Microcontroller Market Size 2025-2029

The microcontroller (MCU) market size is forecast to increase by USD 12.67 billion at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing adoption of wireless connectivity in various industries. Industrial IoT applications, such as motor vehicles and industrial automation, are driving the demand for microcontrollers. In the automotive sector, microcontrollers are being used to enhance safety features and improve fuel efficiency in luxury cars and buses. In the healthcare industry, microcontrollers are being integrated into medical devices, telehealth, and wearable technology for remote patient monitoring and data security. Smart home appliances, LED lighting, and consumer electronics are other major sectors contributing to the market growth. The integration of microcontrollers in smartphones and smart home devices is enabling edge computing and artificial intelligence capabilities.

- In the industrial sector, Industry 4.0 and robotics are driving the need for advanced microcontrollers to ensure data security and machine learning capabilities. The development of edge computing and the increasing importance of data security are key trends in the microcontroller market. Edge computing allows data processing to be done closer to the source, reducing latency and improving response times. Data security is crucial to prevent unauthorized access and ensure privacy, especially in industries like healthcare and automotive. However, the manufacturing challenges associated with the production of microcontrollers, such as semiconductor shortages and increasing production costs, may hinder market growth.

What will be the Size of the Microcontroller (MCU) Market During the Forecast Period?

- The market encompasses a wide range of applications, including smart grid systems, automotive sector, medical devices, and telecommunications. In the medical sector, MCUs are utilized in medical care devices, blood glucose meters, and electronic medical records, catering to the needs of immunodeficiency disorders, elderly individuals, and healthcare services. The automotive industry also leverages MCUs for automobiles, enhancing safety features and improving fuel efficiency. Furthermore, MCUs play a crucial role in the development of smart cities, enabling end-node applications, wireless connectivity, and computing power for various devices such as tablets, gaming consoles, televisions, and smartphones, contributing to the Internet of Things revolution. Overall, the market's growth is driven by the demand for smaller, more powerful, and cost-effective solutions in various industries.

How is this Microcontroller (MCU) Industry segmented and which is the largest segment?

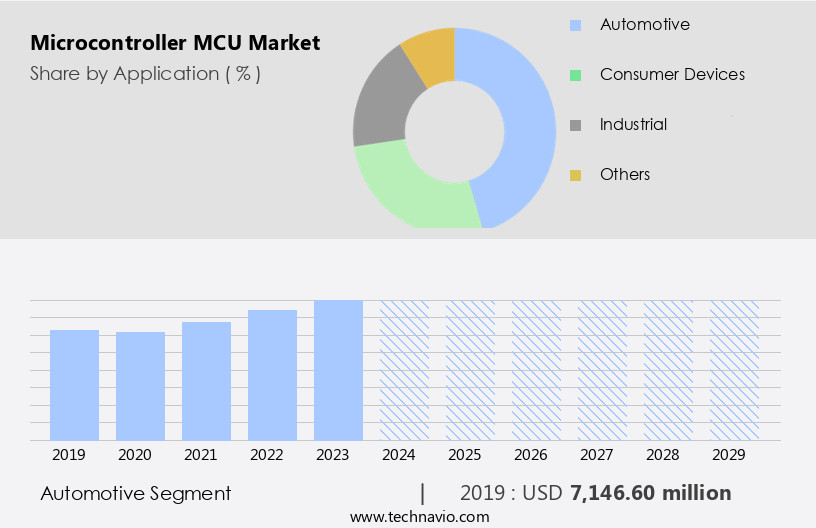

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Automotive

- Consumer devices

- Industrial

- Others

- Product

- 32-bit microcontrollers

- 8-bit microcontrollers

- 16-bit microcontrollers

- Type

- Reduced instruction set computer (RISC)

- Complex instruction set computer (CISC)

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

Microcontrollers (MCUs) play a crucial role in the automotive industry, enabling advanced safety features such as blind-spot detection and collision-avoidance systems. These systems are increasingly important due to rising road accidents and stringent regulations on fuel efficiency and emissions. In addition, automakers are differentiating their offerings through features like gesture and voice recognition. MCUs are integral to these systems, with the number used in automobiles ranging from 25-35 in low-end vehicles to over 100 in high-end luxury cars. The healthcare sector also relies heavily on MCUs for medical devices and services, including those for immunodeficiency disorders, elderly individuals, and medical care devices like blood pressure and sugar level monitors.

MCUs are also integral to smart grid systems and the telecommunications sector, powering IoT applications, home appliances, security systems, and consumer electronics like tablets, gaming consoles, televisions, and smartphones. MCUs are also used in industrial equipment, cameras, and robots, as well as in semiconductor manufacturing and autonomous vehicles. With the integration of artificial intelligence, machine learning, and wireless connectivity, MCUs are becoming more powerful and versatile, enabling on-device AI and privacy protection. MCUs are essential for smart cities, factories, and various end-node applications, providing computing power, sensors, and wireless connectivity.

Get a glance at the market report of share of various segments Request Free Sample

The Automotive segment was valued at USD 7.15 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 67% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is significantly driven by industries in the Asia Pacific (APAC) region, particularly consumer electronics, automotive, healthcare, and industrial sectors. APAC's dominance is attributed to the presence of numerous OEMs, ODMs, semiconductor foundries, outsourced assembly and test companies, and fabless semiconductor firms. The region's abundant raw materials and relatively low establishment and labor costs make it an attractive destination for companies to establish production centers. Top companies are expanding their manufacturing presence in APAC to cater to the increasing demand for MCUs. Moreover, governments in developing countries, such as India, are taking initiatives to establish electronics manufacturing bases, further boosting market growth.

MCUs play a crucial role in various applications, including smart grid systems, medical devices, home appliances, security systems, and IoT endnodes. They integrate computing power, sensors, wireless connectivity, and AI algorithms to power innovative products in the telecommunications, automotive, medical, and consumer electronics sectors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Microcontroller (MCU) Industry?

Increasing use of microcontrollers in automobiles is the key driver of the market.

- Microcontrollers (MCUs) play a crucial role in various sectors, including the automotive industry and healthcare services. In the automotive sector, MCUs manage functions such as fuel efficiency, powertrain control, and advanced safety features in vehicles. Furthermore, MCUs enable additional features in automobiles, such as voice control and capacitive touch sensing. In the healthcare sector, MCUs are used in medical devices, including blood glucose meters and electronic medical records systems. For example, MCUs in blood glucose meters help monitor sugar levels for individuals with immunodeficiency disorders and elderly individuals.

- In healthcare services, MCUs in medical care devices ensure accurate readings and data transmission. The telecommunications sector also utilizes MCUs in innovative products such as tablets, gaming consoles, televisions, smartphones, and Internet of Things (IoT) endnode applications. MCUs provide computing power, wireless connectivity, and sensors for these devices, enabling advanced features such as AI algorithms, machine learning, and privacy protection. Moreover, MCUs are used in industrial applications, including robotics, industrial equipment, cameras, and semiconductor manufacturing.

What are the market trends shaping the Microcontroller (MCU) Industry?

Development of edge computing is the upcoming market trend.

- Edge computing, which involves performing computing applications near the source of data generation instead of distant data centers, is gaining traction in IoT networks. This approach enhances network operations and process speed by focusing on the proximity of data analysis processes to the data source. In IoT systems, microcontrollers play a crucial role in edge computing as they enable devices to collect and analyze data or transmit it to the nearest server for analysis, resulting in quicker data retrieval and application compared to traditional cloud networks. The healthcare sector, particularly in medical devices, is a significant market for edge computing and microcontrollers.

- These include smart medical devices such as blood glucose meters, electronic medical records, and telehealth systems. The automotive sector also utilizes microcontrollers in edge computing for applications like sensor-driven safety features, autonomous vehicles, and infotainment systems. Additionally, the industrial sector, telecommunications, and home appliances sectors are adopting edge computing and microcontrollers for IoT applications, including security systems, tablets, gaming consoles, televisions, smartphones, and industrial equipment. The increasing deployment of AI algorithms, machine learning, and wireless connectivity in edge computing devices further boosts the demand for microcontrollers.

What challenges does the Microcontroller (MCU) Industry face during its growth?

Manufacturing challenge is a key challenge affecting the industry growth.

- Microcontrollers (MCUs) play a pivotal role in powering advanced technologies across various sectors, including smart grid systems, automotive, medical, and telecommunications. In the medical sector, MCUs are utilized in medical devices, such as blood pressure monitors and blood glucose meters, to ensure accurate readings and wireless connectivity. The automotive industry incorporates MCUs in immunodeficiency disorder management systems for elderly individuals, electronic medical records, and sensor-driven safety features in motor vehicles. The telecommunications sector relies on MCUs for powering innovative IoT microcontrollers in smart meters, home appliances, security systems, tablets, gaming consoles, televisions, and smartphones. MCUs enable artificial intelligence (AI) algorithms, machine learning, and wireless connectivity in these devices, enhancing their functionality and performance.

- In the industrial sector, MCUs are crucial for industrial IoT communication, robotics, industrial equipment, cameras, and semiconductor manufacturing. The increasing wafer diameter and the integration of advanced components, such as ECUs and on-device AI, necessitate shorter design-to-production and time-to-market cycles. However, this complexity also increases the criticality of the design and production phases, as defects found during verification can significantly impact production and incur substantial costs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Analog Devices Inc.: The company offers microcontroller units for Internet of Things processing applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Analog Devices Inc.

- Arm Ltd.

- Arrow Electronics Inc.

- Fujitsu Ltd.

- Infineon Technologies AG

- Intel Corp.

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Panasonic Holdings Corp.

- Parallax Inc.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Silicon Laboratories Inc.

- STMicroelectronics NV

- TE Connectivity Ltd.

- Texas Instruments Inc.

- Toshiba Corp.

- Yamaichi Electronics Co. Ltd.

- Zilog Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant growth due to the increasing demand for smart technologies in various sectors. One of the primary drivers of this growth is the integration of MCUs in smart grid systems. These systems are essential for managing the distribution and consumption of electricity efficiently and reliably. MCUs play a crucial role in this context by enabling real-time monitoring and control of power distribution and consumption. Another sector that is witnessing a rise in MCU adoption is the automotive industry. MCUs are increasingly being used in the development of advanced driver-assistance systems (ADAS) and autonomous vehicles. These systems rely heavily on sensors and wireless connectivity to gather data and make real-time decisions.

Moreover, MCUs are the brains behind these systems, processing data from various sensors and enabling seamless communication between different components. The healthcare sector is another area where MCUs are gaining popularity. MCUs are being used in the development of medical devices, such as blood pressure monitors and blood glucose meters. These devices are essential for monitoring the health of individuals with immunodeficiency disorders and elderly individuals. MCUs enable the integration of advanced features, such as artificial intelligence (AI) algorithms and machine learning, into these devices, making them more effective and user-friendly. The telecommunications sector is another major consumer of MCUs.

Furthermore, the Internet of Things (IoT) revolution has led to an explosion in the number of end-node applications, from home appliances to security systems. MCUs are the heart of these applications, providing the necessary computing power and wireless connectivity to enable seamless communication and data processing. MCUs are also finding applications in the development of innovative products in various sectors. For instance, in the consumer electronics sector, MCUs are being used in tablets, gaming consoles, televisions, and smartphones. In the industrial sector, MCUs are being used in robots, industrial equipment, and cameras. MCUs are also playing a crucial role in the development of semiconductor manufacturing, with wafer diameter increasing and MCUs becoming more complex.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 12.67 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.3 |

|

Key countries |

Japan, US, India, South Korea, Australia, UK, China, Germany, France, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Microcontroller (MCU) Market Research and Growth Report?

- CAGR of the Microcontroller (MCU) industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the microcontroller (MCU) market growth of industry companies

We can help! Our analysts can customize this microcontroller (MCU) market research report to meet your requirements.