Steel Manufacturing Market Size 2025-2029

The steel manufacturing market size is valued to increase USD 455.4 billion, at a CAGR of 4.5% from 2024 to 2029. Upsurge in consumption of high-strength steel will drive the steel manufacturing market.

Major Market Trends & Insights

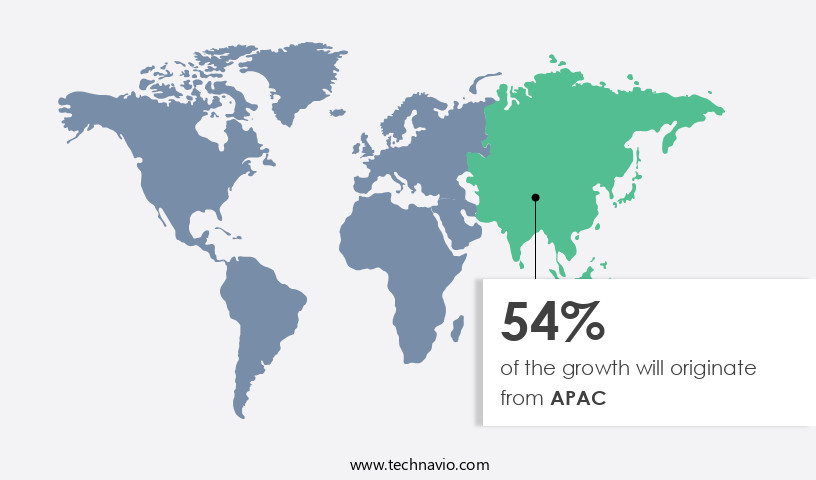

- APAC dominated the market and accounted for a 54% growth during the forecast period.

- By End-user - Construction segment was valued at USD 793.30 billion in 2023

- By Type - Flat segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 35.51 billion

- Market Future Opportunities: USD 455.40 billion

- CAGR : 4.5%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production and distribution of primary steel products, including iron, alloy, and specialty steel. This dynamic industry is driven by several key factors. The upsurge in consumption of high-strength steel, particularly in automotive and construction sectors, is a major growth catalyst. According to the World Steel Association, global steel demand reached 1.8 billion metric tons in 2020, with automotive and construction accounting for approximately 50% of the total consumption. Core technologies, such as electric arc furnaces and continuous casting, are transforming the manufacturing landscape, enabling increased efficiency and productivity. The market also faces challenges, including excess production capacity and growing demand for steel and stainless steel scrap.

- Regulations, including environmental and safety standards, continue to evolve, shaping the competitive landscape. In 2021, the European Union's Green Deal aims to make Europe carbon neutral by 2050, potentially impacting the steel industry's production methods and raw material sourcing. Despite these challenges, opportunities abound, particularly in emerging markets and innovative applications. For instance, the increasing adoption of electric vehicles is expected to boost demand for high-strength steel. In 2020, the electric vehicle market share was approximately 3% of global vehicle sales, with projections indicating significant growth in the coming years. As the market continues to unfold, stakeholders must stay informed of these trends and adapt to the evolving landscape.

What will be the Size of the Steel Manufacturing Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Steel Manufacturing Market Segmented and what are the key trends of market segmentation?

The steel manufacturing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Construction

- Machinery

- Automotive

- Metal products

- Others

- Type

- Flat

- Long

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

The construction segment is estimated to witness significant growth during the forecast period.

The market is a significant global industry, with the construction sector being its largest consumer in 2024. This sector's growth is driven by the construction of various infrastructure projects such as skyscrapers, tech parks, roads, motorways, and bridges. Steel's popularity in the building industry is due to its exceptional properties, including durability, strength, affordability, and adaptability for prolonged weather exposure. In the manufacturing process, material testing procedures ensure product quality and consistency. Annealing processes refine the steel's microstructure, enhancing its mechanical properties. Robotics in steelmaking streamline production, increasing efficiency and reducing labor costs. Surface treatments protect steel from corrosion and improve its appearance.

Waste management strategies minimize environmental impact, aligning with industry sustainability goals. Stainless steel production represents a growing segment due to its resistance to corrosion and high strength. Heat treatment processes further refine the steel's properties, while inventory management systems optimize production schedules. Basic oxygen furnaces and electric arc furnaces are essential in steel production, with the latter offering increased flexibility and energy efficiency. Defect detection methods employ advanced technologies like digital twin technology and mechanical properties testing to minimize production downtime and improve product quality. Alloy steel production caters to various industries, with process optimization techniques ensuring optimal yield and energy efficiency.

Energy efficiency metrics are crucial in the industry, with galvanizing lines and continuous casting processes contributing to significant energy savings. Blast furnace operations and quenching and tempering processes are integral to steel production, with predictive maintenance and quality control systems ensuring optimal performance. Pickling processes remove impurities, while coating processes protect the steel from corrosion. Carbon steel production remains a significant segment due to its versatility and affordability. The steel manufacturing industry is continuously evolving, with a focus on reducing carbon footprints through the adoption of cleaner production methods and energy-efficient technologies. Cold rolling mills and hot rolling mills transform raw steel into finished products, while steel microstructure analysis provides valuable insights into product performance.

Production scheduling optimization and automation technology further streamline operations and improve efficiency.

The Construction segment was valued at USD 793.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Steel Manufacturing Market Demand is Rising in APAC Request Free Sample

The Asia Pacific (APAC) region dominates The market, accounting for a significant market share. This trend is expected to persist throughout the forecast period due to the region's robust industrialization and extensive infrastructural developments. Countries like Indonesia, South Korea, and India are witnessing a surge in industrial, commercial, and residential projects. These projects contribute significantly to the demand for steel in APAC. Moreover, government initiatives in various countries are anticipated to fuel the demand for steel, thereby propelling the growth of the regional the market. According to recent data, the number of ongoing construction projects in APAC is projected to reach over 12,000 by the end of the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry, characterized by continuous optimization of processes and advancements in technology. The steel industry's core focus lies in enhancing the efficiency and quality of steel production, from the optimization of the steel rolling process to the impact of alloying elements and advanced heat treatment techniques. These improvements aim to boost steel casting quality and expand the applications of high-strength steel. Latest advancements in steel production include modern quality control methods, sustainable manufacturing practices, and reducing energy consumption. For instance, implementing automation in steelmaking through robotics and predictive maintenance strategies in steel mills has led to significant improvements in production yield.

Moreover, the steel recycling process is being optimized to minimize waste and promote circular economy principles. The digital transformation in the steel industry is another key trend, with the use of machine learning algorithms and steel microstructure analysis techniques facilitating process optimization in steel plants. Adoption of these advanced technologies is growing rapidly, with more than 70% of leading steel producers investing in digital solutions. This investment is expected to result in substantial improvements in production efficiency and product quality. Comparatively, traditional steel manufacturing practices still account for a significant share of the industry. However, the shift towards sustainable and technologically advanced methods is gaining momentum, with a growing number of players adopting these practices to stay competitive.

The industrial application segment, which accounts for the largest share of steel consumption, is expected to continue driving market growth, with a focus on improving steel production yield and reducing energy consumption.

What are the key market drivers leading to the rise in the adoption of Steel Manufacturing Industry?

- The significant increase in the demand for high-strength steel is the primary market driver. This trend is attributed to the steel's enhanced properties, making it a preferred choice in various industries, including automotive, construction, and manufacturing.

- High-strength stainless steel has experienced escalating demand across various sectors due to its superior properties. This steel type offers enhanced strength at both standard and elevated temperatures, making it a preferred choice for architectural, industrial, and consumer applications. The affordability and high strength-to-weight ratio of high-strength stainless steel have contributed significantly to its increasing consumption. Factors such as strategic positioning and expanded product offerings are expected to bolster sales during the forecast period. The market dynamics of high-strength stainless steel are characterized by continuous evolution and growth. For instance, advancements in manufacturing techniques have led to the production of high-strength stainless steel with improved mechanical properties.

- Additionally, the increasing focus on sustainability and energy efficiency has fueled the adoption of high-strength stainless steel in green technologies. Overall, the market for high-strength stainless steel is poised for significant growth, driven by its versatility and the increasing demand for durable and strong materials.

What are the market trends shaping the Steel Manufacturing Industry?

- The increasing demand for steel and stainless steel scrap represents a notable market trend in the present day. This trend is shaped by various factors, including the expanding construction industry and the growing preference for sustainable manufacturing processes.

- The global steel industry is witnessing a notable shift towards the increased utilization of recycled steel and stainless-steel scrap. This trend is driven by the economic benefits and environmental sustainability that comes with recycling. For every metric ton of scrap steel, approximately 2.9 metric tons of CO2 emissions are saved. This reduction in CO2 emissions is achieved through minimized energy and water consumption, as well as decreased air pollution. The preference for steel and stainless-steel scrap as raw materials for stainless steel production is on the rise.

- Producers can opt for using these materials alone or in conjunction with other raw materials. The adoption of recycled steel and stainless-steel scrap not only bolsters the economic viability of the steel industry but also lessens its environmental impact by decreasing the demand for iron ore extraction for stainless steel production.

What challenges does the Steel Manufacturing Industry face during its growth?

- Excess production capacity poses a significant challenge to the industry's growth by hindering the achievement of optimal utilization of resources and potential revenue generation.

- The market faces ongoing challenges from excess production capacity, leading to persistent oversupply. Despite reformation measures, the utilization ratio is projected to remain low, with steel demand outpacing its supply. For instance, in major producers like China and India, demand has accounted for approximately 88%-92% of their total crude steel production over the past five years. In the third quarter of 2024, Baowu Steel Group, a Chinese steelmaker, produced 12.56 million tons of pig iron and 13.3 million tons of steel.

- These circumstances have resulted in declining profit margins for steel manufacturers. The steel industry's continuous evolution and applications span various sectors, including construction, automotive, and packaging, among others. This data-driven narrative underscores the importance of managing production capacity and adapting to shifting market demands.

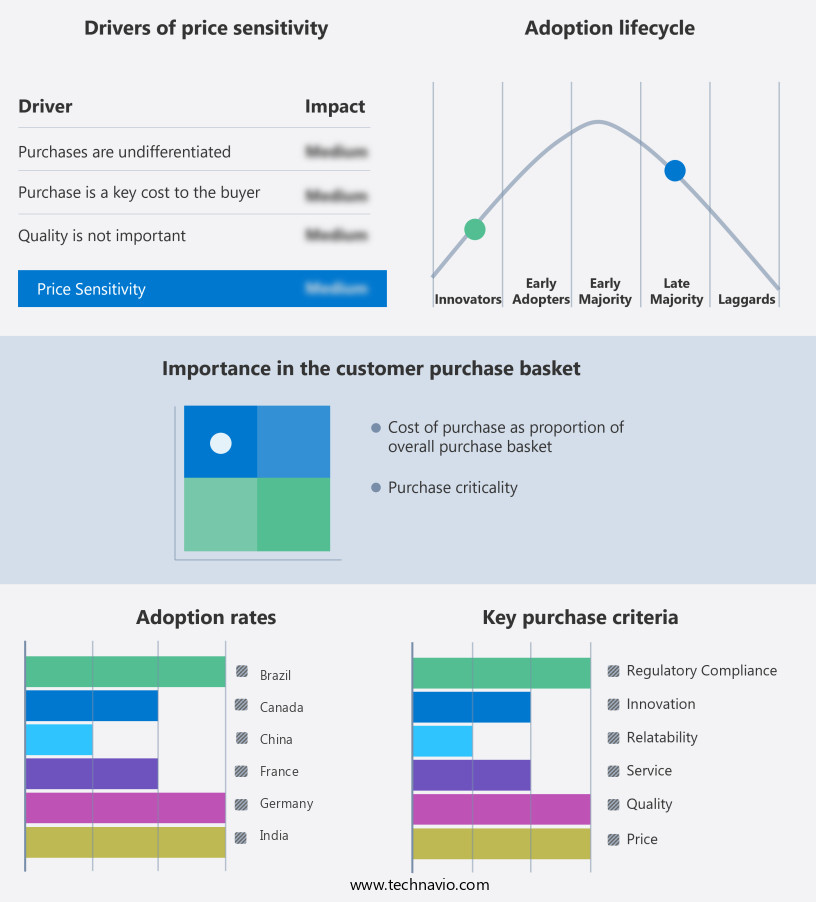

Exclusive Technavio Analysis on Customer Landscape

The steel manufacturing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the steel manufacturing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Steel Manufacturing Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, steel manufacturing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ansteel Group Corp. Ltd. - This company specializes in producing high-quality steel for various industries, including bridge, automotive, and railway sectors. Their steel solutions cater to diverse applications, ensuring strength, durability, and safety. With a focus on innovation and excellence, they deliver top-tier steel manufacturing services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ansteel Group Corp. Ltd.

- ArcelorMittal

- Baosteel Group Corp.

- Beijing Shougang Co. Ltd.

- Benxi Steel Group Co. Ltd.

- China Jianlong Steel Industrial Co. Ltd.

- Essar

- Gerdau SA

- Hebei Jingye Group

- Hyundai Steel Co.

- JFE Holdings Inc.

- Jiangsu Shagang International Trade Co. Ltd.

- JSW Holdings Ltd.

- Nippon Steel Corp.

- NLMK Group

- Nucor Corp.

- POSCO holdings Inc.

- Steel Authority of India Ltd.

- Tata Sons Pvt. Ltd.

- thyssenkrupp AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Steel Manufacturing Market

- In January 2024, ArcelorMittal, the world's leading steel and mining company, announced the launch of its new GreenX steel product line, which utilizes hydrogen-derived direct reduced iron (HDRI) in the steelmaking process, reducing carbon emissions by up to 25% (ArcelorMittal press release, 2024).

- In March 2024, ThyssenKrupp AG and Tata Steel formed a strategic partnership to merge their European steel businesses, creating a new entity, ThyssenKrupp Tata Steel Europe, with an estimated combined market share of 20% in Europe (Reuters, 2024).

- In May 2024, United States Steel Corporation (U.S. Steel) received regulatory approval from the U.S. Department of Defense to construct a new USD1.5 billion mini-mill in Granite City, Illinois, which will increase the company's annual steel production capacity by 3 million tons (U.S. Steel press release, 2024).

- In February 2025, Baosteel Group, China's largest steel producer, signed a memorandum of understanding with Siemens Energy to collaborate on the development of hydrogen-based steelmaking technology, aiming to reduce carbon emissions in the steel industry (Siemens Energy press release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Steel Manufacturing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 455.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.3 |

|

Key countries |

US, China, India, Russia, Germany, Japan, Canada, UK, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of steel manufacturing, various processes and technologies continue to shape the industry's landscape. One significant development is the increasing adoption of advanced testing procedures, such as material testing and steel microstructure analysis, ensuring product quality and consistency. Another transformative trend is the integration of robotics in steelmaking, streamlining production processes and enhancing efficiency. Robotics are employed in various stages, from annealing and heat treatment to surface treatment and coating processes. Moreover, waste management strategies have gained prominence as a critical focus area, with steel companies striving for carbon footprint reduction and energy efficiency.

- Innovations like digital twin technology and production scheduling optimization are key contributors to this goal. The steel industry's technological evolution also extends to steel grade selection and alloy steel production, where automation technology plays a pivotal role. Process optimization techniques, such as predictive maintenance and quality control systems, further ensure optimal performance and minimize defects. Heat treatment processes, including annealing, quenching, and tempering, continue to be refined, with a focus on improving mechanical properties and enhancing product quality. Meanwhile, the operation of traditional processes like the basic oxygen furnace and electric arc furnace is being revolutionized through digital advancements.

- In the realm of stainless steel production, galvanizing lines and continuous casting processes have gained popularity due to their ability to produce high-quality, consistent products. Additionally, the implementation of advanced defect detection methods and cold and hot rolling mills ensures the production of superior steel grades. As the steel manufacturing industry continues to evolve, these trends and technologies will shape its future, driving innovation and growth.

What are the Key Data Covered in this Steel Manufacturing Market Research and Growth Report?

-

What is the expected growth of the Steel Manufacturing Market between 2025 and 2029?

-

USD 455.4 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report segmented by End-user (Construction, Machinery, Automotive, Metal products, and Others), Type (Flat and Long), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Upsurge in consumption of high-strength steel, Excess production capacity

-

-

Who are the major players in the Steel Manufacturing Market?

-

Key Companies Ansteel Group Corp. Ltd., ArcelorMittal, Baosteel Group Corp., Beijing Shougang Co. Ltd., Benxi Steel Group Co. Ltd., China Jianlong Steel Industrial Co. Ltd., Essar, Gerdau SA, Hebei Jingye Group, Hyundai Steel Co., JFE Holdings Inc., Jiangsu Shagang International Trade Co. Ltd., JSW Holdings Ltd., Nippon Steel Corp., NLMK Group, Nucor Corp., POSCO holdings Inc., Steel Authority of India Ltd., Tata Sons Pvt. Ltd., and thyssenkrupp AG

-

Market Research Insights

- The market is a dynamic and complex industry, characterized by continuous innovation and evolution. Two key indicators illustrate its current state. First, the integration of scrap metal recycling into production processes has led to a significant increase in steel product quality. For instance, recycled steel can reduce emissions by up to 86% compared to primary steel production. Second, the adoption of advanced technologies, such as impact testing, hardness testing, and process control algorithms, has boosted production efficiency. For example, high-strength steel now accounts for over 50% of global steel production, with yield strengths exceeding 550 MPa. These advancements not only enhance product performance, but also contribute to industrial safety standards and environmental regulations.

- Additionally, simulation software, predictive modeling, and data analytics platforms enable resource optimization, reducing energy consumption and improving supply chain management. The market's focus on corrosion resistance, wear resistance, and machine learning applications further underscores its commitment to improving steel's properties and overall value proposition.

We can help! Our analysts can customize this steel manufacturing market research report to meet your requirements.