Cardiovascular Ultrasound Imaging Systems Market Size 2024-2028

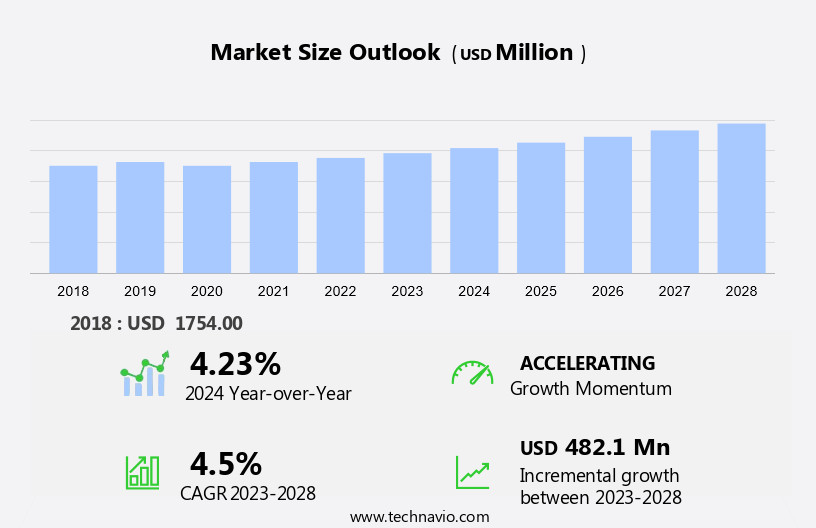

The cardiovascular ultrasound imaging systems market size is forecast to increase by USD 482.1 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increase in product launches and technological advances. The market is witnessing a increase in demand due to the high diagnostic accuracy and non-invasive nature of these systems. However, the high cost of cardiovascular ultrasound imaging systems remains a major challenge for market growth. Despite this, the market is expected to continue expanding due to the rising prevalence of cardiovascular diseases and the growing awareness of early diagnosis and prevention. The use of advanced technologies such as 3D and 4D imaging, artificial intelligence, and machine learning is also expected to drive market growth In the coming years. The market analysis report provides a comprehensive overview of these trends and challenges, offering insights into market size, share, and growth prospects.

What will be the Size of the Market During the Forecast Period?

- The market encompasses modern technologies, including transthoracic echocardiography, B-mode echography, and Doppler modalities, used for cardiac ultrasound imaging. This market is driven by several factors, including the growing geriatric population, increased focus on preventive medicine, and heightened disease awareness for lifestyle-associated chronic diseases such as coronary heart diseases, stroke, and cardiomyopathy. Government agencies play a significant role in market growth through reimbursement policies and scenarios.

- The economic impact of these systems is substantial, as they enable healthcare providers to diagnose and monitor various cardiovascular conditions more accurately and efficiently. Artificial intelligence and Whale Imaging technologies are emerging trends, enhancing image analysis and interpretation capabilities. Reimbursement policies and transducers continue to evolve, ensuring the continued relevance and expansion of the ultrasound market In the healthcare sector.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- 2D 3D and 4D

- 5D

- Geography

- North America

- Canada

- US

- Europe

- Denmark

- Asia

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

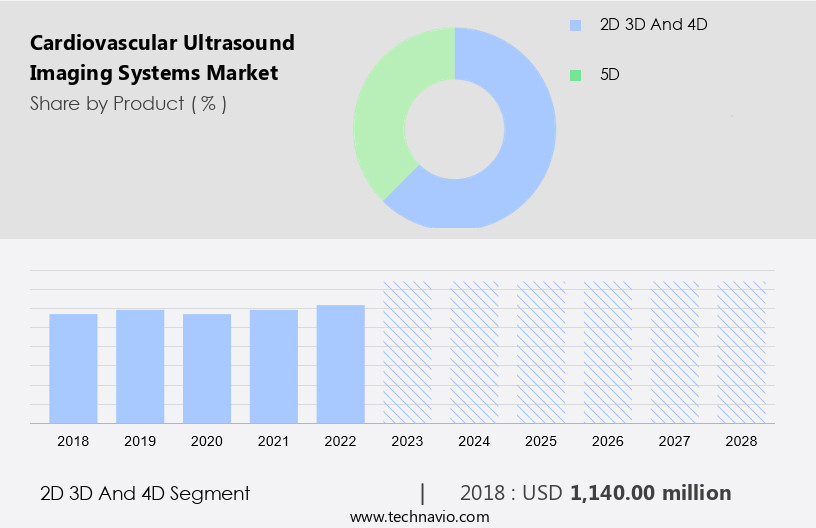

- The 2D 3D and 4D segment is estimated to witness significant growth during the forecast period.

Cardiovascular ultrasound systems, specifically 2D and 3D cardiovascular ultrasound imaging, play a significant role In the healthcare industry for diagnosing various cardiovascular diseases. These non-invasive diagnostic procedures are widely adopted by hospitals, clinics, and diagnostic centers due to their affordability and effectiveness. 2D cardiovascular ultrasound systems are utilized for coronary artery calcifications and stenosis detection, while 3D advanced systems create multiplanar images from 2D data. The geriatric population benefits greatly from these systems due to the high prevalence of cardiovascular diseases among older adults. Government agencies prioritize preventive medicine, making ultrasound diagnosis a popular choice. Modern technologies, such as artificial intelligence and reimbursement policies, are driving the economic impact of cardiovascular ultrasound systems.

Get a glance at the Cardiovascular Ultrasound Imaging Systems Industry report of share of various segments Request Free Sample

The 2D 3D and 4D segment was valued at USD 1.14 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market for cardiovascular ultrasound systems is projected to expand at a steady pace due to the region's significant contribution from the US and Canada. The presence of leading companies, such as GE Healthcare and NeuroLogica Corp., based In the US, fuels market growth. These companies introduce innovative products, including point-of-care ultrasound systems, to cater to the increasing demand for non-invasive diagnostic procedures. Government agencies and healthcare providers prioritize preventive medicine for the geriatric population, which is at a higher risk of cardiovascular diseases like ischemic heart disease, hypertension, and stroke. Modern technologies, such as B-mode echography, Doppler modalities, and fetal echocardiography, enable early diagnosis and effective treatment, reducing mortality rates.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cardiovascular Ultrasound Imaging Systems Industry?

Increase in product launches is the key driver of the market.

- The global cardiovascular ultrasound systems market experiences significant growth due to several factors. The aging geriatric population necessitates preventive medical interventions, leading to an increased demand for non-invasive diagnostic procedures like cardiovascular ultrasound. Government agencies promote the use of modern technologies in healthcare, favoring the adoption of advanced ultrasound systems. Fetal echocardiography and acute cardiac injury diagnosis are critical applications of cardiovascular ultrasound systems, contributing to their increasing utilization. Reimbursement policies and healthcare providers' acceptance of ultrasound diagnosis further boost market expansion. B-mode echography, Doppler modalities, and transducers are essential components of cardiovascular ultrasound systems, enabling the diagnosis of various cardiovascular diseases, such as ischemic heart disease, hypertension, and lifestyle-associated chronic diseases like cardiomyopathy.

- Stroke is another significant application area for these systems. Artificial intelligence integration in cardiovascular ultrasound systems enhances diagnostic accuracy and efficiency, making them indispensable tools in healthcare settings. Reimbursement scenarios and economic impact studies further prioritize the importance of these systems in improving patient care and reducing mortality rates. Companies continually innovate and launch improved cardiovascular ultrasound systems, such as Whale Imaging's latest offerings, to cater to the evolving needs of healthcare providers and patients. These advancements contribute to the dynamic nature of the cardiovascular ultrasound systems market.

What are the market trends shaping the Cardiovascular Ultrasound Imaging Systems Industry?

Technological advances is the upcoming market trend.

- Cardiovascular ultrasound systems have become essential tools In the healthcare industry for diagnosing and managing various cardiac diseases. The geriatric population's increasing prevalence and the rising awareness of preventive medicine have fueled the demand for these systems. Government agencies are also promoting the use of non-invasive diagnostic procedures to reduce healthcare costs and improve patient outcomes. Modern technologies, such as Tissue Doppler Imaging, Strain Imaging, Contrast Echocardiography, 3D Echocardiography, Point-of-Care Ultrasound, Artificial Intelligence Integration, and Advanced Image Processing, have significantly advanced the capabilities of cardiovascular ultrasound systems. These innovations offer improved diagnostic accuracy, enhanced patient care, and increased efficiency in clinical practice.

- Fetal echocardiography is another application of cardiovascular ultrasound systems, enabling early detection and treatment of congenital heart diseases. Additionally, cardiovascular ultrasound systems play a crucial role in diagnosing acute cardiac injury, ischemic heart disease, hypertension, cardiomyopathy, stroke, and other lifestyle-associated chronic diseases. Reimbursement policies and economic impact are critical factors influencing the market dynamics of cardiovascular ultrasound systems. Healthcare providers and patients alike benefit from the cost-effectiveness and accuracy of these systems, making them a valuable investment In the healthcare industry. B-mode echography, sonography, transducers, and Doppler modalities are essential components of cardiovascular ultrasound systems. As technology continues to evolve, the market for these systems is expected to grow significantly during the forecast period.

What challenges does the Cardiovascular Ultrasound Imaging Systems Industry face during its growth?

High cost of cardiovascular ultrasound imaging systems is a key challenge affecting the industry growth.

- The global cardiovascular ultrasound systems market is experiencing significant growth due to the increasing prevalence of cardiovascular diseases, particularly among the geriatric population. Government agencies are promoting preventive medicine, leading to an increased focus on non-invasive diagnostic procedures. Modern technologies, such as artificial intelligence and advanced sonography techniques like B-mode echography, Doppler modalities, and transducers, are enhancing the diagnostic capabilities of these systems. Fetal echocardiography is another growing application area, as early detection and treatment of cardiovascular conditions in infants can significantly reduce mortality rates from ischemic heart disease, hypertension, and other lifestyle-associated chronic diseases. Reimbursement policies vary across regions, impacting the economic viability of systems for healthcare providers.

- Acute cardiac injury, cardiomyopathy, stroke, coronary heart diseases, and other cardiovascular conditions are common indications for imaging. Despite these opportunities, the high cost of systems and the availability of alternatives like X-rays and MRI limit market growth. Reimbursement scenarios and the ongoing development of cost-effective solutions are key factors influencing the future direction of the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Boston Scientific Corp.

- Butterfly Network Inc.

- Canon Inc.

- Chison Medical Technologies Co. Ltd.

- Christie Innomed Inc.

- CQuence Health Group

- Esaote Spa

- FUJIFILM Corp.

- General Electric Co.

- Hitachi Ltd.

- Koninklijke Philips N.V.

- Medis Medical Imaging Systems BV

- Samsung Electronics Co. Ltd.

- Scintica Instrumentation Inc.

- Sectra AB

- Shenzhen Mindray BioMedical Electronics Co. Ltd

- Siemens AG

- Suntrion Wholesale Trading LLC

- Ultromics Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Cardiovascular ultrasound systems have emerged as a crucial diagnostic tool In the healthcare industry, particularly In the context of the growing burden of cardiovascular diseases (CVDs) worldwide. The geriatric population, with its increased susceptibility to CVDs, is a significant consumer of these imaging systems. The role of these systems in preventive medicine is increasingly recognized, as early detection and timely intervention can significantly reduce morbidity and mortality. Modern technologies, including advanced imaging modalities and artificial intelligence (AI) algorithms, have revolutionized imaging. These innovations enable more accurate and efficient diagnosis, leading to improved patient outcomes and reduced healthcare costs.

In addition, fetal echocardiography is one such application that has gained significant traction due to its ability to detect congenital heart defects in utero. Reimbursement policies play a critical role In the adoption of systems. Healthcare providers rely on favorable reimbursement scenarios to justify the investment In these systems. Government agencies, recognizing the economic impact of CVDs, have implemented policies to encourage the use of non-invasive diagnostic procedures, over more invasive alternatives. The increasing prevalence of lifestyle-associated chronic diseases, including ischemic heart disease, hypertension, and sedentary lifestyle-induced cardiomyopathy, has fueled the demand for these systems.

Moreover, stroke, another CVD, is another condition where it plays a pivotal role in diagnosis and monitoring. B-mode echography and Doppler modalities are the two primary imaging techniques used in systems. Ultrasound transducers, which convert electrical signals into sound waves and vice versa, are a critical component of these systems. The integration of AI algorithms into these systems has led to significant advancements in image analysis and interpretation. The economic impact of CVDs is substantial, making the adoption of systems a cost-effective solution for healthcare providers. The ability to diagnose and monitor these conditions non-invasively, in a timely and accurate manner, leads to improved patient outcomes and reduced healthcare costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 482.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, Denmark, China, Canada, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.