Bioactive Glass Market Size 2024-2028

The bioactive glass market size is forecast to increase by USD 1.57 billion, at a CAGR of 21.48% between 2023 and 2028. The market's growth hinges on several key factors. Firstly, there is a robust demand for dental care and cosmetic dentistry, driven by increasing consumer awareness and the desire for improved oral aesthetics. Secondly, the rising prevalence of orthopedic disorders, such as arthritis and osteoporosis, fuels demand for orthopedic treatments and devices. Lastly, the increasing incidence of dental conditions, including cavities and gum disease, underscores the need for preventive and therapeutic dental care solutions. These factors collectively drive growth in the dental and orthopedic markets, prompting innovation in treatments, technologies, and patient care approaches. As healthcare awareness continues to expand globally, the market is poised for sustained development in meeting the evolving needs of patients and practitioners alike.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

The market is witnessing significant growth due to its extensive applications in the dental and medical industries. These glasses, primarily made of silicate-based materials, have gained popularity for their ability to promote tissue engineering and enhance bone regeneration. In the dental industry, bioactive glasses are used for dental repair and as a coating for implants, while in the medical industry, they are utilized for treating conditions like diabetic foot ulcers and septic osteoporosis. The biological reaction between bioactive glasses and living tissues is crucial for their effectiveness. These glasses are composed of calcium, phosphorus, sodium, and other elements, making them similar to human bones. They exhibit both biodegradability and biostability, allowing them to integrate with the host tissue over time. Bioactive glasses are used in surgical operations as medical devices and medical aids for grafting. Hydroxyapatite implants, a type of bioactive glass, have gained popularity due to their high affinity for bone tissue. Silicon, ceramic, and other components in bioactive glasses contribute to their effectiveness in promoting wound healing and bone regeneration. Overall, the Bioactive Glass market is poised for growth due to its potential to enhance the quality of life for patients in need of bone and tissue repair. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

High demand for dental care and cosmetic dentistry is notably driving the bioactive glass market growth. A high incidence of oral diseases such as periodontal disease can lead to tooth loss and infection. Therefore, there is a high demand for dental care techniques such as dental implants, dental bridges, and dentures to maintain oral care and treat dental problems. Advances in dental technology, such as teledentistry, digital x-rays, lasers, and the inclusion of dental insurance in the National Health Insurance (NHI) bill are the factors driving the growth of the market. This will increase the demand for bioactive glasses used in dental implants, driving the growth of the market during the forecast period.

Significant Market Trends

Inorganic growth strategies by the companies are a key trend influencing the bioactive glass market growth. Vendors are implementing various strategies to expand their product portfolio. They pursue various business strategies such as mergers and acquisitions to increase market presence and sales of the orthodontic product line. Vendors are also increasingly collaborating with other companies and research institutes to develop new technologies, enhance their product offerings, and expand their distribution networks. Such strategies offer vendors an opportunity to increase their profit margins.

For example, recently, Heraeus Group announced the acquisition of Mo-Sci Corp, which is a major player in the supply of medical and specialty glass. Therefore, these inorganic growth strategies adopted by the vendors operating in the market will propel the market during the forecast period.

Major Market Challenge

Stringent regulations and product recalls of bioactive glass are challenging the bioactive glass market growth. Government regulations and product recalls can impact vendor revenues and thereby affect market growth. Regulatory bodies impose a strict regulatory framework on bioactive glasses. Medical devices must undergo safety and efficacy evaluations before being approved. Failure to comply with such regulations and laws may hinder new product launches and thus adversely affect market growth. The sterility of bioactive glasses is a major concern for manufacturers and distributors.

On several occasions, such recalls have resulted in corrective procedures for the patient. Additionally, the use of defective bioactive glasses also affects the body parts to which the bioactive glasses are applied. As such, the manufacture and sale of bioactive glasses are highly regulated and require regulatory approval. Products that do not meet regulations are expected to lead to recalls and impact sales volumes, adversely affecting the market growth during the forecast period.

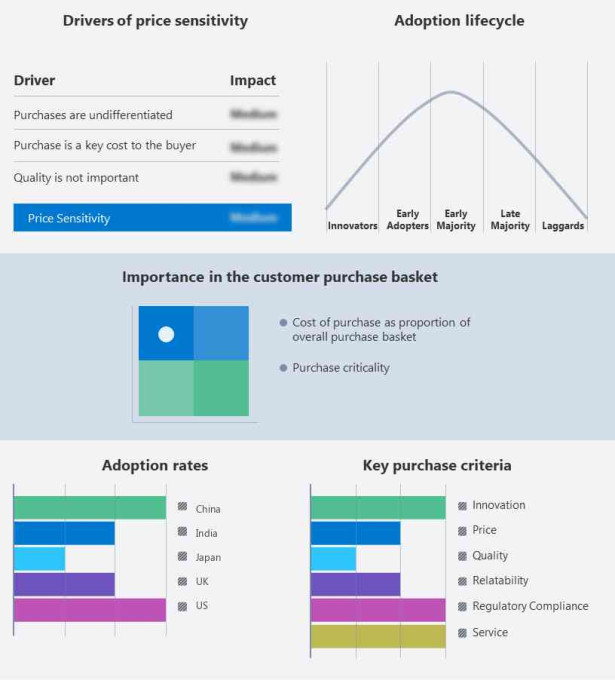

Customer Landscape

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Global Bioactive Glass Market Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BioMin Technologies Ltd: The company has developed specialized toothpaste, such as BioMin toothpaste, which uses bioactive glasses to protect patients' teeth and help to reduce sensitivity and tooth decay.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Arthrex Inc.

- Bonalive Biomaterials Ltd.

- Curasan Inc.

- Ferro Corp.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc.

- Koninklijke DSM NV

- LASAK s.r.o.

- Matexcel

- Merck KGaA

- Mo-Sci Corp.

- NanoFUSE Biologics LLC

- NORAKER

- NovaBone Products LLC

Qualitative and quantitative analysis of vendors has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize vendors as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize vendors as dominant, leading, strong, tentative, and weak.

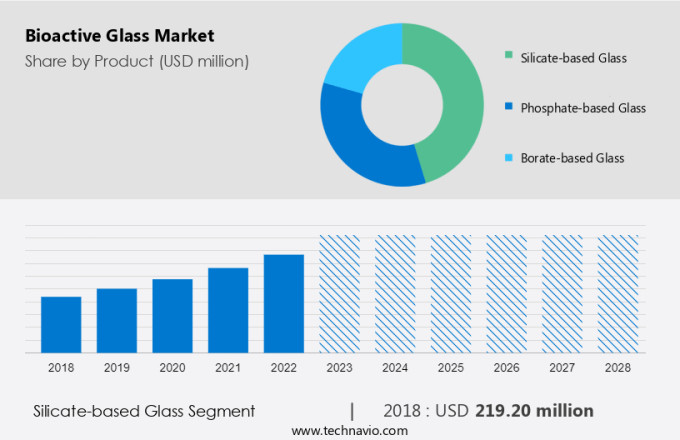

What is the Fastest-Growing Segment in the Market?

The market share growth by the silicate-based glass segment will be significant during the forecast period. Silicate-based glasses are used in dental and orthopedic surgery as they aid in bone regeneration. Lower extremity fractures and dislocations, total and partial hip replacements, and spinal fusions are some of the major orthopedic diseases requiring the use of silicate-based bioactive glasses. Bioactive glasses are used for spinal fixation after cervical and lumbar surgery. The biomaterial transmits low-level electrical signals to stimulate the natural bone healing process.

Get a glance at the market contribution of various segments View the PDF Sample

The silicate-based glass segment was valued at USD 219.20 million in 2018. Diseases such as tooth decay and periodontal disease are among the most common and significant oral health burdens in the world. These diseases are caused by excessive sugar intake and insufficient exposure to fluoride. Smoking is also believed to be the main risk factor for periodontal disease in adults. The frequency of oral diseases is increasing. Long-term exposure to various risk factors that cause oral disease leads to tooth decay. People with this condition, therefore, need dental implants, which are glass made of silicate. The rising incidence of various oral diseases is expected to drive the segment and, hence, the growth of the market during the forecast period.

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 43% to the growth of the global bioactive glass market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The United States is the largest contributor in North America due to the increasing prevalence of dental disease, the growing popularity of dental procedures, and growing awareness and interest in oral health. The United States is the main source of revenue for the North American market. Market growth in the region can be attributed to the number of product approvals, the strong presence of established suppliers such as Zimmer and Stryker, and the increasing prevalence of dental disease and related risk factors. In addition, rising healthcare costs and an increase in dentists and dental facilities are boosting the market growth in the region.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Silicate-based glass

- Phosphate-based glass

- Borate-based glass

- Application Outlook

- Medical

- Dentistry

- Cosmetics

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- Asia

- China

- India

- Rest of World (ROW)

- Brazil

- Middle East

- South Africa

- North America

You may also interested in below market reports:

- Bioactive Wound Dressing Market - Bioactive Wound Dressing Market by Type and Geography - Forecast and Analysis

- Cosmetic Ingredients Market - Cosmetic Ingredients Market Analysis APAC, North America, Europe, South America, Middle East and Africa - France, Singapore, South Korea, Japan, US - Size and Forecast

- Botanical Extracts Market - Botanical Extracts Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, France, China, Canada, Germany - Size and Forecast

Market Analyst Overview

The market is witnessing significant growth in the Dental and Medical industries due to its unique properties that promote tissue engineering and bone regeneration. These glasses, made primarily of silicate-based materials, are gaining popularity in the treatment of various conditions, including Diabetic foot ulcers and Septic osteoporosis. Silicon, Calcium, and Phosphorus are the primary elements in these glasses, making them biocompatible and osteoconductive. The biological reaction between the glass and living tissues results in the formation of a new mineral structure, similar to genuine bone. The Orthopedic segment of the market is expected to dominate due to the increasing demand for Hydroxyapatite implants in Orthopedic jaw surgeries and Osteomyelitis treatment. Moreover, the dental segment is also witnessing growth due to the use of Bioactive Glass in tooth filling and Dental implants with Hydroxyapatite coating. The Geriatric patient population is a significant end-user of Bioactive Glass due to the high prevalence of bone-related conditions in this age group. The market is expected to grow further due to the increasing demand for Biomaterials in Craniofacial procedures and Wound healing.

Further, the market is rapidly expanding due to its versatile applications in orthopedics, regenerative medicine, and dental care. Bioactive glasses like S53P4 and 45S5 exhibit osteoconductive and biocompatible qualities, promoting bone regeneration in orthopedic applications and benign bone tumor defects. They interact with physiological fluids, initiating regenerative processes crucial for healing bone abnormalities and enhancing tissue repair. Advances in medical research and materials science have enabled customized formulations and 3D printing technologies for personalized implants and drug delivery systems. These glasses find use in dental fillings, gum regeneration, and nerve conduits, supporting the neurological industry and artificial organ development. With high bioactivity and bioresorbable properties, bioactive glasses are revolutionizing contemporary healthcare by facilitating quicker healing and improving outcomes in medical procedures across specialty markets.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 21.48% |

|

Market Growth 2024-2028 |

USD 1.56 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.4 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 43% |

|

Key countries |

US, China, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arthrex Inc., BioMin Technologies Ltd., Bonalive Biomaterials Ltd., Curasan Inc., Vibrantz, GlaxoSmithKline Plc, Johnson and Johnson Services Inc., Koninklijke DSM NV, LASAK s.r.o., Matexcel, Merck KGaA, Mo-Sci Corp., NanoFUSE Biologics LLC, NORAKER, NovaBone Products LLC, Pulpdent Corp., SCHOTT AG, Stryker Corp., Synergy Biomedical LLC, and Zimmer Biomet Holdings Inc. |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch