India Captive Power Generation Market Size 2025-2029

The india captive power generation market size is forecast to increase by USD 8.76 billion at a CAGR of 7.9% between 2024 and 2029.

- The market presents significant opportunities for investors and businesses seeking to mitigate rising power costs and ensure energy security. Key drivers include high industrial power tariffs, which have increased by an average of 8-10% annually over the past decade, making captive power generation an attractive alternative for energy-intensive industries. Additionally, the increasing adoption of cogeneration plants, which produce both power and heat, is gaining traction due to their efficiency and cost savings. However, challenges persist, with the shortage of coal being a major concern for captive power generators, as coal remains the primary fuel source for most plants in India.

- Navigating this complex market landscape requires a deep of regulatory policies, fuel availability, and technological advancements. Companies seeking to capitalize on market opportunities and navigate challenges effectively should consider strategic partnerships, diversification of fuel sources, and investments in renewable energy solutions.

What will be the size of the India Captive Power Generation Market during the forecast period?

- The market is experiencing significant growth, driven by the country's emphasis on energy independence and the integration of renewable energy sources. Microgrid development, fueled by advances in power electronics and automation technologies, is a key trend in the market. Artificial intelligence (AI) and machine learning (ML) are increasingly being adopted for peak shaving, power system stability, and performance optimization. The circular economy is also influencing the market, with a focus on lifecycle cost analysis and energy conservation. Decentralized power, including hybrid power systems and distributed generation solutions, are gaining popularity due to grid modernization efforts. Big data analytics and cloud computing are enabling more efficient energy management and demand response.

- Renewable energy development and integration are major factors, with energy audit services and contractual energy services playing crucial roles. Harmonics mitigation, load shedding, and asset management are other areas of focus. The market encompasses various power generation technologies, including gas-based power plants, coal-based power plants, and renewable energy sources. Digital twins and energy consulting are also essential components of the evolving landscape. Overall, the Indian captive power generation market is dynamic and forward-thinking, with a strong emphasis on innovation and sustainability.

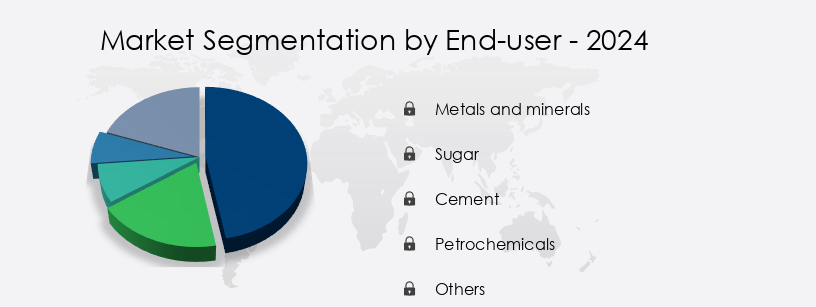

How is this market segmented?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Metals and minerals

- Sugar

- Cement

- Petrochemicals

- Others

- Fuel Type

- Coal

- Diesel

- Gas

- Renewables

- Ownership

- Multiple

- Single

- Technology

- Reciprocating engine

- Diesel generators

- Combined heat and power (CHP)

- Gas turbine

- Steam turbine

- Connectivity

- On-Grid

- Off-Grid

- Geography

- India

By End-user Insights

The metals and minerals segment is estimated to witness significant growth during the forecast period.

The metals and minerals industry is a significant consumer of energy due to the energy-intensive processes involved, such as mining, chemical extraction, beneficiation, and recycling. Processes like smelting, leaching, and electrowinning require substantial power for their operation, leading to high energy consumption and grid instability due to load variation. Consequently, the metals and minerals end-user segment relies heavily on captive power generation. Energy efficiency, fuel optimization, and emissions reduction are critical concerns for this sector. Renewable energy sources, including solar, wind, and biomass power, are increasingly being adopted for captive power generation due to their environmental benefits and cost savings.

Energy management software, IoT integration, and smart grid technologies are essential tools for optimizing power quality and ensuring grid integration. Industrial power generation solutions, such as steam turbines, gas turbines, diesel generators, and reciprocating engines, are commonly used for captive power generation in the metals and minerals industry. Government incentives, EPC services, and power management systems are also vital in facilitating the adoption of captive power generation. Energy storage solutions, such as battery energy storage, are increasingly being integrated into captive power generation systems to ensure power availability and reliability. Data centers and commercial buildings are also significant consumers of energy and are adopting captive power generation for energy efficiency and cost savings.

Process optimization and net metering are essential strategies for managing energy usage and costs in captive power generation systems.

Get a glance at the market report of share of various segments Request Free Sample

The Metals and minerals segment was valued at USD 5683.20 million in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of India Captive Power Generation Market?

- High industrial power tariffs is the key driver of the market.

- Electricity is an essential input for various industries, particularly in manufacturing, where it significantly impacts the process value chain and final products. High electricity tariffs can negatively affect industries that rely heavily on electricity, increasing competition with international manufacturers and ultimately passing on price increments to consumers. This results in higher prices for manufactured commodities. For energy-intensive applications, such as metal smelting or steel manufacturing, high industrial power tariffs lead to increased operational expenditure due to high costs of operation.

- As per , the high electricity costs pose a significant challenge for businesses in India, with the manufacturing sector being the most affected. This trend is expected to continue, necessitating the need for cost-effective power generation solutions.

What are the market trends shaping the India Captive Power Generation Market?

- Increasing adoption of cogeneration plants is the upcoming trend in the market.

- Cogeneration plants, also referred to as combined heat and power (CHP) or distributed generation, are facilities that generate two or more forms of energy from a single fuel source. These plants offer higher efficiency rates compared to traditional single-generation plants. The primary advantage of cogeneration plants lies in their ability to produce additional energy using the waste heat from various components, such as manufacturing plant exhausts, to generate electricity and heat for power plants. This recycling of waste heat leads to increased energy production and reduced fuel consumption, resulting in improved efficiency and decreased operational expenses.

- Heat is a crucial element in several industries, including fertilizer and textile manufacturing, making efficient heat utilization essential. Cogeneration plants effectively address this requirement by generating electricity and heat concurrently, thereby optimizing energy usage and minimizing fuel consumption. This approach not only enhances overall efficiency but also reduces operational costs for businesses.

What challenges does India Captive Power Generation Market face during the growth?

- Shortage of coal for captive power generation is a key challenge affecting the market growth.

- The market primarily depends on coal as the primary fuel source, accounting for a significant portion of fuel usage in this sector. However, coal scarcity has become a pressing issue for captive power plant owners due to government priorities to supply coal to utility power plants. This coal shortage negatively affects captive power plant operations and poses a threat to the production of various end-products such as steel, cement, aluminum, and fertilizers.

- Consequently, captive power plants are operating below their full capacity, impacting the overall output of manufacturing facilities. This situation highlights the need for alternative fuel sources and efficient coal management strategies to mitigate the impact of coal scarcity on captive power generation in India.

Exclusive India Captive Power Generation Market Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ambuja Cements Ltd.

- Bharat Heavy Electricals Ltd.

- Dalmia Bharat Group

- DCM Shriram Ltd.

- Ducon Infratechnologies Ltd.

- Essar

- General Electric Co.

- Hindalco Industries Ltd.

- Infosys Ltd.

- Jakson Group

- Jindal Steel and Power Ltd.

- Larsen and Toubro Ltd.

- Lloyds Metals and Energy Ltd.

- National Aluminium Co. Ltd.

- Reliance Industries Ltd.

- Tata Power Co. Ltd.

- Thermax Ltd.

- UltraTech Cement Ltd.

- Vedanta Ltd.

- Visa Steel Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by various factors including the increasing demand for energy efficiency, emissions reduction, and the integration of renewable energy sources. Project development in the industrial sector has been a key focus area, with energy management software and IoT integration playing crucial roles in optimizing power quality and energy efficiency. Industrial power generation continues to be a significant contributor to carbon footprints, making the adoption of green energy solutions increasingly important. Biomass power, solar power, and wind power have emerged as popular alternatives to traditional fossil fuel-based power generation.

Reciprocating engines and steam turbines have been widely used in captive power plants to generate electricity on-site, while gas turbines and diesel generators provide backup power and grid support. Fuel optimization has become a critical aspect of power generation, with companies focusing on reducing emissions and improving efficiency. Process optimization and grid integration have also gained importance, with smart grid technologies enabling better energy management and demand response. Metals and mining companies, data centers, and commercial buildings are among the major consumers of captive power, and net metering and energy services have emerged as key solutions for managing their energy needs.

The Indian government has introduced various incentives to promote the adoption of renewable energy and distributed generation. EPC services have gained popularity in the implementation of captive power projects, while power management systems have become essential for optimizing energy usage and ensuring power quality. Energy audits have become a crucial tool for identifying energy savings opportunities and reducing operational costs. Battery energy storage has emerged as a key enabler for renewable energy integration and grid stability. Industrial automation and IoT integration have also played a significant role in optimizing power generation and distribution. The evolving market dynamics have led to increased competition and innovation, with companies focusing on developing advanced technologies and solutions to meet the growing demand for reliable and efficient power generation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.9% |

|

Market growth 2025-2029 |

USD 8757.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across India

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements Get in touch