Chronic Disease Management Market Size 2025-2029

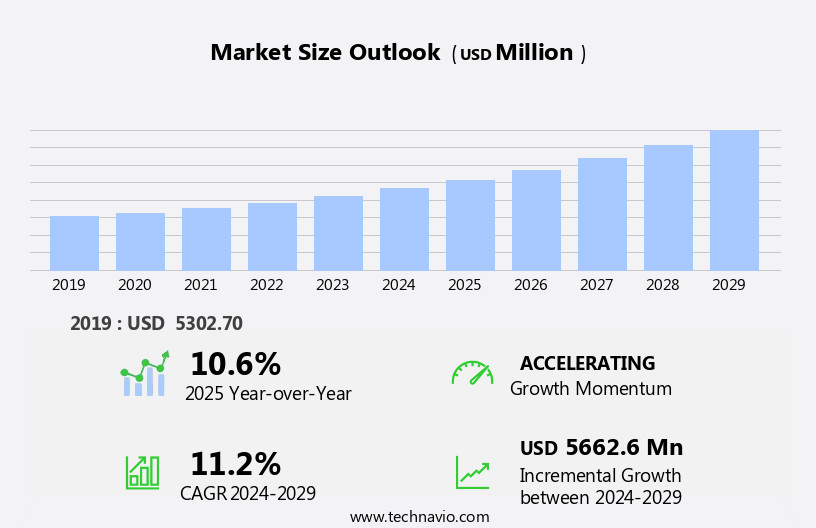

The chronic disease management market size is forecast to increase by USD 5.66 billion, at a CAGR of 11.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing geriatric population and the prevalence of chronic diseases. With an aging population comes a higher incidence of chronic conditions, such as diabetes, cardiovascular diseases, and cancer, necessitating effective management solutions. Technological advancements are playing a pivotal role in this market, enabling remote monitoring, telehealth, and data analytics, which improve patient outcomes and reduce healthcare costs. However, challenges persist in the form of medical data privacy concerns. As the digitalization of health data continues, ensuring its security and confidentiality becomes increasingly important to mitigate potential risks and maintain patient trust.

- Companies seeking to capitalize on market opportunities must prioritize innovation, data security, and regulatory compliance to meet the evolving needs of patients and healthcare providers.

What will be the Size of the Chronic Disease Management Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting healthcare priorities. Integral components of this dynamic landscape include machine learning algorithms, interoperability standards, medication adherence tracking, healthcare payers, data security protocols, risk stratification models, and personalized treatment plans. These elements are seamlessly integrated into various sectors, such as diabetes management tools, data analytics dashboards, virtual care consultations, population health management, remote patient monitoring, lifestyle modification programs, telemedicine platforms, mobile health applications, health coaching services, respiratory disease management, predictive modeling, pain management solutions, remote therapeutic monitoring, clinical trials management, patient engagement tools, healthcare IoT devices, AI-powered diagnostics, mental health platforms, behavioral interventions, wearable sensors, oncology care management, and cardiovascular disease management.

The ongoing unfolding of market activities reveals a focus on improving patient outcomes through innovative solutions. For instance, machine learning algorithms are employed to analyze vast amounts of data, enabling early detection and intervention. Interoperability standards ensure seamless data exchange between different systems, enhancing care coordination. Medication adherence tracking helps manage chronic conditions more effectively, reducing hospitalizations and improving patient satisfaction. Healthcare payers are increasingly adopting value-based care models, which incentivize providers to deliver high-quality care while managing costs. Data security protocols are strengthened to protect sensitive patient information. Risk stratification models help identify high-risk patients, allowing for targeted interventions and personalized treatment plans.

Pharmacovigilance systems monitor drug safety, ensuring patient safety and regulatory compliance. The integration of technology in chronic disease management is transforming the industry, with telemedicine platforms and virtual care consultations enabling remote access to care. Remote patient monitoring allows for continuous monitoring of vital signs, while wearable sensors provide real-time data. AI-powered diagnostics enable faster and more accurate diagnoses. Mental health platforms and behavioral interventions address the growing need for holistic care. In conclusion, the market is characterized by continuous evolution, driven by technological advancements and shifting healthcare priorities. The integration of machine learning algorithms, interoperability standards, medication adherence tracking, healthcare payers, data security protocols, risk stratification models, and personalized treatment plans is transforming the industry, improving patient outcomes and enhancing care coordination.

This dynamic landscape is shaping the future of chronic disease management, with a focus on innovation, efficiency, and patient-centered care.

How is this Chronic Disease Management Industry segmented?

The chronic disease management industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Solutions

- Services

- End-user

- Healthcare providers

- Healthcare payers

- Disease Type

- Cardiovascular diseases

- Diabetes

- Chronic obstructive pulmonary disorders

- Arthritis

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

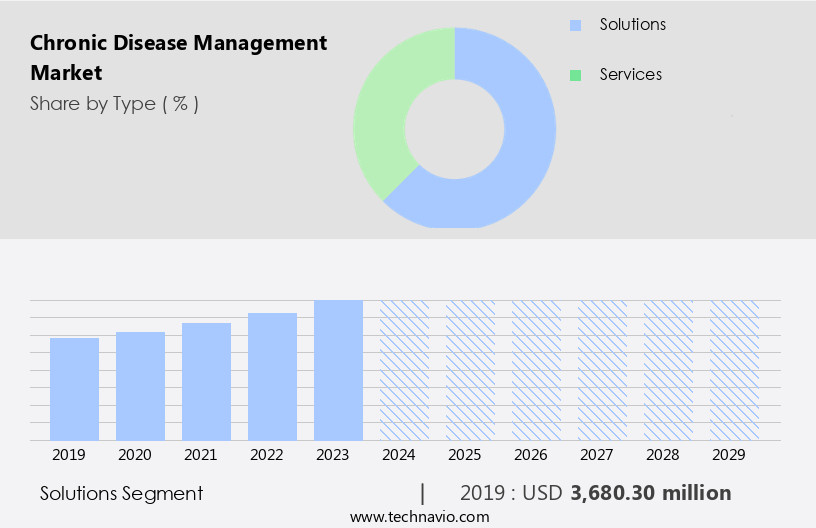

The solutions segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing adoption of advanced solutions that prioritize regulatory compliance and population health management. Provider networks are integrating diabetes management tools, data analytics dashboards, and virtual care consultations to enhance patient care and improve outcomes. Remote patient monitoring, lifestyle modification programs, and telemedicine platforms are becoming essential components of chronic disease management, enabling real-time monitoring and personalized treatment plans. In the realm of respiratory disease management, predictive modeling and machine learning algorithms facilitate early intervention and risk stratification. Pain management solutions, remote therapeutic monitoring, and clinical trials management streamline care delivery and optimize resource allocation.

Wearable sensors, healthcare IoT devices, and AI-powered diagnostics offer actionable insights, while mental health platforms and behavioral interventions address the holistic needs of patients. Oncology care management and cardiovascular disease management are two major applications of chronic disease management, with a growing emphasis on value-based care models and medication adherence tracking. Pharmacovigilance systems ensure safety and efficacy, while interoperability standards and data security protocols protect patient privacy and maintain data integrity. The market's evolution is driven by the increasing demand for cost-effective care, with an emphasis on remote care and population health management. Firms are investing in research and development to produce innovative solutions, capitalizing on opportunities in developing regions and medical tourism.

Overall, the market is poised for continued growth, as it addresses the complex needs of patients and healthcare providers alike.

The Solutions segment was valued at USD 3.68 billion in 2019 and showed a gradual increase during the forecast period.

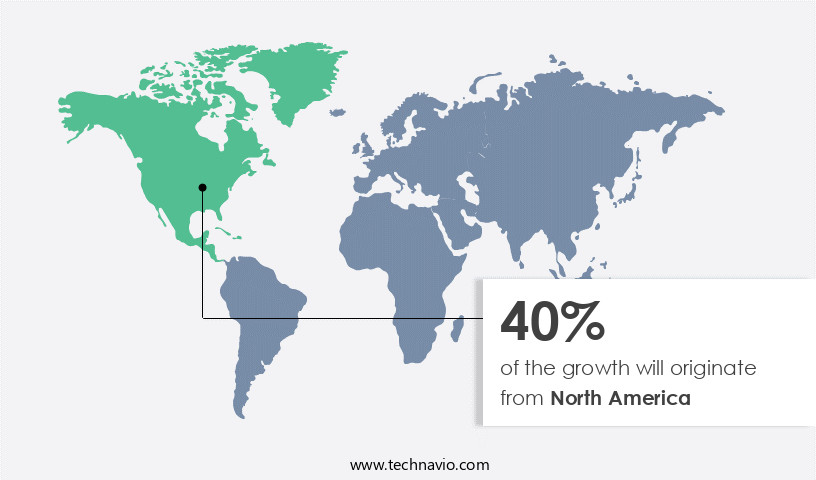

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth, with the US leading the way due to increasing awareness, expanding mobile coverage, and a high prevalence of chronic diseases. Advanced technologies, such as smart pills, smart cabinets, and mHealth services, are being adopted by hospitals in the US to improve care delivery. The growing geriatric population in the region, many of whom suffer from mental and chronic disorders, necessitates the use of remote patient monitoring, data analytics dashboards, and virtual care consultations to manage their conditions effectively. Telemedicine platforms, mobile health applications, and health coaching services are also gaining popularity for their convenience and accessibility.

In the US, diabetes management tools, wearable sensors, and oncology care management solutions are increasingly being used to improve patient outcomes and reduce healthcare costs. Predictive modeling, machine learning algorithms, and interoperability standards enable personalized treatment plans, medication adherence tracking, and risk stratification models. Pharmacovigilance systems and value-based care models ensure regulatory compliance and improve patient engagement. Remote therapeutic monitoring, clinical trials management, and pain management solutions are also essential components of the market. Provider networks and healthcare payers prioritize data security protocols to protect sensitive patient information. Mental health platforms, behavioral interventions, and respiratory disease management solutions are also gaining traction to address the growing burden of chronic diseases.

Overall, the market in North America is evolving to meet the unique needs of patients and healthcare providers, driven by technological advancements and changing demographics.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Global Cold Chain Logistics Market: Trends, Technologies, Sustainability, and Growth Prospects (2025-2030) The global cold chain logistics market is a critical sector that ensures the safe and efficient transportation and storage of temperature-sensitive goods, particularly in the healthcare industry. This market is expected to grow significantly during the 2025-2030 period, driven by the increasing demand for temperature-controlled supply chains in sectors such as pharmaceuticals, food and beverage, and agriculture. Key Market Trends: 1. Technological Advancements: The integration of IoT, RFID, and GPS technologies in cold chain logistics is revolutionizing the industry by providing real-time monitoring and tracking capabilities, ensuring product integrity and reducing wastage. 2. Sustainability Practices: With growing concerns over the environmental impact of cold chain logistics, the market is witnessing an increasing adoption of green technologies such as renewable energy, insulated containers, and refrigerants with lower global warming potential. 3. Asia-Pacific Region: The Asia-Pacific region is expected to witness the fastest growth in the cold chain logistics market due to the rising demand for temperature-controlled supply chains in emerging economies such as China and India. Market Segments: 1. Temperature Zones: The market is segmented into three temperature zones - ultra-low (<-20°C), low (2-8°C), and controlled room temperature (15-25°C). The ultra-low temperature segment is expected to dominate the market due to the increasing demand for temperature-sensitive pharmaceuticals. 2. Services: The market is segmented into transportation, storage, and value-added services. The transportation segment is expected to dominate the market due to the increasing demand for temperature-controlled transportation services. Challenges and Solutions: 1. Cost: The high cost of building and maintaining temperature-controlled facilities and the cost of fuel for transportation are major challenges for the cold chain logistics market. Solutions include the adoption of energy-efficient technologies and the use of alternative fuels. 2. Regulatory Compliance: Strict regulatory requirements for temperature-controlled supply chains in industries such as pharmaceuticals and food and beverage pose a challenge for the market. Solutions include the use of certified logistics providers and the implementation of advanced monitoring and tracking technologies. B2B and Procurement Strategies: 1. Strategic Partnerships: Collaborations between cold chain logistics providers and pharmaceutical companies are becoming increasingly common to ensure the timely and efficient delivery of temperature-sensitive products. 2. Technology Integration: The integration of advanced technologies such as IoT, RFID, and GPS in procurement processes is enabling real-time monitoring and tracking of temperature-sensitive goods, reducing the risk of wastage and ensuring product integrity. In conclusion, the global cold chain logistics market is poised for significant growth during the 2025-2030 period, driven by the increasing demand for temperature-controlled supply chains in various industries. Technological advancements, sustainability practices, and the Asia-Pacific region are key growth drivers, while challenges such as cost and regulatory compliance are being addressed through strategic partnerships and technology integration.

What are the key market drivers leading to the rise in the adoption of Chronic Disease Management Industry?

- The geriatric population's continuous expansion and the prevalence of chronic diseases serve as the primary drivers for market growth.

- Chronic diseases, such as cancer and diabetes, are a significant global health concern, with the World Health Organization reporting that they accounted for nearly 10 million deaths in 2023. The increasing prevalence of these diseases can be attributed to unhealthy lifestyle choices, including poor diet, sedentary lifestyles, tobacco and alcohol use, and obesity. As a result, there is a growing demand for effective chronic disease management solutions and services. Telemedicine platforms, mobile health applications, health coaching services, predictive modeling, pain management solutions, remote therapeutic monitoring, and clinical trials management are among the innovative technologies and services that are transforming chronic disease management.

- These solutions enable early diagnosis, regular monitoring, and personalized treatment plans, improving patient outcomes and reducing healthcare costs. Predictive modeling, for instance, can help identify patients at risk of developing chronic diseases, enabling early intervention and prevention. Remote therapeutic monitoring allows patients to receive care from the comfort of their homes, reducing the need for frequent hospital visits. Telemedicine platforms and mobile health applications offer convenient access to healthcare services, enabling patients to manage their conditions more effectively. The need for chronic disease management solutions and services is expected to continue to grow as the global population ages and the prevalence of chronic diseases increases.

- By leveraging advanced technologies and innovative approaches, healthcare providers can improve patient outcomes, reduce healthcare costs, and enhance the overall patient experience.

What are the market trends shaping the Chronic Disease Management Industry?

- The market is experiencing significant technological advancements, which is becoming a notable trend. This progression is marked by the integration of innovative technologies, such as telehealth, artificial intelligence, and remote monitoring systems, to improve disease management and patient outcomes.

- The market is experiencing significant growth due to technological advancements in healthcare. AI-powered diagnostics and patient engagement tools, such as mental health platforms, behavioral interventions, wearable sensors, and oncology care management, are revolutionizing the way chronic diseases are treated. These technologies enable early intervention and improved patient outcomes for conditions like diabetes, heart disease, and cancer. Furthermore, chronic disease management companies offer essential support to patients with diabetes, contributing to the market's expansion.

- The integration of healthcare IoT devices and AI in chronic disease management is expected to continue driving market growth during the forecast period.

What challenges does the Chronic Disease Management Industry face during its growth?

- The escalating concern for medical data privacy poses a significant challenge to the expansion of the healthcare industry.

- The market is witnessing significant growth due to the implementation of machine learning algorithms and interoperability standards. These technologies enable healthcare payers to effectively manage medication adherence tracking and risk stratification models. However, data security protocols are of utmost importance to ensure the confidentiality of sensitive patient information. Personalized treatment plans are developed based on comprehensive analysis of patient data, which highlights the need for robust data security measures. Furthermore, pharmacovigilance systems are essential to monitor medication safety and efficacy.

- The integration of these advanced technologies in chronic disease management enhances the overall efficiency and effectiveness of healthcare services. It is crucial to adhere to data privacy regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the US, and similar laws in other countries, to maintain the confidentiality of patient information.

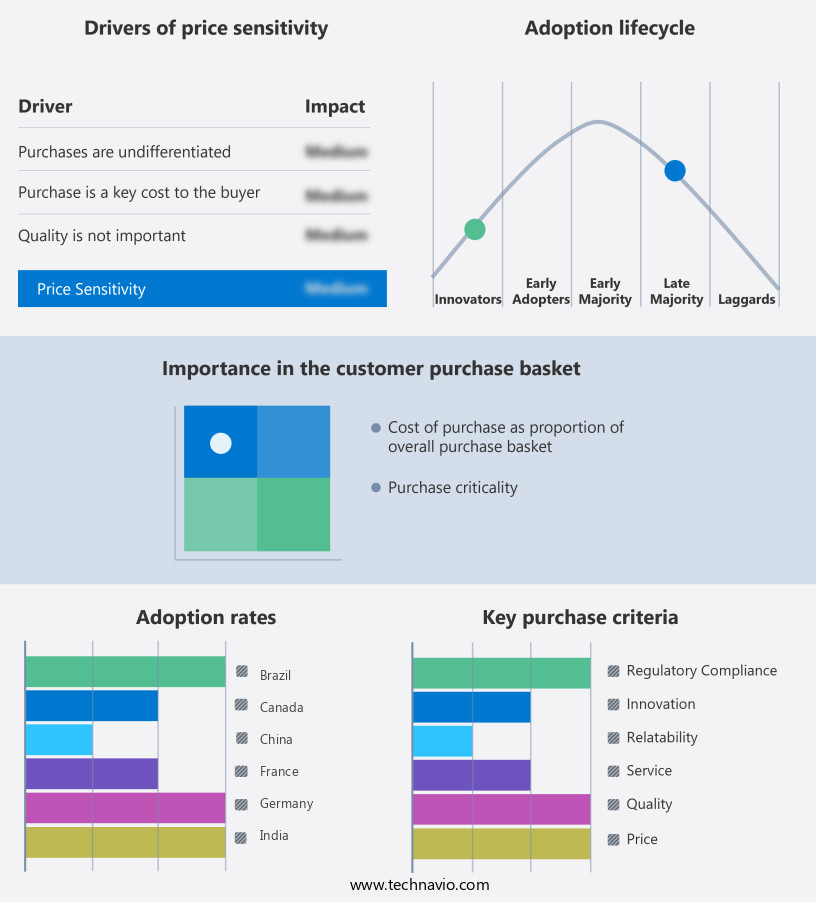

Exclusive Customer Landscape

The chronic disease management market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chronic disease management market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chronic disease management market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ALLSCRIPTS HEALTHCARE SOLUTIONS INC. - This company specializes in chronic disease management services, enabling healthcare providers to streamline care for patients with complex conditions. Services encompass care plan creation, medication reconciliation, scheduling preventive care, and patient outreach, enhancing overall patient care management.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALLSCRIPTS HEALTHCARE SOLUTIONS INC.

- Cedar Gate Technologies

- cliexa Inc.

- Cognizant Technology Solutions Corp.

- Epic Systems Corp.

- ExlService Holdings Inc.

- Health Care Service Corp.

- Health Catalyst Inc.

- HealthEdge Software Inc.

- Hinduja Global Solutions Ltd.

- Infosys Ltd.

- Koninklijke Philips NV

- MINES and Associates Inc.

- NextGen Healthcare Inc.

- Pegasystems Inc.

- ScienceSoft USA Corp.

- Vivify Health Inc.

- WellSky Corp.

- ZeOmega Inc.

- Zyter Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Chronic Disease Management Market

- In January 2024, Merck & Co. Announced the FDA approval of their new digital therapeutic, 'Solutions Suite,' designed to manage type 2 diabetes. This innovative solution combines digital tools with Merck's traditional medicines to enhance patient care and outcomes (Merck press release, 2024).

- In March 2024, IBM Watson Health and CVS Health entered into a strategic partnership to develop personalized care plans for patients with chronic conditions. The collaboration aimed to integrate IBM Watson Health's AI-powered analytics with CVS Health's pharmacy benefits and clinical services (CVS Health press release, 2024).

- In May 2024, Roche Holding AG completed the acquisition of Genoptix Medical Laboratory Inc. For approximately USD1.05 billion. This acquisition expanded Roche's diagnostics portfolio and enabled the company to offer comprehensive solutions for chronic disease management (Roche press release, 2024).

- In April 2025, the European Commission approved the use of Abbott's FreeStyle Libre 3 system, a next-generation continuous glucose monitoring system for people with diabetes. This approval marked a significant technological advancement in non-invasive glucose monitoring, offering greater accuracy and ease of use (Abbott press release, 2025).

Research Analyst Overview

- In the market, real-time data analysis plays a crucial role in optimizing clinical workflows for conditions such as COPD management and asthma. Multi-channel communication and caregiver support tools ensure effective patient engagement, while medication reconciliation and treatment adherence programs enhance health outcomes. Data governance and anonymization are essential for maintaining HIPAA and GDPR compliance. Incentive programs and mental wellness programs further boost patient engagement, while medication adherence is monitored through smartphone integration, third-party integrations, and API connections. Home healthcare devices and predictive analytics enable early intervention and personalized care plans. Big data analytics and prescriptive analytics provide valuable insights for cancer survivorship care and chronic pain management.

- Alerting systems and clinical workflow optimization streamline care delivery, while HIPAA and GDPR compliance ensure data security. Data visualization tools facilitate easier understanding of complex patient data, and self-management tools empower patients to take control of their health. Gamification strategies engage patients and improve treatment adherence. Cloud-based platforms facilitate seamless integration and access to care, making chronic disease management more efficient and effective.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Chronic Disease Management Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.2% |

|

Market growth 2025-2029 |

USD 5662.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.6 |

|

Key countries |

US, UK, Germany, Japan, Canada, China, France, Italy, Brazil, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chronic Disease Management Market Research and Growth Report?

- CAGR of the Chronic Disease Management industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chronic disease management market growth of industry companies

We can help! Our analysts can customize this chronic disease management market research report to meet your requirements.