Automotive Active Seat Belt System Market Size 2024-2028

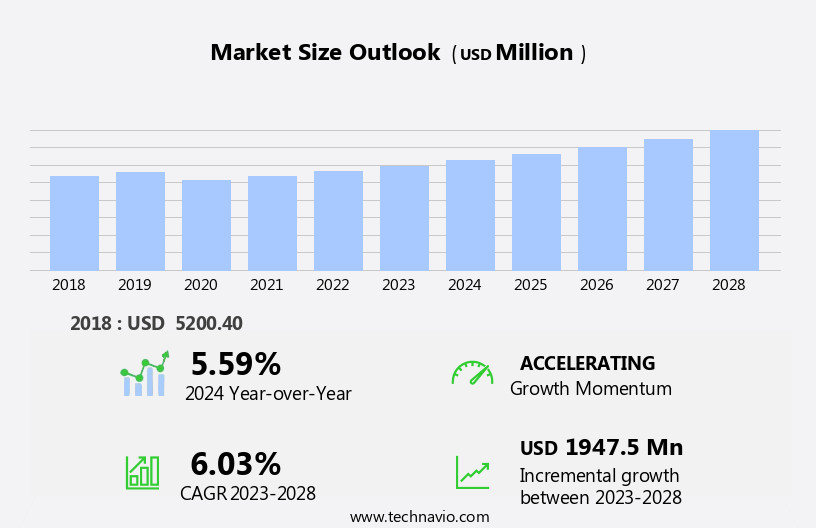

The automotive active seat belt system market size is forecast to increase by USD 1.95 billion at a CAGR of 6.03% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increasing demand for luxury vehicles, with their emphasis on advanced safety features, is driving market expansion. Furthermore, the integration of advanced technologies into automotive active seat belt systems, such as sensors and connectivity, is enhancing their functionality and appeal to consumers. However, the automotive industry's uncertainty, including economic fluctuations and regulatory changes, poses challenges for market growth. Despite these challenges, the future looks promising for the market as consumers prioritize safety and comfort In their vehicles.

What will be the Size of the Automotive Active Seat Belt System Market During the Forecast Period?

- The market In the US is experiencing significant growth due to increasing road safety concerns and the risk of injuries and fatalities in collisions. New vehicle production and urbanization are key drivers, as automakers prioritize advanced safety features to meet stringent safety standards. Active seat belts, which provide specific movements to passengers during collisions, represent a notable advancement from traditional seat belts. These systems utilize radar technology and can interact with pretensioners, seat belt reminders, gear locks, and interlocks to optimize safety precautions. SUVs and personal vehicles are major markets for active seat belts, with fleet expansion also contributing to demand.

- However, the market may face challenges from cheat devices and the ongoing debate surrounding their legality. Overall, the active seat belt system market is poised for continued growth as consumers prioritize vehicle safety.

How is this Automotive Active Seat Belt System Industry segmented and which is the largest segment?

The automotive active seat belt system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Light commercial vehicles

- Heavy commercial vehicles

- Type

- Three-point

- Two-point

- Four-point and above

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- Middle East and Africa

- South America

- APAC

By Application Insights

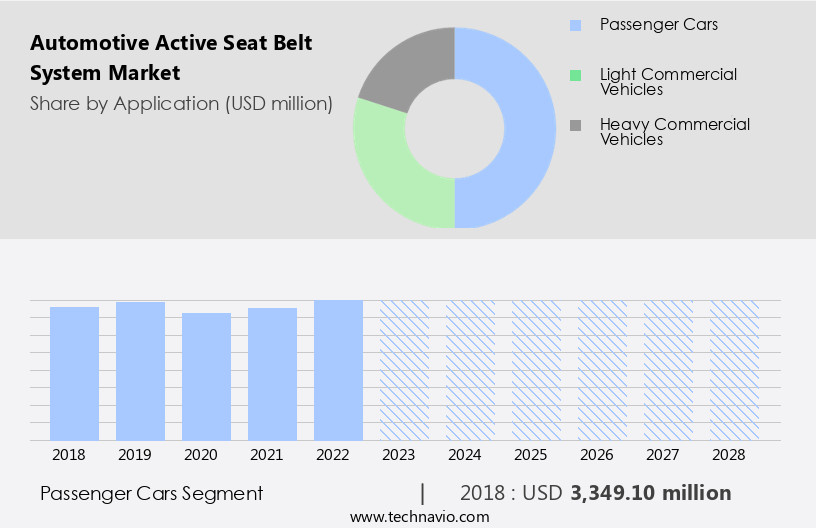

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing growth due to the increasing demand for passenger cars in emerging economies and the popularity of high-performance vehicles in North America and Europe. The rise in urbanization and disposable income in countries such as Brazil, India, China, South Africa, UAE, Qatar, and Saudi Arabia is fueling the growth of the passenger car segment. In response, automakers are focusing on enhancing safety features, including active seat belt systems, to cater to consumer demands. These systems use advanced technologies such as biosensors, retractors, buckle lifters, and electronic control units (ECUs) to provide additional safety features beyond traditional seat belts.

Despite the high cost, these systems are gaining popularity in luxury vehicles and light commercial vehicles, particularly due to increasing driving protocols and safety norms. The integration of phone, messaging, and surfing functions into vehicles is also driving the demand for electronic seat belts.

Get a glance at the Automotive Active Seat Belt System Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 3.35 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

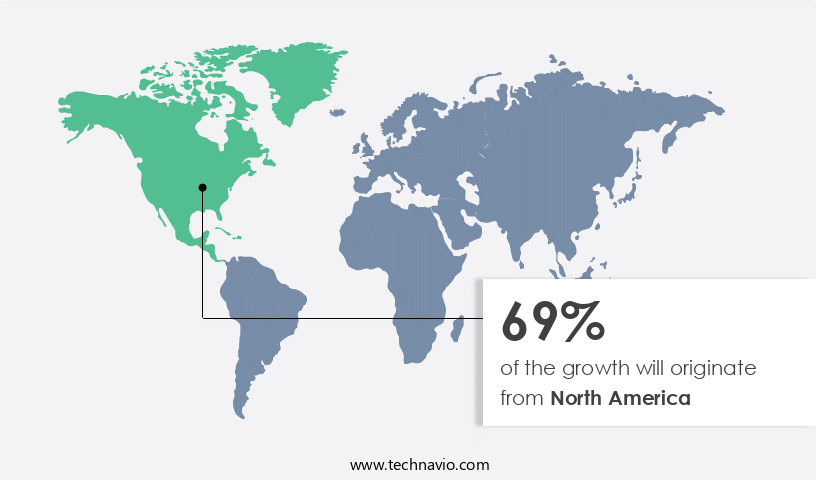

- North America is estimated to contribute 69% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is driven by the increasing demand for commercial vehicles and the associated parts and components. Countries such as China, Japan, South Korea, and India, with a high demand for commercial vehicles, significantly contribute to market growth. Developed automotive markets, including Japan, South Korea, and Australia, serve as prominent automotive export markets in APAC. The expansion of fleets and urbanization further boost market growth. The production of automotive active seat belt systems is reliant on the production and sales of commercial vehicles, particularly in export-oriented production of automotive components. The rise in manufacturing and logistics industries, which improve land transport modes, also influences market growth.

Despite these opportunities, challenges such as high production costs and stringent safety standards pose pitfalls for market players.

Market Dynamics

Our automotive active seat belt system market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Active Seat Belt System Industry?

Increasing demand for luxury vehicles is the key driver of the market.

- The market is driven by the increasing prioritization of road safety and the risk of injuries and fatalities in collisions. New vehicle production and aftermarket sales are significant contributors to the market's growth, with urbanization, fleet expansion, and the popularity of vehicles such as SUVs, crossovers, and Electric Vehicles (EVs) increasing the demand for enhanced safety features. However, pitfalls and challenges such as counterfeit seat belts and authenticity concerns pose a threat to the market's growth. Seat belt manufacturers are investing in advanced technology, including sensors, connectivity features, and occupant behavior analysis, to improve safety performance and effectiveness. Electronic Stability Control, collision avoidance systems, and smart technologies like two-point and three-point seat belts are becoming standard safety devices in new vehicle models.

- The luxury vehicle segment, despite its high cost, is expected to lead the market due to the demand for improved safety systems and the growing preference for personal vehicles. The adoption of improved technology and stricter automotive safety norms is also driving the market. Occupants' safety in crashes is a primary concern for consumers, automotive manufacturers, and safety advocates alike. Seat belt components, such as pretensioners, retractors, buckle lifters, and inflatable seat belts, are essential safety features in modern vehicles. The integration of sensors, cameras, and electronic seat belts with autonomous driving sensors and speed warning systems further enhances vehicle safety.

- The market is expected to experience significant growth In the coming years, driven by the increasing demand for advanced safety features and the evolving needs of consumers and regulatory bodies.

What are the market trends shaping the Automotive Active Seat Belt System Industry?

Growing integration of advanced features in automotive active seat belt systems is the upcoming market trend.

- In the automotive industry, road safety remains a top priority as the risk of injuries and fatalities continues to be a concern. To address this, seat belt manufacturers are integrating advanced features into seat belt systems to enhance safety. For example, Bosch's integrated collision detection technology enables earlier and more reliable triggering of safety features, such as seat belts, by utilizing information from the vehicle's surrounding-area sensors. This technology can activate seat belts 25 milliseconds after impact, increasing the impact sensitivity of crash algorithms. New vehicle production and urbanization are driving the demand for enhanced safety features, including advanced seat belt systems.

- However, pitfalls and challenges such as counterfeit seat belts and authenticity concerns persist. Consumers, safety advocates, and automotive manufacturers are adopting improved technology and stricter regulations to address these issues. The market for seat belts includes various vehicle types, such as passenger cars, SUVs, crossovers, and electric vehicles. Components of seat belt systems include seat belt webbing, pretensioners, retractors, buckle lifters, and sensors. Advanced technologies like electronic stability control, collision avoidance systems, and biosensors are also being integrated into seat belts. Occupant behavior and collision scenarios are being considered In the development of real-time feedback and alert systems. Active safety systems, such as electronic seat belts and autonomous driving sensors, are also gaining popularity.

- The market for seat belts is expected to grow, with luxury vehicles and high-cost vehicles leading the way. However, the high cost of these advanced systems may limit their adoption in light commercial and heavy commercial vehicles. Safety performance and effectiveness are key considerations for consumers, who are increasingly demanding smart technologies and connectivity features In their vehicles. Vehicle safety is a critical concern for all automobile owners, and seat belts remain an essential safety precaution.

What challenges does the Automotive Active Seat Belt System Industry face during its growth?

Uncertainty in automotive industry is a key challenge affecting the industry growth.

- The market is a significant component of the broader automotive safety industry, driven by the increasing prioritization of road safety and the risk of injuries and fatalities in collisions. New vehicle production and aftermarket sales are key growth areas for this market, with urbanization and fleet expansion leading to an increased number of vehicles on the road. SUVs, crossovers, and Electric Vehicles are among the vehicle types that are seeing significant growth, necessitating enhanced safety features such as active seat belt systems. However, the market faces pitfalls and challenges, including the issue of counterfeit seat belts and the authenticity of safety components.

- Seat belt manufacturers must ensure the safety and effectiveness of their products, as well as comply with safety standards and regulations. New vehicle models are increasingly incorporating smart technologies such as sensors, connectivity features, and real-time feedback to improve occupant behavior and collision scenarios. Active safety systems, such as Electronic Stability Control and collision avoidance systems, are becoming standard features in passenger cars, light commercial vehicles, and heavy commercial vehicles. Two-point and three-point seat belts, as well as seat belt pretensioners and retractors, are essential components of these systems. Seat belt webbing and environmental sensors, such as radar, are also critical components.

- Despite these advancements, seat belts remain a crucial safety precaution In the event of crashes. Electronic seat belts, autonomous driving sensors, and inflatable seat belts are among the improved technologies being adopted to enhance vehicle safety. Automotive safety norms continue to evolve, with a focus on reducing fatal injuries and improving overall safety performance. However, the high cost of luxury vehicles and advanced technologies may limit the adoption of active seat belt systems in certain markets. A skilled workforce and strict regulations are also necessary to ensure the proper installation and maintenance of these systems. The automotive industry is continuously evolving, with a focus on improving safety and reducing risks for occupants.

Exclusive Customer Landscape

The automotive active seat belt system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive active seat belt system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive active seat belt system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Ashimori Industry Co. Ltd. - Our company specializes In the provision of advanced Automotive Active Seat Belt Systems. These systems include state-of-the-art components such as retractors, buckles, and load limiters. Our offerings prioritize safety and innovation, ensuring that your vehicle's seat belts are not just passive restraints but active elements in protecting you during accidents. By integrating intelligent technologies into seat belts, we enhance passenger safety and provide peace of mind on the road.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ashimori Industry Co. Ltd.

- Autoliv Inc.

- Continental AG

- Daicel Corp.

- DENSO Corp.

- E. Oppermann Mech. Gurt und Bandweberei GmbH

- GWR

- Hesham Industrial Solutions

- Hyundai Motor Group

- Infineon Technologies AG

- ITW Automotive Products GmbH

- Joyson Safety Systems Aschaffenburg GmbH

- KSS Abhishek Safety Systems Pvt. Ltd.

- MG Seating Systems Pvt. Ltd.

- Motorlamp Auto Electrical Pvt. Ltd.

- Robert Bosch GmbH

- Seatbelt Solutions LLC

- Tokai Rika Co. Ltd.

- Wenzhou Far Europe Automobile Safety System Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive industry continues to prioritize road safety as a critical aspect of vehicle production, with seat belts being a fundamental component in preventing injuries and fatalities. The market for seat belts, encompassing both new vehicle production and aftermarket sales, is driven by various factors. Urbanization and fleet expansion have led to an increased number of vehicles on the roads, necessitating enhanced safety features. New vehicle models are incorporating advanced technologies such as sensors, connectivity features, and real-time feedback to improve safety performance. These systems include electronic stability control, collision avoidance systems, and active seat belts. Active seat belts represent a significant evolution in seat belt technology.

Unlike traditional seat belts, active seat belts use sensors and connectivity to monitor occupant behavior and collision scenarios. They provide real-time feedback and alerts to occupants, enabling them to take preventative measures. These systems can also interact with other safety systems, such as electronic stability control and brake assist systems, to optimize safety performance. The adoption of active seat belts is driven by a growing awareness of the importance of safety, as well as stringent regulations. Safety advocates and consumers demand improved technology and safety norms, particularly in luxury vehicles and special utility vehicles. However, the high cost of these advanced systems presents pitfalls and challenges for seat belt manufacturers.

Counterfeiters pose another significant challenge to the market, with the proliferation of counterfeit seat belts posing a risk to consumers. Ensuring authenticity and safety is crucial, with manufacturers implementing measures such as biosensors, retractors, buckle lifters, and environmental sensors to prevent counterfeiting. The market for seat belts is diverse, catering to various vehicle types, including passenger cars, light commercial vehicles, and heavy commercial vehicles. Seat belt manufacturers must adapt to driving protocols and vehicle modifications, such as those seen in SUVs, crossovers, and electric vehicles. Collisions remain a significant risk, with seat belts playing a crucial role in mitigating injuries and fatalities.

Seat belt pretensioners and specific movements are essential safety features, working in conjunction with other safety devices such as airbags and speed warning systems. The future of seat belts lies in advanced technology and connectivity. Electronic seat belts, autonomous driving sensors, and surge protection systems are all areas of research and development. As the automotive industry continues to evolve, seat belts will remain a critical component in ensuring vehicle safety.

|

Automotive Active Seat Belt System Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

179 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.03% |

|

Market growth 2024-2028 |

USD 1947.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.59 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Active Seat Belt System Market Research and Growth Report?

- CAGR of the Automotive Active Seat Belt System industry during the forecast period

- Detailed information on factors that will drive the Automotive Active Seat Belt System growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive active seat belt system market growth of industry companies

We can help! Our analysts can customize this automotive active seat belt system market research report to meet your requirements.