Bcl-2 (B-Cell Lymphoma 2) Inhibitors Market Size 2024-2028

The BCL-2 (b-cell lymphoma 2) inhibitors market size is forecast to increase by USD 2.29 billion, at a CAGR of 15.2% between 2023 and 2028.

- The BCL-2 Inhibitors Market is witnessing significant growth, driven by the rising geriatric population worldwide. The aging demographic is more susceptible to various forms of cancer, including B-cell lymphoma, thereby fueling the demand for effective treatment options. Another key trend influencing the market is the increase in the number of patient assistance programs. These initiatives aim to make these life-saving treatments more accessible and affordable to patients, thereby expanding the market's reach. However, the market faces challenges as well. The availability of substitutes, including generic drugs and alternative treatment modalities, poses a significant threat to market growth.

- These alternatives offer cost advantages and, in some cases, comparable efficacy, making it essential for market players to differentiate themselves through innovative offerings and value-added services. To capitalize on opportunities and navigate challenges effectively, companies must focus on developing novel therapeutic approaches, enhancing patient support programs, and collaborating with key stakeholders to expand their market presence.

What will be the Size of the BCL-2 (B-Cell Lymphoma 2) Inhibitors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

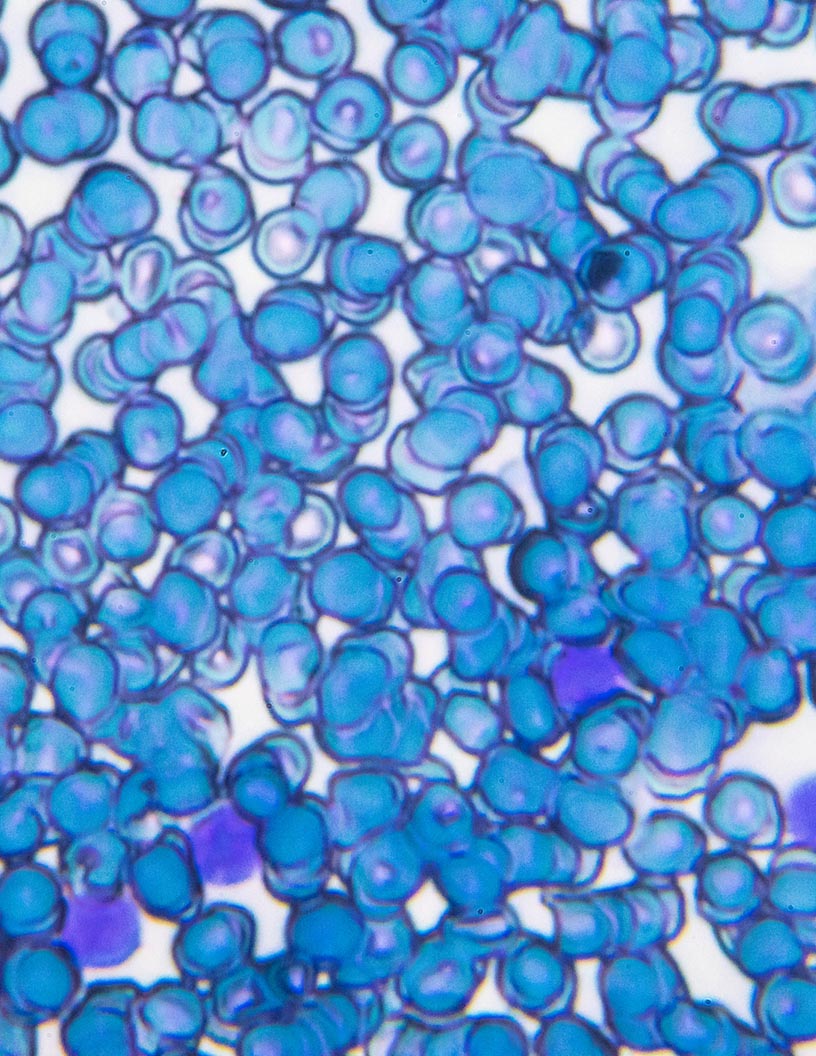

The BCL-2 inhibitor market continues to evolve, driven by ongoing research and development in cancer therapy. These small molecule inhibitors target the BCL-2 protein, a key regulator of apoptosis, or programmed cell death. The application of BCL-2 inhibitors extends beyond hematological malignancies, with potential in solid tumors and radiation therapy. Synergistic effects have been observed when combining BCL-2 inhibitors with other therapies, such as precision oncology and targeted therapy. Intellectual property and clinical trials play a significant role in the market dynamics. Companies invest heavily in research and development, seeking to secure patents and regulatory approvals for their innovative drugs.

FDA approval and EMA approval are crucial milestones, enabling market access and commercialization. Clinical outcomes are a key focus, with response rates, progression-free survival, and overall survival closely monitored. Drug development involves rigorous clinical pharmacology studies to optimize dosing and minimize drug interactions. Personalized medicine approaches are increasingly being adopted, tailoring treatments to individual patients based on their genetic makeup and clinical characteristics. Market access and pricing strategies are also important considerations. Patient management and regulatory approval processes can impact market penetration and profitability. Drug resistance and mechanisms of action are ongoing areas of research, as cancer cells develop new ways to evade treatment.

Monoclonal antibodies and immune checkpoint inhibitors represent other emerging trends in cancer therapy. The interplay between these various approaches and BCL-2 inhibitors is an area of active research, with potential for significant synergies and improved patient outcomes. The continuous unfolding of market activities and evolving patterns underscores the dynamic nature of the BCL-2 inhibitor market.

How is this BCL-2 (B-Cell Lymphoma 2) Inhibitors Industry segmented?

The BCL-2 (b-cell lymphoma 2) inhibitors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Combination therapy

- Monotherapy

- Type

- Diffuse large B-cell lymphoma (DLBCL)

- Follicular lymphoma

- Chronic lymphocytic leukemia

- Mantle cell lymphoma (MCL)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Rest of World (ROW)

- North America

.

By Product Insights

The combination therapy segment is estimated to witness significant growth during the forecast period.

The BCL-2 inhibitors market encompasses the use of small molecule inhibitors in the treatment of various types of cancer, with a significant focus on hematological malignancies and solid tumors. Patient advocacy plays a crucial role in driving research and development in this field. Drug metabolism and precision oncology are essential aspects of BCL-2 inhibitor therapy, ensuring optimal clinical outcomes. Radiation therapy and synergistic effects with other treatments, such as combination therapies, are also gaining prominence. Venetoclax and navitoclax, in combination with other cancer drugs like rituximab, azacitidine, decitabine, cytarabine, and obinutuzumab, have shown high efficacy and tolerability. The mechanism of action for BCL-2 inhibitors lies in their ability to disrupt the BCL-2 protein, inhibiting the survival of cancer cells.

Combination therapies have become increasingly popular due to their potential to eliminate cancer cells more effectively than monotherapy. Monotherapy drugs target cancer cells at different stages of the cell cycle, but combination therapy increases the likelihood of complete elimination. The combination therapy segment was the largest in the global BCL-2 inhibitors market in 2023, fueled by the label expansion of venetoclax and the advantages of combination therapy over monotherapy. Quality of life and intellectual property are essential considerations in the development and market access of BCL-2 inhibitors. Clinical trials and regulatory approval processes are ongoing to assess safety, efficacy, and pricing strategies for these treatments.

Personalized medicine and drug interactions are also crucial factors in the successful implementation of BCL-2 inhibitor therapies. Targeted therapy, response rates, progression-free survival, and overall survival are key clinical outcomes that are closely monitored in the development and implementation of BCL-2 inhibitors. Target validation and the emergence of drug resistance are ongoing challenges in the field. Multiple myeloma and other hematological malignancies have shown significant response rates to BCL-2 inhibitor therapies, leading to improved survival rates. Immune checkpoint inhibitors have shown synergistic effects when used in combination with BCL-2 inhibitors, offering new possibilities for cancer therapy. Monoclonal antibodies and healthcare costs are also important considerations in the BCL-2 inhibitors market.

The market's evolution is shaped by ongoing research, drug development, clinical pharmacology, and regulatory approval processes.

The Combination therapy segment was valued at USD 1.09 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The BCL-2 inhibitor market in the US is experiencing significant growth, fueled by recent regulatory approvals and the high unmet need for new treatment options in hematological malignancies, particularly myelodysplastic syndromes (MDS). One notable development is the US Food and Drug Administration (FDA) granting Breakthrough Therapy Designation (BTD) to Venclexta (venetoclax) in combination with azacitidine in 2021. This designation encourages companies to further investigate the potential of this combination for other diseases. Venetoclax, jointly developed and commercialized by AbbVie and Roche in the US, and AbbVie outside the US, targets the Bcl-2 protein, which plays a crucial role in cancer cell survival.

The US sees approximately 10,000 new MDS diagnoses annually, necessitating innovative therapies to improve patient outcomes. Additionally, the integration of precision oncology and personalized medicine in cancer therapy, as well as the exploration of synergistic effects and combination therapies, contribute to the market's evolution. Intellectual property protections and clinical trial successes further bolster market growth. However, drug development challenges, drug interactions, and healthcare costs remain critical considerations. Regulatory approvals in Europe and other regions, as well as advancements in targeted therapy and immunotherapy, are expected to shape the market landscape.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of BCL-2 (B-Cell Lymphoma 2) Inhibitors Industry?

- The global market is significantly driven by the rising geriatric population, who represent a growing consumer base with unique healthcare needs.

- The global BCL-2 inhibitors market is experiencing significant growth due to the increasing geriatric population worldwide. According to the World Bank Group, the global geriatric population, defined as individuals aged 65 years and above, has grown to approximately 9.32% of the total population in 2021, up from 8.93% in 2018. In the US, which holds a substantial share of the market, the geriatric population has seen a notable rise in recent years. The Centers for Disease Control and Prevention (CDC) projects that the US geriatric population will reach 19% by 2030. This demographic trend is a crucial growth factor for the BCL-2 inhibitors market, as these inhibitors play a vital role in treating various types of cancer, which disproportionately affect older adults.

- The increasing prevalence of cancer in the geriatric population, coupled with the growing awareness and accessibility of cancer treatments, is expected to drive market growth during the forecast period.

What are the market trends shaping the BCL-2 (B-Cell Lymphoma 2) Inhibitors Industry?

- The rise in the number of patient assistance programs represents a significant market trend. This trend reflects the growing emphasis on improving patient access to healthcare and reducing financial burdens associated with treatment.

- Small molecule inhibitors, such as VENCLEXTA from the BCL-2 inhibitors family, are transforming the treatment landscape for chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL) and acute myeloid leukemia (AML). However, the high cost of these therapies poses a significant challenge for patients and the healthcare system. In response, various organizations, including companies and non-governmental organizations (NGOs), are taking steps to help. They offer financial and clinical assistance to patients undergoing treatment for CLL/SLL and AML. For instance, Genentech's BioOncology Co-pay program assists patients with specific disease states by providing financial support. The annual cost of VENCLEXTA for CLL/SLL and AML ranges from USD20,000 to USD25,000.

- The focus on patient advocacy and financial assistance is crucial in the context of precision oncology and the treatment of solid tumors, where radiation therapy and synergistic effects of combination therapies can significantly improve quality of life. The ongoing research in this field aims to make these therapies more accessible and affordable, ultimately benefiting patients and the healthcare system as a whole.

What challenges does the BCL-2 (B-Cell Lymphoma 2) Inhibitors Industry face during its growth?

- The industry's growth is significantly impacted by the increasing supply of substitutes, posing a significant challenge.

- The BCL-2 inhibitors market faces challenges due to the availability and growing preference for alternative treatments for hematological malignancies. Substitutes such as chemotherapy, radiation therapy, surgery, laser therapy, and biologics offer viable options for patients. Currently, only one BCL-2 inhibitor drug is FDA-approved for the treatment of chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL) and acute myeloid leukemia (AML). The increasing prevalence and incidence of various cancers notwithstanding, the strong efficacy of these alternatives has led to a rise in their adoption. Clinical trials are ongoing to evaluate the clinical outcomes of BCL-2 inhibitors in combination with other therapies to improve treatment efficacy and reduce side effects.

- Market access remains a crucial factor in the drug development process, with clinical pharmacology studies focusing on personalized medicine to optimize treatment for individual patients. The intellectual property landscape is dynamic, with ongoing patent expirations and new patent filings shaping the competitive landscape. Clinical trials and FDA approval processes are essential steps in bringing new BCL-2 inhibitors to market, and understanding these processes is crucial for stakeholders in the drug development ecosystem.

Exclusive Customer Landscape

The BCL-2 (b-cell lymphoma 2) inhibitors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the BCL-2 (b-cell lymphoma 2) inhibitors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bcl-2 (b-cell lymphoma 2) inhibitors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AbbVie Inc. - The company specializes in the development and commercialization of innovative therapeutic solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AbbVie Inc.

- Danaher Corp.

- Amgen Inc.

- Ascentage Pharma Group International

- AstraZeneca Plc

- BeiGene Ltd.

- Bio Techne Corp.

- Biorbyt Ltd.

- Bristol Myers Squibb Co.

- F. Hoffmann La Roche Ltd.

- Ipsen Pharma

- Merck and Co. Inc.

- Novartis AG

- Santa Cruz Biotechnology Inc.

- Seagen Inc.

- Les Laboratoires Servier

- Eli Lilly and Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in BCL-2 (B-Cell Lymphoma 2) Inhibitors Market

- In February 2023, Roche Holding AG announced the approval of its BCL-2 inhibitor, Polatuzumab vedotin, in combination with bendamustine and rituximab, for the treatment of relapsed or refractory follicular lymphoma. This approval marked a significant expansion of the indications for this drug, which was previously approved for the treatment of certain types of diffuse large B-cell lymphoma (DLBCL) and chronic lymphocytic leukemia (CLL) (Roche Press Release, 2023).

- In March 2024, AbbVie and Genmab entered into a strategic collaboration to co-develop and commercialize MGa-311, an investigational BCL-2 inhibitor, for the treatment of various B-cell malignancies. This partnership brought together AbbVie's commercial expertise and Genmab's scientific knowledge, aiming to accelerate the development and market entry of MGa-311 (AbbVie Press Release, 2024).

- In May 2024, BeiGene Limited announced the successful completion of a Phase 3 trial for its BCL-2 inhibitor, Zanubrutinib, in the treatment of Waldenstrom's macroglobulinemia. This trial demonstrated a significant improvement in progression-free survival compared to ibrutinib, making Zanubrutinib a potential first-in-class therapy for this disease (BeiGene Press Release, 2024).

- In December 2024, the US Food and Drug Administration (FDA) granted accelerated approval to Selinexor, a Bcl-2/Bcl-xL inhibitor developed by Karyopharm Therapeutics, in combination with dexamethasone for the treatment of multiple myeloma patients who have received at least four prior lines of therapy. This approval marked the first approval of a selinexor combination regimen in multiple myeloma and further solidified its position as a key player in the BCL-2 inhibitor market (FDA Press Release, 2024).

Research Analyst Overview

- The BCL-2 inhibitor market is experiencing significant activity and trends as pharmaceutical companies explore new avenues to combat drug resistance mechanisms in B-cell lymphoma. Data analysis plays a crucial role in personalized treatment plans, with phase II trials utilizing statistical modeling to optimize patient outcomes. The drug development pipeline is rich with next-generation sequencing technologies, enabling the discovery of novel biomarkers and overcoming resistance through targeted drug delivery and immune system modulation. Phase I trials are underway for various BH3 mimetics, while clinical practice guidelines continue to evolve with the latest research. Patient education and support groups are essential in disease progression management, with liquid biopsy emerging as a promising tool for real-time monitoring.

- Clinical trial design is increasingly focused on companion diagnostics and genetic testing to ensure effective treatments for individual patients. The tumor microenvironment remains an active area of research, with drug delivery systems holding promise for improved therapeutic efficacy. Healthcare professionals are collaborating to advance the field, ensuring that the latest developments in BCL-2 inhibitor research translate into meaningful clinical benefits.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bcl-2 (B-Cell Lymphoma 2) Inhibitors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2024-2028 |

USD 2288.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.86 |

|

Key countries |

US, Canada, Germany, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bcl-2 (B-Cell Lymphoma 2) Inhibitors Market Research and Growth Report?

- CAGR of the Bcl-2 (B-Cell Lymphoma 2) Inhibitors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bcl-2 (b-cell lymphoma 2) inhibitors market growth of industry companies

We can help! Our analysts can customize this bcl-2 (b-cell lymphoma 2) inhibitors market research report to meet your requirements.