Cleanroom Apparels Market Size 2024-2028

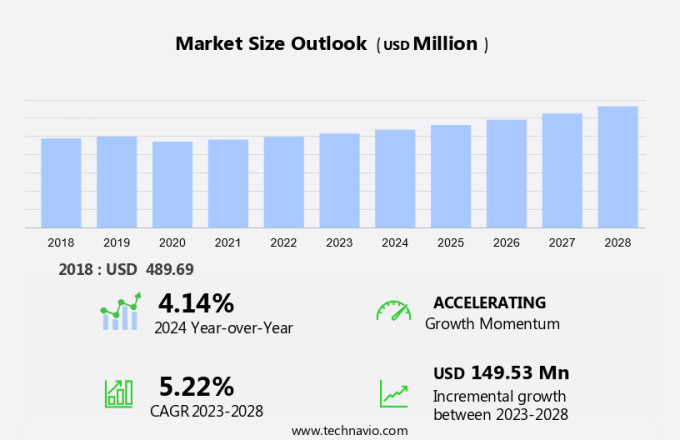

The cleanroom apparels market size is forecast to increase by USD 149.53 million, at a CAGR of 5.22% between 2023 and 2028.

- The market is experiencing significant growth, driven by increasing investments in fabrication facilities, particularly in the semiconductor and pharmaceutical industries, and the adoption of eco-friendly disposables. The expansion of these facilities necessitates the use of high-quality cleanroom apparels to maintain stringent hygiene standards and ensure product integrity. Moreover, the shift towards eco-friendly disposables is gaining momentum due to growing environmental concerns and regulatory pressures. However, the market also faces challenges. The high cost of producing advanced cleanroom apparels and the need for frequent replacement pose significant financial burdens.

- Additionally, the complex nature of cleanroom environments necessitates specialized knowledge and expertise to design and manufacture effective apparel solutions. Companies seeking to capitalize on market opportunities must focus on innovation and sustainability, while addressing these challenges through strategic partnerships, technological advancements, and cost optimization measures. The market's strategic landscape is dynamic, requiring agility and adaptability to stay competitive and meet evolving customer needs.

What will be the Size of the Cleanroom Apparels Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-increasing demand for advanced contamination control solutions across various industries. Particle filtration efficiency remains a key focus, with ongoing research and development in cleanroom garment materials and protective hood designs. Sterile apparel construction and electrostatic discharge protection are also crucial elements, ensuring the integrity of critical environments. Cleanroom apparel logistics and storage solutions have gained significance, as organizations seek to optimize their supply chains and minimize contamination risks. Comfort is another essential factor, with garment sizing and fabric breathability levels being carefully considered to enhance wearer satisfaction and productivity.

Microbiological barrier fabrics and laminar airflow protection are increasingly being adopted to address the challenges of contamination control. Cleanroom garment maintenance, testing, and inspection are integral parts of the overall solution, ensuring the continued effectiveness of protective apparel. The market dynamics of cleanroom apparels are continually unfolding, with new innovations in protective apparel fabrics, barrier technology apparel, and personal protective equipment. Fiber shedding reduction and antistatic properties are becoming essential features, as organizations strive to maintain the highest levels of cleanliness and safety in their operations. Cleanroom apparel standards continue to evolve, reflecting the latest research and best practices in contamination control.

As the market continues to grow and adapt, it will be essential for organizations to stay informed and responsive to the latest trends and developments.

How is this Cleanroom Apparels Industry segmented?

The cleanroom apparels industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Reusable

- Disposable

- End-user

- Medical

- Semiconductor

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Type Insights

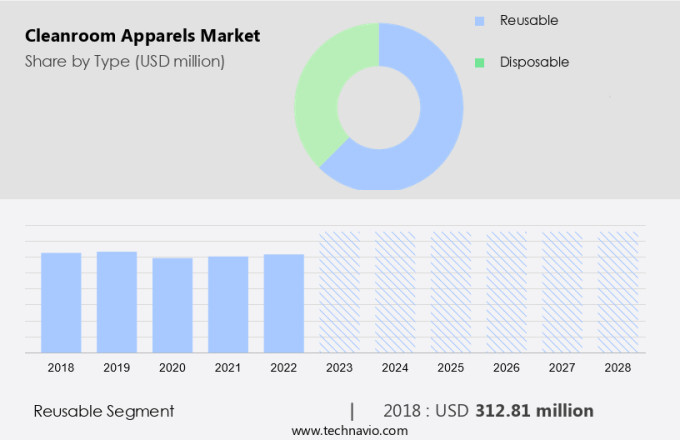

The reusable segment is estimated to witness significant growth during the forecast period.

Reusable cleanroom apparel, including garments with high efficiency particulate filtration and chemical splash protection, is gaining popularity due to its cost-effectiveness and durability. Semiconductor and electronics industries are significant end-users, as the sterility and bioburden concerns are minimal in their manufacturing processes. In contrast, the medical research and manufacturing industries prioritize disposable garments due to stringent sterility requirements. The cost of purchasing and maintaining cleanroom apparel is a critical factor influencing the market's dynamics. Reusable apparel offers a solution by reducing overall operational and maintenance costs. Cleanroom shoe covers, garment materials, and protective hood designs ensure comfort and compliance with contamination control standards.

Sterile apparel construction, microbiological barrier fabrics, and electrostatic discharge protection further enhance the functionality of these garments. Cleanroom garment storage, logistics, and inspection are essential aspects ensuring the continuous availability of cleanroom apparel. Fabric breathability levels, laundering, and maintenance are crucial factors impacting the market trends. Barrier technology apparel, laminar airflow protection, and personal protective equipment with fiber shedding reduction are emerging trends. Cleanroom apparel standards, such as antistatic cleanroom suits, ensure consistent quality and performance.

The Reusable segment was valued at USD 312.81 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

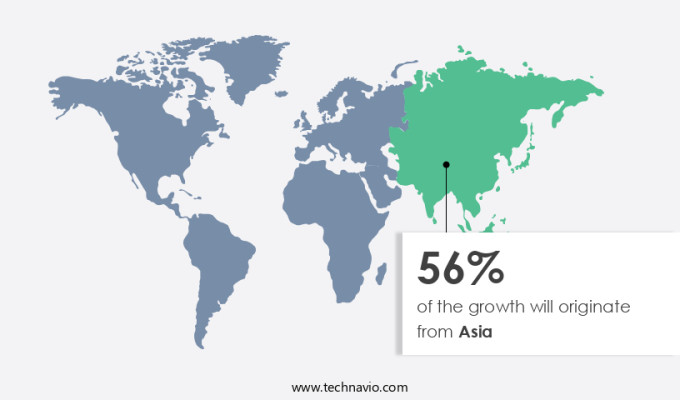

Asia is estimated to contribute 56% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The cleanroom apparel market in Asia is experiencing significant growth due to the expansion of the end-user industries, particularly the medical and semiconductor sectors. Asia's dominance in semiconductor manufacturing, with major players located in Taiwan, China, Japan, and South Korea, significantly contributes to the market's growth. The region is also the fastest-growing market for electronic devices, driven by economic growth and technology adoption. Semiconductor manufacturing outsourcing from developed countries and the growing semiconductor assembly and testing services (SATS) market further fuel this trend. Cleanroom apparel plays a crucial role in maintaining high particle filtration efficiency, chemical splash protection, and garment sterility assurance in these industries.

The market demand is driven by the need for contamination control garments, cleanroom shoe covers, and protective hood designs. Cleanroom garment materials, such as microbiological barrier fabrics and antistatic cleanroom suits, are essential to prevent fiber shedding and electrostatic discharge. Cleanroom apparel logistics and storage, fabric breathability levels, and laundering are essential considerations for ensuring cleanroom garment durability and comfort. Laminar airflow protection and cleanroom garment testing are crucial to maintaining a sterile environment and ensuring compliance with cleanroom apparel standards. The market for barrier technology apparel and airborne particle barriers is also growing, as personal protective equipment (PPE) requirements become increasingly stringent.

In conclusion, the cleanroom apparel market in Asia is driven by the expansion of end-user industries, particularly semiconductor manufacturing, and the growing demand for electronic devices. The market's growth is underpinned by the need for high-performance cleanroom garments that offer particle filtration efficiency, chemical splash protection, sterility assurance, and durability. Cleanroom apparel design, sizing, and inspection are also essential considerations to ensure compliance with industry standards and maintain a contamination-free environment.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of garments specifically designed to maintain cleanroom environments, ensuring the preservation of product quality and safety in various industries. These industries, such as pharmaceuticals, electronics, and semiconductors, focus on maintaining stringent cleanroom standards to prevent contamination. Cleanroom apparels include coveralls, hoods, boot covers, and gloves, all manufactured from materials that minimize particle generation and retention. Long-term advancements in fabric technology have led to the development of innovative solutions, including antimicrobial and flame-resistant fabrics, further expanding the market's applications. Moreover, cleanroom apparels are essential in areas with high-risk contamination, such as in the production of biopharmaceuticals and advanced electronics. Including these industries, the market is witnessing significant growth, driven by the increasing demand for stringent cleanroom regulations and the need for enhanced product protection. Furthermore, the integration of automation and robotics in manufacturing processes necessitates the use of cleanroom apparels to ensure the equipment remains free from contamination. This trend is particularly prominent in the semiconductor industry, where the production of microchips requires an ultra-clean environment. In conclusion, the market continues to evolve, offering innovative solutions to meet the unique demands of various industries. Long-term advancements in fabric technology and the increasing importance of maintaining stringent cleanroom standards will further drive market growth.

What are the key market drivers leading to the rise in the adoption of Cleanroom Apparels Industry?

- The significant expansion of investment in fabrication facilities serves as the primary catalyst for market growth.

- The semiconductor industry's ongoing expansion and the increasing demand for advanced memory technologies, such as 3D NAND, have led to significant investments in next-generation fabrication facilities. Companies like Samsung Electronics, Western Digital, Micron Technology, Toshiba, SK Hynix, and Intel are enhancing their production capacity to stay competitive. This trend is driven by the rising need for 3D NAND, which presents opportunities for various supply chain members, including chipmakers, equipment manufacturers, and material suppliers. One such pioneer in this field is NEO Semiconductor, which unveiled its groundbreaking technology, 3D X-DRAMTM, in May 2023. This innovation aims to address the growing demand for high-performance, high-density memory solutions.

- In the realm of cleanroom apparel, this development underscores the importance of contamination control garments in ensuring the integrity of advanced manufacturing processes. Disposable cleanroom garments, cleanroom shoe covers, and garment sterility assurance are crucial components of this process. The selection of appropriate cleanroom garment materials, such as polyester or polypropylene, is vital for both contamination control and garment durability. These materials offer excellent cleanroom performance, chemical splash protection, and are easy to clean and sterilize. In conclusion, the semiconductor industry's growth and the subsequent investments in advanced fabrication facilities highlight the significance of cleanroom apparel in maintaining a contamination-free environment.

What are the market trends shaping the Cleanroom Apparels Industry?

- Eco-friendly disposables are gaining popularity as the new market trend. This shift towards sustainable options is a significant development in the disposables industry.

- Cleanroom apparels play a crucial role in maintaining a particle-free environment in industries such as pharmaceuticals and chemicals. However, disposable cleanroom apparels, which are commonly used due to the risk of contamination from hazardous compounds, pose challenges in terms of sustainability. To address this issue, several companies are innovating eco-friendly alternatives. For instance, Valtek, a prominent player in the market, has initiated a recycling program to minimize environmental impact. Used disposable cleanroom apparels are collected in recycling boxes and subsequently recycled by the company.

- Moreover, comfort and protection are essential considerations in cleanroom apparel design. Protective hoods and sterile apparel construction ensure particle filtration efficiency. Protective apparel fabrics offer electrostatic discharge protection, ensuring the cleanroom environment remains uncontaminated. Effective cleanroom apparel logistics and storage systems further ensure the integrity of the cleanroom environment. These advancements underscore the industry's commitment to continuous improvement and innovation.

What challenges does the Cleanroom Apparels Industry face during its growth?

- The increasing implementation of automation technology in cleanrooms poses a significant challenge to the industry's growth trajectory.

- The global cleanroom apparel market is experiencing significant growth due to the increasing adoption of automation in various industries, including medicine, semiconductors, pharmaceuticals, and food and beverage. Automation has become a crucial requirement in these sectors to ensure precise, contamination-free, and error-free manufacturing processes. However, the use of automation poses a challenge for the cleanroom apparel market, as maintaining the integrity of cleanroom environments is essential to prevent contamination. Microbiological barrier fabrics, cleanroom garment maintenance, laminar airflow protection, and cleanroom glove materials are key considerations for the design and sizing of cleanroom apparel. Fabric breathability levels are also important to ensure the comfort and productivity of workers.

- The need to maintain a sterile environment and minimize contaminants is a significant factor driving the growth of the cleanroom apparel market. Additionally, the cost and efficiency benefits of automation are also contributing to the market's expansion. Cleanroom garment testing is a critical process to ensure the effectiveness of the protective clothing in preventing contamination. Proper cleaning and maintenance of cleanroom garments are essential to maintain their functionality and extend their lifespan. The use of advanced materials and technologies in cleanroom apparel is also driving innovation in the market. Overall, the global cleanroom apparel market is poised for continued growth as industries increasingly prioritize contamination control and automation.

Exclusive Customer Landscape

The cleanroom apparels market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cleanroom apparels market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cleanroom apparels market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - This company specializes in providing advanced cleanroom apparel, including 3M's disposable chemical protective coveralls, available in model 4565 BLK XXL, ensuring worker safety and compliance with industry standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Alpha Pro Tech Ltd.

- Ansell Ltd.

- Aramark

- Berkshire Corp.

- CliniMed Holdings Ltd.

- Cole Parmer Instrument Co. LLC

- Contec Inc.

- DuPont de Nemours Inc.

- Dycem Ltd.

- Foamtec International WCC

- High Tech Conversions Inc.

- Illinois Tool Works Inc.

- Kimberly Clark Corp.

- Micronclean Ltd.

- Micronova Manufacturing Inc.

- STERIS Plc.

- Terra Universal Inc.

- Thermo Fisher Scientific Inc.

- Valutek Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Cleanroom Apparels Market

- In January 2024, DuPont, a leading global materials science company, announced the launch of its new Tyvek® 800J protective apparel, designed specifically for use in the cleanroom industry. This innovative product offers enhanced breathability and comfort, while maintaining the high level of particle protection required in cleanroom environments (DuPont Press Release, 2024).

- In March 2024, 3M and Honeywell International, two major players in the cleanroom apparel market, entered into a strategic partnership to expand their joint offerings in this sector. The collaboration aims to leverage each company's strengths and expertise to deliver comprehensive solutions for cleanroom customers (3M Press Release, 2024).

- In May 2024, Showa Denko K.K., a leading Japanese chemical company, completed the acquisition of a significant stake in the cleanroom apparel manufacturer, Mitsui Chemicals, Inc. This investment strengthens Showa Denko's position in the global cleanroom apparel market and enables the expansion of its product offerings (Showa Denko Press Release, 2024).

- In April 2025, the European Union (EU) implemented new regulations for cleanroom apparel, requiring stricter particle filtration standards and increased transparency in product certifications. This policy change is expected to drive demand for advanced cleanroom apparel technologies and solutions (European Commission Press Release, 2025).

Research Analyst Overview

- In the intricately regulated cleanroom environment, the selection and usage of appropriate cleanroom apparel are paramount. The market for cleanroom fabrics continues to evolve, with a focus on optimizing fabric drape properties and minimizing apparel contamination risk. Protective apparel closures and garment sterility methods ensure the integrity of cleanroom suits, while traceability and labeling maintain accountability. Contamination monitoring remains a critical aspect of cleanroom apparel usage, with rigorous testing for particle retention, material permeability, and garment breathability. Comfort and protective layers are also essential considerations, with ESD protective apparel and garment color choices catering to specific applications.

- Regulations governing cleanroom apparel are stringent, necessitating regular fabric selection, seam inspection, and air permeability testing to ensure longevity and disposal in accordance with industry standards. Protective clothing fabrics undergo extensive testing to meet cleanroom requirements, ensuring the highest level of protection and suitability for various industries.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Cleanroom Apparels Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.22% |

|

Market growth 2024-2028 |

USD 149.53 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.14 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cleanroom Apparels Market Research and Growth Report?

- CAGR of the Cleanroom Apparels industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Asia, North America, Europe, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cleanroom apparels market growth of industry companies

We can help! Our analysts can customize this cleanroom apparels market research report to meet your requirements.