Chromite Market Size 2024-2028

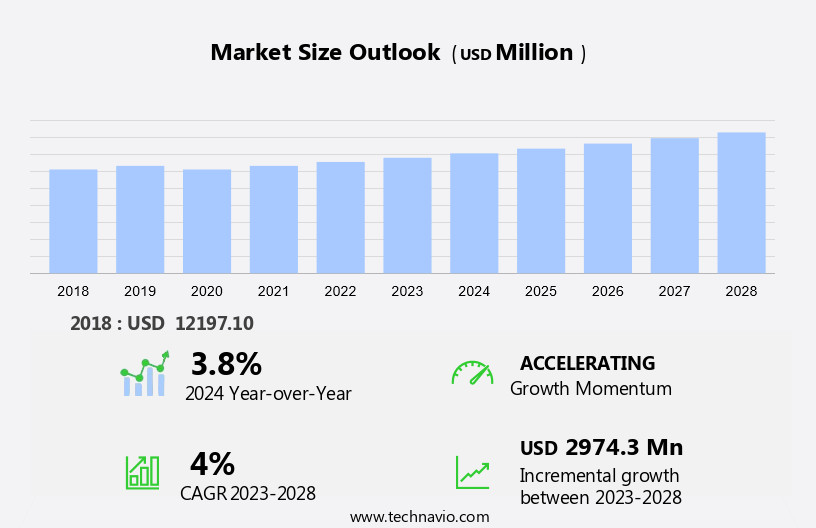

The chromite market size is forecast to increase by USD 2.97 billion at a CAGR of 4% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand from developing countries and the rising need for steel. However, the market faces challenges such as the decline in refractory chromite production. Developing countries, particularly in Asia, are witnessing a growth in infrastructure development and urbanization, leading to an increased demand for chromite as a primary raw material in steel production. Chromite's dark brown to black color, metallic luster, and distinct crystal habit make it easily identifiable. Its chemical properties classify it as an accessory mineral, with magnesium, aluminum, and other common impurities influencing its color and crystal structure. Additionally, the global steel industry is expanding, further fueling the demand for chromite. Conversely, the decrease in refractory chromite production poses a challenge to market growth. Despite this, the market is expected to remain stable due to the strong demand from key end-use industries.

What will be the Size of the Chromite Market During the Forecast Period?

- The market encompasses the global trade of iron chromium oxide (FeCr2O4), a significant member of the spinel group and an essential ore for chromium production. Chromite is recognized for its octahedral crystals, which can manifest in various forms such as massive, lenses, tabular bodies, disseminated, and granular inclusions. This mineral is predominantly found in igneous rocks and sediments, including chromitites and placer deposits. Chromite's importance lies in its primary use as a source of chromium, an essential element in various industries, including stainless steel production. Its chemical classification as a complex oxide contributes to its unique properties and widespread application.

How is this Chromite Industry segmented and which is the largest segment?

The chromite industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Metallurgical

- Chemical and foundry

- Refractory

- Geography

- APAC

- China

- North America

- Canada

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Type Insights

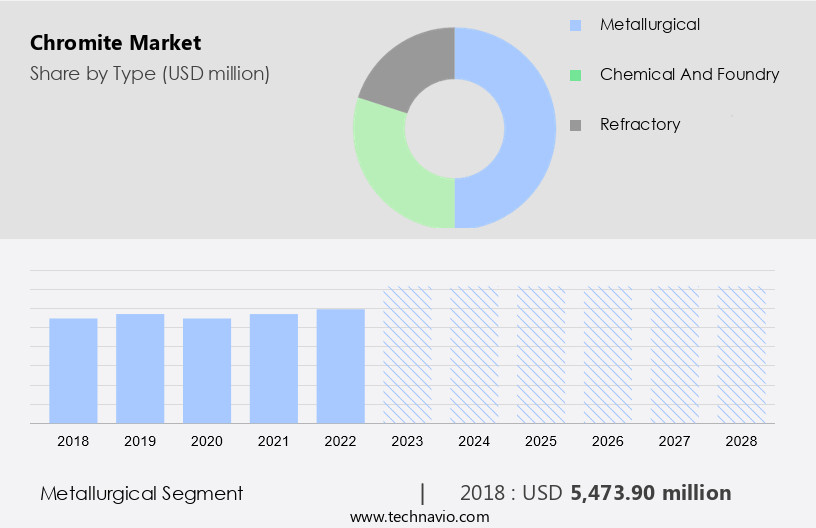

- The metallurgical segment is estimated to witness significant growth during the forecast period.

Chromite, a significant ore of iron chromium oxide (FeCr2O4), is a member of the spinel group with an octahedral crystal structure. It is an important mineral, found in various forms such as crystals, massive, lenses, tabular bodies, disseminated, and granules. Chromite crystals exhibit a dark brown to black color with a Mohs hardness of 5.5-6.5 and a density of 3.5-4.2 g/cm3. This mineral is an accessory mineral commonly found in igneous rocks, particularly chromitites and placer deposits. Chromite is used extensively In the metallurgical industry for producing ferrochrome, a key ingredient in stainless steel and metal alloys. Additionally, it is employed in dyes and pigments, chrome plating, leather tanning, wood preservation, and the refractory industry.

Despite its importance, chromite is also a groundwater and soil contaminant due to its chemical properties, including its high density and tendency to release chromium ions into water sources. Chromite has a cubic crystalline structure, atomic weight of 52.01 g/mol, and a melting point of 1985°C. Its thermal expansion coefficient is relatively low, making it suitable for high-temperature applications. The market is driven by the increasing demand for stainless steel and other alloys, making it a critical component in various industries.

Get a glance at the Chromite Industry report of share of various segments Request Free Sample

The metallurgical segment was valued at USD 5.47 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

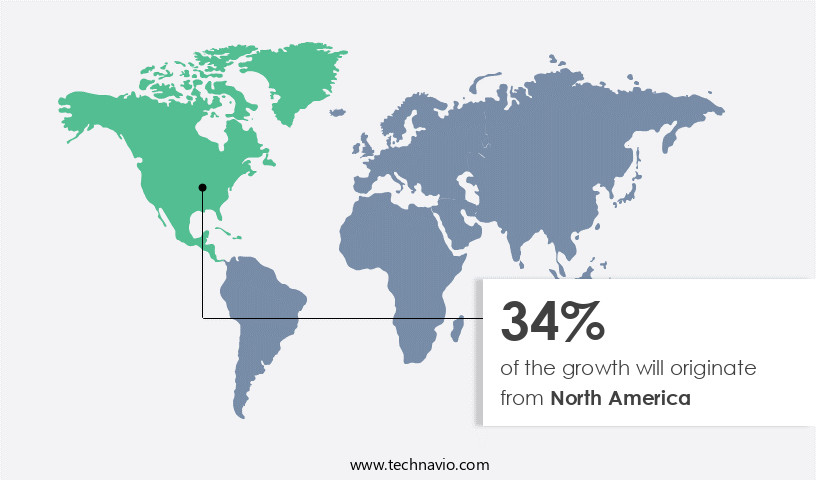

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Chromite, an essential ore of chromium, is primarily used In the production of ferrochrome. Ferrochrome is a significant input In the manufacturing of stainless steel, low alloy steels, and other alloys. The demand for these metals, particularly In the construction, automobile, and heavy industries in Asia Pacific, is driving the market. Notable chromite reserves are found in countries such as India, Afghanistan, Australia, and the Philippines. Major chromite producers, including China, India, and Japan, contribute significantly to the market's growth. The crystalline inclusion of chromite in igneous rocks, such as chromitites and placer deposits, exhibits various crystal habits, including octahedral, massive, lenses, tabular bodies, and disseminated granules.

Chromite's chemical properties include a dark brown to black color, a Mohs hardness of 5.5-6.5, and a cubic crystalline structure. It is an accessory mineral in igneous rocks and can be found in soils, groundwater, and soil contaminants as an inorganic groundwater contaminant. Despite its benefits, chromite mining and processing can pose hazards, including the release of priority pollutants and hazardous substances, posing potential human health threats and contributing to Superfund sites. Chromite's atomic weight is 51.996 g/mol, and its melting point is 1985°C. It has a thermal expansion coefficient of 5.5 x 10-6/°C and a density of 3.51 g/cm³.

Chromite's tenacity is brittle, and its fracture is conchoidal to uneven.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Chromite Industry?

Increase in demand from developing countries is the key driver of the market.

- Chromite, an oxide mineral composed of iron chromium oxide, is a significant member of the Spinel group and an important ore for chromium. This mineral is primarily found in crystalline inclusion in igneous rocks such as chromitites, placer deposits, and in association with other silicate minerals. Chromite crystals exhibit various crystal habits, including octahedral, massive, lenses, tabular bodies, disseminated, and granules. The mineral's color ranges from dark brown to black, with a Mohs hardness of 5.5-6.5 and a density of 3.5-4.2 g/cm³. Chromite is a priority pollutant due to its hazardous properties, including its potential to contaminate groundwater and soils as an inorganic groundwater contaminant.

- The market is experiencing significant growth, driven by the increasing demand for chromite in various industries, including the metallurgical industry for stainless steel and metal alloys, dyes and pigments, chrome plating, leather tanning, wood preservation, and the refractory industry. Major chromite producing countries include South Africa, Zimbabwe, Kazakhstan, India, and Pakistan, where the availability of vast reserves, low-cost labor, and favorable government policies are promoting market expansion. Chromite has essential chemical properties and is classified as a chromic oxide, with common impurities including magnesium, aluminum, and iron. Its atomic weight is approximately 51.997 g/mol, and it has a cubic crystalline structure with a melting point of 1975°C and a thermal expansion coefficient of 5.4 x 10-6/°C. Despite its potential hazards, chromite is an essential resource for numerous industries, contributing significantly to economic growth and industrial development.

What are the market trends shaping the Chromite Industry?

Increasing demand for steel is the upcoming market trend.

- Chromite, an oxide mineral of iron and chromium, is a crucial component In the production of steel. As a significant ore of chromium, it is essential for the steel industry, which is a major contributor to economic development and infrastructure growth. Chromite is primarily found In the Spinel group of minerals and can manifest in various forms, including crystals, massive lenses, tabular bodies, disseminated grains, and crystalline inclusions. Its chemical properties classify it as a dark brown to black mineral with a Mohs hardness of 5.5-6.5 and a density of 3.5-4.2 g/cm3. Chromite is commonly found in igneous rocks, such as chromitites and placer deposits, and can be identified by its crystal system, tenacity, and cleavage.

- Chromite's chemical composition is essential for various industries. In the metallurgical industry, it is used to produce stainless steel, metal alloys, and chrome plating. In the chemical industry, it is used as a pigment in dyes and pigments, leather tanning, and wood preservation. In the refractory industry, it is used as a groundwater and soil contaminant due to its high chromium content, which can pose hazards as priority pollutants and hazardous substances, threatening human health and the environment. Chromite's atomic weight is 52.01 g/mol, and its melting point is 1985°C. It exhibits thermal expansion and has a cubic crystalline structure. Chromite's abundance In the Earth's crust is approximately 0.01%, making it a valuable resource for various industries.

What challenges does the Chromite Industry face during its growth?

Decline in refractory chromite is a key challenge affecting the industry growth.

- Chromite, an oxide mineral consisting of iron chromium oxide, is a crucial ore In the Spinel group. Its crystalline inclusions in olivine and pyroxene are often found in igneous rocks, particularly in Chromitites and Placer deposits. Chromite exhibits various crystal habits, including octahedral, massive, lenses, tabular bodies, disseminated, and granules. The mineral's color ranges from dark brown to black, with a Mohs hardness of 5.5-6.5 and a density of 3.5-4.2 g/cm³. The chemical properties and classification of Chromite include its crystal system (cubic), tenacity (brittle), and atomic weight (52.52 g/mol). Chromite is a significant component in various industries, including the Metallurgical industry for stainless steel and metal alloys, Dyes and pigments, Chrome plating, Leather tanning, and Wood preservation.

- However, it is also a priority pollutant and hazardous substance due to its potential to contaminate groundwater and soils as an inorganic groundwater contaminant. The market has faced challenges due to increasing regulations and policies limiting the use of mag-chrome bricks, which are a significant source of chromite. The shift towards hydrometallurgical processes and the environmental concerns associated with hexavalent chromium production in cement kilns have impeded market growth. Proper disposal of hexavalent chromium involves high costs, making it a significant challenge for the industry.

Exclusive Customer Landscape

The chromite market forecasting report includes the adoption lifecycle of the market, market growth and forecasting, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the chromite market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, chromite market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

CDE Global Ltd. - The company offers chromite, which is offered in various forms, encompassing Feed Preparation and Concentration processes. These offerings cater to diverse market requirements, ensuring a comprehensive solution for chromite consumers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- CDE Global Ltd.

- Chrometco

- EK CO. AG

- Encore Minerals Pvt. Ltd.

- Eurasian Resources Group Sarl

- Glencore Plc

- LKAB Minerals

- Merafe Resources

- Opta Group LLC

- Outokumpu Oyj

- Samancor Chrome Holdings Proprietary Ltd.

- SHYAMJI Group of Co.

- SCR Sibelco NV

- Tharisa Plc

- Vulkan-TM

- Yildirim Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The oxide mineral, specifically identified as Iron Chromium Oxide, is a significant member of the Spinel Group. This mineral, characterized by its unique crystal structure, plays a crucial role as an important ore in various industries. The crystalline formations of this mineral can manifest in various ways, including octahedral, massive, lenses, tabular bodies, disseminated, and granular. Its crystals exhibit a distinct octahedral symmetry, with some forming in tabular shapes. The color of Iron Chromium Oxide can range from dark brown to black, with a streak consistent with its dark hue. The luster of this mineral is metallic, and it exhibits perfect cleavage in one direction. Its diaphaneity is translucent to opaque, and its Mohs hardness falls within the range of 5.5 to 6.5. The crystal system of Iron Chromium Oxide is cubic, with a tenacity that is brittle. Its density is relatively high, making it a valuable resource for various industries. This mineral is not limited to specific geological formations; it can be found in igneous rocks such as placer deposits. Iron Chromium Oxide possesses unique chemical properties that make it a valuable resource for various industries.

Moreover, its chemical classification places it within the complex oxides category. Common impurities include Magnesium, Aluminum, and other trace elements. Its crystal habit, color, streak, luster, cleavage, diaphaneity, Mohs hardness, crystal system, tenacity, density, and fracture are essential characteristics used to identify and classify this mineral. The presence of Iron Chromium Oxide In the Earth's crust is significant due to its abundance and diverse applications. It is a priority pollutant and a hazardous substance due to its potential health threats. Superfund sites, contaminated soils, and groundwater are common sources of Iron Chromium Oxide contamination. The atomic weight of Iron Chromium Oxide is approximately 558.23 g/mol, and its melting point is around 1975°C.

Thus, its thermal expansion coefficient is moderate, making it suitable for various applications In the metallurgical industry, including stainless steel, metal alloys, dyes and pigments, chrome plating, leather tanning, wood preservation, and the refractory industry. Despite its numerous applications, the extraction and processing of Iron Chromium Oxide can pose environmental challenges. It is essential to adhere to safety guidelines and best practices to minimize the potential risks associated with its handling and disposal.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2024-2028 |

USD 2.97 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

China, US, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Chromite Market Research and Growth Report?

- CAGR of the Chromite industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the chromite market growth of industry companies

We can help! Our analysts can customize this chromite market research report to meet your requirements.