Chocolate Milk Market Size 2024-2028

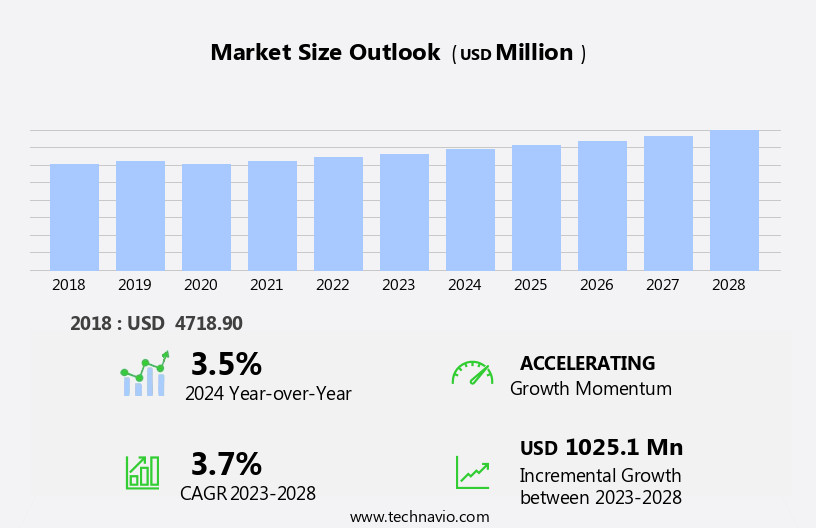

The chocolate milk market size is forecast to increase by USD 1.03 billion at a CAGR of 3.7% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the increasing disposable income of consumers, enabling them to indulge in premium dairy products. Another trend shaping the market is the development of sugar-free and organic chocolate, catering to the health-conscious consumer base.

- Furthermore, the availability of substitutes, such as plant-based protein products, is posing a challenge to traditional dairy chocolate milk. These trends and challenges are shaping the future growth trajectory of the market.

What will be the Size of the Chocolate Milk Market During the Forecast Period?

- The market encompasses a wide range of flavored dairy products, primarily made from cow's milk infused with cocoa and various sweeteners. These beverages offer essential nutrients, including calcium and Vitamin D, making them a popular choice among consumers seeking to maintain a balanced diet. However, the high sugar content of chocolate milk has raised concerns regarding its association with obesity and diabetes. In response, the market has seen an increase in demand for organic, sugar-free, and low-sugar options.

- Health consciousness and urbanization have driven retail sales, with attractive packaging and convenient portability further boosting market growth. The market caters to diverse consumer preferences, including vegan trends and lactose intolerance, with non-dairy alternatives made from plant-based milk.

- Fortified products, offering additional proteins, vitamins, and minerals, are gaining traction as nutritional supplements and post-exercise recovery options. Overall, the market continues to evolve, responding to consumer demands for healthier, more sustainable, and convenient options.

How is this Chocolate Milk Industry segmented and which is the largest segment?

The chocolate milk industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Dairy Based Chocolate Milk

- Non-Dairy Based Chocolate Milk

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

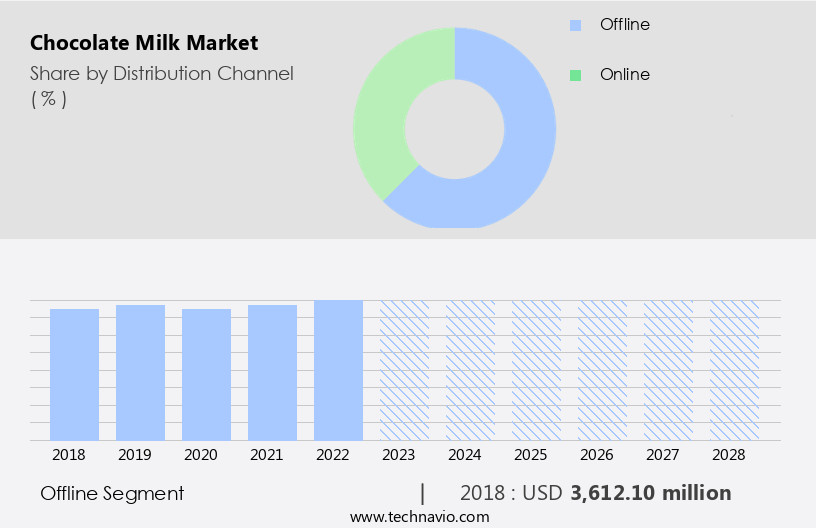

The offline segment is estimated to witness significant growth during the forecast period. The market in developed countries, including the US, Canada, the UK, France, and Germany, experiences significant growth due to the widespread availability of chocolate milk in supermarkets and hypermarkets. These retail channels offer ample shelf space and storage areas, enabling a diverse range of chocolate milk brands from companies such as Arla Foods amba, Dairy Farmers of America Inc., Muller UK and Ireland Group LLP, Saputo Inc., and Sofina SA. Consumers value the convenience of shopping at these retailers, which house multiple product categories, a feature that smaller shops lack. Chocolate milk, rich in calcium, vitamin D, and essential nutrients, is a popular quick meal option and attractive beverage choice, especially in urban areas. Additionally, the market caters to various dietary preferences, including organic, sugar-free, dairy-based, non-dairy, and fortified products. Sustainable packaging and personalized nutrition trends further boost market growth.

Get a glance at the share of various segments. Request Free Sample

The Offline segment was valued at USD 3.61 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

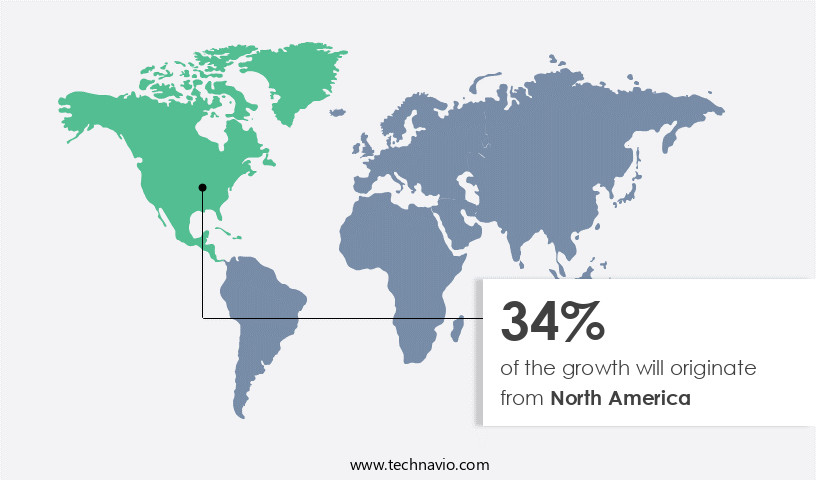

North America is estimated to contribute 34% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Chocolate milk is a popular beverage in North America, particularly In the US and Canada. The market offers various options, including dairy-based chocolate milk, sugar-free versions, organic milk products, and non-dairy alternatives. Brands like Nestle SA and Sofina SA cater to this demand. Health consciousness and the rise of veganism have led to an increased preference for dairy-free chocolate milk. Essential nutrients such as calcium, vitamin D, and proteins make chocolate milk an attractive quick meal option, especially in urban areas. Retail outlets, including convenience stores, supermarkets, and hypermarkets, stock these products, often featuring attractive packaging. Consumers prioritize fortified dairy products, ingredient innovation, and health benefits.

Low-sugar and plant-based products are also gaining popularity due to nutritional preferences and lactose intolerance. Online stores and specialty retailers are increasingly offering organic, sugar-free, vegan, and grass-fed organic dairy chocolate milk, as well as alternatives made from A2 protein and probiotic drinks.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Chocolate Milk Industry?

Increasing consumer disposable income is the key driver of the market.

- The market has experienced significant growth due to the increasing health consciousness among consumers. Chocolate Milk, a popular dairy-based beverage fortified with essential nutrients like Calcium and Vitamin D, has gained popularity as a quick meal option and attractive portable beverage. Cow's Milk, enriched with Cocoa, Sweeteners, and Nutrients, caters to various nutritional preferences, including those seeking high sugar content, sugar reduction, or sugar-free options. Non-Dairy Chocolate Milk, including Vegan and Plant-Based alternatives, has emerged as a response to the Veganism trend and Lactose Intolerance. Fortified Dairy Products and Ingredient Innovation have led to the development of Organic Chocolate Milk, Probiotic Drinks, and Protein-rich options.

- Health-Enhancing Ingredients, such as A2 Protein, have added to the Nutritional Benefits of these beverages. Retail outlets, including Convenience Stores and Supermarkets, and E-commerce Platforms, have made Chocolate Milk accessible to consumers, with Attractive Packaging catering to various tastes and preferences. The market dynamics include the demand for Low-Sugar Products, Personalized Nutrition, and Sustainable Packaging. The market continues to evolve, offering a range of options for consumers seeking flavored nutritional drinks as part of a healthy lifestyle.

What are the market trends shaping the Chocolate Milk Industry?

Development of sugar-free organic chocolate milk is the upcoming market trend.

- The market is witnessing significant growth due to the increasing consumer preference for portable beverages that offer essential nutrients, such as calcium and vitamin D. With the rise in health consciousness, there is a growing demand for fortified dairy products, including chocolate milk, which are rich in proteins, vitamins, and minerals. However, the market also caters to consumers with nutritional preferences such as veganism, lactose intolerance, and sugar reduction. As a result, companies offer non-dairy chocolate milk alternatives made from plant-based milk, such as soy, almond, or oat milk. Additionally, there is a trend towards sugar-free, organic chocolate milk, which is free from artificial ingredients and additives.

- The convenience of chocolate milk as a quick meal option, particularly in urban areas, and its health benefits, including post-exercise recovery and healthy snack, further boost market growth. The market encompasses flavored nutritional drinks, probiotic drinks, and personalized nutrition options, making it a dynamic and innovative industry. E-commerce platforms and specialty stores are key retail outlets for these products, with attractive packaging and sustainable packaging being essential factors in consumer decision-making.

What challenges does the Chocolate Milk Industry face during its growth?

Availability of substitutes is a key challenge affecting the industry growth.

- The market In the US has witnessed significant growth due to the increasing health consciousness among consumers. With a focus on essential nutrients such as calcium, vitamin D, and protein, chocolate milk has emerged as a popular choice for both children and adults. However, concerns regarding high sugar content have led to the introduction of sugar-free and organic chocolate milk options. Dairy-based and non-dairy chocolate milk variants cater to various nutritional preferences, including veganism and lactose intolerance. Food and beverage companies are innovating with ingredient solutions to meet consumer demands. Fortified dairy products and plant-based milk alternatives are gaining popularity.

- The convenience of portable beverages has made chocolate milk a quick meal option, particularly in urban areas. Packaging plays a crucial role in attracting consumers, with sustainable and personalized options becoming increasingly important. Regulations promoting the use of natural ingredients and prohibiting artificial additives have further boosted the market. Chocolate milk is now available in various retail outlets, from convenience stores to hypermarkets, and online platforms. As consumers seek healthier alternatives, low-sugar and plant-based products are becoming more prevalent In the market. The future of the market lies in catering to diverse nutritional needs and offering health-enhancing ingredients.

Exclusive Customer Landscape

The chocolate milk market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chocolate milk market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chocolate milk market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Arla Foods amba - The company introduces chocolate milk offerings, including Arla Protein and Arla Protein Chocolate flavored milk drinks, featuring reduced sugar content. These products cater to consumers seeking chocolate milk beverages with a lower sugar profile.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arla Foods amba

- Britannia Industries Ltd.

- Dairy Farmers of America Inc.

- Drums Food International Pvt. Ltd.

- FrieslandCampina

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Heritage Foods Ltd.

- Inner Mongolia Yili Industrial Group Co. Ltd.

- Maryland and Virginia Milk Producers Cooperative Association Inc.

- MilkyMist Dairy Food Pvt. Ltd.

- Muller UK and Ireland Group LLP

- National Dairy Development Board

- Nestle SA

- Punjab Sind Foods (India) Pvt. Ltd.

- Saputo Inc.

- Simpl Innovative Brands Pvt. Ltd.

- Snackstar

- Sofina SA

- The Hershey Co.

- Veganarke Enteprises Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of dairy and non-dairy beverage offerings, each providing unique nutritional benefits to consumers. These beverages, characterized by their chocolate flavor and creamy texture, have gained popularity due to their versatility and convenience. Cocoa, a key ingredient in chocolate milk, contributes essential nutrients such as calcium and vitamin D. Calcium is crucial for bone health, while vitamin D aids In the absorption of calcium and maintains healthy bones and teeth. Cow's milk forms the base for traditional dairy-based chocolate milk, providing additional nutrients like protein, vitamins, and minerals. Sweeteners play a significant role in enhancing the taste of chocolate milk.

However, consumer preferences have shifted towards reduced sugar content due to health consciousness. As a result, sugar-free and low-sugar chocolate milk options have emerged In the market. The convenience of portable beverages has made chocolate milk a popular choice for urban areas, where consumers lead busy lifestyles. Retail outlets such as convenience stores, hypermarkets, and e-commerce platforms cater to this demand. Veganism and lactose intolerance have driven the growth of non-dairy chocolate milk alternatives. Plant-based milk, such as soy, almond, and oat milk, are used as bases for these beverages. Vegan chocolate milk offers consumers an ethical and dietary alternative to dairy-based options.

Fortified dairy products, including chocolate milk, have gained traction due to their health benefits. Ingredient innovation continues to drive the market, with the addition of protein, vitamins, minerals, and health-enhancing ingredients like probiotics. Attractive packaging and convenient formats, such as single-serve bottles and cartons, have made chocolate milk an attractive quick meal option. Consumers increasingly seek out free-from products with natural ingredients and sustainable packaging. The market is influenced by various trends, including veganism, nutritional preferences, and health consciousness. Consumers are more aware of the health benefits of essential nutrients and are seeking out fortified products to support their active lifestyles.

Protein-rich chocolate milk is popular among athletes and fitness enthusiasts for post-exercise recovery. Healthy snack options, such as flavored nutritional drinks, cater to consumers seeking convenient and nutritious choices. In conclusion, the market is a dynamic and evolving industry driven by consumer preferences for convenience, health benefits, and ethical and dietary considerations. The market offers a diverse range of dairy and non-dairy options, catering to various dietary needs and lifestyles.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

133 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.7% |

|

Market growth 2024-2028 |

USD 1.03 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.5 |

|

Key countries |

US, China, Germany, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chocolate Milk Market Research and Growth Report?

- CAGR of the Chocolate Milk industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chocolate milk market growth of industry companies

We can help! Our analysts can customize this chocolate milk market research report to meet your requirements.