Automotive Active Safety System Market Size 2024-2028

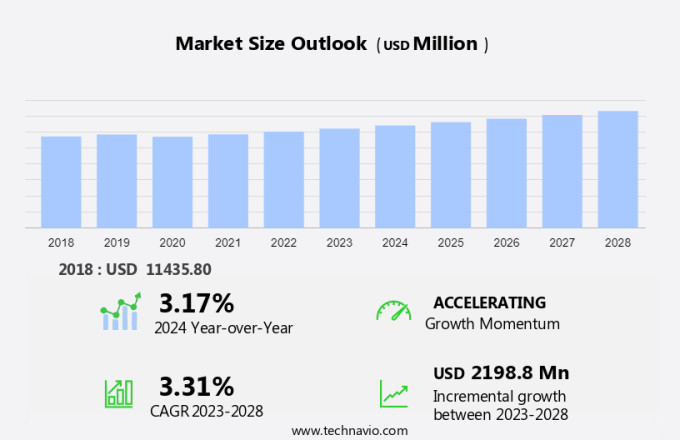

The automotive active safety system market size is forecast to increase by USD 2.20 billion at a CAGR of 3.31% between 2023 and 2028.

- The market is experiencing significant growth due to increasing safety concerns among consumers and the development of advanced AI-enabled Advanced Driver-Assistance Systems (ADAS) solutions. However, the market is facing challenges such as the slowdown in automobile manufacturing, which may hinder its growth. Despite these restraints, there are numerous opportunities for investment in this market, particularly in the development of next-generation ADAS technologies.

- The market is expected to witness continued growth as the demand for advanced safety features in vehicles increases. Technological improvements in active safety systems, such as ultrasonic sensors, are enabling vehicles to detect potential collisions and take corrective measures to prevent accidents. The report provides a comprehensive analysis of the market trends, growth drivers, challenges, and investment pockets to help businesses make informed decisions in the market.

What will the Automotive Active Safety System Market Size be during the forecast period?

- The automotive active safety systems market is witnessing significant growth due to several factors. Traffic congestion and the increasing number of road accidents continue to be major concerns in the automobiles industry. As a result, there is a rising demand for advanced safety features that can mitigate the risks associated with driving. Urbanization and the increasing popularity of driverless and connected cars are also driving the growth of the automotive active safety systems market. With the advent of high-speed vehicles and long-distance travel becoming more common, the need for reliable safety systems is more critical than ever. These systems can identify obstacles, pedestrians, and other vehicles in real-time, providing drivers with ample warning and allowing them to react accordingly. Moreover, shifting customer tastes are favoring vehicles with advanced safety features. Consumers are increasingly looking for vehicles that offer enhanced safety and convenience, particularly for road trips and long-distance travel. Environmental concerns are also playing a role in the growth of the automotive active safety systems market.

- With governments and regulatory bodies imposing stricter emissions norms, automakers are focusing on developing safety systems that can reduce the carbon footprint of vehicles. Connected vehicles and telematics are other key trends in the automotive active safety systems market. These technologies enable real-time communication between vehicles and the outside world, allowing for more accurate and timely responses to potential hazards. In conclusion, the automotive active safety systems market is poised for steady growth due to the increasing demand for advanced safety features, urbanization, technological improvements, shifting customer preferences, and environmental concerns. The market is expected to witness significant growth in the coming years as automakers continue to invest in developing safer and more connected vehicles.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Safety And Signaling System

- Anti-lock braking system

- Lane departure warning system

- Electronic stability control

- Adaptive cruise control

- Automatic emergency braking and others

- Vehicle Type

- Passenger cars

- Commercial vehicles

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Safety And Signaling System Insights

- The anti-lock braking system segment is estimated to witness significant growth during the forecast period.

Anti-lock braking system (ABS) prevents the wheels of the vehicle from locking during hard braking. As a result, stability is maintained after hard braking and braking distances are shortened. The device thus increases the vehicle and driver protection index. Additionally, the development of ABS has reduced weight and size, making it easier to integrate with the vehicle's other security features.

Further, ABS is widely used in passenger cars and commercial vehicles. It is an expensive unit. However, it offers the safety benefits required in the automotive sector. Also, the increasing implementation of electronic content in automobiles has contributed to the adoption of ABS as it is also an electronic device. Traditional mechanical parts, such as the fuel injection system, have been replaced with more efficient electronic fuel injection. Hence, these factors drive the growth of the segment during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

The anti-lock braking system segment was valued at USD 5.45 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

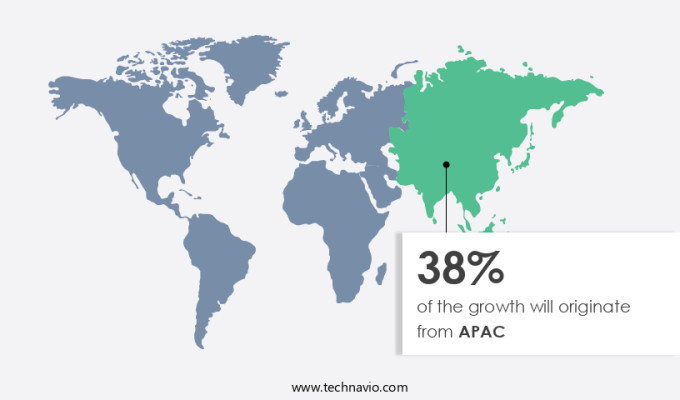

- APAC is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In the automobile industry, safety has emerged as a top priority for consumers in developed regions like Europe and the United States. Meanwhile, the focus on automotive safety is gaining traction in Asia Pacific countries, such as China, which previously prioritized fuel economy, low maintenance costs, and affordable pricing. This shift in consumer preferences is significant as these markets represent high growth potential for the automotive sector. With the increasing awareness of vehicle safety, the demand for active safety systems, including seatbelts and headrests, is expected to swell in the region. The economic expansion in emerging economies like China and India is anticipated to generate ample opportunities for the passenger car market, thereby boosting the demand for advanced safety features.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Automotive Active Safety System Market?

Increase in safety concerns is the key driver of the market.

- In the global context, the utilization of automobiles has experienced significant growth. Individuals are employing vehicles for extended trips, thereby increasing the average distance commuted by passengers. Road transportation is poised to remain a significant means of transportation in the upcoming years. However, mobility comes with challenges such as environmental concerns, sustainability, and safety issues. Over the past decade, the automotive sector has been proactively addressing road safety concerns by implementing measures to prevent accidents and minimize injuries. A primary focus of these efforts has been on drivers, as human error is a leading cause of accidents. Active safety systems, a technological advancement, have proven effective in accident prevention by alerting drivers to potential hazards before they materialize.

What are the market trends shaping the Automotive Active Safety System Market?

Growing development of AI-enabled ADAS solutions is the upcoming trend in the market.

- In the automotive industry, there is a growing emphasis on advanced safety systems that cater to customer needs and provide personalized solutions in a connected environment. Artificial Intelligence (AI) technology is increasingly being adopted in Advanced Driver-Assistance Systems (ADAS) due to the rising demand to mimic human cognitive functions. AI-based ADAS solutions continuously learn from their surroundings, improving their ability to detect and recognize objects around the vehicle. These systems consume less power and reduce the development time of ADAS, making them an attractive investment for prominent manufacturers. The integration of AI in ADAS significantly enhances their capabilities, enabling vehicles to better comprehend and react to their environment.

What challenges does Automotive Active Safety System Market face during the growth?

Slowdown in automobile manufacturing is a key challenge affecting market growth.

- The automotive industry in the United States is currently experiencing production challenges due to various factors, including the semiconductor chip shortage, supply chain disruptions, and the ongoing COVID-19 pandemic. These issues are expected to significantly impact the active safety system market during the forecast period. One of the primary concerns for both the automotive industry and the active safety system market is the uncertainty surrounding the availability of essential components, such as semiconductor chips. The persistent chip shortage has resulted in production delays and decreased output, potentially hindering the installation of active safety systems in new vehicles. Young customers in the US market are increasingly demanding advanced safety features for their high-speed vehicles.

- Blind spot detection, lane keep assist, and anti-roll braking systems are among the most sought-after active safety technologies. These systems enhance safety and provide peace of mind for drivers during long-distance travel. As the automotive industry navigates production challenges, the demand for these advanced safety features is expected to remain strong. Automotive active safety systems play a crucial role in ensuring passenger safety in high-speed vehicles. Blind spot detection systems alert drivers to vehicles in their blind spots, reducing the risk of collisions. Lane keep assist systems help drivers maintain their vehicles in their lanes, reducing the likelihood of lane departure accidents.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aptiv Plc

- Autoliv Inc.

- Continental AG

- DENSO Corp.

- Faurecia SE

- Infineon Technologies AG

- Joyson Safety Systems Aschaffenburg GmbH

- Knorr Bremse AG

- Lear Corp.

- Magna International Inc.

- Mobileye Technologies Ltd.

- Ningbo Jifeng Auto Parts Co. Ltd.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- TomTom NV

- Toyoda Gosei Co. Ltd.

- Valeo SA

- Veoneer Inc.

- Visteon Corp.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for vehicle safety systems in the automobiles industry. Traffic congestion and urbanization have led to an increase in road accidents, making safety a top priority for automobile manufacturers. Advanced safety features such as blind spot detection, lane keep assist, and anti-roll braking systems are gaining popularity among buyers, especially young customers who prefer long distance travel and high-speed vehicles. Market trends include the development of driverless and connected cars, which rely heavily on sensor technology, including lidar, radar, cameras, and ultrasonic sensors. Technological improvements in machine learning and artificial intelligence (AI) are also driving market growth.

Additionally, key drivers include shifting customer tastes towards safer vehicles and regulatory requirements for advanced safety features. However, the market faces certain restraints, including high production costs and competitive intensity among suppliers. Opportunities exist in the development of new safety technologies and the increasing demand for autonomous and connected vehicles. The market is expected to witness significant growth in the coming years, with investment pockets in telematics, environmental concerns, and the integration of safety systems with infotainment and navigation systems.

Further, the market is rapidly growing, driven by innovations in driverless & connected cars and autonomous vehicles. Advanced Driver Assistance Systems (ADAS) play a critical role, with technologies like Lane Departure Warning System (LDWS), Electronic Stability Control (ESC), and Tire Pressure Monitoring System (TPMS) enhancing vehicle safety. These systems work in tandem to improve driver and pedestrian safety, preventing accidents through early detection and intervention. The headrest technology, integrated with active safety systems, helps minimize whiplash injuries during collisions. As the demand for passenger and commercial vehicles rises, passenger & vehicle safety solutions are increasingly prioritized in the European automotive active safety systems market, ensuring better protection for all road users.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.31% |

|

Market growth 2024-2028 |

USD 2.20 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.17 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch