetting systems use air displacement technology, ultrasound, piezoelectric, solenoid, or contact dispensing to precisely dispense sample volumes. Microplate washers employ centrifugal force technology to ensure efficient washing of well plates.

Furthermore, Next-generation sequencing and other advanced applications require high sample preparation throughput, making automation a necessity. Artificial intelligence and machine learning are being integrated into these systems to improve accuracy and efficiency. Automated liquid handling systems cater to various applications, including sample preparation, bio molecular systems, and clinical research. They offer benefits such as increased accuracy, reduced human error, and improved productivity. The market is expected to grow significantly due to the increasing demand for automation in laboratories and the need for high-throughput testing in various industries.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increasing investments in drug discovery is the key driver of the market. In the realm of pharmaceutical and biotechnology research, the significance of automated liquid handling systems has grown substantially due to the increasing focus on genome sequencing, drug discovery, and personalized medicine. These systems play a pivotal role in the initial stages of drug development, specifically during protein target identification. Automated liquid handling systems are indispensable for high-throughput drug screening, enabling the efficient and accurate handling of reagents and consumables. Innovations in this field include miniaturization of assays, expediting the process of querying biological systems with chemical probes, and the identification of potential drug candidates. The adoption of these systems in research laboratories and academic institutions facilitates the streamlining of screening operations, enhances throughput, consistency, and reliability, and eliminates human error.

Furthermore, the expansion of the distribution network for specialized liquid handlers, pipetting workstations, multipurpose workstations, and workstation modules, has made these advanced technologies accessible to a broader range of users in the drug development sector.

Market Trends

Additional software programs assisting in better analysis is the upcoming trend in the market. Automated liquid handling systems have gained significant traction in research laboratories and academic institutions due to their precision engineering and ability to handle genome sequencing and drug discovery processes. These systems incorporate robotics technology and offer specialized liquid handlers and pipetting workstations for microarray technology and drug screening applications. companies provide software as an additional service to maintain customer loyalty and ensure quality results. The intuitive and flexible user interface of these software programs simplifies data analysis, making it similar to manual plating procedures.

Furthermore, compliant with regulatory recommendations such as Certificates of Analysis (COA) and Certificates of Conformance (COC), these software programs can be customized to meet the specific requirements of end-users. For instance, Thermo Fisher Scientific's Versette ControlMate Software enables the creation and execution of pipetting programs for intricate pipetting sequences like plate reformatting, serial dilutions, and immunoaffinity sample preparations using MSIA pipette tips. The distribution network of these companies ensures easy access to reagents and consumables, further enhancing the market's growth.

Market Challenge

The inability of small-scale and medium-scale laboratories to fully adopt automated solutions is a key challenge affecting the market growth. Automated Liquid Handling Systems (ALHS) have gained significant attention in research laboratories and academic institutions due to their precision engineering capabilities in handling reagents and consumables for various applications. Genome sequencing, drug discovery, microarray technology, and drug screening are some areas where ALHS have proven to be indispensable. T

Furthermore, tese systems offer specialized liquid handlers and multipurpose workstations with workstation modules for drug development and distribution network integration. Initially, large-scale facilities with adequate budgets and trained personnel were the primary adopters of ALHS. However, medium and small-scale laboratories are now embracing these systems to enhance their productivity and efficiency. Despite limited floor space, these laboratories recognize the benefits of ALHS in handling low volumes of samples with high accuracy and consistency. companies have responded by developing a range of ALHS, from pipetting workstations to large-scale systems, catering to diverse applications and budgets.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Agilent Technologies Inc. - The company offers products such as open liquid handling platform.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Aurora Biomed Inc.

- BRAND GmbH and Co. KG

- Corning Inc.

- Danaher Corp.

- Dynex Technologies Inc.

- Endress Hauser Group Services AG

- Eppendorf SE

- Fluotics

- FORMULATRIX Inc.

- Hamilton Co.

- Hudson Robotics Inc.

- Mettler Toledo International Inc.

- Perkin Elmer Inc.

- QIAGEN NV

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Waters Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Automated liquid handling systems have become indispensable in the life science industry, enabling laboratories to streamline their processes and enhance productivity. These systems, which include automated pipetting systems, automated microplate washers, and dispensers, have replaced manual handling techniques in various applications such as assay throughput, bioprocess, clinical research laboratories, universities, and pharmaceutical liquid handling. Advanced technologies like Air displacement technology, ultrasound, piezoelectric, solenoid, and centrifugal force technology have revolutionized pipetting and washing processes, ensuring high throughput, contamination risk reduction, and precise sample volumes. These systems have become essential for next-generation sequencing and other high-throughput testing applications.

Furthermore, automated liquid handling systems have also integrated Artificial intelligence and machine learning to optimize sample preparation throughput and reduce the risk of cross contamination. Robots, droplets, and well plates are now standard components of these systems, making lab automation a reality for professionals in various fields. Modality, such as contact dispensing, ultrasound, and piezoelectric, and washing technology, like centrifugal force and cross flow, have significantly improved the performance of automated liquid handling systems. Bio Molecular Systems and academic research laboratories have also adopted these systems to enhance their research capabilities. Overall, automated liquid handling systems have transformed the way samples are prepared and processed, making them an essential tool for the life science industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

150 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.64% |

|

Market growth 2024-2028 |

USD 721 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.11 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 39% |

|

Key countries |

US, Germany, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agilent Technologies Inc., Aurora Biomed Inc., BRAND GmbH and Co. KG, Corning Inc., Danaher Corp., Dynex Technologies Inc., Endress Hauser Group Services AG, Eppendorf SE, Fluotics, FORMULATRIX Inc., Hamilton Co., Hudson Robotics Inc., Mettler Toledo International Inc., Perkin Elmer Inc., QIAGEN NV, Tecan Trading AG, Thermo Fisher Scientific Inc., and Waters Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch