Bone Biopsy Market Size 2024-2028

The bone biopsy market size is forecast to increase by USD 86.4 million at a CAGR of 8.09% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing number of diagnostic centers and the rising demand for minimally invasive procedures such as MRI and ultrasound-guided bone biopsies. These advanced techniques offer improved accuracy and reduced risk compared to traditional open biopsies. However, the market faces challenges due to the limited technical skills required to perform these procedures, which may hinder widespread adoption. Additionally, the high cost of these advanced biopsy techniques and the lack of reimbursement policies in some regions may also restrict market growth. MRI and CT scans are essential tools In the diagnosis of bone cancer and sarcoma, providing detailed images of the affected area. Despite these challenges, the market is expected to continue expanding due to the increasing prevalence of bone diseases and the ongoing development of innovative biopsy technologies.

What will be the Size of the Bone Biopsy Market During the Forecast Period?

- The market is witnessing significant growth due to the increasing prevalence of bone disorders, bone tumors, and bone cancers such as lymphoma, leukemia, and sarcomas. Bone Marrow Biopsies are commonly used to diagnose and monitor marrow diseases, including blood disorders. The healthcare infrastructure in emerging countries is improving, leading to an increase in the number of diagnostic procedures. Regulatory policies and technological advancements are driving the market, with a focus on minimally invasive procedures like needle biopsies and MRI guidance.

- The geriatric population is a significant consumer of bone biopsies due to the higher prevalence of bone diseases in this age group. The transportation infrastructure and outpatient setting are also contributing factors to the market's growth. Companies like Argon Medical are leading the market with their innovative medical devices. However, the coronavirus pandemic has disrupted the healthcare sector, leading to challenges In the market's growth.

How is this Bone Biopsy Industry segmented and which is the largest segment?

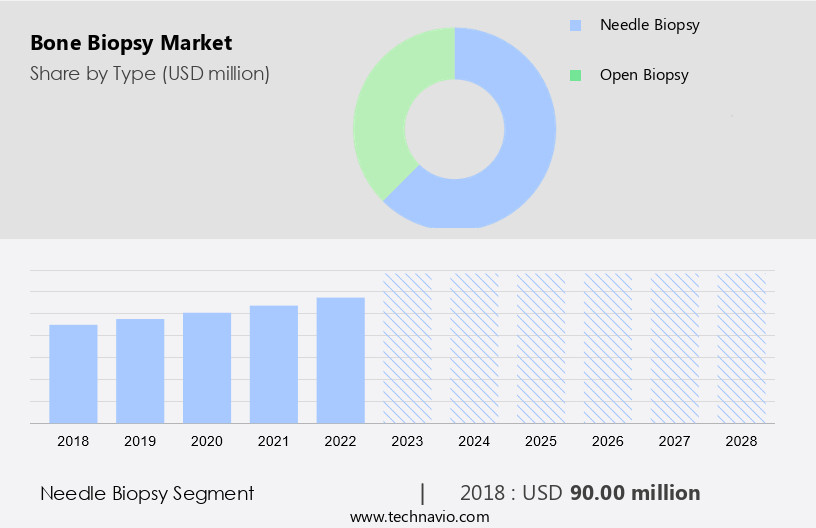

The bone biopsy industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Needle biopsy

- Open biopsy

- End-user

- Hospitals

- Diagnostic centers

- Geography

- North America

- US

- Europe

- Germany

- France

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

- The needle biopsy segment is estimated to witness significant growth during the forecast period.

The market encompasses diagnostic procedures for identifying bone disorders, bone tumors, and bone cancers, including lymphoma and leukemia. Healthcare infrastructure development in emerging countries and regulatory policies are driving market growth. Bone marrow biopsies are commonly used for diagnosing blood marrow diseases such as sarcomas and metabolic bone diseases like osteoporosis and chronic kidney disease. Minimally invasive procedures like needle biopsies and outpatient settings are gaining popularity. Companies like Argon Medical are leading in medical devices for bone biopsies.

The geriatric patient population, with a higher risk of bone-related diseases and fractures, is a significant market segment. Regulatory authorizations and cancer prevalence continue to influence market expansion. Bone tissue abnormalities, bone lesions, infections, and bone malignancies are common indications for bone biopsies. Technological advancements in imaging modalities like computed tomography and hospital-based procedures are also contributing to market growth. The International Osteoporosis Foundation focus on the importance of early diagnosis and treatment for bone disorders.

Get a glance at the market report of share of various segments Request Free Sample

The needle biopsy segment was valued at USD 90.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- Asia is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth due to the rising incidence of bone cancer and sarcoma. Diagnostic technology advancements, such as magnetic resonance imaging (MRI) and computed tomography (CT), play a crucial role In the early detection and diagnosis of these conditions. Healthcare systems worldwide are investing in preventive strategies and awareness campaigns to encourage early diagnosis and improve patient outcomes. Biopsy device advancements, including imaging guidance, automation, real-time monitoring, and nanotechnology, are enhancing the accuracy and safety of bone biopsies. Siemens Healthineers, a leading healthcare technology company, is at the forefront of these innovations, integrating artificial intelligence (AI) and single-payor, socialized, and privatized systems to streamline diagnostic processes and improve patient care.

The integration of AI In these imaging modalities can improve diagnostic accuracy and reduce the need for invasive biopsies. Moreover, the development of minimally invasive biopsy techniques and the use of imaging guidance systems are making bone biopsies safer and more comfortable for patients. Thus, the market is expected to grow significantly due to the rising incidence of bone cancer and sarcoma, diagnostic technology advancements, and biopsy device innovations. Healthcare systems worldwide are investing in preventive strategies and awareness campaigns to improve patient outcomes, while companies like Siemens Healthineers are leading the way In the integration of AI and advanced imaging technologies to streamline diagnostic processes and enhance patient care.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Bone Biopsy Industry?

The growing number of diagnostic centers is the key driver of the market.

- The market encompasses diagnostic procedures used to identify bone disorders, bone tumors, bone cancers, and related abnormalities. These conditions include lymphoma, leukemia, sarcomas, bone marrow diseases, and metabolic bone diseases such as osteoporosis and chronic kidney disease. Bone biopsies can be performed through minimally invasive procedures like needle biopsies or open biopsies, depending on the severity and location of the bone lesion. Healthcare infrastructure in emerging countries is evolving, with a growing focus on regulatory policies and the healthcare sector. The geriatric population is a significant consumer of bone biopsy services due to the higher prevalence of bone-related diseases and fracture risk. In many regions, transportation challenges limit access to specialized healthcare facilities, making outpatient settings and minimally invasive procedures increasingly popular. Argon Medical, among other medical device manufacturers, offers innovative solutions for bone biopsy procedures.

- Regulatory authorizations and cancer prevalence rates vary across countries, necessitating a customized approach to market penetration. The International Osteoporosis Foundation highlights the importance of early diagnosis and treatment for bone tissue health. Computed tomography and hospital-based cancer diagnosis are common practices, but the shift towards geriatric patient populations and minimally invasive procedures in an outpatient setting is gaining momentum. Bone biopsies are essential for identifying various bone abnormalities, including infections, metabolic bone diseases, and bone malignancies. Ensuring proper diagnostic procedures and timely treatment can significantly impact patient outcomes and reduce the overall burden on healthcare systems.

What are the market trends shaping the Bone Biopsy Industry?

Growing demand for MRI and ultrasound-guided bone biopsy procedures is the upcoming market trend.

- The market is witnessing significant growth due to the increasing prevalence of bone disorders, bone tumors, and bone cancers. Bone Marrow Biopsies are commonly used for diagnosing lymphoma, leukemia, and other bone marrow diseases. The healthcare infrastructure in emerging countries is improving, leading to increased regulatory policies and investments In the healthcare sector. This growth is particularly noticeable In the geriatric patient population, who are at a higher risk for bone malignancies, osteoporosis, chronic kidney disease, and metabolic bone diseases. Minimally invasive procedures, such as needle biopsies, are gaining popularity in an outpatient setting, reducing the need for hospitalization. Advancements in medical devices, such as those by Argon Medical, are making bone biopsies more precise and less invasive. Computed Tomography (CT) and MRI are the primary imaging modalities used in bone biopsies. MRI, in particular, has seen significant advancements, including functional information through magnetic resonance spectroscopy, dynamic contrast-enhanced (DCE), and diffusion-weighted imaging (DWI), which have the potential to exclude significant cancer in most cases.

- However, transportation and accessibility remain challenges, especially in remote areas. Regulatory authorizations and cancer prevalence continue to drive the market for bone biopsies. The focus is on developing cost-effective and accurate bone biopsy techniques to address the growing need for early detection and treatment of bone-related diseases and abnormalities, including bone lesions, infections, and bone malignancies. The International Osteoporosis Foundation focus on the importance of early diagnosis and treatment to reduce fracture risk.

What challenges does the Bone Biopsy Industry face during its growth?

Limited technical skills is a key challenge affecting the industry growth.

- Bone biopsies are essential diagnostic procedures for identifying bone disorders, including bone tumors and cancers, such as lymphoma, leukemia, and sarcomas. The healthcare infrastructure in both developed and emerging countries continues to evolve, with a focus on minimally invasive procedures and advanced medical devices to improve patient outcomes. Regulatory policies play a crucial role in ensuring the safety and efficacy of these procedures, particularly In the healthcare sector. Bone biopsies can be performed through various methods, including bone marrow biopsy and needle biopsies. The geriatric population is at a higher risk for bone-related diseases, including osteoporosis, chronic kidney disease, and metabolic bone diseases, making regular bone biopsies essential.

- However, the accuracy and safety of these procedures depend on the skill and experience of the healthcare professional executing them. Argon Medical, among other medical device manufacturers, offers innovative solutions to improve the precision and safety of bone biopsies. In an outpatient setting, computed tomography (CT) guided bone biopsies offer increased accuracy and reduced risk of complications. However, open biopsies, which require hospitalization, are still necessary in some cases. Cancer prevalence continues to rise, and the need for accurate and safe bone biopsies is more critical than ever. Bone tissue abnormalities, infections, and bone malignancies require prompt diagnosis and treatment to prevent complications and fracture risk. The International Osteoporosis Foundation focuses on the importance of regulatory authorizations and continuous research to improve bone health and reduce the need for invasive procedures.

Exclusive Customer Landscape

The bone biopsy market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bone biopsy market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bone biopsy market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- B.Braun SE

- Becton Dickinson and Co.

- BIOPSYBELL Srl

- Cardinal Health Inc.

- Cook Group Inc.

- Kimal Group

- Laurane Medical LLC

- Meditech Devices Pvt. Ltd.

- Medtronic Plc

- Merit Medical Systems Inc.

- Moller Medical GmbH

- Remington Medical

- SOMATEX Medical Technologies GmbH

- Stryker Corp.

- Teleflex Inc.

- Tsunami Medical Srl

- Zamar Care

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bone biopsy is a diagnostic medical procedure used to identify bone disorders, bone tumors, bone cancers, and other bone-related abnormalities. The procedure involves extracting a small sample of bone tissue for laboratory examination. Bone disorders, such as osteoporosis, chronic kidney disease, and metabolic bone diseases, are common health issues affecting the geriatric population. The rising prevalence of cancer, particularly lymphoma and leukemia, is another significant factor driving the market. Bone biopsies can be performed through minimally invasive procedures, such as needle biopsies, or through open biopsies. The healthcare sector's growing infrastructure in emerging countries and regulatory policies supporting the use of medical devices for diagnostic purposes are expected to boost market growth. Argon Medical, among others, is a leading player In the market. Bone marrow biopsies are commonly used to diagnose marrow diseases, such as sarcomas and blood malignancies. The outpatient setting is increasingly preferred for bone biopsies due to its convenience and cost-effectiveness. Technological advancements, such as the use of computed tomography and magnetic resonance imaging, facilitate accurate diagnosis and improve patient outcomes.

Regulatory authorizations and cancer prevalence are significant factors influencing market growth. The International Osteoporosis Foundation reports that one in three women and one in five men over the age of 50 will experience a fracture due to osteoporosis. The transportation infrastructure's development in emerging countries and the increasing focus on minimally invasive procedures are also expected to drive market growth. In summary, the market is expected to grow due to the rising prevalence of bone disorders, bone tumors, and bone cancers, particularly In the geriatric population. Technological advancements, regulatory policies, and the increasing focus on minimally invasive procedures are further driving market growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

162 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 86.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, Germany, China, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bone Biopsy Market Research and Growth Report?

- CAGR of the Bone Biopsy industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bone biopsy market growth of industry companies

We can help! Our analysts can customize this bone biopsy market research report to meet your requirements.