Botanical Extracts Market Size 2025-2029

The botanical extracts market size is forecast to increase by USD 17.31 billion at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth due to the rising prevalence of chronic diseases and the subsequent demand for alternative sources of drug development. This trend is particularly prominent in developed regions, where the burden of chronic diseases is high. Additionally, the expanding applications of botanical extracts in various industries, most notably the beverage sector, are fueling market expansion. However, the high initial cost associated with the sourcing and processing of herbs and spices used in the production of botanical extracts poses a challenge for market growth. Companies seeking to capitalize on this market opportunity must focus on cost-effective sourcing strategies and innovative production techniques to remain competitive.

- Furthermore, collaborations and partnerships with key stakeholders, such as research institutions and industry players, can provide valuable insights and resources for market expansion. Overall, the market presents a promising landscape for growth, with opportunities in the healthcare and food and beverage industries, and challenges that can be addressed through strategic partnerships and operational efficiencies.

What will be the Size of the Botanical Extracts Market during the forecast period?

- The market is experiencing significant growth due to increasing consumer preference for natural and herbal remedies. Clinical research validating the synergistic effects of botanical ingredients in herbal supplements is driving brand building and consumer perception. Topical applications of these extracts are gaining popularity for their medicinal properties, leading to market penetration and customer loyalty. Quality assurance and ethical sourcing are crucial factors in industry trends, ensuring the future outlook remains positive.

- Botanical and plant-based ingredients, including medicinal herbs, are revolutionizing supply chain management and dosage forms. The market dynamics are influenced by factors such as industry trends, consumer preferences, and regulatory requirements. The future of botanical extracts lies in product positioning and continued research to unlock their full potential.

How is this Botanical Extracts Industry segmented?

The botanical extracts industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- F and B

- Nutraceuticals

- Cosmetics

- Type

- Powder

- Liquid

- Source

- Herbs

- Spices

- Fruits

- Flowers

- Distribution Channel

- Direct Sales

- Distributors

- Online Retail

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

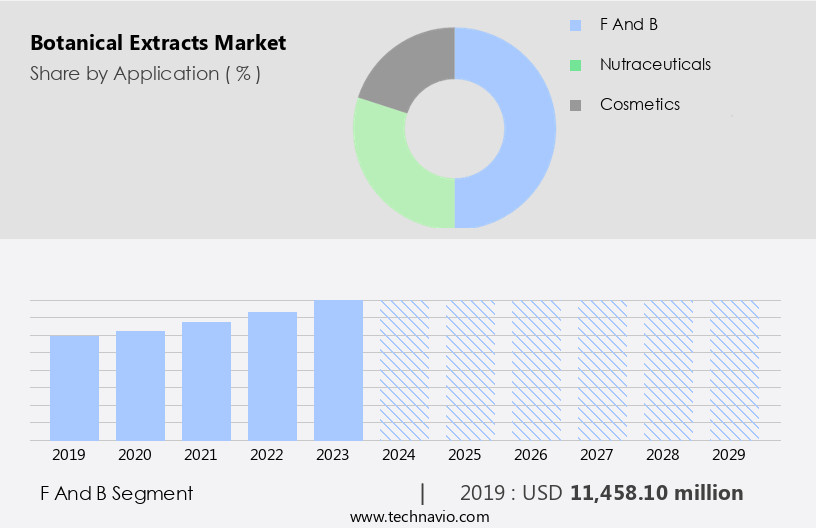

The F and B segment is estimated to witness significant growth during the forecast period.

In the food and beverage industry, botanical extracts have gained significant traction as they offer functional benefits and enhance the taste and aroma of various products. These extracts, derived from natural sources such as plants, are used in the production of alcoholic and non-alcoholic beverages, dairy products, meat items, bakery, and confectionery. The increasing preference for clean-label, transparent, and premium products, which are fresh and minimally processed, fuels the demand for botanical extracts. Botanical extracts are valued for their health benefits, including anti-inflammatory, antioxidant, and antibacterial properties. For example, green tea, rooibos, and berry extracts are added to yogurt drinks to boost their antioxidant properties and improve taste.

In the realm of functional foods, botanical extracts play a pivotal role, contributing to the development of new products that cater to the health-conscious consumer base. ISO certification, a symbol of quality control, is increasingly sought after in the market. Companies prioritize this certification to ensure their products meet international standards and maintain consumer trust. Additionally, the use of sustainable sourcing practices and various extraction methods, such as hydroalcoholic extraction and supercritical fluid extraction, are essential to meet the evolving market demands. The market encompasses various sectors, including herbal medicine, traditional medicine, and dietary supplements.

As regulatory compliance becomes increasingly stringent, companies focus on safety assessment and efficacy studies to ensure the potency and efficacy of their products. Furthermore, product differentiation and ingredient labeling are crucial aspects of marketing and distribution strategies. In the realm of natural remedies, botanical extracts have found a strong foothold in the health and wellness industry. From Chinese medicine and Ayurvedic medicine to functional foods and herbal extracts, the applications of botanical extracts are vast and diverse. The value proposition of botanical extracts lies in their ability to provide natural alternatives to synthetic ingredients while catering to the growing demand for holistic health and wellness solutions.

Get a glance at the market report of share of various segments Request Free Sample

The F and B segment was valued at USD 11.46 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

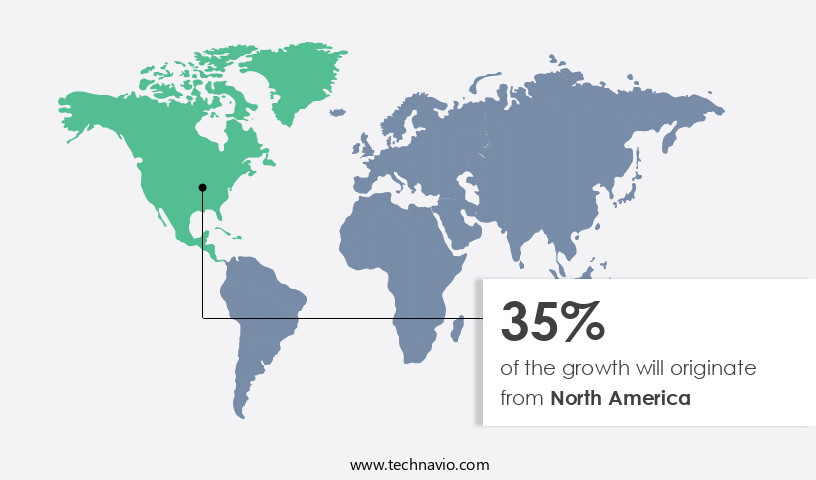

North America is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American market is currently driven by the region's strong preference for natural products, influenced by urbanization and the wellness trend. The presence of leading domestic players, such as BI Nutraceuticals, International Flavors and Fragrances, and Prinova Group, further bolsters market growth. The US, Canada, and Mexico are the major revenue contributors to the market. Urbanization in North America has led to an increase in urban household income, encouraging a focus on luxury categories and driving demand for botanical extracts. The food and beverage industry's well-established presence in the region also plays a significant role in market growth.

Natural remedies, such as plant extracts, are increasingly being adopted for their health benefits. Extraction methods, including hydroalcoholic extraction and supercritical fluid extraction, are used to derive these bioactive compounds from plants. Product differentiation through safety assessment, efficacy studies, and ingredient labeling is crucial in this market. Regulatory compliance, sustainable sourcing, and organic extracts are essential factors influencing market trends. Functional foods and dietary supplements are significant applications for botanical extracts. Herbal medicine, Chinese medicine, and Ayurvedic medicine are traditional practices that continue to influence the market. ISO certification, extract potency, and competitive advantage are essential factors for market players.

Pricing strategies, distribution channels, and value proposition are critical elements for companies to maintain a competitive edge. Clinical trials and research and development are ongoing to discover new applications and uses for botanical extracts. Natural extracts are increasingly being used in various industries, including food and beverage, cosmetics, and pharmaceuticals. The market's future growth is expected to be driven by these trends and the increasing focus on holistic health.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Botanical Extracts Industry?

- Rising prevalence of chronic diseases driving demand for alternative drug sources is the key driver of the market.

- Chronic diseases, such as cancer, cardiovascular diseases (CVDs), diabetes, and autoimmune diseases, are on the rise due to factors like pollution and sedentary lifestyles, leading to an increased annual mortality rate. According to the CDC, in the US, approximately 1.5 million new cases of cancer are diagnosed, and around 500,000 individuals die from the disease each year. The high cost and complex manufacturing process of synthetic drugs have resulted in a growing demand for plant-derived drugs as alternative therapeutics. Pharmaceutical companies are increasingly exploring natural sources for drug development due to the lower costs associated with their production compared to synthetic drugs.

- This trend is expected to continue as the need for effective and affordable treatments for chronic diseases increases.

What are the market trends shaping the Botanical Extracts Industry?

- Growing applications of botanical extracts in beverage industry is the upcoming market trend.

- The market in the Food and Beverage (F&B) industry is experiencing growth due to the rising health consciousness and preference for natural products. These extracts are increasingly used as food ingredients and in beverage manufacturing, particularly in wine and beer production. The market is expanding, with significant growth observed in China and India, driven by increased production capacities. The demand for botanical extracts is further propelled by the development of new beer flavors, which utilizes these extracts as functional additives.

- The supply and consumption of brewing enzymes are projected to increase in the coming years, fueling the market's growth. Botanical extracts offer numerous benefits, making them a popular choice in the F&B industry.

What challenges does the Botanical Extracts Industry face during its growth?

- High initial cost associated with herbs and spices is a key challenge affecting the industry growth.

- The market is marked by a substantial number of participants, with major companies leading the way through technological advancements and product innovation. These key players invest heavily in research and development, securing patents for their discoveries to maintain a competitive edge. This increases the cost of botanical extracts for the Food and Beverage industry, subsequently raising the prices of their products. While this does not significantly impact the market in regions with high disposable income, it alters consumption patterns in cost-sensitive developing economies.

- Consumers in these regions often opt for alternative, more affordable options due to their lower disposable income. Despite this challenge, the market continues to grow, driven by increasing consumer awareness and demand for natural, healthier food and beverage options.

Exclusive Customer Landscape

The botanical extracts market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the botanical extracts market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, botanical extracts market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arjuna Natural Pvt Ltd.

- BI Nutraceuticals

- Blue Sky Botanics Ltd.

- Botanic Healthcare

- Döhler GmbH

- Euromed S.A.

- Frutarom Industries Ltd.

- Givaudan

- Haldin Pacific Semesta

- Indena S.p.A.

- Kalsec Inc.

- Kerry Group

- Layn Natural Ingredients

- Martin Bauer Group

- Naturex (Givaudan)

- Nexira

- Organic Herb Inc.

- Sabinsa Corporation

- Symrise AG

- Synthite Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Botanical extracts have gained significant traction in various industries, particularly in the realms of functional foods, dietary supplements, and traditional medicine. The market for these extracts is driven by the growing demand for natural remedies and the increasing focus on holistic health and wellness. Research and development in the botanical extracts sector is a key market dynamic, with companies continually seeking to discover new bioactive compounds and improve extraction methods. Standardized extracts, which ensure consistent potency and quality, have become increasingly popular due to their ability to provide reliable and effective results. Several extraction methods are used to obtain botanical extracts, including solvent extraction, hydroalcoholic extraction, and supercritical fluid extraction.

Each method has its advantages and disadvantages, and the choice of method depends on factors such as the plant material, desired compounds, and cost. Quality control is a critical aspect of the market, with companies implementing rigorous testing procedures to ensure the safety and efficacy of their products. ISO certification and regulatory compliance are essential for companies looking to establish a competitive advantage and build consumer trust. Functional foods and beverages are significant markets for botanical extracts, with many products incorporating these extracts to provide health benefits. Herbal extracts, such as those derived from Chinese medicine and Ayurvedic medicine, have gained popularity due to their long history of use and proven efficacy.

Product differentiation is another key market trend, with companies focusing on niche markets and offering unique value propositions to distinguish themselves from competitors. For example, some companies specialize in organic extracts, while others prioritize sustainable sourcing and ingredient labeling. Clinical trials and safety assessment are crucial for companies looking to bring new botanical extracts to market. Efficacy studies are essential to demonstrate the health benefits of these extracts, while safety assessments ensure that they are safe for consumption. The market is diverse and dynamic, with new developments and trends emerging continually. Companies that can adapt to these changes and provide high-quality, effective, and safe products will be well-positioned to succeed.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 17312.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.2 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Botanical Extracts Market Research and Growth Report?

- CAGR of the Botanical Extracts industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the botanical extracts market growth of industry companies

We can help! Our analysts can customize this botanical extracts market research report to meet your requirements.