Clutch Bag Market Size 2024-2028

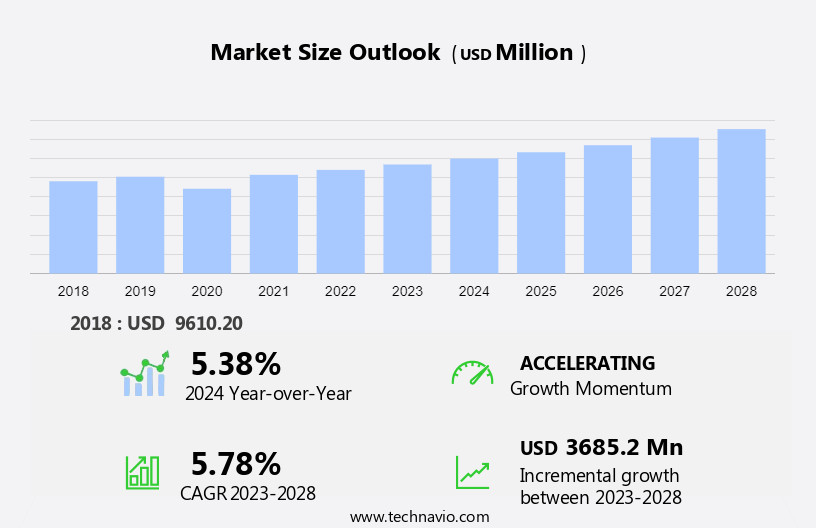

The clutch bag market size is forecast to increase by USD 3.68 billion at a CAGR of 5.78% between 2023 and 2028. The clutch bag market is seeing substantial growth, primarily due to the rising demand for luxury handbags. This surge is bolstered by continuously evolving styles and designs that cater to a wide range of consumer preferences. Brands and international labels are becoming more accessible, making it simpler for consumers to purchase high-end clutch bags. These factors synergistically contribute to the vibrant and expanding clutch bag market. As consumer tastes diversify and access to luxury brands increases, the market continues to evolve dynamically. This growth underscores a trend where luxury clutch bags are not only fashion statements but also accessible symbols of style and sophistication.

To learn more about this report, View Sample PDF

Key Companies & Market Insights

Companies are implementing various market growth and forecasting strategies by analyzing factors such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product or service launches, to enhance their presence in the market.

Bulgari S.p.A - The key offerings of the company include clutch bags such as Serpenti Clutch, Serpenti Cabochon Crossbody Mini Bag, and Serpenti Cabochon Crossbody Mini Bag.

The market report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

Abercrombie and Fitch Co., Acne Studios AB, Adidas AG, Aeffe Spa, Burberry Group Plc, Capri Holdings Ltd., Chanel Ltd., CHARLESKEITH.COM Pte. Ltd, Dolce and Gabbana S.r.l., Fossil Group Inc., Giorgio Armani S.p.A., Hermes International SA, Kering SA, LVMH Moet Hennessy Louis Vuitton SE, Ralph Lauren Corp., Svala, Tapestry Inc., and VIP Industries Ltd.

Qualitative and quantitative analysis of market growth and trends of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified. Furthermore, market growth and forecasting it is also quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Dynamics

The clutch bag market is a significant segment of the broader accessories industry, catering to the needs of modern corporate executives in their professional settings. This market encompasses a wide range of styles, materials, and sizes, including cotton, silk, jute, nylon, leather bags, clutches, and wristlets. The continuous innovation in product design and changing consumer trends have led to the introduction of new materials and designs, making clutch bags a desirable personal item for both men and women. The clutch bag market is driven by the purchasing power of consumers, with a growing emphasis on style and functionality. The market for luxury clutch bags, in particular, has seen significant growth as they serve as a fashion statement in various professional settings. However, the market also faces challenges from counterfeit products and brand presence, requiring stringent measures to ensure authenticity and maintain consumer trust.

Key Market Drivers

The handbag market, specifically the clutch bag segment, experiences significant growth due to the increasing preference for fashionable accessories among corporate executives and modern professionals. In today's fast-paced professional life, clutch bags and wristlets have become essential items for both men and women, offering style and functionality in professional settings. The clutch bag market caters to various fabric options, including cotton, silk, jute, nylon, and vegan leather, to cater to diverse consumer preferences. Social media channels and celebrity fashion trends have significantly influenced the clutch bag market, driving demand for luxury branded goods with prominent logos for brand recognition. Consumers seek high-quality leather products, such as satchels and clutches, for their durability and timeless appeal.

Moreover, the market also includes the tote bag segment, which remains popular due to its versatility and spaciousness, accommodating tablets, wallets, and other essentials. Department stores, specialty stores, and retail outlets contribute to the growth of the clutch bag market, offering a wide range of designs, materials, and price points. Korean fashion trends and eco-friendly materials, such as recycled nylon and jute, have gained popularity in recent years, reflecting consumers' increasing focus on fashion sense and purchasing power. The clutch bag market continues to evolve, catering to the diverse needs and preferences of consumers in the global fashion industry. Such factors will increase the market growth during the forecast period.

Significant Market Trends

Increasing demand for personalized items in both developed and emerging economies is a key trend. Modern professional life and corporate executives seek unique styles for professional settings, leading to the popularity of customized clutch bags. Customization options range from straps and buckles to embroidery and adding names or pictures. Clutch bags can be personalized with customers' preferred designs, making them an ideal match for specific outfits. Various materials, such as cotton, silk, jute, nylon, and vegan leather, are used to cater to diverse fashion sensibilities and purchasing power. Social media channels and department stores serve as major platforms for showcasing and purchasing these customized clutch bags. The tote bag segment, which includes men and women's clutch bags and wristlets, has experienced substantial growth due to the convenience they offer in carrying tablets, wallets, and other essentials.

Furthermore, luxury branded goods with logos and brand recognition continue to dominate the market, while eco-friendly materials like canvas and sustainable fabrics gain traction due to their appeal to socially and environmentally conscious consumers. The clutch bag market encompasses various styles, including Korean fashion and celebrity-inspired designs, catering to the diverse tastes of consumers. In summary, the clutch bag market is a dynamic and evolving sector driven by the increasing demand for personalized accessories, diverse materials, and various styles that cater to the modern professional lifestyle and fashion sense. Such factors will increase the market growth during the forecast period.

Major Market Challenges

The clutch bag market, a segment of the larger handbag industry, encounters significant challenges due to the volatile pricing of key materials. Principal components in clutch bag production consist of leather, rubber, vinyl, and fabric. The unpredictable supply-demand equilibrium of these materials results in price instability, impacting the profitability of clutch bags. Manufacturing hubs for handbags, including clutch bags, are primarily situated in Asian nations like China, Indonesia, Vietnam, and Bangladesh, due to their low labor costs. However, the evolving economic landscape has led to a rise in labor expenses, thereby increasing production costs. In modern professional life, clutch bags and other accessories have become indispensable for corporate executives and working women. These items are essential in professional settings, where style and functionality are paramount. Cotton, silk, jute, nylon, and various eco-friendly materials are popular choices for clutch bags, catering to diverse fashion sensibilities and purchasing power.

However, social media channels and celebrity fashion trends significantly influence the clutch bag market. Tote bags, satchels, and other handbag segments, including clutches and wristlets, are popular among men and women. Tablets and wallets are common additions to these bags, making them versatile and convenient. Luxury branded goods, featuring logos and brand recognition, continue to dominate the market. Leather products, such as tote bags and clutches, remain popular due to their durability and timeless appeal. Korean fashion and vegan leather are emerging trends, reflecting the industry's adaptability to changing consumer preferences. The clutch bag market is a dynamic and evolving sector, influenced by various factors, including raw material costs, production locations, and consumer trends. Such factors will hinder the market growth during the forecast period.

Get a detailed analysis of drivers, trends, and challenges Request Free PDF Sample !

Market Segmentation

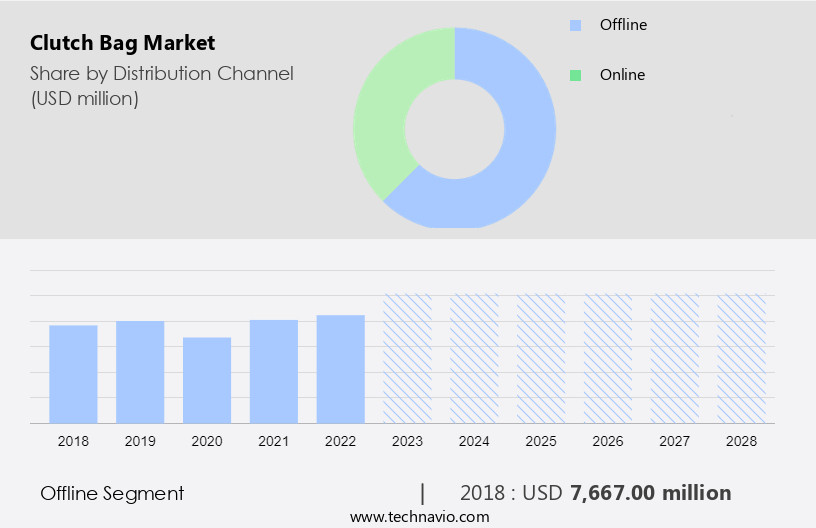

Distribution Channel Analysis

The market share growth by the offline segment will be significant during the forecast period. With the advent of new retail formats, such as signature stores, factory outlets, malls, and shopping centres, consumers' preference for buying clutch bags through such stores has increased, owing to the convenience they offer. This changing consumer preference is expected to drive the growth of the global market during the forecast period. Furthermore, most of the clutch bag vendors have opened their own retail outlets for selling their products.

To gain further insights on the market contribution of various segments Request a PDF Sample

The offline segment of the clutch bag market was valued at USD 7.67 billion in 2018. Physical retail stores remain the most reliable option for consumers in developing economies to buy clutch bags. Retailers are expanding their businesses by opening new stores in developing countries, while brands are establishing new stores in prominent markets to improve the store experience. These strategies are expected to drive consistent sales growth through offline stores and propel the market's growth during the forecast period.

Type Analysis

Based on Type, the market has been segmented into non-luxury brand and luxury brand. The non-luxury brand?segment will account for the largest share of this segment.

Regional Analysis

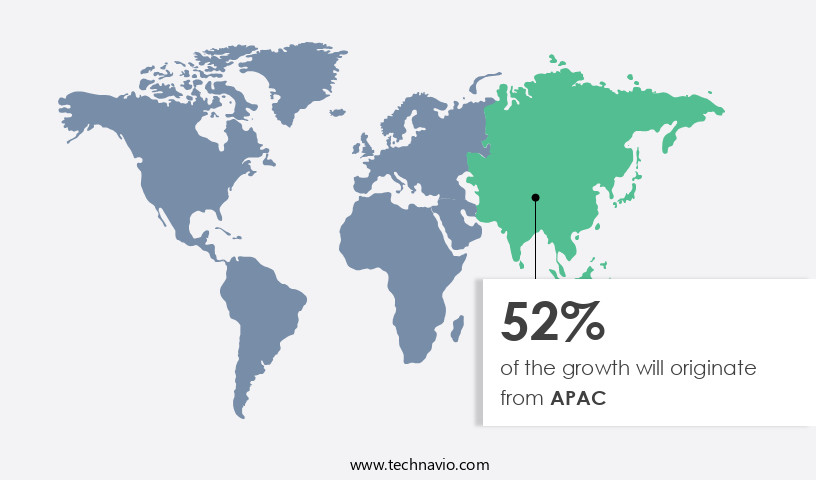

APAC is estimated to contribute 52% during the forecast period.

For more insights on the market share of various regions Request PDF Sample now!

Technavio's analysts have provided extensive insight into the market forecasting, detailing the regional trends and drivers influencing the market's trajectory throughout the forecast period. The Clutch Bag Market is characterized by continuous innovation and product design, catering to evolving consumer trends. This market encompasses a wide range of offerings, from luxury handbags serving as fashion statements to functional clutches for personal care and cosmetics. Changing consumer preferences have led to an increased focus on new designs, with Fede tote bags and those featuring wooden handles gaining popularity. Brand presence plays a significant role in the market, with fashion bloggers and influencers promoting various brands and styles. Fashion accessories, such as clutches, are essential components of any outfit, adding elegance and sophistication.

However, the market is not without challenges, with the prevalence of counterfeit products posing a threat to authentic brands. In the realm of luxury handbags, the Clutch Bag Market continues to evolve, offering consumers a diverse array of choices. These bags are more than just functional items; they serve as status symbols and fashion statements. New designs and trends emerge regularly, reflecting the dynamic nature of the market. Personal care and cosmetics are increasingly being integrated into clutch bags, making them more versatile and convenient for consumers. The use of high-quality materials, such as leather and wood, adds to the appeal and durability of these bags. The Fede tote bag, with its distinctive design and functionality, is a prime example of the innovation and creativity driving the market.

You may also interested in below market reports:

UK - Handbags Market UK - Handbags Market by Product, Distribution Channel and Material - Forecast and Analysis

India - Handbags Market India - Handbags Market by Product Type, and Distribution Channel Forecast and Analysis

Japan - Handbags Market Japan - Handbags Market by Distribution Channel, Product and Type - Forecast and Analysis

Market Analyst Overview

The clutch bag market is a significant segment within the global handbag industry. These bags are compact in size, designed to be carried by hand, and often come with a detachable strap. Clutch bags are popular among consumers due to their versatility and style. Marketing strategies for clutch bags focus on their unique selling points, such as their compact size, trendy designs, and functionality. Brands often collaborate with fashion influencers and celebrities to promote their clutch bag offerings. Social media platforms are also utilized extensively to reach a wider audience and engage potential customers. Clutch bags are manufactured using various materials, including leather, synthetic fabrics, and velvet.

Moreover, the production process involves cutting, stitching, and assembling the different components. Brands may also offer customization options, such as monogramming or personalized designs, to cater to individual preferences. The market for clutch bags is driven by factors such as increasing disposable income, growing fashion consciousness, and the desire for unique and trendy accessories. Consumers are also seeking sustainable and eco-friendly options, leading to the emergence of vegan leather and other eco-friendly materials in the clutch bag market. In conclusion, the clutch bag market is a dynamic and evolving segment within the handbag industry. Effective marketing strategies, innovative designs, and a focus on sustainability are key factors that will drive growth in this market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2023 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.78% |

|

Market growth 2024-2028 |

USD 3.68 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.38 |

|

Regional analysis |

Europe, APAC, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 52% |

|

Key consumer countries |

US, China, France, Italy, and Japan |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

Abercrombie and Fitch Co., Acne Studios AB, Adidas AG, Aeffe Spa, Bulgari S.p.A, Burberry Group Plc, Capri Holdings Ltd., Chanel Ltd., CHARLESKEITH.COM Pte. Ltd, Dolce and Gabbana S.r.l., Fossil Group Inc., Giorgio Armani S.p.A., Hermes International SA, Kering SA, LVMH Moet Hennessy Louis Vuitton SE, Ralph Lauren Corp., Svala, Tapestry Inc., and VIP Industries Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Forecast Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch