Borehole Enlargement Systems Market Size 2024-2028

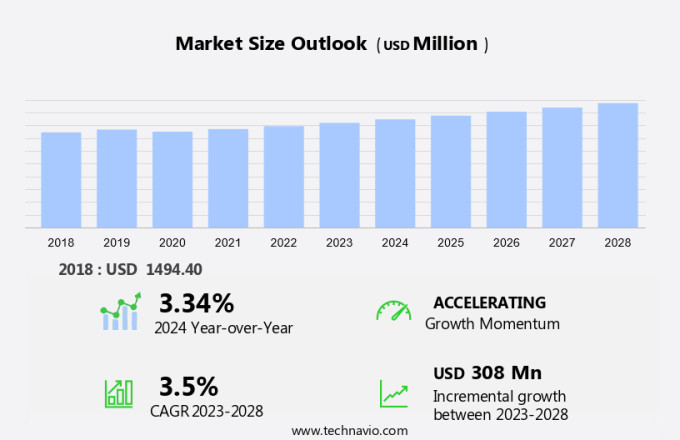

The borehole enlargement systems market size is forecast to increase by USD 308 million at a CAGR of 3.5% between 2023 and 2028. The market is experiencing significant growth due to the rising demand for oil and natural gas, which is driving the need for more efficient drilling techniques. One such innovation is the emergence of laser drilling technology in the oil and gas industry, which offers increased drilling accuracy and efficiency. Additionally, the change in energy mix towards cleaner sources is fueling the adoption of borehole enlargement systems for enhanced oil recovery (EOR) applications. EOR techniques, such as water flooding and gas injection, require larger boreholes to optimize reservoir production. Furthermore, the increasing focus on reducing drilling costs and enhancing productivity is propelling market growth. Upstream oil and gas equipment companies are developing seismic survey technologies and increasing investments in R&D to improve the efficiency of surveys, which is increasing the number of oil exploration activities across the world. Fossil fuels have a leading position in the energy mix, but burning fossil fuels for power generation increases the volume of greenhouse gas (GHG) emissions into the atmosphere. However, challenges such as high capital investment, complex drilling operations, and stringent regulatory requirements may hinder market expansion. Despite these challenges, the Borehole Enlargement Systems Market is expected to continue its growth trajectory due to the increasing demand for oil and gas and the ongoing technological advancements in drilling techniques. The market report forecast market size, historical data spanning from 2018 - 2022, and future projections, all presented in terms of value in USD million for each of the mentioned segments.

Market Segmentation

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application Outlook

- Onshore

- Offshore

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

By Application Insights

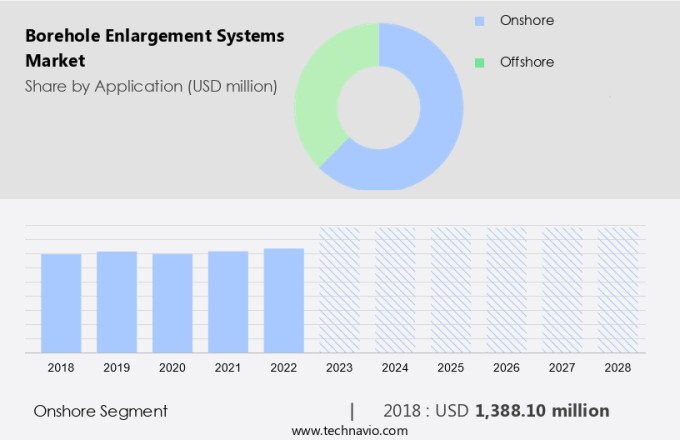

The onshore segment is estimated to witness significant growth during the forecast period. The market encompasses the production and supply of under-reamers, hole openers, and related technologies used to enhance drilling efficiency and ensure wellbore stability during the drilling process. These systems, which include under-reamers with cutter arms and steel balls, are hydraulically actuated to enlarge the wellbore and improve production capacity.

Get a glance at the market share of various regions Download the PDF Sample

The onshore segment accounted for USD 1.39 billion in 2018. Advanced technologies such as RFID and mud telemetry are increasingly being integrated into these systems to optimize drilling operations and ensure safety in both onshore and offshore drilling. Despite the global energy consumption and fluctuating oil prices, the demand for borehole enlargement systems remains in water well drilling and hydrocarbon recovery applications. Technological barriers, including the need for precise engineering and adherence to safety regulations such as the Offshore Safety Directive, continue to drive innovation in the market. Output/shipments of underreamers and hole openers are expected to increase as drilling companies seek to maximize production capacity and minimize casing installations.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

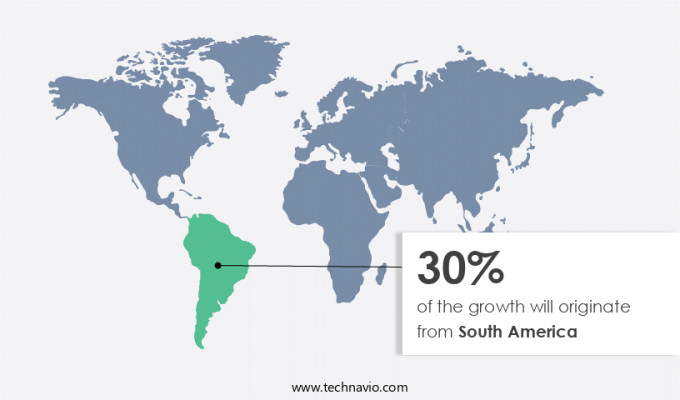

South America is estimated to contribute 30% to the growth of the global market during the market forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Borehole Enlargement Systems market encompasses technologies and equipment used to enhance the drilling process in both onshore and offshore applications. These systems include under-reamers, hole openers, and cutter arms, which are utilized to enlarge the wellbore and ensure wellbore stability during drilling. Under-reamers, hydraulically actuated tools with cutter arms and steel balls, are employed to widen the wellbore and improve drilling efficiency. Advanced borehole enlargement systems incorporate RFID technology and mud telemetry to monitor drilling progress and optimize drilling parameters in real-time. The output/shipments of borehole enlargement systems are driven by global energy consumption and fluctuating oil prices. The market is witnessing growth due to the increasing demand for hydrocarbon recovery and production capacity in the oil and gas industry. Casing installations in water well drilling and offshore drilling are significant applications of borehole enlargement systems. However, technological barriers, such as high costs and safety concerns, particularly in offshore drilling, may hinder market growth. The Offshore Safety Directive and stringent regulations ensure the safety of offshore drilling operations, thereby driving the development of advanced borehole enlargement systems.

Market Dynamics

The Borehole Enlargement Systems Market encompasses technologies and equipment used to widen existing wellbores during the drilling process. Key components include under-reamers, hole openers, and cutter arms, which utilize steel balls and hydraulically actuated mechanisms. RFID and mud telemetry systems ensure efficient drilling and enhance wellbore stability. The market's output/shipments are influenced by various factors such as drilling efficiency, hydrocarbon recovery, and production capacity. Applications span across various industries, including oil and gas, Geothermal Drilling energy projects, and water well drilling. Global energy consumption and fluctuating oil prices significantly impact market growth. Technological barriers, such as the Offshore Safety Directive, pose challenges to market expansion. Underreamers and casing installations are essential in addressing these challenges, ensuring optimal drilling performance and safety. The market is expected to witness growth in offshore drilling projects and the increasing demand for water well drilling in developing countries. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The rise in oil and natural gas demand is notably driving market growth. The drilling process for both water wells and hydrocarbon exploration involves continuous advancement to enhance wellbore stability, drilling efficiency, and production capacity. Under-reamers, a crucial component in borehole enlargement systems, play a significant role in this regard. Under-reamers, which include cutter arms and steel balls, are hydraulically actuated tools that enlarge the wellbore during the drilling process. Advanced under-reamers incorporate technologies like RFID and mud telemetry for real-time monitoring and improved drilling performance. The global energy sector's increasing demand, driven by economic growth and the need for hydrocarbon recovery, has led to a rise in output/shipments of underreamers and hole openers. However, technological barriers, such as high costs and safety concerns, particularly in offshore drilling, pose challenges to market growth. Despite these challenges, the market for borehole enlargement systems is expected to expand, driven by the Offshore Safety Directive and the need for increased production capacity in response to fluctuating oil prices. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The emergence of laser drilling technology in oil and gas industry is the key trend in the market. The global market caters to the increasing demand for hydrocarbon production by optimizing the drilling process in both onshore and offshore locations. Traditional drilling methods, such as mechanical drilling, have been the backbone of oil and gas production for decades. However, drilling in hard rock formations necessitates the application of substantial weight to penetrate the ground, leading to rapid wear and tear of drill bits, and increased drilling costs. To address this challenge, borehole enlargement systems, including under-reamers and hole openers, have gained popularity. Under-reamers, equipped with cutter arms and steel balls, are hydraulically actuated tools that enlarge the wellbore by removing the drilled rock. Advanced borehole enlargement systems employ RFID technology and mud telemetry for real-time monitoring of drilling parameters, ensuring wellbore stability and drilling efficiency. Moreover, the integration of these systems in water well drilling enhances production capacity and casing installations. Amidst fluctuating oil prices and global energy consumption, borehole enlargement systems contribute to hydrocarbon recovery and improved drilling efficiency. However, technological barriers and safety concerns, particularly in offshore drilling, necessitate stringent adherence to regulations, such as the Offshore Safety Directive. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

The change in energy mix is the major challenge that affects the growth of the market. The drilling process for both water wells and hydrocarbon exploration involves enlarging the wellbore to ensure optimal wellbore stability, drilling efficiency, and production capacity. Under-reamers, such as those equipped with cutter arms and steel balls, are utilized to widen the wellbore during the drilling process. Advanced technologies like RFID and mud telemetry are integrated into underreamers and hole openers to enhance drilling efficiency and ensure accurate casing installations. The borehole enlargement systems market is witnessing significant growth due to the increasing global energy consumption and fluctuating oil prices. The need for hydrocarbon recovery from mature fields and the offshore drilling industry's safety regulations, such as the Offshore Safety Directive, are driving the market's expansion. Technological barriers, including the high cost of underreamers and the complexity of their operation, are challenges that market participants must address to maintain growth. The global energy sector's shift towards sustainable and renewable energy sources has led to a decrease in the demand for traditional drilling methods. However, the demand for borehole enlargement systems remains strong due to their application in water well drilling and the ongoing need for hydrocarbon production. The market's output/shipments are expected to grow steadily, driven by the increasing demand for energy and the need to maximize production capacity from existing wells. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atlas Copco AB - The company offers dril air drilling solution which has been designed with high pressure, dynamic flow boost, stage four compliancy, extended pressure range to enhance productivity, thus contribute higher profitability during drilling operations.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Copco AB

- Baker Hughes Co.

- DRILLING TOOLS INTERNATIONAL

- Drillstar Industries

- EasyDrill LLC

- Halliburton Co.

- Hole Opener Corp.

- NOV Inc.

- Oilfields Supply Center Ltd.

- Paradigm Group BV

- Radius Service LLC

- Redback Drilling Tools

- Reservoir Group

- Sandvik AB

- Schlumberger Ltd.

- Schoeller Bleckmann Oilfield Equipment AG

- The Industrialization and Energy Services Co.KSA

- Weatherford International Plc

- Wenzel Downhole Tools

- Western Drilling Tools Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Analyst Overview

Borehole enlargement systems refer to the technologies and equipment used to increase the size of existing wellbores during the drilling process. These systems are essential for enhancing wellbore stability, drilling efficiency, and hydrocarbon recovery in various applications, including water well drilling and oil and gas exploration. Key components of borehole enlargement systems include under-reamers, hole openers, and cutter arms, which are hydraulically actuated to widen the wellbore. Advanced technologies like RFID and mud telemetry are integrated into these systems to optimize performance and ensure safety during the drilling process. The global borehole enlargement systems market is driven by increasing output/shipments, casing installations, and production capacity requirements in the energy sector. However, fluctuating oil prices and technological barriers pose challenges to market growth. Wellbore stability and hydrocarbon recovery are critical factors influencing the adoption of borehole enlargement systems. Offshore drilling projects, in particular, require advanced systems to ensure safety and efficiency in drilling operations.

The Borehole Enlargement Systems Market is witnessing significant growth due to increasing energy demand and the need to maximize production from deep oil and gas wells, geothermal explorations, and renewable energy sources. Key technologies driving this market include under reamers, expandable cutter arms, and hydraulically controlled systems, enabling extended reach drilling in hard rocks and managing sand and gravel movement or shale movement during drilling. These systems are essential for horizontal wells, directional wells, and hydraulically fractured wells, commonly found in onshore locations and deep water, ultradeepwater environments. Energy demand growth, shale oil and gas investments, and energy mix changes due to crude oil price fluctuations and world bank funding are major factors fueling market expansion. Borehole enlargement systems are designed using hollow drill strings, tool joints, and standard drill pipes made of materials like aluminum alloy. They are crucial for drilling in various geological formations and are increasingly being adopted for use in hydraulic fracturing and shale gas and geothermal energy projects. However, environmental considerations and upstream investment challenges remain critical factors influencing market trends.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

146 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.5% |

|

Market growth 2024-2028 |

USD 308 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.34 |

|

Regional analysis |

North America, Europe, South America, APAC, and Middle East and Africa |

|

Performing market contribution |

South America at 30% |

|

Key countries |

US, China, Russia, Canada, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Atlas Copco AB, Baker Hughes Co., DRILLING TOOLS INTERNATIONAL, Drillstar Industries, EasyDrill LLC, Halliburton Co., Hole Opener Corp., NOV Inc., Oilfields Supply Center Ltd., Paradigm Group BV, Radius Service LLC, Redback Drilling Tools, Reservoir Group, Sandvik AB, Schlumberger Ltd., Schoeller Bleckmann Oilfield Equipment AG, The Industrialization and Energy Services Co.KSA, Weatherford International Plc, Wenzel Downhole Tools, and Western Drilling Tools Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, South America, APAC, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch