It Services Market Size 2024-2028

The it services market size is forecast to increase by USD 676.5 billion at a CAGR of 8.64% between 2023 and 2028.

What will be the Size of the It Services Market During the Forecast Period?

How is this It Services Industry segmented and which is the largest segment?

The it services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Technology and telecommunication

- BFSI

- Travel and hospitality

- Healthcare

- Others

- Service

- IT consulting services

- Internet services and infrastructure

- Data processing and outsources services

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- UK

- South America

- Middle East and Africa

- APAC

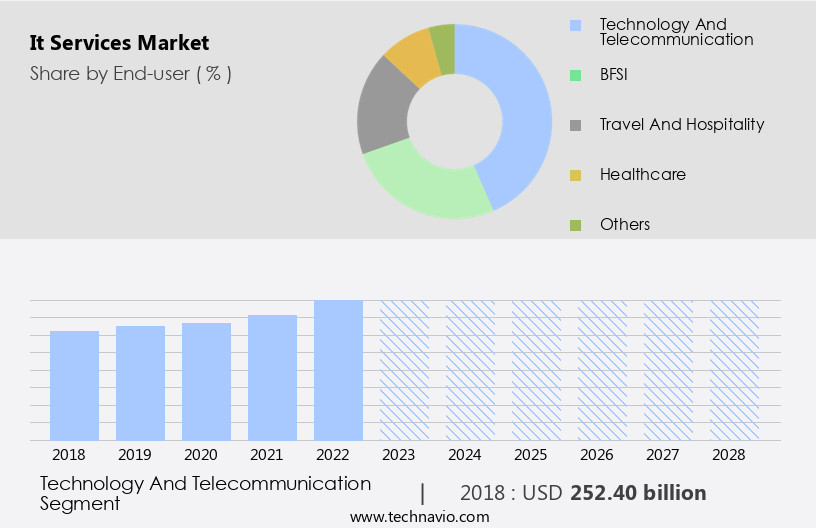

By End-user Insights

- The technology and telecommunication segment is estimated to witness significant growth during the forecast period.

The market plays a pivotal role In the telecommunications sector, enabling advanced technologies such as cloud computing, digital tools, and cybersecurity solutions. Telecommunications companies require IT services for complex pricing systems, real-time processes, and the integration of digital technologies into their offerings. IT infrastructure is essential for voice communication services, especially in markets where growth is slowing down. In the current business landscape, IT services are not just a necessity but a value-driver. Telecommunications firms invest in innovation and automation, including machine learning, data analytics, and big data solutions, to enhance customer experience and streamline operations. Cybersecurity and data privacy regulations are top priorities, necessitating robust IT strategies and planning.

IT support services, including managed security services, are increasingly in demand. The e-commerce sector and retail industry are significant end-users of IT services. The IT & telecom sector, along with large enterprises, is expected to be the major contributor to the market's growth. The future development of IT services is driven by investments in artificial intelligence, cloud-based IT services, and the implementation of IT infrastructure in smart cities and emerging countries. The market's success is determined by feasibility, cost, and user experience. Businesses and organizations across industries are adopting IT services to improve operational agility, storage management flexibility, and cost savings.

Get a glance at the It Services Industry report of share of various segments Request Free Sample

The Technology and telecommunication segment was valued at USD 252.40 billion in 2018 and showed a gradual increase during the forecast period.

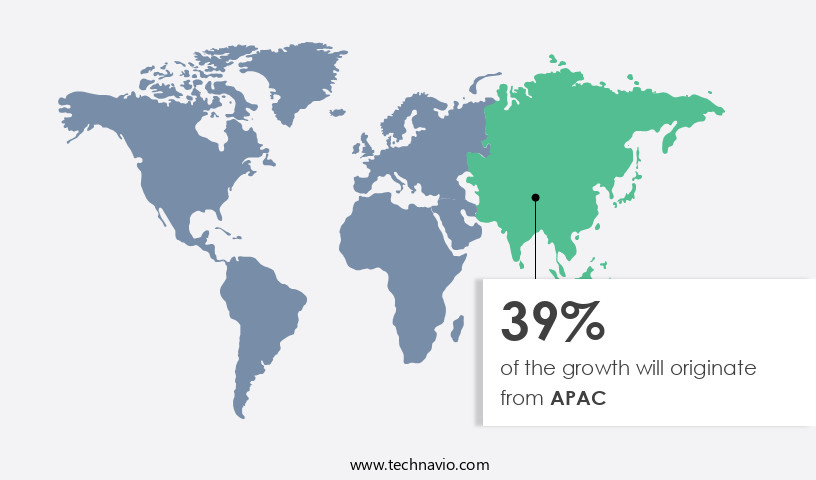

Regional Analysis

- APAC is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific (APAC) region presents a significant opportunity for IT services due to the region's rapid technological advancements and increasing number of small and medium-sized enterprises (SMEs). Although North America and Europe currently dominate the market, APAC is predicted to experience the fastest growth during the forecast period. The region's the market is expanding rapidly, driven by the adoption of modern technologies such as cloud computing and data analytics. Major IT companies are responding to this trend by expanding their service offerings through mergers and acquisitions to remain competitive. The increasing use of digital technologies, cybersecurity solutions, innovation and automation, and the growing demand for data security and privacy protection are key drivers for IT services growth in APAC.

The region's IT infrastructure is undergoing significant development, with a focus on operational agility, storage management flexibility, and cost savings. The future of IT services in APAC lies in areas such as business intelligence, big data analytics, and the implementation of cloud-based IT services. The market's success is contingent upon factors such as feasibility, implementation costs, and user experience. The financial burden of IT services adoption is a concern for many businesses, but the potential for cost savings and improved operational efficiency make it an attractive investment. The market is expected to continue growing, driven by the increasing adoption of automation and the demand for tailored pricing and improved customer experience.

The professional services industry, retail sector, IT and telecom sector, and operations and maintenance are major end-use industries for IT services in APAC. The market is also being influenced by factors such as data privacy regulations, e-commerce, and the increasing use of digital tools and digital transformation initiatives. The market's future development is expected to be driven by investments in artificial intelligence, cybersecurity, and the implementation of smart cities and environmental goals by global governments and member states in emerging countries.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of It Services Industry?

Rising adoption of AI in information management is the key driver of the market.

What are the market trends shaping the It Services Industry?

Emergence of cloud-based platforms is the upcoming market trend.

What challenges does the It Services Industry face during its growth?

Increasing risks involved in outsourcing is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The it services market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the it services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, it services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Accenture Plc - The company provides a range of IT services, encompassing cybersecurity, Data and Artificial Intelligence, Digital Engineering and manufacturing, and cloud solutions, among others. These offerings cater to businesses seeking expertise in various technology domains to optimize their operations and enhance competitive advantage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accenture Plc

- Amazon.com Inc.

- Avaya LLC

- Broadcom Inc.

- Cisco Systems Inc.

- Cognizant Technology Solutions Corp.

- Dell Technologies Inc.

- DXC Technology Co.

- Fortinet Inc.

- Fujitsu Ltd.

- Hewlett Packard Enterprise Co

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- Infosys Ltd.

- Juniper Networks Inc.

- Larsen and Toubro Ltd.

- Microsoft Corp.

- Nokia Corp.

- Oracle Corp.

- Tata Consultancy Services Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market continues to evolve as businesses increasingly rely on digital technologies to drive innovation and automation. The adoption of cloud computing, digital tools, and cybersecurity solutions has become a necessity for organizations to remain competitive and meet the demands of their customers. Data security and privacy protection are critical concerns for businesses, as they navigate the complex landscape of data analytics, machine learning, and big data solutions. Connected devices and the Internet of Things (IoT) are also transforming the way businesses operate, creating new opportunities and challenges. The market is influenced by various factors, including the implementation of data privacy regulations, the shift towards remote working, and the need for proactive IT services.

Reactive IT services, which focus on fixing issues as they arise, are giving way to proactive services that aim to prevent issues before they occur. The professional services industry is undergoing a digital transformation, with businesses seeking tailored pricing and improved customer experience. IT companies are responding by offering a range of services, from application management and data management to cloud-based IT services and managed security services. The IT & telecom sector and the retail sector are major contributors to the market, with large enterprises driving significant revenue growth. The deployment platform for IT services is also evolving, with cloud-based services becoming increasingly popular due to their operational agility and storage management flexibility.

Global governments and smart cities are also investing in IT services to achieve environmental goals and improve standardization. Emerging countries are expected to be significant growth drivers In the market, as they adopt digital technologies and automation to boost economic expansion. The IT infrastructure is a critical component of business operations, and the future development of the market will be driven by investments in artificial intelligence, cybersecurity, and automation. The skills shortage and the need for a highly-skilled labour force are key market restraints, as businesses compete for talent and face the financial burden of hiring and training.

Businesses are seeking to gain a competitive advantage through the adoption of business intelligence and forecasting tools, which enable them to make informed decisions and reduce resource waste. The post-pandemic business landscape is expected to bring new challenges and opportunities, with economic expansion and the need for cost savings being key priorities. The market is diverse, with various service types and end-use industry types contributing to its growth. The cloud sector is a significant contributor, with total revenue expected to continue growing as businesses seek to improve their operational agility and reduce installation costs. In conclusion, the market is a dynamic and complex landscape, driven by the adoption of digital technologies, the need for data security and privacy protection, and the shift towards proactive IT services.

Businesses are seeking to gain a competitive advantage through the adoption of automation, business intelligence, and cloud-based services, while facing challenges such as the skills shortage and the financial burden of talent acquisition. The future of the market will be shaped by investments in artificial intelligence, cybersecurity, and automation, as well as the evolving needs of various industries and market conditions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.64% |

|

Market growth 2024-2028 |

USD 676.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.37 |

|

Key countries |

US, China, India, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this It Services Market Research and Growth Report?

- CAGR of the It Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the it services market growth of industry companies

We can help! Our analysts can customize this it services market research report to meet your requirements.