Carbon Black Market Size 2025-2029

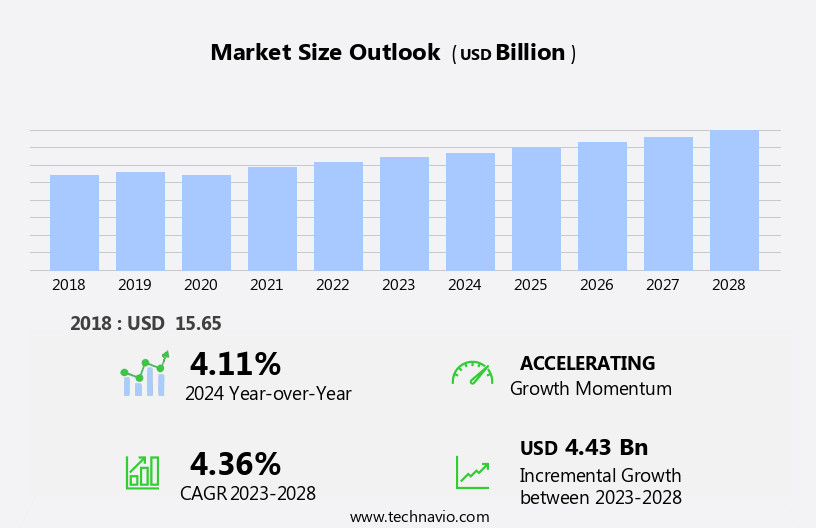

The carbon black market size is forecast to increase by USD 4.77 billion, at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing use of carbon black in various end-user industries, particularly in the tire sector. This trend is driven by the demand for superior product performance and durability. Another key factor fueling market growth is the rising preference for sustainable carbon black, which is derived from renewable sources and reduces the environmental impact of traditional production methods. However, the market is not without challenges. Fluctuations in crude oil prices pose a significant risk to the market's stability, as carbon black is derived from crude oil. Producers must navigate these price fluctuations to maintain profitability and competitiveness.

- Additionally, the market faces challenges from alternative materials, such as speciality chemicals, silica and nanotechnology-based products, which offer similar performance benefits but may be more cost-effective or environmentally friendly. Companies seeking to capitalize on market opportunities must stay abreast of these trends and challenges to effectively meet customer demands and maintain a competitive edge.

What will be the Size of the Carbon Black Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the diverse applications and advancements in technology across various sectors. Renewable resources are increasingly utilized in carbon black production through gas-phase synthesis, complementing traditional oil-based methods. Injection molding and tire manufacturing industries remain significant consumers, with tire shredding and recycling gaining traction in the circular economy. X-ray diffraction and transmission electron microscopy provide insights into carbon black's surface morphology, influencing its properties in tire reinforcement and conductive fillers. Infrared spectroscopy and thermogravimetric analysis are essential for performance testing and quality control in rubber compounds. Carbon nanotubes and nanocarbon materials offer enhanced abrasive resistance and conductivity, expanding applications in battery electrodes, conductive inks, and functionalized carbon black.

Masterbatch production and dispersion technology ensure uniform distribution of carbon black in polymers, improving their properties. Environmental sustainability is a growing concern, leading to research on bio-based carbon black and gas-based methods. Surface tension analysis and dynamic mechanical analysis contribute to understanding the behavior of carbon black in various applications. Carbon black recovery and waste management are crucial aspects of the market, with ongoing efforts to optimize processes and reduce environmental impact. ASTM and ISO standards ensure consistency and quality in carbon black grades, while surface area and tensile strength remain key performance indicators. The evolving the market is shaped by continuous research, technological advancements, and the pursuit of improved performance and sustainability in various industries.

How is this Carbon Black Industry segmented?

The carbon black industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Tires

- Non-tires rubber

- Non-rubber

- Grade Type

- Specialty grade

- Standard grade

- Type

- Furnace black

- Thermal black

- Acetylene black

- Channel black

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

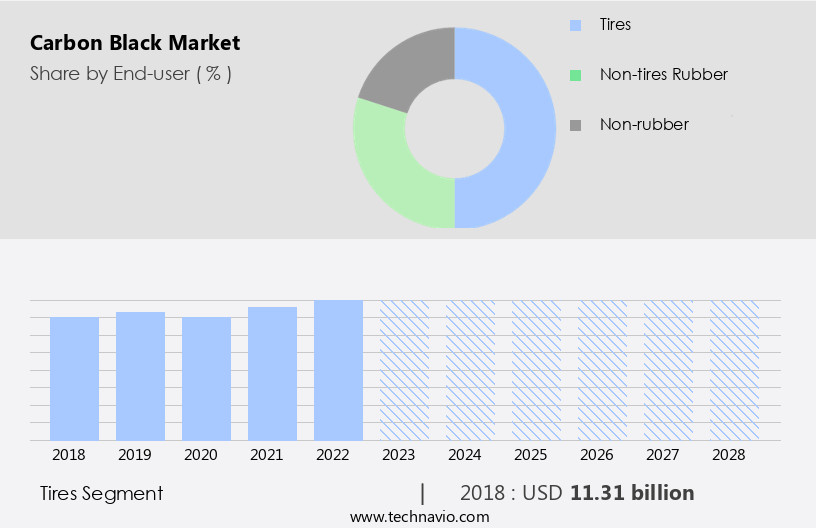

By End-user Insights

The tires segment is estimated to witness significant growth during the forecast period.

Carbon black is a crucial component in tire manufacturing, contributing to improved performance properties and the tires' distinctive black color. Its role extends beyond aesthetics, as it enhances wear resistance and heat dissipation, thereby increasing tire service life. The escalating global population and rising purchasing power fuel the demand for automobiles, consequently driving the growth of the market. Europe, with major automotive manufacturing hubs like Germany and Italy, is a significant contributor to market expansion. Developing countries, such as India and Brazil, are experiencing substantial growth in their automotive industries, further propelling market growth. The circular economy concept is gaining traction, with tire recycling emerging as a viable solution for waste management.

This trend is leading to the production of bio-based carbon black and the reuse of carbon black in the manufacturing of plastic additives and reinforcing fillers. Nanocarbon materials, including carbon nanotubes and functionalized carbon black, are increasingly being used in high-performance applications, such as battery electrodes and conductive inks. Gas-phase synthesis and thermogravimetric analysis are employed in the production of carbon black, ensuring consistent quality and adherence to industry standards. Carbon black is also utilized in various industries beyond tire manufacturing. It is used as a pigment in rubber compounds, contributing to their enhanced abrasion resistance and thermal stability.

In the realm of printed electronics, carbon black is employed as a conductive filler, while in the production of organic solar cells, it plays a role in improving surface area and surface tension. The market for carbon black is diverse, with applications ranging from industrial applications to high-tech industries. The integration of carbon black in various industries is a testament to its versatility and indispensability. Injection molding, x-ray diffraction, and transmission electron microscopy are used in the production and analysis of carbon black grades, ensuring consistency and quality. The market for carbon black is subjected to stringent regulations, with organizations such as ASTM and ISO setting industry standards for quality control.

The market is continually evolving, with advancements in technology leading to the development of new carbon black grades and applications. The future of the market is promising, with a focus on environmental sustainability, renewable resources, and the circular economy.

The Tires segment was valued at USD 11.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

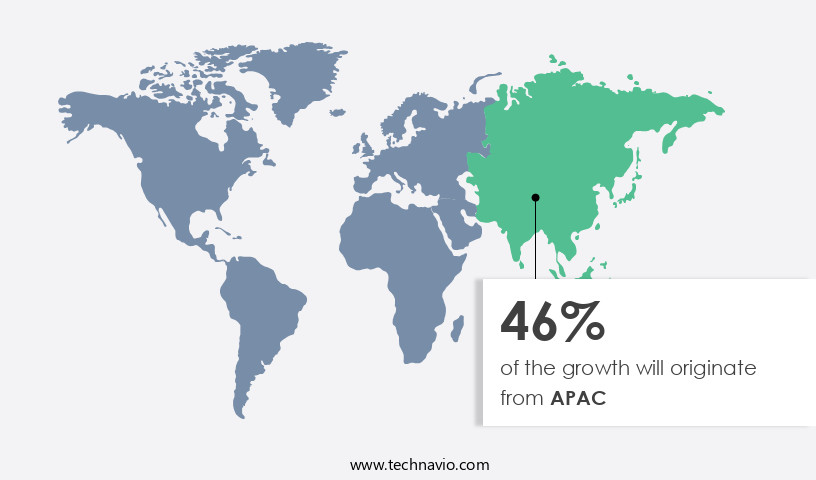

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The APAC region, specifically China, India, Japan, and South Korea, dominates The market, driving both production and consumption trends. China, as the world's largest carbon black producer, accounts for a substantial portion of the global output. Rapid industrialization, automotive sector expansion, and infrastructure development in China have fueled the demand for carbon black in various applications, including tire manufacturing, plastics, and coatings. This robust demand from China influences global market dynamics, affecting prices, production volumes, and trade patterns. Carbon black production methods include lamp black, gas-based, and oil-based processes. Gas-based and oil-based carbon black production have gained traction due to their cost-effectiveness and environmental sustainability.

Bio-based carbon black and nanocarbon materials are emerging as eco-friendly alternatives, aligning with the circular economy. Performance testing, surface tension, and particle size distribution are crucial factors in carbon black production and application. Carbon black finds extensive use in tire manufacturing for reinforcement and wear resistance. In the plastics industry, it acts as a pigment and reinforcing filler, enhancing the material's strength and durability. In the coatings sector, carbon black is used for its conductive properties and UV protection. Carbon nanotubes, conductive fillers, and functionalized carbon black are advanced materials with enhanced properties, gaining popularity in various applications.

Carbon black production involves various processes, including gas chromatography, thermogravimetric analysis, and x-ray diffraction, to ensure quality control and product consistency. Waste management, including tire shredding and carbon black recovery, is a critical aspect of the carbon black industry, focusing on reducing environmental impact and promoting sustainability. Injection molding, printing electronics, and battery electrodes are emerging applications for carbon black, offering growth opportunities in the market. Environmental sustainability, thermal decomposition, and dynamic mechanical analysis are essential factors influencing the development of carbon black technology. The market continues to evolve, with a focus on renewable resources, iso standards, and advanced dispersion technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Carbon Black Industry?

- The significant expansion of carbon black utilization across various end-user industries serves as the primary market growth catalyst.

- Carbon black is an essential component in the production of rubber products, particularly in the automotive industry for tire reinforcement. This material enhances the durability and wear resistance of tires by improving their elasticity and strength. In addition, carbon black plays a crucial role in heat dissipation, preventing thermal damage and extending tire life. Carbon black is also used in various industrial applications, such as battery electrodes, conductive inks, and pigment concentrates. The production of carbon black involves gas-phase synthesis, followed by thermogravimetric analysis to determine the quality and composition of the final product. Carbon black grades vary based on their particle size and dispersion technology, which impacts their performance in different applications.

- Waste management is a significant concern in carbon black production, and the use of wetting agents and other additives can help optimize the process and minimize environmental impact. Adhering to ASTM standards ensures the consistency and quality of carbon black products.

What are the market trends shaping the Carbon Black Industry?

- The trend in the market is shifting towards increased demand for sustainable options. Sustainable carbon black is becoming a priority for businesses seeking to reduce their environmental footprint.

- The market is experiencing growth due to the increasing demand for sustainable alternatives in the chemical industry. Bio-based carbon black, derived from renewable resources such as vegetable oil through processes like injection molding and x-ray diffraction, is gaining traction as an eco-friendly substitute for oil-based carbon black. Recycled carbon black, produced from recycled tires and waste materials, is another sustainable option that reduces waste and contributes to environmental sustainability. Sustainable carbon black is expected to witness significant growth during the forecast period as consumers and regulators prioritize environmental concerns. Companies like Bolder Industries and Black Bear Carbon are leading the way in sustainable carbon black production, using masterbatch production techniques and advanced technologies like infrared spectroscopy and transmission electron microscopy to ensure high-quality products.

- Sustainable carbon black offers advantages such as improved abrasive resistance and surface morphology, making it suitable for various applications, including tire manufacturing and electrochemical applications. The use of carbon black as conductive fillers in these industries is expected to further boost market growth. Overall, the market is poised for growth as the demand for sustainable alternatives continues to rise.

What challenges does the Carbon Black Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- Carbon black is a critical component in the production of various industrial products, primarily rubber compounds. It is manufactured through thermal decomposition or partial combustion of hydrocarbons, primarily oil and natural gas. The furnace process is the most common method used for producing carbon black, resulting in the formation of furnace black. This type of carbon black differs from that produced by other methods. Carbon black acts as a filler and reinforcing agent in rubber, enhancing its properties such as abrasion resistance, iso standards compliance, and improved polymer additives performance. In the tire industry, carbon black is used extensively in inner liners, carcasses, sidewalls, and treads based on specific performance requirements.

- The production process of carbon black involves elemental analysis using techniques such as Raman spectroscopy and thermal decomposition. These methods ensure the quality control of carbon black, maintaining consistent particle size distribution and dynamic mechanical analysis properties. Carbon black also finds applications in emerging fields like printed electronics, further expanding its market potential.

Exclusive Customer Landscape

The carbon black market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the carbon black market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, carbon black market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aditya Birla Management Corp. Pvt. Ltd. - Birla Carbon, a leading global provider in carbon black solutions, delivers innovative, high-performance products to various industries. Our offerings cater to diverse applications, ensuring optimal functionality and sustainability. Through advanced research and development, we create carbon black solutions that enhance tire performance, improve fuel efficiency, and contribute to a greener future. Our commitment to quality and innovation sets US apart, driving customer satisfaction and industry advancement.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aditya Birla Management Corp. Pvt. Ltd.

- Bridgestone Corp.

- Cabot Corp.

- CSRC Investment Holdings Co. Ltd.

- Himadri Speciality Chemical Ltd.

- Imerys S.A.

- Kemipex

- Longxing Chemical Industry Co. Ltd.

- Mitsubishi Chemical Corp.

- OCI Co. Ltd.

- Omsk Carbon Group

- Orion Engineered Carbons SA

- Phillips Carbon Black Ltd.

- Saudi Basic Industries Corp.

- The Dow Chemical Co.

- Tokai Carbon Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Carbon Black Market

- In February 2023, Carbon Black, a leading cybersecurity company specializing in endpoint security, announced the launch of its Cloud-Native Protection Platform (CNPP), expanding its offerings beyond traditional on-premises solutions. This strategic move aimed to cater to the growing demand for cloud security and positioned Carbon Black as a major player in the cloud security market (Carbon Black Press Release).

- In June 2024, VMware, a global leader in cloud infrastructure and digital workspace technology, completed its acquisition of Carbon Black for approximately USD2.1 billion. This merger aimed to strengthen VMware's security portfolio and enhance its ability to provide comprehensive cybersecurity solutions to its clients (VMware Press Release).

- In October 2024, Carbon Black unveiled its advanced threat hunting capabilities, enabling security teams to proactively identify and respond to sophisticated cyber threats. This technological advancement showcased Carbon Black's commitment to innovation and staying ahead of evolving threat landscapes (Carbon Black Press Release).

- In March 2025, Carbon Black expanded its presence in the Asia Pacific region by opening a new office in Singapore. This strategic move aimed to cater to the growing demand for cybersecurity solutions in the region and to better serve its clients in the area (Carbon Black Press Release).

Research Analyst Overview

- Carbon black, a key additive in reinforced composites, continues to influence various industries due to its unique properties. In tire manufacturing, carbon black composites enhance wear resistance, rolling resistance, and hydroplaning resistance in tires, contributing to fuel efficiency and improved performance. Meanwhile, in the realm of biocompatible materials, carbon black innovation is paving the way for advancements in tissue engineering and biomedical applications. Carbon black dispersions and conductive plastics are also gaining traction in the electronics sector. These materials, with their high electrical conductivity, are essential in producing antistatic plastics and electrical conductive polymers, enhancing the performance of electronic devices.

- Moreover, carbon black's corrosion resistance and thermal conductivity make it an ideal additive in high-performance plastics. This property is particularly valuable in extreme temperatures, ensuring durability and reliability in various industries. The market is driven by the increasing demand for high-performance materials in various sectors. With the continuous innovation in carbon black technology, the market is expected to grow, offering significant opportunities for businesses. Carbon black pricing remains a critical factor in the market, with the cost-effectiveness of carbon black dispersions and surface modification techniques influencing the competitiveness of various applications. As the demand for sustainable and eco-friendly alternatives grows, biodegradable carbon black and alternative reinforcement materials are gaining attention, potentially disrupting the traditional the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Carbon Black Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 4768.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

China, US, India, Brazil, Germany, Japan, France, South Korea, Canada, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Carbon Black Market Research and Growth Report?

- CAGR of the Carbon Black industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the carbon black market growth of industry companies

We can help! Our analysts can customize this carbon black market research report to meet your requirements.