Automotive Central Gateway Module Market Size 2024-2028

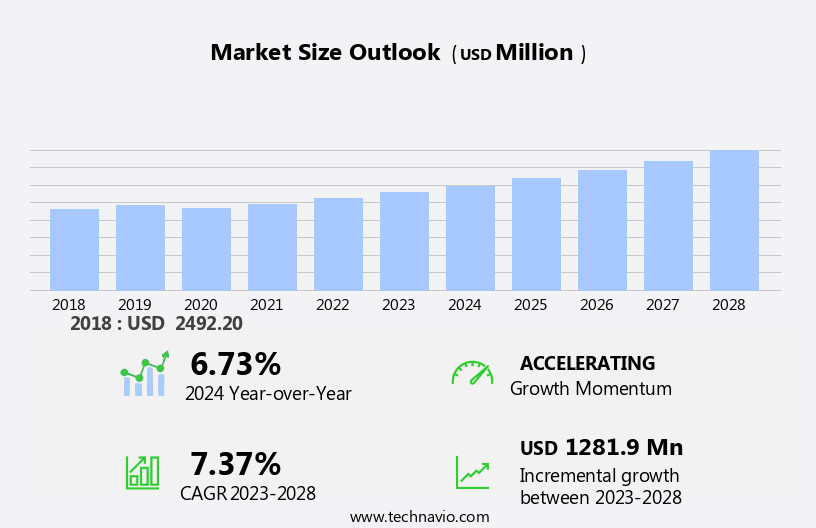

The automotive central gateway module market size is forecast to increase by USD 1.28 billion at a CAGR of 7.37% between 2023 and 2028.

- The automotive central gateway module (CGM) market is witnessing significant growth due to several key factors. One of the primary drivers is the increasing government support to promote the development and adoption of electric vehicles (EVs). Governments worldwide are investing in EV infrastructure and incentives, creating a favorable environment for market growth. Additionally, the development of integrated cybersecurity solutions is another trend In the CGM market. As vehicles become more connected, the need for strong security measures to protect against cyber threats is becoming increasingly important.

- The market's expansion is fueled by the growing demand for vehicle electrification, novel technologies such as artificial intelligence and machine learning, and structural changes In the automotive industry. However, one challenge facing the market is the low consumer awareness toward advanced safety technologies. Despite the benefits of CGMs in enhancing vehicle safety and security, many consumers are not yet fully informed about these technologies. This lack of awareness may inhibit revenue growth In the short term. Overall, the CGM market is poised for growth, driven by government support, cybersecurity solutions, and the increasing adoption of EVs.

What will be the Size of the Automotive Central Gateway Module Market During the Forecast Period?

- The market is experiencing significant growth, driven by the increasing integration of powertrain, safety, comfort, infotainment, and data sharing features in vehicles. Central gateway modules serve as the nerve center of modern vehicles, facilitating communication and control between various systems, including advanced driver assistance, electric powertrains, and infotainment systems. Automotive original equipment manufacturers (OEMs) are investing heavily in central gateway modules to enhance driver convenience, improve vehicle weight and emissions, and offer advanced safety features.

- The market's size is expected to grow substantially due to the increasing adoption of level 2 active safety systems and the integration of robotic efficiency In the manufacturing process. Central gateway modules play a crucial role in enabling seamless data sharing and communication between vehicle components, contributing to revenue growth for OEMs and suppliers alike.

How is this Automotive Central Gateway Module Industry segmented and which is the largest segment?

The automotive central gateway module industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- LIN central gateway module

- CAN central gateway module

- Ethernet central gateway module

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Application Insights

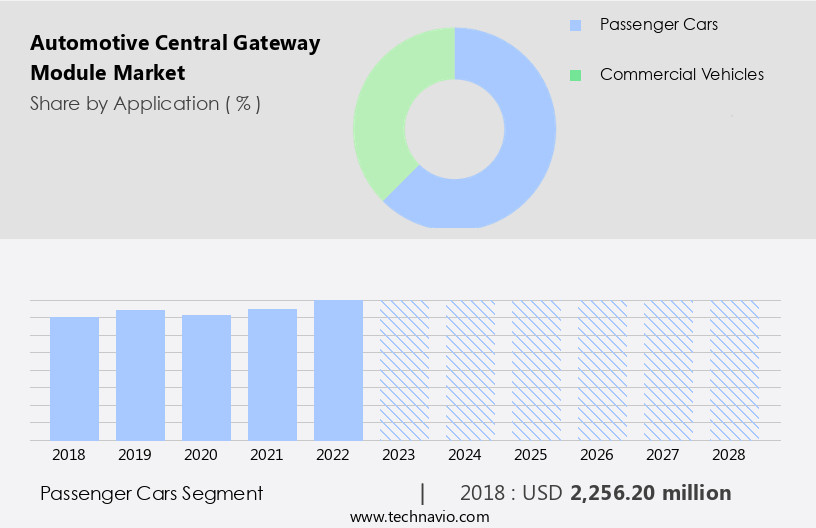

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The automotive central gateway module (CGM) market is experiencing significant growth, particularly In the passenger car segment. Automakers prioritize enhancing vehicle safety and are integrating advanced safety functions that necessitate secure communications. Over the last decade, passenger vehicles have undergone substantial electrification, with the adoption of advanced features in safety, security, propulsion, connectivity, and environmental sustainability. These advancements are driven by escalating consumer expectations, intensifying competition among OEMs to maintain market share, and regulatory demands for enhanced safety, fuel efficiency, and security features. The automotive CGM market's growth is further fueled by the integration of electric vehicles (EVs), telematics, autonomous vehicles, and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication systems.

The market's complexity arises from stringent regulations, low-cost suppliers, and the need for scalability, product innovation, and product features. Novel technologies, such as artificial intelligence (AI) and machine learning, are transforming manufacturing processes, ensuring robotic efficiency, accuracy, and consistency. Despite delays in technology implementation and economic uncertainties, the market's revenue growth is expected to continue, particularly in developing economies and public transport sectors.

Get a glance at the market report of share of various segments Request Free Sample

The passenger cars segment was valued at USD 2.26 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

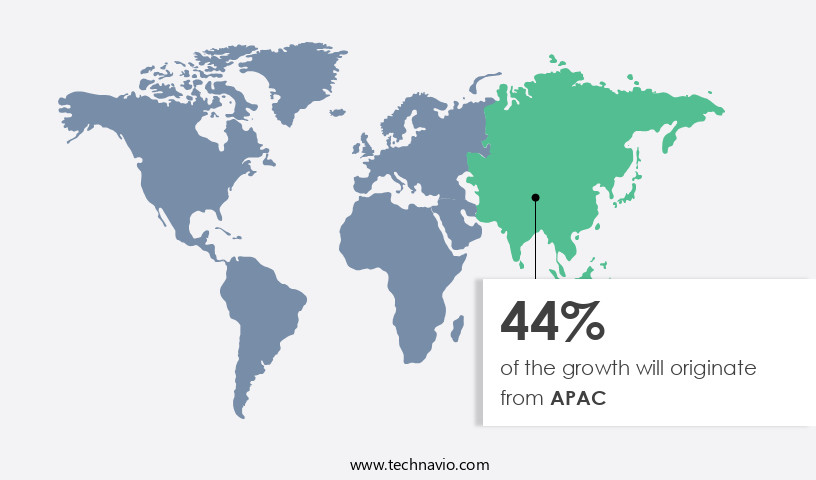

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Automotive Central Gateway Module (CGM) market In the Asia Pacific (APAC) region is projected to experience significant growth during the forecast period. China is a significant market driver and the largest contributor to the APAC automotive CGM market, attributed to the high volume of vehicle adoption. Japan is another key contributor to the demand for automotive CGM. The increasing penetration of luxury vehicles in India and China due to rising disposable income further boosts market growth. Additionally, these countries benefit from a cost advantage due to their proximity to manufacturing plants. Automotive CGMs play a crucial role in managing powertrain, safety, comfort, infotainment, data sharing, communication, control, and driver convenience systems. The integration of advanced driver assistance systems (ADAS), electric vehicles (EVs), telematics, autonomous vehicles, and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technologies in CGMs is driving market growth. The market is segmented into Light Duty Vehicles (LDV) and Heavy Duty Vehicles (HDV). The automotive CGM market faces complex supply chain challenges, intense competition, and fluctuating prices.

However, OEM preferences, revenue growth opportunities in Level 4 autonomous vehicles, and the economic revival post-lockdowns offer significant growth prospects. Developing economies, particularly in APAC, present substantial revenue opportunities due to their large vehicle populations and increasing vehicle electrification. Innovative product features, scalability, inorganic growth strategies, and business roadmaps are essential for market success. Companies must focus on product innovation, process improvements, and distribution to gain a competitive edge. Novel technologies, such as artificial intelligence, machine learning, and manufacturing process improvements, are crucial for enhancing accuracy and consistency. Thus, the APAC automotive CGM market is poised for growth due to the increasing demand for advanced vehicle systems and the cost advantages of manufacturing In the region. Key players must focus on product innovation, process improvements, and distribution to capture market share.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Central Gateway Module Industry?

Increasing government support to promote EVs is the key driver of the market.

- The market is driven by the integration of Powertrain, Safety, Comfort, Infotainment, and Vehicle electrification systems in modern vehicles. Governments worldwide are promoting Electric Vehicles (EVs) due to oil dependency, climate change, and clean air concerns. Incentives such as tax credits, subsidies, and grants are provided to consumers to encourage EV adoption. For instance, in February 2022, the Indian government announced the expansion of public EV charging infrastructure, installing approximately 678 charging stations in 9 major cities. Moreover, the market is witnessing significant advancements in areas like Data sharing, Communication, Control, and Driver convenience through Advanced driver assistance systems (ADAS) and Autonomous vehicles. Novel technologies such as Artificial intelligence (AI) and Machine learning (ML) are being integrated into Infotainment systems for enhanced Product Innovation and Product features. The market's Complex supply chain involves Supplier Bargaining, Intense competition, and Fluctuating prices, with OEMs focusing on Inorganic growth and Business Roadmap to gain a competitive edge.

- The market's subsegments include Vehicle-to-vehicle (V2V) and Vehicle-to-infrastructure (V2I) communication, Telematics, and various levels of Autonomous vehicles. The market's Structural changes include the integration of Raw materials, Components, and Manufacturing process improvements for Robotic efficiency, Accuracy, and Consistency. The market's Scalability is being addressed through Level 2 Active safety systems, Driver assistance, and Level 4 autonomous vehicles, with potential Delays due to Technology and Consumer acceptance. The market's winning strategies include Product folio expansion, Profiles of key players, and Strategic partnerships. Developing economies are also expected to contribute significantly to the market's Revenues, with the Product types and Processes undergoing constant innovation and Distribution improvements.

What are the market trends shaping the Automotive Central Gateway Module Industry?

Development of integrated cybersecurity solutions is the upcoming market trend.

- The Automotive Central Gateway Module (CGM) market is a critical component in addressing cybersecurity concerns in modern vehicles. With the increasing electrification of vehicles and the integration of advanced technologies such as Powertrain, Safety, Comfort, Infotainment, and Autonomous systems, the risk of cyber-attacks has escalated. As a result, OEMs are focusing on implementing strong cybersecurity solutions, including CGMs. These modules enable secure data communication between various vehicle systems and external networks, ensuring driver convenience and advanced driver assistance. Infineon Technologies AG and Argus cyber security's collaboration in 2016 marked a significant milestone In the development of integrated cybersecurity solutions for vehicles.

- Their CGM consists of Infineon's AURIX multicore microcontroller and Argus' Intrusion Detection and Prevention System (IDPS) and remote cloud platform. This collaboration highlights the importance of collaboration between raw material suppliers and component manufacturers to develop cutting-edge solutions for the complex supply chain In the automotive industry. The CGM market's growth is influenced by several factors, including the increasing demand for vehicle electrification, stringent regulations for emissions, and the growing popularity of Infotainment systems. Additionally, the emergence of telematics, vehicle-to-vehicle and vehicle-to-infrastructure communication, and the development of Level 2, 3, and 4 autonomous vehicles are driving the market's revenue growth. Despite the challenges posed by intense competition, fluctuating prices, and supplier bargaining, OEMs continue to invest in CGMs to stay competitive and meet consumers' demands for advanced vehicle features and scalability.

What challenges does the Automotive Central Gateway Module Industry face during its growth?

Low consumer awareness toward advanced safety technologies inhibits revenue growth of CGM is a key challenge affecting the industry growth.

- The Automotive Central Gateway Module (CGM) market is driven by the increasing integration of advanced technologies such as Powertrain, Safety, Comfort, Infotainment, Data sharing, Communication, Control, and Driver convenience in vehicles. These technologies, particularly in Electric Vehicles (EVs), require sophisticated CGMs to support vehicle electrification, telematics, and vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication. However, the market growth is influenced by factors such as stringent regulations on vehicle weight and emissions, the emergence of autonomous vehicles, and the complex supply chain. To cater to the evolving market dynamics, OEMs are focusing on Product Innovation, Scalability, and Inorganic growth through mergers and acquisitions. The market is segmented into Light Duty Vehicles (LDV) and Heavy Duty Vehicles (HDV), with each subsegment undergoing Structural changes due to technological advancements. Novel technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into CGMs to enhance manufacturing process efficiency, robotic efficiency, and accuracy.

- Despite the market's potential, the adoption of advanced driver assistance systems (ADAS) is still limited due to their high cost and the unfamiliarity of consumers with these technologies. To address this, there is a need to increase customer awareness of the benefits of ADAS technologies. Our research indicates that consumers tend to prefer vehicles with advanced safety systems, particularly Level 2 Active safety systems and driver assistance features, when well-informed. The market's future growth is expected to be influenced by factors such as the economic revival, the increasing popularity of public transport, and the expansion of the product folio to include autonomous vehicles. Winning strategies for market players include focusing on cutting-edge technologies, maintaining a strong supplier bargaining position, and ensuring Level 4 autonomous vehicle readiness to cater to the evolving consumer demand.

Exclusive Customer Landscape

The automotive central gateway module market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive central gateway module market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive central gateway module market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Beijing Jingwei Hirain Technologies Co. Inc.

- Continental AG

- DENSO Corp.

- FEV Group GmbH

- Flex Ltd.

- Hitachi Ltd.

- Infineon Technologies AG

- Lear Corp.

- MarkLines Co Ltd.

- MRS Electronic GmbH and Co. KG

- NXP Semiconductors NV

- OMRON Corp.

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- STMicroelectronics International N.V.

- Tata Elxsi Ltd.

- TDK Corp.

- Texas Instruments Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is a critical component of modern vehicles, serving as the nerve center for powertrain control, safety features, comfort, and infotainment systems. This market is characterized by continuous innovation and evolution, driven by consumer demands for advanced driver convenience, vehicle electrification, and data sharing. Central gateway modules enable seamless communication between various vehicle subsystems, including powertrain, safety, and infotainment systems. These modules facilitate vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, enabling advanced features such as autonomous driving, telematics, and real-time traffic updates. The market for central gateway modules is influenced by several factors, including stringent safety regulations, low-cost suppliers, and complex supply chain dynamics. The market is segmented into various subsegments based on product innovation, product features, scalability, and inorganic growth strategies. The emergence of novel technologies, such as artificial intelligence (AI) and machine learning, is driving product innovation In the central gateway module market. These technologies enable advanced driver assistance systems (ADAS) and autonomous driving capabilities, providing consumers with enhanced convenience and safety. The manufacturing process for central gateway modules is undergoing significant changes, with a focus on robotic efficiency, accuracy, and consistency. OEMs are prioritizing product folios that cater to various vehicle segments, including LDVs (light commercial vehicles) and HDVs (heavy commercial vehicles).

The central gateway module market is experiencing intense competition, with manufacturers vying for market share through product innovation, pricing strategies, and business roadmaps. Delays in technology development and economic revival are posing challenges for market growth, particularly in developing economies. The market for central gateway modules is expected to grow significantly In the coming years, driven by revenue growth opportunities In the electric vehicle (EV) segment and the increasing adoption of autonomous vehicles in public transport. The market is also being shaped by structural changes In the automotive industry, including the integration of infotainment systems and the emergence of new business models. Thus, the central gateway module market is a dynamic and evolving market, driven by consumer demands for advanced features, regulatory requirements, and technological innovations. The market is characterized by intense competition, with manufacturers focusing on product innovation, cost competitiveness, and scalability to gain a competitive edge. The market is expected to continue growing, driven by the increasing adoption of electric and autonomous vehicles and the integration of advanced technologies such as AI and machine learning.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.37% |

|

Market growth 2024-2028 |

USD 1.28 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.73 |

|

Key countries |

US, China, Germany, Japan, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Central Gateway Module Market Research and Growth Report?

- CAGR of the Automotive Central Gateway Module industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive central gateway module market growth of industry companies

We can help! Our analysts can customize this automotive central gateway module market research report to meet your requirements.