Automotive Aftermarket Shock Absorbers Market Size 2024-2028

The automotive aftermarket shock absorbers market size is forecast to increase by USD 1.12 billion at a CAGR of 4.15% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The aging vehicle fleet, with a high number of in-use vehicles, presents a lucrative opportunity for market expansion. Additionally, auto component manufacturers are increasingly opting for selective alliances to enhance their product offerings and improve operational efficiency. Conversely, the decreasing global sales and production of vehicles may pose a challenge to market growth. In addition, the increasing demand for e-commerce logistics, construction sector expansion, and mining industry growth are fueling the commercial vehicle market. Despite this, the market is expected to remain resilient, driven by the increasing demand for vehicle maintenance and repair services. The focus on enhancing vehicle performance and safety, coupled with the growing popularity of aftermarket parts, will continue to fuel market growth. The market analysis report provides an in-depth assessment of these trends and their impact on the market dynamics.

What will be the Size of the Automotive Aftermarket Shock Absorbers Market During the Forecast Period?

- The automotive aftermarket for shock absorbers In the United States is driven by the constant demand for suspension system upgrades in both automobiles and motorcycles. These components, which include cylindrical devices with sliding pistons that control the oscillations of carriage springs or act as landing gear for motorcycles, are essential for maintaining vehicle stability and ensuring passenger comfort. Shock absorbers utilize hydraulic fluid, air, or oil pump technology to convert kinetic energy into heat, absorbing the impact of road irregularities. Market trends include the development of advanced suspension designs, such as twin-tube and mono-tube designs, gas charged designs, position sensitive damping, and acceleration sensitive damping.

- Additionally, adjustable and non-adjustable shocks cater to varying driver preferences and vehicle applications. Industrial machines also utilize these for improved performance and durability. Key components, such as steering spindles, kingpins, and friction disks, contribute to the overall functionality of these systems. The market is expected to grow due to the increasing demand for performance shock absorbers and the continuous pursuit of improved driver control and passenger comfort.

How is this Automotive Aftermarket Shock Absorbers Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Twin tube

- Mono tube

- Vehicle Type

- Passenger vehicles

- Commercial vehicles

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

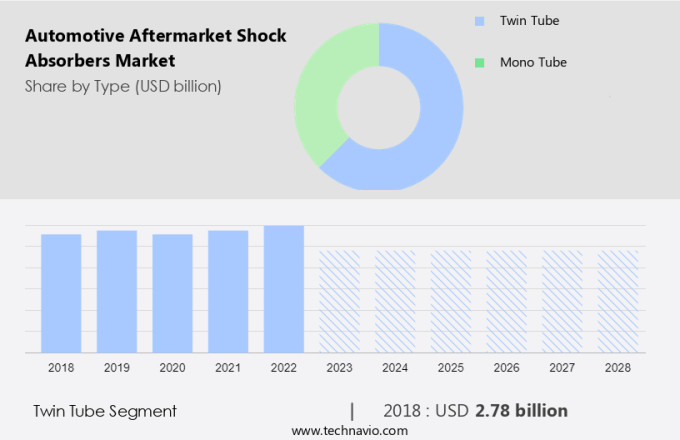

- The twin tube segment is estimated to witness significant growth during the forecast period.

The market is experiencing growth due to the rising demand for high-performance and customizable products. Twin-tube shock absorbers, a popular choice in this market, consist of two tubes - an inner and an outer tube - with a piston and oil-filled chamber between them. The inner tube houses the piston's movement, while the outer tube functions as an oil reservoir, enhancing heat dissipation and performance.

Additionally, companies such as Gabriel India and KYB lead the market with innovative and quality twin-tube shock absorber designs. Suspension systems, including steering spindles, kingpins, leaf springs, and carriage springs, all benefit from the use of these shock absorbers, ensuring improved driver control and passenger comfort. The market's growth is also driven by the durability and reliability of these components, making them a crucial investment for vehicle owners.

Get a glance at the Industry report of share of various segments Request Free Sample

The twin tube segment was valued at USD 2.78 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

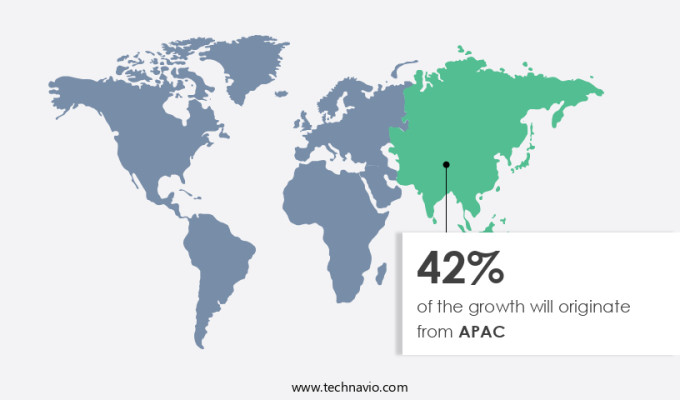

- APAC is estimated to contribute 42% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The automotive aftermarket shock absorber market in APAC is experiencing significant growth due to the expanding automotive industry In the region. Factors such as increasing consumer income, financing services availability, and the growing demand for passenger and commercial vehicles are driving market growth. With a significantly lower number of vehicles per capita and insufficient public transportation facilities in several countries, the demand for personal vehicles is increasing. They play a crucial role in ensuring steering performance, comfort, and vehicle stability by reducing road-induced noise, vibration, harshness, wheel hop, and tyre-to-road contact. As a result, the demand for these components is expected to remain strong In the APAC automotive aftermarket.

Market Dynamics

Our market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Aftermarket Shock Absorbers Industry?

An aging vehicle fleet with a high number of in-use vehicles is the key driver of the market.

- The increasing average age of vehicles in North America and Europe presents a significant opportunity for the automotive aftermarket, particularly for components such as shock absorbers. According to the US Department of Energy, the average age of light vehicles In the US has risen by nearly 23% since 2002 and is projected to reach an average of 12 years In the coming years. Similarly, the average age of passenger vehicles In the EU has increased by 5.71% between 2011 and 2021. With a growing number of in-use vehicles, the demand for replacement parts, including shock absorbers, is expected to rise. They are a crucial suspension component that ensures vehicle stability, comfort, and safety. They convert kinetic energy from the vehicle's suspension into heat energy through hydraulic fluid, reducing the oscillation of the vehicle's unsprung weight. Shock absorbers come in various designs, including twin-tube, mono-tube, and gas charged designs, each offering different levels of performance and durability.

- Additionally, they are available in adjustable and non-adjustable options, catering to different automobile applications. Adjustable shocks allow drivers to fine-tune the ride experience for optimal performance in high-performance applications, such as drag racing, traction, and competition engineering. In contrast, non-adjustable shocks are designed for standard automotive applications, prioritizing comfort and vehicle safety. Suspension designs vary between motorcycles and automobiles, with motorcycles utilizing leaf springs, sliding pistons, and friction disks, while automobiles primarily use coil springs and hydraulic shock absorbers. Industrial machines also employ similar shock absorber technology for landing gear and steering spindles to ensure smooth operation and stability. The durability is crucial, as they are subjected to constant wear and tear. Regular inspection and maintenance are essential to ensure the function correctly and provide optimal performance. Original Equipment (OE) manufacturers and aftermarket solutions offer trusted brands and replacement parts for various vehicle models, ensuring the ride experience remains comfortable and safe.

- Thus, factors such as driver control, passenger comfort, and vehicle safety are essential considerations when selecting shock absorbers. Performance shock absorbers cater to high-performance applications, providing adjustable options for acceleration sensitivity and position sensitivity damping. Single-adjustable and double-adjustable shocks offer varying levels of customization for the driver. Electronic suspensions, such as frequency dependent damping, offer advanced ride performance and vehicle stability, providing a smoother ride experience and improved tire grip. Vehicle manufacturers and aftermarket solutions continue to innovate and develop new shock absorber technologies to cater to the evolving needs of the automotive industry.

What are the market trends shaping the Automotive Aftermarket Shock Absorbers Industry?

Auto component manufacturers shift towards selective alliances is the upcoming market trend.

- The market encompasses various suspension components that convert kinetic energy from vehicle movement into mechanical energy, ensuring stability, comfort, and optimal tire-to-road contact. These components, including oil pumps, cylinders with sliding pistons, and hydraulic fluid, are essential in both automobiles and motorcycles. Suspension designs, such as twin-tube, mono-tube, and gas charged, cater to different vehicle applications and performance levels. Adjustable shocks, available in single-adjustable and double-adjustable variants, provide drivers with customizable control over their vehicle's ride experience. Nonadjustable shocks, on the other hand, offer cost-effective solutions for standard automotive applications. Industrial machines and landing gear also utilize shock absorbers for improved performance and durability. Suspension components, such as steering spindles, kingpins, leaf springs, and friction disks, work in harmony to ensure vehicle safety, steering performance, and passenger comfort.

- Additionally, wear and tear, harshness, wheel hop, road-induced noise, and vibration are common issues addressed by these components. Performance shock absorbers, designed for high-performance applications, cater to the needs of drag racing, traction, and competition engineering. Specialty shocks, such as those for unsprung weight reduction and antisquat, are also available In the market. Manufacturers, such as Monroe, offer replacement parts and engineering solutions to cater to the aftermarket demand for quality suspension components. Electronic suspensions, with features like Frequency Dependent Damping and Ride performance, are gaining popularity among vehicle manufacturers and consumers alike.

- Overall, the market is witnessing significant growth due to the increasing demand for vehicle safety, comfort, and performance. Consumers and vehicle manufacturers are continuously seeking innovative solutions to enhance the ride experience, and shock absorbers play a crucial role in achieving this goal. Mechanics and automotive technology experts are continually researching and developing new suspension solutions to cater to the evolving needs of the industry.

What challenges does the Automotive Aftermarket Shock Absorbers Industry face during its growth?

Decreasing global sales and production of vehicles is a key challenge affecting the industry's growth.

- The market encompasses various suspension components that convert kinetic energy from vehicle movement into hydraulic pressure. These components, including cylinders with sliding pistons, friction disks, and hydraulic fluid, are essential for maintaining vehicle stability, comfort, and performance. Shock absorbers are used in both automobiles and motorcycles, serving as landing gear for the former and contributing to steering performance In the latter. Suspension designs come in various forms, such as twin-tube, mono-tube, and gas charged, each catering to different vehicle applications and requirements. Adjustable shocks offer driver control over suspension settings for enhanced performance in high-performance applications, while non-adjustable shocks prioritize durability and cost-effectiveness.

- Additionally, industrial machines and other heavy equipment also utilize shock absorbers to manage the impact of movement and ensure vehicle safety. The market includes various shock absorber designs, including position sensitive damping, acceleration sensitive damping, and frequency dependent damping, to cater to diverse vehicle needs. In the automotive industry, they play a crucial role in addressing unsprung weight, improving ride performance, and ensuring vehicle stability. They contribute to tire-to-road contact, steering precision, and stopping performance, while minimizing road-induced noise, vibration, harshness, wheel hop, and clunking sounds. As vehicle safety becomes increasingly important, they continue to be a vital component in automotive applications.

- Thus, mechanics and automotive technology companies focus on manufacturing and engineering high-quality shock absorbers to meet the demands of various vehicle models and the evolving automotive landscape. Electronic suspensions further enhance the capabilities of shock absorbers, offering advanced features and improved ride experiences for consumers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market growth and forecasting, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ADD Industry Zhejiang Co Ltd

- AL-KO Vehicle Technology Group

- ANAND Group

- Arnott LLC

- Dorman Products Inc.

- DRiV Inc.

- Festo SE and Co. KG

- Hangzhou Smart Mfg Group Co. Ltd.

- Hitachi Ltd.

- KAVO B.V.

- KYB Corp.

- MAPCO Autotechnik GmbH

- MEYLE AG

- Roberto Nuti Group

- Skyjacker Ltd.

- SUSPA GmbH

- Taylor Devices Inc.

- Tenneco Inc.

- thyssenkrupp AG

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital segment of the automotive industry, catering to the demand for suspension components that ensure vehicle stability, comfort, and optimal performance. Shock absorbers are essential components of a vehicle's suspension system, responsible for controlling the oscillations caused by road irregularities. These components play a pivotal role in enhancing the overall driving experience by minimizing the effects of road-induced noise, vibration, harshness, and wheel hop. Suspension systems, consisting of various components such as steering spindles, kingpins, leaf springs, and sliding pistons, work in harmony to provide a smooth ride. Shock absorbers, specifically, are designed to absorb the kinetic energy generated during vehicle movement, converting it into heat through friction. This process prevents excessive bouncing and oscillations, ensuring proper tyre-to-road contact and improved vehicle stability. Two primary designs dominate the shock absorber market: twin-tube and mono-tube. Twin-tube shock absorbers feature a separate chamber for the hydraulic fluid and the gas charge, allowing for easier manufacturing and installation. In contrast, mono-tube shock absorbers house both the hydraulic fluid and the gas charge within the same tube, offering increased performance and durability.

Additionally, different shock absorber designs cater to various automotive applications, ranging from passenger cars to heavy-duty industrial machines. For instance, adjustable shocks provide drivers with the flexibility to fine-tune their suspension settings for specific driving conditions, while non-adjustable shocks offer a more cost-effective solution for standard automotive applications. Performance shock absorbers are a popular choice for high-performance vehicles and competition engineering applications, as they offer enhanced handling, traction, and stopping performance. These shocks often employ advanced technologies such as position sensitive damping and acceleration sensitive damping to optimize ride performance based on vehicle speed and road conditions. The aftermarket for shock absorbers is a significant contributor to the overall automotive industry, providing replacement parts and engineering solutions for various vehicle models. Aftermarket shock absorbers are designed to meet or exceed original equipment (OE) specifications, ensuring vehicle safety and performance. Inspection and maintenance of shock absorbers are crucial to maintaining vehicle performance and longevity.

Thus, wear and tear, such as leaking hydraulic fluid or a clunking sound, may indicate the need for replacement. Mechanics and automotive technology have advanced significantly, allowing for the development of electronic suspensions and frequency-dependent damping systems that further enhance ride performance. In summary, the automotive aftermarket shock absorber market plays a vital role in ensuring vehicle safety, comfort, and performance. With various designs and applications catering to diverse automotive needs, shock absorbers remain an essential component of the automotive industry. The continuous advancements in automotive technology and the growing demand for improved ride experiences ensure a promising future for this market.

|

Automotive Aftermarket Shock Absorbers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.15% |

|

Market growth 2024-2028 |

USD 1.12 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.89 |

|

Key countries |

US, China, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Aftermarket Shock Absorbers Market Research and Growth Report?

- CAGR of the Automotive Aftermarket Shock Absorbers industry during the forecast period

- Detailed information on factors that will drive the Automotive Aftermarket Shock Absorbers growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive aftermarket shock absorbers market growth of industry companies

We can help! Our analysts can customize this automotive aftermarket shock absorbers market research report to meet your requirements.