Civil Engineering Market Size 2024-2028

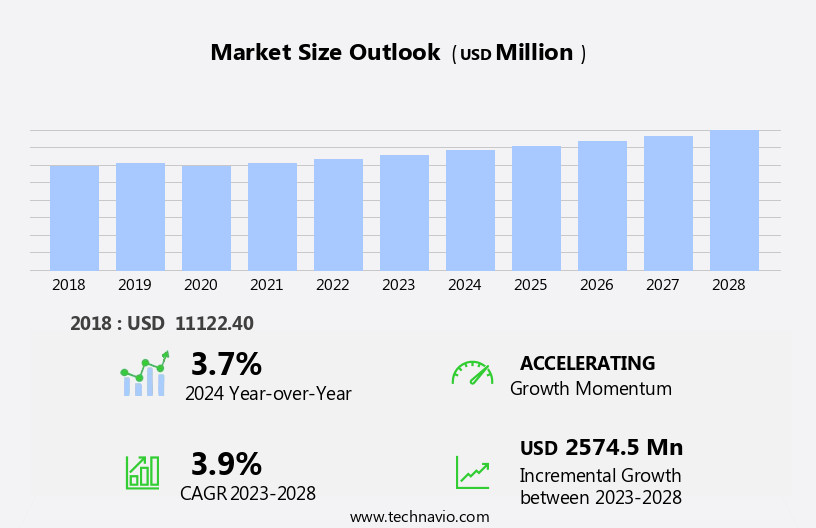

The civil engineering market size is forecast to increase by USD 2.57 billion at a CAGR of 3.9% between 2023 and 2028.

- The market is experiencing significant growth, driven by the surge in construction activities in developing countries. This trend is expected to continue as infrastructure development remains a priority for many governments. Another key factor fueling market growth is the adoption of intelligent processing in civil engineering projects. This includes the use of technologies such as Building Information Modeling (BIM) and Geographic Information Systems (GIS) to improve project efficiency and accuracy.

- However, the market is also facing challenges, including the decline in construction activities in some regions due to economic downturns and natural disasters. Despite these challenges, the future of the market looks promising, with continued investment in infrastructure development and the ongoing integration of advanced technologies.

What will be the Size of the Civil Engineering Market During the Forecast Period?

- The civil engineering services market encompasses a broad range of construction activities, including social infrastructure, residential, offices, educational institutes, luxury hotels, restaurants, transport buildings, online retail warehousing, and various types of infrastructure projects such as roads, bridges, railroads, airports, and ports. This market is driven by various factors, including population growth, urbanization, and the increasing demand for sustainable and energy-efficient structures.

- Digitalization plays a significant role In the civil engineering sector, with the adoption of digital civil engineering, smart grids, urban transportation systems, industrial automation, parking systems, and IT services. Additionally, there is a growing trend towards the development of zero-energy buildings, insulated buildings, double skin facades, PV panels, and e-permit systems.

- Inspection technology and integrated 3D modeling are also becoming increasingly important In the civil engineering industry, enabling more accurate and efficient design and construction processes. The market is expected to continue growing, driven by the increasing demand for infrastructure development and the ongoing digital transformation of the industry.

How is this Civil Engineering Industry segmented and which is the largest segment?

The civil engineering industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Real estate

- Infrastructure

- Industrial

- Geography

- APAC

- China

- India

- North America

- Canada

- US

- Europe

- Germany

- Middle East and Africa

- South America

- APAC

By Application Insights

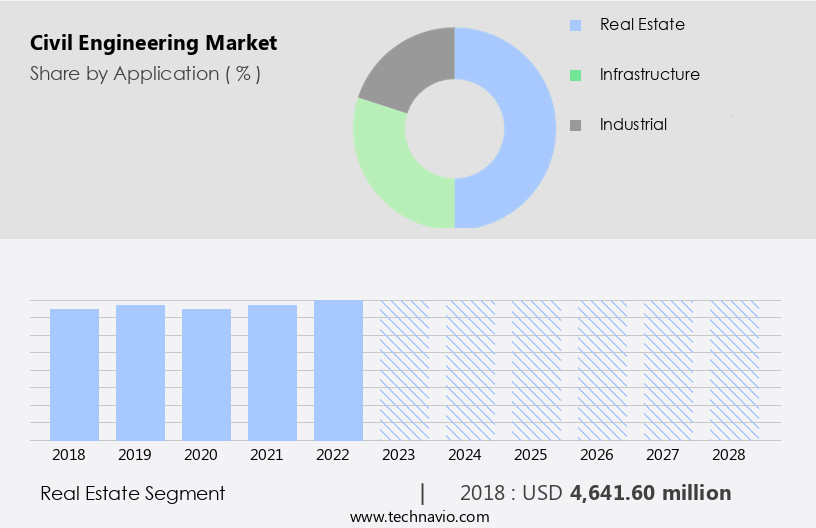

The real estate segment is estimated to witness significant growth during the forecast period. The real estate market encompasses the development, acquisition, and sale of property, land, and buildings. Global urbanization and infrastructure investment growth have significantly impacted this sector. In particular, the Asia Pacific region has seen rapid expansion in various sectors, such as commercial construction, with India leading the charge. Notably, international real estate development is projected to present opportunities for countries like India, as demonstrated by the October 2021 MoU between the Jammu and Kashmir administration and the Dubai government, focusing on industrial parks, IT towers, and super-specialty hospitals. Civil engineering services play a crucial role in real estate development, with a focus on social infrastructure, residential, construction activities, offices, educational institutes, hotels, restaurants, transport buildings, online retail warehousing, immigration, housing, and construction.

Innovations in green building products, energy efficiency, sustainable construction materials, such as cross-laminated timber, and digital technology are transforming the industry. Key areas of growth include infrastructure, oil and gas, energy and power, aviation, public spending, non-residential construction, healthcare centers, infrastructure projects, and digital civil engineering. Civil engineering firms provide essential services, including rail structures, tunnels, bridges, maintenance services, renovation activities, and energy-efficient products. The real estate segment also includes industrial real estate and housing development, with a shift towards flexible infrastructure, roads, railroads, airports, ports, single-family houses, and home remodeling. The industry is embracing advanced simulation tools, drone technology, and carbon emissions reduction initiatives, such as net-zero energy buildings, pre-fabrication, data analytics, machine learning, and construction management software. Building norms, Eurocode, and LEED certification are essential considerations in the industry's evolution.

Get a glance at the Civil Engineering Industry report of share of various segments Request Free Sample

The Real estate segment was valued at USD 4.64 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC region dominated The market in 2023, driven by the surge in construction activities. India and China are major contributors to this growth, with numerous projects underway in China set to boost demand. Notably, the Indonesian government's 15-year economic development master plan, MP3EI, launched in 2011, is expected to significantly contribute to the construction sector and civil engineering services In the country. The construction industry in APAC is poised for substantial growth, with a focus on social infrastructure, residential, offices, educational institutes, hotels, restaurants, transport buildings, online retail warehousing, immigration, housing, construction, architectural designs, green building products, energy efficiency, and sustainable construction materials.

Key areas of investment include rail structures, tunnels, bridges, maintenance services, renovation activities, energy-efficient products, real estate segment, infrastructure, oil and gas, energy and power, aviation, public spending, non-residential construction, healthcare centers, infrastructure projects, digital civil engineering, digitalization, smart grids, urban transportation, industrial automation, parking systems, zero-energy buildings, insulated buildings, double skin facades, PV panels, professional IT services, inspection technology, e-permit system, integrated 3D modeling, building norms, Eurocode, and civil engineering planning and design. The use of renewable materials, LEED certification, smart buildings, and ESG elements is also gaining momentum In the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Civil Engineering Industry?

- Rise in construction activities in developing countries is the key driver of the market.The market is experiencing significant growth due to increasing construction activities in developing countries. Economic expansion, urbanization, and substantial public spending on infrastructure projects are driving the demand for civil engineering services. For instance, India's National Infrastructure Pipeline aims to invest USD1.4 trillion in development projects from 2019 to 2025, while China's Belt and Road Initiative continues to foster civil engineering efforts across Asia and beyond. These investments address immediate infrastructure needs and lay the groundwork for long-term economic stability. The non-residential construction sector, including offices, educational institutes, hotels, restaurants, transport buildings, online retail warehousing, and healthcare centers, is a major contributor to this market growth. The adoption of green building products, energy efficiency, and sustainable construction materials, such as cross-laminated timber, is also gaining momentum. Digitalization plays a crucial role in civil engineering, with the use of software tools, professional IT services, inspection technology, e-permit systems, and integrated 3D modeling becoming increasingly prevalent. Moreover, the infrastructure sector, including rail structures, tunnels, bridges, maintenance services, and renovation activities, is expected to witness substantial growth. The integration of energy-efficient products, renewable energy, and smart grids in infrastructure projects is a key trend. Industrial real estate, housing development, and flexible infrastructure, such as roads, railroads, airports, and ports, are also experiencing significant growth. In the residential sector, the demand for single-family houses and home remodeling is on the rise. Civil engineering firms offer planning and design services using green construction materials and sustainable building materials, such as cross-laminated timber. The implementation of building norms and adherence to Eurocode standards ensure the safety and durability of structures. In conclusion, the market is witnessing robust growth due to increasing construction activities, infrastructure investments, and the adoption of digital technology and sustainable practices. The market dynamics are influenced by factors such as economic growth, urbanization, and government initiatives. The future of civil engineering lies In the integration of renewable materials, LEED certification, smart buildings, and ESG elements, as well as the development of digital infrastructure and smart cities.

What are the market trends shaping the Civil Engineering Industry?

- Adoption of intelligent processing in civil engineering is the upcoming market trend. The civil engineering services market is experiencing significant growth as players integrate artificial intelligence (AI) into architecture, engineering, and construction (AEC) solutions. Although the civil industry has fewer applications of AI and slow adoption due to high research and development costs, the integration of AI offers numerous benefits. By applying algorithms, end-users, including builders, contractors, engineers, and architects, can overcome challenges, enhance efficiency and productivity, and save time and money. AI also contributes to improving human life quality and generating innovative solutions to engineering problems. For instance, AI algorithms have been employed in civil engineering to address issues such as infrastructure planning and design, green construction materials, and sustainable building materials, like cross-laminated timber (CLT). Furthermore, AI can optimize the use of digital technology, advanced simulation tools, drone technology, and carbon emissions reduction in civil engineering projects. The real estate segment, including residential, offices, educational institutes, hotels, restaurants, transport buildings, online retail warehousing, and healthcare centers, is also adopting AI for energy efficiency, smart grids, urban transportation, industrial automation, parking systems, zero-energy buildings, insulated buildings, double skin facades, PV panels, professional IT services, inspection technology, e-permit systems, integrated 3D modeling, building norms, and Eurocode compliance. The construction services sector, including maintenance services, renovation activities, and energy-efficient products, is also benefiting from AI applications. Overall, AI integration in civil engineering and construction services is revolutionizing the industry, offering cost savings, increased productivity, and improved quality.

What challenges does the Civil Engineering Industry face during its growth?

- Decline in construction activities is a key challenge affecting the industry growth. The market experiences a downturn due to the economic slowdown and the struggling MSME sector, resulting in decreased construction activities. This decline is evident In the closure of civil engineering departments in educational institutes, such as in Tiruchi, India, due to decreasing admissions. The demand for skilled civil engineers is on the rise, as a lack of expertise could lead to unemployment and disruptions In the construction industry. Additionally, the importance of green building products, energy efficiency, and sustainable construction materials, such as cross-laminated timber (CLT), is increasing In the real estate segment and non-residential construction projects, including offices, hotels, and residential buildings. Digitalization plays a significant role In the market, with the adoption of software tools, professional IT services, inspection technology, and e-permit systems. The integration of advanced simulation tools, drone technology, and data analytics in construction management and project management software is transforming the industry. Furthermore, the trend towards renewable energy, smart grids, urban transportation, industrial automation, and parking systems is driving the market forward. Civil engineering firms focus on offering maintenance services, renovation activities, and energy-efficient products to meet the evolving needs of property developers, contractors, consultants, builders, and construction services. The market encompasses various infrastructure projects, including rail structures, tunnels, bridges, and maintenance services, as well as renewable materials, LEED certification, smart buildings, and ESG elements. The digitalization of civil engineering, including digital infrastructure, smart cities, and integrated planning, is shaping the future of the industry.

Exclusive Customer Landscape

The civil engineering market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the civil engineering market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, civil engineering market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AECOM - The company specializes in construction management, engineering innovative high-performance buildings and foundations. Their expertise encompasses overseeing project planning, execution, and completion while ensuring structural integrity and energy efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- ACS Actividades de Construccion Y Servicios SA

- AtkinsRealis Group Inc

- Balfour Beatty Plc

- Bouygues Construction SA

- Fluor Corp.

- Galfar Engineering and Contracting SAOG

- HDR Inc.

- Hill Construction (N.E) Ltd.

- HOCHTIEF AG

- Hyundai Motor Co.

- Jacobs Solutions Inc.

- John Wood Group PLC

- Kiewit Corp.

- Skanska AB

- Stantec Inc.

- STRABAG SE

- Tetra Tech Inc.

- VINCI Construction UK Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Civil engineering services play a vital role In the development and maintenance of social infrastructure, encompassing various sectors such as residential, construction activities, offices, educational institutes, hotels, restaurants, transport buildings, online retail warehousing, and more. These services are essential for creating and enhancing the built environment, ensuring the safety, functionality, and sustainability of structures. Social infrastructure projects require the collaboration of numerous stakeholders, including property developers, contractors, consultants, builders, and construction services providers. The construction industry is continually evolving, with a focus on innovation and digitalization. Advanced software tools, inspection technology, and e-permit systems streamline processes and improve efficiency.

In the realm of civil engineering, infrastructure projects span industries like oil and gas, energy and power, aviation, and public spending. Non-residential construction encompasses healthcare centers, infrastructure projects, and digital civil engineering. The integration of smart grids, urban transportation, industrial automation, parking systems, and zero-energy buildings is transforming the sector. Green building products and sustainable construction materials, such as cross-laminated timber (CLT), are increasingly popular due to their environmental benefits and energy efficiency. The real estate segment is embracing these trends, with a growing emphasis on ESG (Environmental, Social, and Governance) elements. Flexible infrastructure, including roads, railroads, airports, and ports, is crucial for accommodating changing societal needs.

The construction industry is undergoing a digital transformation, with the adoption of advanced simulation tools, drone technology, data analytics, machine learning, construction management software, and cloud-based collaboration. Lean construction and integrated planning are essential for optimizing resources and minimizing waste. Building norms and regulations, such as Eurocode, guide the design and construction process, ensuring safety and compliance with industry standards. Renewable energy and urban infrastructure projects are driving innovation In the civil engineering sector, with a focus on reducing carbon emissions and creating net-zero energy buildings. Pre-fabrication and insulated buildings, including single-family houses and home remodeling projects, are gaining popularity due to their cost-effectiveness and environmental benefits.

The construction spending landscape is influenced by various factors, including renewable energy investments, public-private partnerships, and government initiatives. In conclusion, the civil engineering services market is dynamic and diverse, with a focus on innovation, sustainability, and digitalization. The sector plays a crucial role in creating and maintaining social infrastructure, driving economic growth, and addressing societal needs. Collaboration between stakeholders, adoption of advanced technologies, and adherence to industry regulations are key to ensuring the success of civil engineering projects.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.9% |

|

Market growth 2024-2028 |

USD 2.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.7 |

|

Key countries |

China, US, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Civil Engineering Market Research and Growth Report?

- CAGR of the Civil Engineering industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the civil engineering market growth of industry companies

We can help! Our analysts can customize this civil engineering market research report to meet your requirements.