Automotive Seat Belt Sensor Market Size 2023-2027

The Automotive Seat Belt Sensor Market size of the market is forecast to increase by 44.26 million units, at a CAGR of 3.78% between 2022 and 2027. The Automotive Seat Belt Sensor market is experiencing significant growth due to several influential factors. Primarily, the emphasis on enhancing occupant safety throughout the automotive value chain is driving market expansion. Additionally, government initiatives aimed at regulating seat belts and reducing accidents further boost market growth. Seat Belt Reminders (SBRs), which are integrated with seat belt sensors, significantly impact the New Car Assessment Program (NCAP) star rating system, making them a favorable addition to modern vehicles. Consequently, the market for automotive seat belt sensors is poised for continued expansion as safety regulations become increasingly stringent and consumer demand for advanced safety features heightens.

What will the Size of the Automotive Seat Belt Sensor Market be During the Forecast Period?

To learn more about this report, Download Report Sample

Market Dynamics

Ensuring road safety remains a paramount concern, especially with strict laws and safety regulations governing automotive seat belts and vehicle restraint systems. Advances in Advanced Driver Assistance Systems and autonomous driving technologies like Electronic Stability Control, Collision Avoidance Systems, and Autonomous Emergency Braking enhance safety measures in passenger vehicles, SUVs, crossovers, trucks, and buses. Engineering excellence drives safety innovation with adaptive restraint systems and technologically advanced inflatable seat belts, crucial for mitigating injuries in road accidents. Compliance with regulatory standards and certification processes ensures vehicle electrification and autonomous vehicles meet stringent safety requirements. Privacy and data security in IoT connectivity and cloud-based platforms for vehicle control units enable over-the-air updates and personalization, supporting luxury vehicles and fleet expansion. Vigilance against counterfeit and non-compliant seat belts underscores the importance of sourcing from reputable OEMs and aftermarket suppliers to combat street trading activity and safeguard public safety.

Key Market Driver

The market growth is being propelled by the increasing focus on improving occupant safety throughout the value chain. Passenger safety has become a primary concern for players across the automotive industry, leading to the adoption of both passive and active safety systems. To reduce the impact of accidents, automobile manufacturers are integrating passive safety systems with active safety systems, including seat belts, seat belt sensors, seat belt lock engagement, and side airbags.

Moreover, this emphasis on safety systems has resulted in double-digit growth rates in the overall automotive safety systems market, as evidenced by the weightage scale for the EU NCAP rating in recent years. As a result, seat belts, seat belt sensors, airbags, and other enhancements such as active seat belts are expected to become increasingly important fitments in vehicles, driving market growth in the forecast period.

Key Market Trend

The key trend driving the growth of the automotive seat belt sensor market is the increased adoption of low-cost, compact vehicles, and commercial vehicles (CVs). The need for enhanced safety features has increased across all automotive segments, including low-cost and compact automotive segments, due to regulatory mandates and consumer demand. Technavio predicts that there will be a significant surge in demand for automotive seat belt sensors in low-cost and compact vehicles during the forecast period, especially in developed regions. The adoption of seat belt sensors in CVs is expected to increase due to growing concerns about road fatalities and awareness among consumers for safety features.

Key Market Challenge

The major challenge impeding the growth of the market is the malfunctioning of seat belt sensors. Accurate tuning of the system is essential to avoid false-positive alarms and prevent unwanted activation of pretensions or tightening of seat belts when not required. Seat belt sensor manufacturers need to be aware of such consequences to deliver products that meet user expectations and prevent occasional faults that can negatively impact the acceptance and adoption of the system.

Key Automotive Seat Belt Sensor Market Customer Landscape

The market report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Global Automotive Seat Belt Sensor Market Customer Landscape

Who are the Major Automotive Seat Belt Sensor Market Vendors?

Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ZF Friedrichshafen AG - The company offers an active control retractor (ACR8) which provides occupant protection with reversible seat belt pre-tensioning. Through the active safety system segment, the company offers the development and production of steering and braking systems for the automotive industry. Additionally, the company offers chassis systems and components.

The automotive seat belt sensor market report also includes detailed analyses of the competitive landscape of the market and information about 15 market vendors, including:

- Amber Valley Developments LLP

- Amphenol Corp.

- Aptiv

- CTS Corp.

- Hesham Industrial Solutions

- IEE International Electronics and Engineering S.A.

- InterMotive Inc.

- Littelfuse Inc.

- Lockliv Holdings Pty Ltd.

- Olea Systems Inc.

- Reed Relays and Electronics India Ltd.

- Securon (Amersham) LTD

- Standex Electronics Inc.

- TE Connectivity Ltd.

- Wenzhou Far Europe Automobile Safety System Co. Ltd.

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

What is the Fastest-Growing Segment in the Automotive Seat Belt Sensor Market?

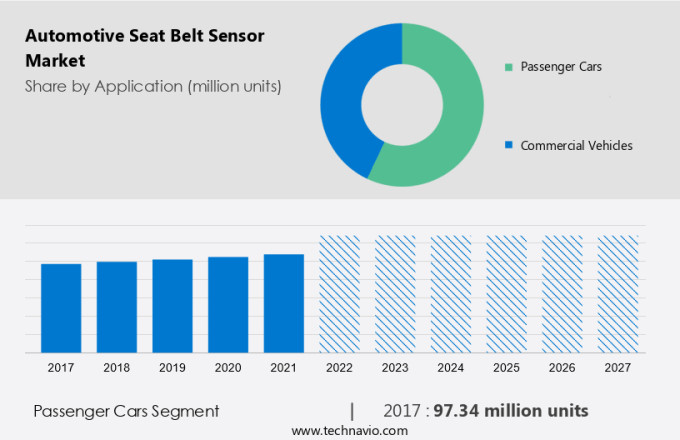

By Application

Based on application, the market is segmented into passenger cars and commercial vehicles. The market share growth by the passenger cars segment will be significant during the forecast period. The penetration of passenger cars is expected to grow steadily, and the adoption of seat belt sensors in these vehicles will drive this market during the forecast period. The passenger cars segment is expected to record higher growth than the commercial vehicles segment during the forecast period. Rapid electrification in passenger cars resulted in the adoption of new technologies that increased the comfort and safety of drivers. Seat belt sensors were earlier limited to luxury cars and later entered mid-segment vehicles over the last few years, thereby resulting in an increase in volume. Additionally, the NCAP star rating is motivating manufacturers to equip safety features in passenger cars.

Get a glance at the market contribution of various segments Request a PDF Sample

The passenger car segment shows a gradual increase in the market share of 97.34 million units in 2017 and will continue to grow by 2021. The rising adoption of premium vehicles is crucial for the market because they contribute high revenue owing to the adoption of advanced safety features in the vehicles. The customer pays the premium price for the added benefits, which boost his or her social status, comfort, and safety. Moreover, the increase in disposable incomes is fueling the adoption of luxury cars. Hence, the increased penetration of luxury cars will push revenue growth for the global passenger car seat belt sensor market during the forecast period.

Which are the Key Regions for the Automotive Seat Belt Sensor Market?

For more insights on the market share of various regions Request PDF Sample now!

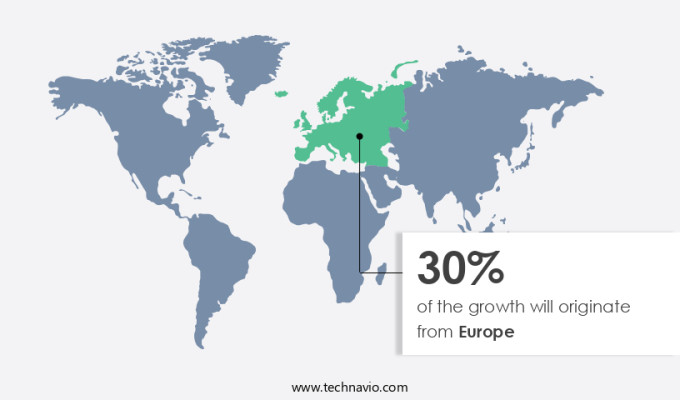

Europe is projected to contribute 30% by 2023. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The rapid penetration of seat belt sensors in Europe, owing to the region's car market standardizing the product in several car variants, will make Europe one of the leading contributors. Further, Europe is home to several high-end passenger cars, such as Mercedes and accounts for the top leaders in cars equipped with seat belt sensor systems. With improving car sales in the Eurozone and increased traction among the OEMs in equipping vehicles with seat belt sensor systems, we expect business prospects for the uptake of such systems to improve during the forecast period.

Following the outbreak of COVID-19, Europe's automobile industry faced widespread production losses, as factories were shut down as per the lockdown protocols. However, in 2021, with the marked decline in the number of COVID-19 cases following the rising vaccination rate, players in the European automobile industry restarted their investment and production activities in the region. This has positively impacted the sales of various automobile players. Thus, the growth in automobile sales, new product launches, the electrification of vehicles, and government initiatives for electric vehicles will drive the use of seat belts and, in turn, automotive seat belt sensors during the forecast period.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Million" for the period 2023 to 2027, as well as historical data from 2017 to 2022 for the following segments.

- Application Outlook

- Passenger cars

- Commercial vehicles

- Type Outlook

- Two-point seat belt

- Three-point seat belt

- Four-point seat belt

- Region Outlook

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- North America

- The U.S.

- Canada

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- Europe

You may also interested in below market reports:

1. Automotive Active Seat Belt System Market Analysis APAC, Europe, North America, Middle East and Africa, South America - China, US, Germany, Japan, UK - Size and Forecast

2. Automotive Passive Safety System Market Analysis APAC, Europe, North America, Middle East and Africa, South America - US, China, Japan, Germany, UK - Size and Forecast

3. Automotive Active Safety System Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Germany, Japan, UK - Size and Forecast

Market Analyst Overview

In the automotive industry, seat belt sensors are integral components of advanced safety technologies aimed at enhancing vehicle occupant protection. From sedans to hatchbacks and vans, various vehicle types employ two-point, three-point, and even four-point safety belts to secure passengers during travel. Despite advancements, challenges like counterfeit seat belts and faulty seat belts in the aftermarket segment pose significant safety risks, emphasizing the importance of sourcing from reputable OEMs. Vehicle crash speed is a critical factor influencing the effectiveness of vehicle restraint systems, where occupant detection technologies utilize artificial intelligence and machine learning for precise response mechanisms. Internet of Things (IoT) connectivity enables service providers to monitor and optimize seat belt performance, ensuring compliance and functionality. Innovations such as five-point seat belts further enhance safety standards, particularly in light commercial vehicles and heavy commercial vehicles, where vehicle ownership and safety remain top priorities for automakers and consumers alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

163 |

|

Base year |

2022 |

|

Historic period |

2017 - 2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.78% |

|

Market growth 2023-2027 |

44.26 million |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023(%) |

3.49 |

|

Regional analysis |

Europe, APAC, North America, South America, and Middle East and Africa |

|

Performing market contribution |

Europe at 30% |

|

Key countries |

US, China, Japan, India, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Allegro MicroSystems Inc., Amber Valley Developments LLP, Amphenol Corp., Aptiv, CTS Corp., Hesham Industrial Solutions, IEE International Electronics and Engineering S.A., InterMotive Inc., Littelfuse Inc., Lockliv Holdings Pty Ltd., Olea Systems Inc., Reed Relays and Electronics India Ltd., Securon (Amersham) LTD, Standex Electronics Inc., TE Connectivity Ltd., Wenzhou Far Europe Automobile Safety System Co. Ltd., and ZF Friedrichshafen AG |

|

Market dynamics |

Parent market analysis, Market forecasting growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market's competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch